In real trading environments, losses are unavoidable. Even experienced traders face situations where a trade moves sharply against expectations due to sudden volatility, news impact, or timing errors. What separates disciplined traders from emotional ones is not the absence of losses, but the ability to manage and recover them systematically.

Loss Recovery 1 EA V3.2 MT4 is designed precisely for this purpose. Rather than opening random new trades or chasing profits blindly, this Expert Advisor focuses on structured loss management and controlled recovery. It does not replace your trading strategy; instead, it acts as a specialized recovery engine that intervenes when trades enter unfavorable territory.

This EA is built for traders who understand that recovery must be mathematical, controlled, and rule-based rather than emotional or impulsive.

Understanding the Core Purpose of Loss Recovery 1 EA

Loss Recovery 1 EA V3.2 MT4 is not a signal-based trading robot. It does not analyze indicators to decide buy or sell entries like traditional Expert Advisors. Instead, it works as a post-entry management system.

Once a trade is already open and begins moving into drawdown, the EA takes over the recovery process using a calculated basket logic. This approach allows traders to transform unmanaged losing trades into structured recovery cycles that aim to exit the market at break-even or controlled profit levels.

This distinction is critical. Loss Recovery 1 EA is not about predicting markets. It is about managing damage and restoring balance.

How Loss Recovery 1 EA V3.2 MT4 Works

The EA continuously monitors open positions on the account, chart symbol, or defined trade group. When a position reaches a predefined loss threshold, the recovery process begins.

Instead of adding trades recklessly, the system carefully opens a combination of positions both in the same direction and the opposite direction of the original trade. This dual-direction approach helps stabilize floating losses while allowing price movement to assist in recovery rather than worsen it.

The EA calculates spacing, lot distribution, and basket exposure dynamically. All trades are treated as part of a single recovery structure rather than isolated positions. Once the total basket reaches its predefined recovery target, all positions are closed simultaneously.

Key Recovery Logic Explained

Loss Recovery 1 EA V3.2 MT4 uses distance-based and volatility-aware triggers to initiate recovery. Traders can define when the EA should intervene using parameters such as price movement distance, volatility measurements, or percentage-based loss levels.

This flexibility allows the EA to adapt to different trading styles, whether the original trade was manual or automated. The recovery cycle remains active only as long as necessary, preventing endless trade accumulation.

The focus is not aggressive profit generation but controlled damage control.

Customization and Recovery Control

One of the strongest advantages of Loss Recovery 1 EA is its customization depth. Traders can choose how recovery behaves based on their account size, leverage, and risk tolerance.

Recovery parameters allow control over trade spacing, lot allocation balance, and exit logic. Conservative traders can configure wide spacing and slower recovery, while more aggressive users can reduce spacing for faster exits.

Importantly, the EA allows recovery management by symbol, magic number, or entire account, giving traders precise control over which trades are managed and which remain untouched.

Risk Awareness and Practical Use

Any recovery-based system carries inherent risk, and Loss Recovery 1 EA V3.2 MT4 is no exception. Recovery baskets may require higher margin during active phases, especially when markets trend strongly in one direction.

This EA is best used by traders who understand margin dynamics and account exposure. It is not suitable for very small accounts or traders who cannot tolerate temporary drawdowns during recovery cycles.

When used responsibly, it becomes a powerful defensive trading tool rather than a reckless multiplier.

Ideal Trading Conditions

Loss Recovery 1 EA performs best in markets with normal volatility and sufficient liquidity. Stable spreads and hedging-enabled trading environments provide the best operational conditions.

It can be applied across major forex pairs and selected indices where price movement remains technically structured. Extremely erratic market conditions may extend recovery duration, which is why disciplined parameter selection is essential.

Installation and Setup Guide

Setting up Loss Recovery 1 EA V3.2 MT4 is straightforward and beginner-friendly.

First, copy the EA file into the Experts folder of your MetaTrader 4 directory. Restart the platform to ensure proper loading.

Next, attach the EA to the chart of the symbol you want it to manage. Enable automated trading and verify that all required permissions are allowed.

