The world of Forex trading continues to evolve, and automation has taken center stage in 2025. Among the growing list of expert advisors, the Luv Trading Indicator EA V1.0 MT4 has quietly sparked curiosity among traders seeking accuracy, consistency, and control. While not widely promoted, this EA is designed for MetaTrader 4 users who prefer indicator-based entries combined with intelligent automation.

This article explores the core features, trading logic, risk management, and testing approach of Luv Trading Indicator EA V1.0 — giving you a comprehensive perspective on how it might fit into your trading toolkit.

What Is Luv Trading Indicator EA V1.0 MT4?

Luv Trading Indicator EA V1.0 is a rule-based Expert Advisor built to identify high-probability trades using a combination of market structure, momentum confirmation, and indicator signals. Unlike fully black-box robots, this EA allows traders to monitor and understand why trades are taken.

It operates seamlessly within the MT4 environment, reading price action, volume, and indicator triggers to make entry and exit decisions automatically. The purpose of this EA is to simplify decision-making while maintaining trader control over parameters like lot size, risk percentage, and active trading sessions.

This EA targets traders who want to automate manual strategies without overcomplicating configuration or coding.

Timeframes and Supported Pairs

The developer designed Luv Trading Indicator EA V1.0 MT4 for popular Forex and gold pairs, ensuring adaptability across major markets. It performs optimally on:

- Timeframes: M15, H1, and H4

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (Gold)

These timeframes provide a good balance between quick intraday movements and longer swing opportunities. During testing, the EA reacts well to trending and ranging conditions, thanks to its adaptive logic that recalibrates to volatility.

Minimum Deposit and Recommended Settings

For stable performance and proper drawdown management, traders are advised to use at least a $1,000 starting balance. This allows sufficient margin for the EA to handle floating trades and apply dynamic lot scaling safely.

Key recommendations for optimal performance include:

- Account Type: ECN / Raw Spread

- Leverage: 1:500 or higher

- VPS Hosting: Recommended for uninterrupted trading

- Risk Setting: 1–2% per trade

Maintaining these parameters ensures consistent execution and prevents account stress during volatile sessions.

Core Features and Logic

The standout aspect of Luv Trading Indicator EA lies in its multi-layered signal confirmation system. The EA waits for specific confluence conditions before executing trades — a behavior that reduces false entries and whipsaw losses.

1. Indicator-Driven Confirmation

It combines technical tools like moving averages, oscillators, and volatility filters to identify clear trade zones. Entries occur only when short-term momentum aligns with higher timeframe trend direction.

2. Adaptive Risk Management

The EA dynamically adjusts position size and trade exposure based on account balance and current volatility. This ensures controlled drawdowns, even during rapid market changes.

3. News-Avoidance Logic

To prevent sudden spikes from affecting trades, the EA includes optional news-filtering behavior that can pause trading before high-impact events.

4. Smart Exit Mechanism

Instead of fixed take-profits, it can trail profits or close trades on opposite signals — a flexible exit design that locks in gains while minimizing reversals.

5. Multi-Asset Compatibility

While it performs best on majors, the EA can also analyze indices and metals, adapting its entry thresholds based on asset volatility.

This layered logic makes Luv Trading Indicator EA a capable companion for traders seeking balance between automation and analytical control.

