Larry FX EA V1.0 MT4 – Ladder Grid Power for Gold Traders

If you’ve ever tried to trade XAUUSD manually, you already know how wild gold can be. Spikes, fakeouts, sudden reversals… one minute you’re in profit, the next minute the candle eats your stop. That’s exactly the kind of chaos Larry FX EA V1.0 MT4 is built to handle.

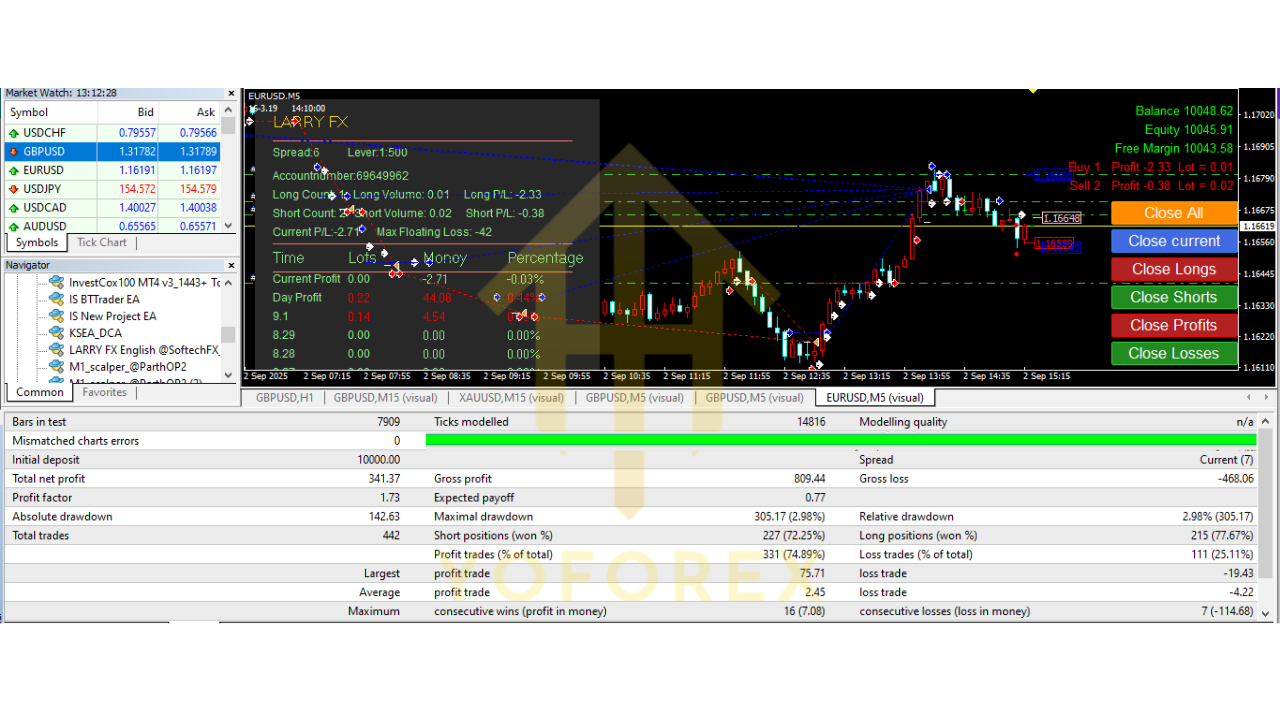

This Expert Advisor focuses purely on XAUUSD (Gold) and uses a ladder grid system to open, manage, and close trades in a structured way. Instead of chasing every candle, it builds positions step-by-step, prioritising capital security and controlled exposure over reckless, all-in aggression. Real trading profit has been verified on live accounts, so this isn’t just a nice backtest screenshot — it’s an EA designed for real-world conditions.

In this blog, we’ll walk through what Larry FX EA actually does, how its ladder grid logic works, the recommended trading conditions, risk management tips, and how you can install it on your MetaTrader 4 platform. If you’re looking for steady, low-risk automated growth on gold (as “low risk” as XAUUSD can realistically be, tho), keep reading.

What Is Larry FX EA V1.0 MT4?

Larry FX EA V1.0 is a fully automated forex trading robot built specifically for XAUUSD (Gold) on the MetaTrader 4 platform.

It uses a ladder grid system to:

- Open trades at pre-defined price intervals

- Manage active positions with structured take-profit and safety levels

- Close trades in batches for consistent realised gains instead of random one-off wins

In simple terms, it tries to profit from the natural back-and-forth movement of gold, rather than predicting one single big move.