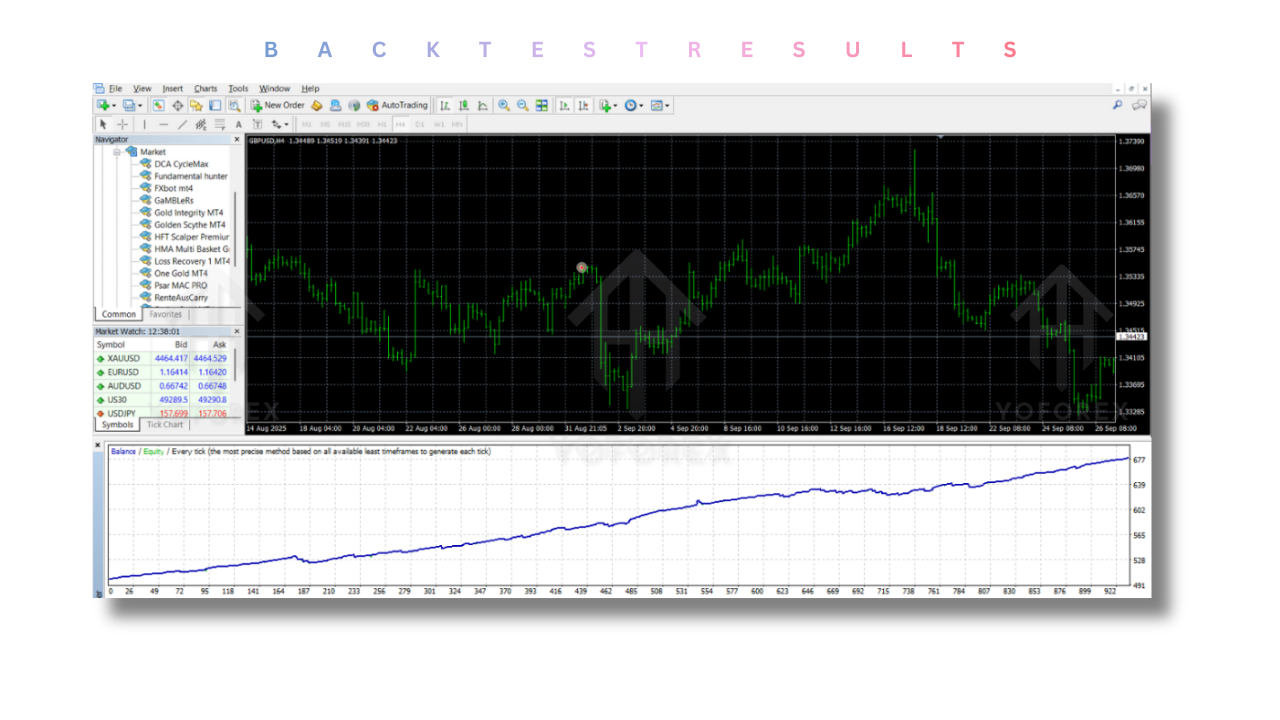

Adjust recovery parameters carefully before live deployment. It is recommended to test the EA on a demo account to understand how recovery cycles behave under different market conditions.

Advantages of Loss Recovery 1 EA V3.2 MT4

One major advantage is emotional neutrality. The EA removes panic-driven decisions when trades go wrong.

Another benefit is structured exposure management. Trades are treated as part of a recovery system rather than isolated losses.

The EA also integrates seamlessly with existing strategies, making it suitable for traders who already use manual or automated entry systems.

Finally, its flexibility allows it to adapt across multiple account types and trading styles.

Limitations You Should Know

Loss Recovery 1 EA does not eliminate risk. Prolonged trends against the recovery direction may increase margin usage.

It is not designed for ultra-low balance accounts or traders seeking instant recovery. Patience and discipline are required.

Improper configuration may lead to excessive exposure, making responsible setup essential.

Who Should Use This EA

Loss Recovery 1 EA V3.2 MT4 is suitable for intermediate to advanced traders who understand drawdown mechanics.

It is ideal for traders who sometimes face deep drawdowns from manual entries or external EAs and want a structured solution rather than emotional decisions.

It is not recommended for beginners without basic risk management knowledge.

Strategic Use in a Trading Plan

When integrated correctly, Loss Recovery 1 EA becomes a risk mitigation layer rather than a profit-seeking tool.

Many professional traders use recovery systems as a last-line defense, not as a primary trading engine. This EA fits perfectly into such frameworks when applied selectively and responsibly.

Conclusion

Loss Recovery 1 EA V3.2 MT4 is a specialized Expert Advisor focused on one critical trading problem: how to handle losing trades intelligently.

Rather than promising unrealistic profits, it offers a structured, rule-based approach to recovery that aligns with professional trading discipline.

For traders who understand its purpose and respect its limitations, this EA can become a valuable component of a balanced trading system.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: Click here

Telegram Group: Join our community

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Refferal

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges, join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Happy Trading

Comments

Leave a Comment