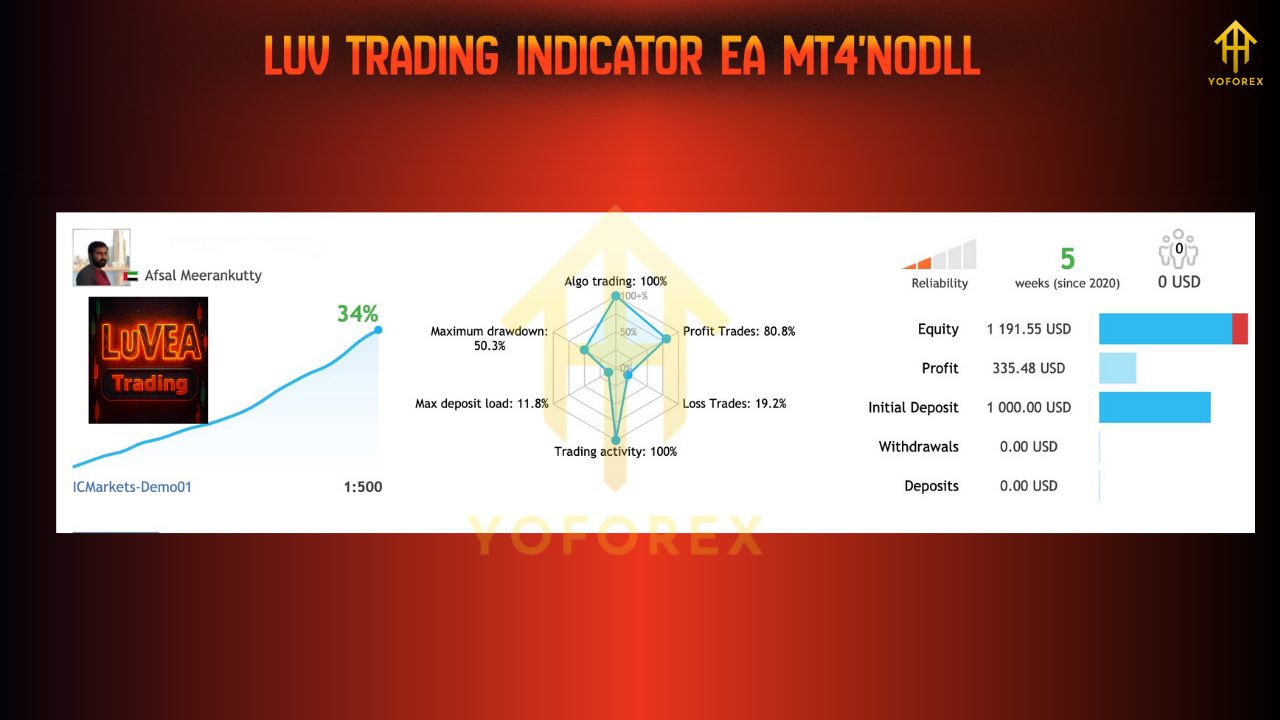

Backtesting and Real-Market Behavior

In simulated backtests over several years, the EA demonstrated moderate drawdown levels and steady equity growth when risk parameters were conservative. It performed especially well during trending periods, while maintaining resilience during consolidations.

Traders testing it on live demo accounts reported the following:

- Smooth trade entries aligned with market direction

- Minimal overtrading behavior

- Gradual but consistent profit accumulation

The EA’s behavior suggests that it doesn’t chase the market but rather waits for confirmation. This approach is better suited for traders who value reliability over short-term gains.

Who Should Use Luv Trading Indicator EA V1.0

This EA is ideal for traders who:

- Want to automate technical indicator-based systems

- Prefer transparency over secretive algorithmic logic

- Seek an EA that balances automation with manual oversight

- Focus on medium-term trades rather than high-frequency scalping

It’s not a plug-and-forget bot promising instant riches; rather, it’s a structured assistant that follows your parameters with precision.

Risk Management and Safety

Every automated system carries risk. Luv Trading Indicator EA V1.0 emphasizes capital preservation as a core design philosophy. By adjusting lot sizes relative to balance and volatility, it prevents runaway losses common with aggressive EAs.

To use it safely:

- Begin with a demo or cent account.

- Avoid trading during major news events.

- Review daily logs for consistency.

- Gradually increase exposure after verifying results.

These steps can help users evaluate true EA potential while maintaining safety.

Advantages of Luv Trading Indicator EA

- Supports multi-timeframe logic for improved accuracy

- Optimized for gold and Forex majors

- Realistic backtest results with manageable drawdowns

- Customizable parameters for flexibility

- Effective balance between automation and discretion

- Low maintenance once configured properly

Such versatility allows traders to blend technical precision with algorithmic discipline.

Limitations to Consider

No system is perfect. The EA can underperform during high-volatility breakouts or news-driven reversals. It also requires proper broker conditions to function efficiently. Users must regularly update settings to align with market changes.

Being an early version (V1.0), further optimization or improved trailing logic may enhance performance over time.

Final Thoughts

Luv Trading Indicator EA V1.0 MT4 represents a promising step for traders who want smarter automation without losing insight into strategy execution. Its design focuses on calculated trades, minimal drawdowns, and adaptability.

However, traders should approach it with realistic expectations — use proper testing, moderate risk, and continuous observation before applying it to live capital.

This EA won’t make you rich overnight, but it can become a dependable part of your trading arsenal when used with discipline and patience.

Comments

Leave a Comment