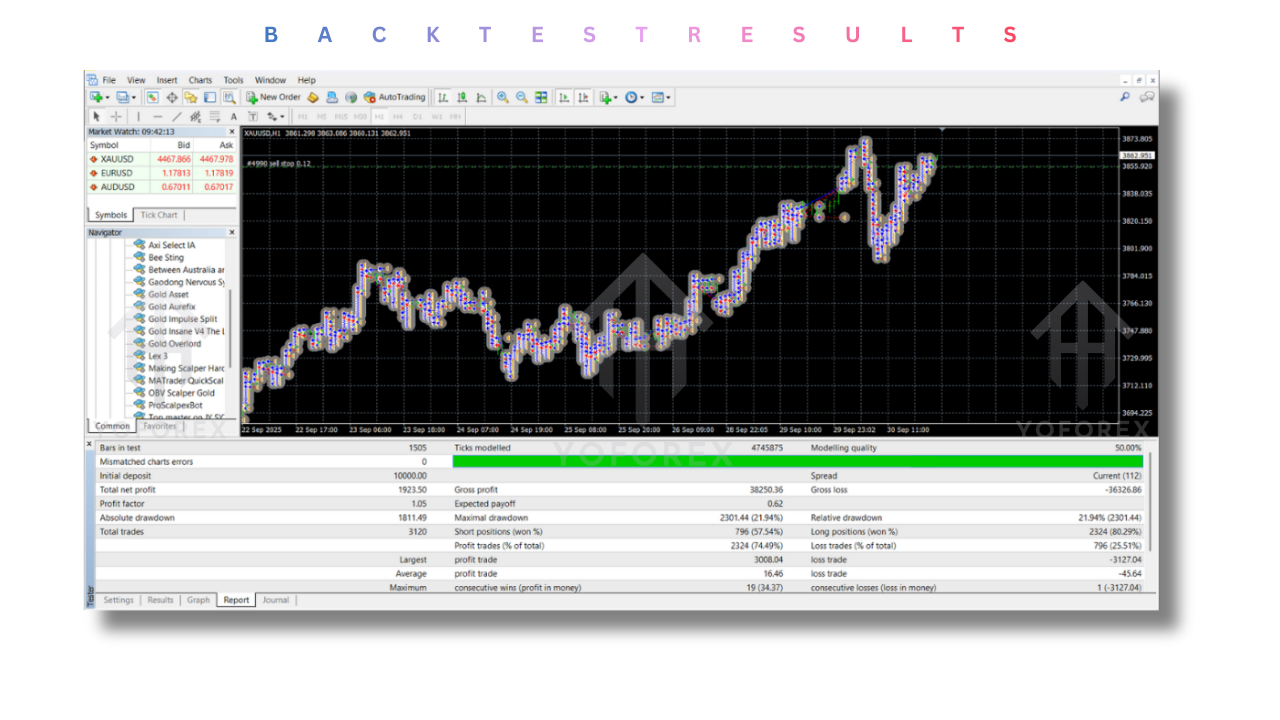

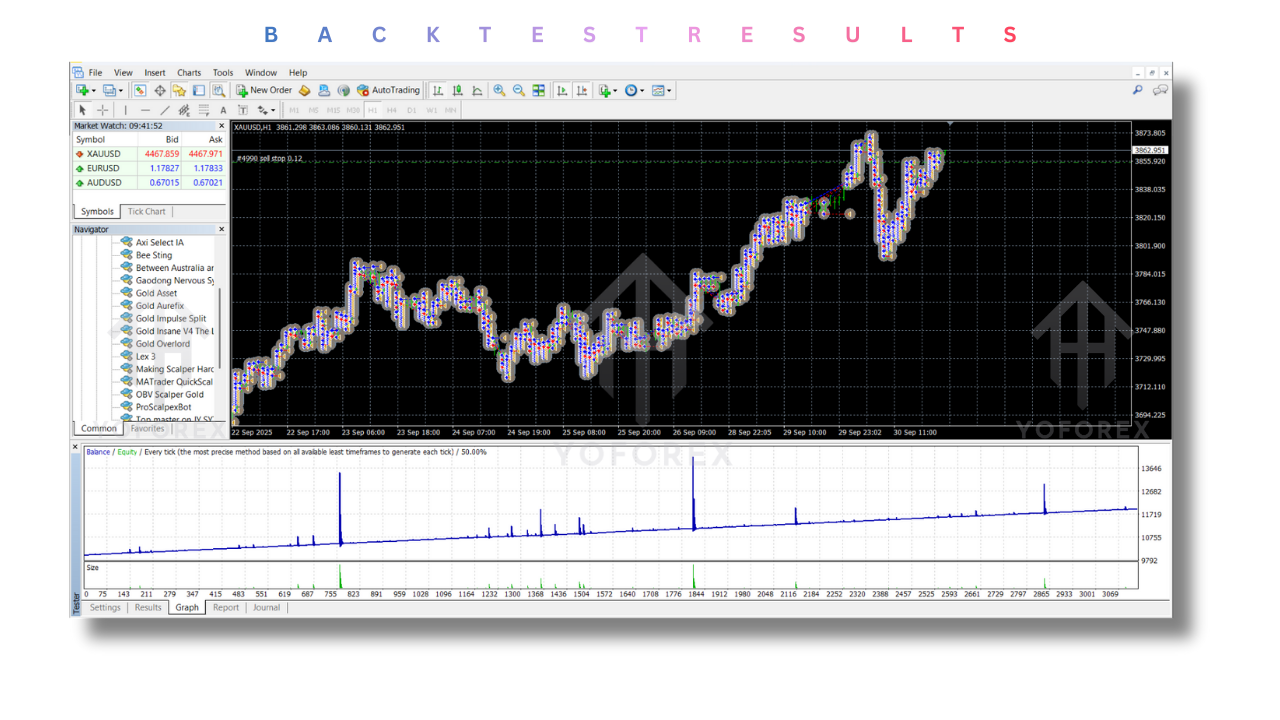

Automated forex trading has evolved significantly over the years, moving far beyond simple indicator-based robots. Today’s traders demand systems that can adapt to volatility, manage risk intelligently, and operate with discipline even when market conditions turn aggressive. Lex 3 EA V1.0 MT4 is designed with this modern mindset in focus.

Lex 3 EA is positioned as a next-generation Expert Advisor for MetaTrader 4, built to operate during critical market conditions such as strong trends, impulsive price movements, and high volatility sessions. Unlike traditional EAs that struggle when markets accelerate, Lex 3 EA aims to remain active and calculated when volatility increases.

In this in-depth review, we break down how Lex 3 EA V1.0 MT4 works, its trading logic, risk profile, ideal usage scenarios, and who it is best suited for. This guide is written especially for beginner and intermediate traders who want a clear, honest, and educational overview before using an automated trading system.

What Is Lex 3 EA V1.0 MT4?

Lex 3 EA V1.0 is an automated forex trading robot developed exclusively for the MetaTrader 4 platform. It is designed to trade multiple instruments, including major and minor currency pairs as well as precious metals, with a strategy that adapts to fast-moving market environments.

The EA uses a structured order-placement system that focuses on price distance, market momentum, and controlled position sizing. Rather than relying on a single indicator signal, Lex 3 EA manages trades dynamically based on market behavior, allowing it to remain active even when price action becomes irregular or volatile.

This EA is not positioned as a “set and forget” miracle tool. Instead, it is marketed as a disciplined trading system that requires proper configuration, sensible lot sizing, and realistic expectations from the user.

Core Trading Logic and Strategy

At its foundation, Lex 3 EA operates using a distance-based order management model. The system defines specific price gaps between orders, allowing it to structure entries logically rather than randomly.

When the market moves aggressively, the EA evaluates price behavior and places trades based on predefined spacing rules. This approach helps it avoid clustering trades too tightly during volatile conditions, which is a common weakness of poorly designed automated systems.

The EA is particularly focused on:

- Identifying impulsive price movements

- Managing exposure through controlled order spacing

- Adjusting to volatility rather than avoiding it

- Maintaining balance between opportunity and account load

Lex 3 EA is designed to work best when the market provides sufficient movement. Flat, low-volatility sessions may result in fewer trades, while active sessions are where the system seeks opportunity.