Core Purpose

The EA is designed for traders who:

- Want automation rather than staring at charts all day

- Prefer controlled, systematic risk instead of emotional decision-making

- Like the idea of grid trading, but want something that’s more intelligent and safer than blind martingale approaches

Larry FX EA focuses on:

- Capital security – keeping position sizes and distance between orders under control

- Structured trading distances – spacing trades logically as price moves

- Stable, low-risk growth – aiming for smoother equity curves rather than “moon or blow” type performance

It’s not a magic money printer (no robot is), but it aims to give you a rules-based, disciplined approach to trading gold.

How the Ladder Grid System Works

The heart of Larry FX EA is its ladder grid logic. If you’re new to grid systems, don’t worry, we’ll break it down without too much jargon.

H3: Structured Entries on XAUUSD

Instead of opening one big position, the EA:

- Places multiple smaller orders at different price levels (like steps on a ladder)

- Uses pre-defined spacing between those orders (the “grid distance”)

- Builds a position gradually as price moves up or down

So, if gold spikes against your initial entry, the EA doesn’t panic; it adds another small position at the next step in the ladder — always respecting the configured grid rules.

This approach helps to:

- Average out entry price

- Capture profits when price snaps back

- Avoid over-leveraging on a single entry point

H3: Trade Management & Exits

Once positions are open, Larry FX EA:

- Tracks basket profit (combined profit of all open grid trades)

- Closes multiple trades together when a target profit is reached

- Can use dynamic take-profit levels based on volatility (depending on how you configure it)

Rather than waiting for every single trade to hit its own TP individually, the EA focuses on net result. That’s one reason grid systems can stay profitable in choppy markets, coz they don’t need “perfect” entries.

H3: Focus on Capital Security (Not Crazy Martingale)

While some grid systems blindly double the lot size every few steps, Larry FX EA is structured for capital preservation.

You can configure:

- Initial lot size

- Lot progression (if any)

- Maximum number of open trades

- Maximum drawdown limits (via your own risk rules)

Used properly, this turns the EA into a controlled ladder system, not a runaway martingale monster.

Recommended Trading Conditions for Larry FX EA

Let’s recap the core specs and what they mean for your setup:

- Trading Platform: MetaTrader 4 (MT4)

- Timeframes: M5, M15, M30, H1

- Currency Pair: XAUUSD (Gold)

- Minimum / Recommended Deposit: $500

- Minimum / Recommended Leverage: 1:100

- Account Types: Any (Standard, ECN, Raw spread, Cent, etc.)

H3: Choosing the Right Timeframe

You can attach Larry FX EA to multiple timeframes, but each one has its own “personality”:

- M5 / M15:

- More frequent trades

- More sensitivity to intraday volatility

- Suitable if you like active trading and are okay with more floating positions

- M30 / H1:

- Fewer but more “structured” setups

- Smoother grid behaviour, generally less noise

- Good if you’re aiming for mid-term, lower-frequency exposure

H3: Why $500 and 1:100 Leverage?

- $500 gives the grid enough breathing room to handle pullbacks without instantly stressing your margin (assuming modest lot size).

- 1:100 leverage is a balanced middle ground — high enough to trade gold with a small account, but not so high that one spike wipes you out instantly.

You can use higher capital for smoother performance; many traders prefer $1,000+ for extra safety, especially if they want to run multiple timeframes or higher risk.

Risk Management & Drawdown Control

Even the smartest EA needs good risk rules. Larry FX EA gives you the tool; how you configure it decides whether you’re trading professionally or gambling.

H3: Key Parameters to Adjust

Typical risk-related settings you should pay attention to:

- Initial Lot Size:

- For a $500 account, many traders start with 0.01 on XAUUSD

- Scaling this too fast can kill the account during heavy trends

- Grid Distance (Step):

- Wider steps = fewer trades, more breathing room

- Tighter steps = more trades, faster profits, but higher exposure

- Max Orders / Max Grid Depth:

- Limits how many trades can be opened in one direction

- Helps protect you during long, one-sided gold moves

H3: Practical Risk Tips

- Start on demo first to see how the EA behaves in real market conditions

- Avoid cranking up risk just because you see a few good weeks

- Consider pausing the EA during major news events (like FOMC, CPI, NFP) when gold can move violently

- Always have a max daily or weekly loss in your own plan — don’t rely on any EA to “never lose”

Remember: grid trading works best when you respect drawdown. The EA is built for stability, but if you push lot sizes too hard, no algorithm can save the account from extreme volatility.

Example Performance Behaviour (Hypothetical)

While actual results will vary by broker, spread, VPS quality, and settings, here’s a hypothetical scenario just to visualise how Larry FX EA might behave:

- Account Balance: $500

- Timeframe: M15

- Risk Mode: Conservative

- Target: Around 3–5% per month in normal conditions

In a typical month with normal volatility:

- The EA may open and close dozens of small trades as gold oscillates

- Equity might pull back temporarily during strong trends, but recover when price reverts

- Profit is usually generated from batches of trades closing together, rather than one big hero trade

This kind of flow is what many traders aim for — slow, consistent growth with controlled DD, instead of YOLO 100% in a week and margin call next week. Past performance is never guaranteed, but the strategy behind Larry FX EA is built for incremental compounding, not quick thrills.

How to Install & Set Up Larry FX EA on MT4

Getting started with Larry FX EA V1.0 is straightforward. Here’s a simple step-by-step:

H3: Step 1 – Add the EA to MT4

- Open your MetaTrader 4 platform.

- Go to File > Open Data Folder.

- Navigate to MQL4 > Experts.

- Copy the Larry FX EA V1.0.ex4 (or .mq4) file into this folder.

- Close and restart MT4 so it can load the new EA.

H3: Step 2 – Attach the EA to XAUUSD Chart

- Open a XAUUSD chart.

- Choose your timeframe: M5, M15, M30, or H1.

- In the Navigator panel, find Larry FX EA under Expert Advisors.

- Drag and drop it onto the chart.

H3: Step 3 – Enable Live Trading & Adjust Inputs

- In the EA settings window, check:

- Allow live trading

- Allow DLL imports (if required by the EA)

2. Go to the Inputs tab and configure:

- Initial lot size

- Grid step / distance

- Maximum number of open orders

- Take-profit and safety parameters

3. Click OK, and make sure the AutoTrading button on MT4 is turned ON.

4. The EA should now start monitoring the market and placing trades according to its logic.

Always let it run on demo first with the exact broker and VPS conditions you plan to use live. Once you’re happy with the behaviour, move to a real account using the same configuration.

Who Is Larry FX EA Best Suited For?

Larry FX EA isn’t for everyone, but it’s a strong fit if you see yourself in one of these groups:

H3: Busy Traders Who Love Gold

If you like trading gold but don’t have time to sit at your desk all day, this EA lets you:

- Automate your entries and exits

- Let the robot handle position management

- Check progress a few times a day instead of watching every 5-minute candle

H3: Traders Who Prefer Controlled Grid Systems

If you’re curious about grid trading but scared of insane martingale bots, Larry FX EA gives you:

- A more structured, ladder-style approach

- Flexibility to adjust risk

- A system that’s built with capital security in mind

H3: Intermediate to Advanced Traders

Beginners can still use the EA, but traders with at least some basic understanding of:

- Margin and leverage

- Drawdown

- Volatility of XAUUSD

…will get the most out of it, because they’ll know how to configure the EA in line with their risk appetite.

Pros and Limitations of Larry FX EA

No EA is perfect. Here’s a balanced view so you know what you’re getting into.

H3: Key Advantages

- Dedicated to XAUUSD (Gold) – built around one of the most popular trading instruments

- Ladder grid system – structured layering of trades instead of random entries

- Multi-timeframe support – M5 to H1 gives flexibility

- Capital security focus – designed for structured risk, not reckless gambling

- Live-account verified performance – not just an in-sample backtest story

H3: Potential Drawbacks

- Grid = exposure – any grid system will face heavier drawdown during strong trends

- Requires discipline – if you over-leverage or reduce grid distance too much, risk can spike fast

- Not news-proof – very high-impact events can still cause temporary or large drawdown

The EA gives you structure and logic, but you control the risk. If you treat it as a professional tool, it can fit well into a diversified trading plan.

Final Thoughts on Larry FX EA V1.0 MT4

Larry FX EA V1.0 MT4 is a solid option for traders who:

- Want to automate their gold trading

- Appreciate the ladder grid concept

- Care about capital security and structured risk

- Prefer steady account growth over flashy, ultra-high-risk setups

It won’t make you rich overnight, and it’s not a “no-loss” holy grail (nothing is). But as part of a sensible approach — using proper lot sizes, a realistic profit expectation, and strictly controlled drawdown — Larry FX EA can become a reliable engine in your XAUUSD strategy.

Comments

Leave a Comment