Supported Instruments and Timeframes

Lex 3 EA V1.0 MT4 supports trading across a wide range of instruments. These include major forex pairs, cross pairs, and precious metals. However, users should not assume that all instruments will perform equally.

From a professional perspective, it is recommended to start with one or two well-behaved instruments and expand only after proper testing.

The recommended timeframes are:

- M15

- M30

- H1

These timeframes provide a balance between trade frequency and signal reliability. Lower timeframes may introduce unnecessary noise, while higher timeframes may reduce trading opportunities.

Risk Management Philosophy

Risk management is one of the most important aspects of any Expert Advisor, and Lex 3 EA emphasizes controlled exposure rather than aggressive position sizing.

The EA allows traders to start with small lot sizes, such as 0.01, making it suitable for small or medium-sized accounts when configured correctly. Position spacing plays a crucial role in controlling drawdown, especially during prolonged price movements.

However, traders must understand that systems using structured order placement require strict discipline. Proper account balance, conservative lot sizing, and realistic profit expectations are essential for long-term sustainability.

Lex 3 EA is best used on accounts where the trader is comfortable monitoring performance and adjusting parameters when market conditions change.

Market Conditions Where Lex 3 EA Performs Best

Lex 3 EA is optimized for dynamic market environments. These include:

- High-volatility trading sessions

- Strong directional moves

- Impulsive price action after consolidation

- Markets with consistent liquidity

It is less effective during extremely tight ranges or during periods of low liquidity. Understanding market context is critical when running this EA, especially for beginners.

Using the EA during active trading sessions can significantly improve its efficiency and trade execution quality.

Installation and Setup Overview

Installing Lex 3 EA V1.0 MT4 follows the standard MetaTrader 4 process. After placing the EA file in the Experts folder and restarting the platform, traders can attach it to the desired chart and timeframe.

Before enabling live trading, users should:

- Verify lot size settings

- Confirm order distance parameters

- Test on a demo account

- Ensure auto-trading is enabled

Proper setup plays a major role in how the EA performs over time.

Who Should Use Lex 3 EA?

Lex 3 EA is suitable for:

- Beginner traders learning automated trading

- Traders who understand basic risk management

- Users comfortable with monitoring EA performance

- Traders who prefer structured, rule-based systems

It may not be suitable for traders looking for extremely low-risk or passive long-term solutions without oversight. Like any automated system, understanding its logic improves results significantly.

Strengths of Lex 3 EA V1.0 MT4

One of the strongest aspects of Lex 3 EA is its adaptability to volatile conditions. Instead of shutting down during aggressive price movement, it attempts to work with volatility in a controlled manner.

Additional strengths include:

- Flexible configuration options

- Beginner-friendly lot sizing capability

- Multi-instrument support

- Clear trading structure

These characteristics make it an interesting option for traders who want exposure to automated trading without excessive complexity.

Limitations and Considerations

While Lex 3 EA offers several advantages, traders should remain realistic. No Expert Advisor is immune to drawdowns or changing market behavior.

Users should be aware that:

- Poor configuration can increase risk

- Over-leveraging can lead to account stress

- Continuous monitoring is recommended

- Results vary by broker and market condition

Using proper risk control is essential to long-term success.

Best Practices for Long-Term Use

To maximize the potential of Lex 3 EA, traders should:

- Start with a demo account

- Use conservative lot sizes

- Avoid running too many symbols at once

- Monitor drawdown regularly

- Adjust settings as market volatility changes

Consistency and discipline are more important than short-term gains when using automated systems.

Final Verdict

Lex 3 EA V1.0 MT4 presents itself as a structured, volatility-aware Expert Advisor designed for modern forex market conditions. It is not marketed as a guaranteed profit machine, but rather as a tool that works best when combined with sensible risk management and trader awareness.

For beginners exploring automated trading or intermediate traders looking for a disciplined EA to test and learn from, Lex 3 EA can serve as a valuable educational and trading companion when used responsibly.

Upgrade

Upgrade your trading approach by combining automation with discipline. Lex 3 EA V1.0 MT4 is best used as part of a well-planned trading strategy rather than a standalone solution.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment