M1 Scalper ParthOP EA V2.0 MT4 — Lightning-Quick Entries for Serious Scalpers

Scalping the 1-minute chart is not for the faint-hearted. Price moves in blips, spreads matter a ton, and slippage can make or break your day; but when you get it right… it’s addictive. Enter M1 Scalper ParthOP EA V2.0 for MT4—a purpose-built expert advisor designed to hunt micro-impulses, stack small wins, and manage risk like a pro. If you’ve ever thought, “I can read the M1 tape but I can’t click fast enough,” this EA might be your shortcut. It focuses on highly liquid pairs, bids for ultra-tight spreads, and executes with the kind of discipline humans promise but rarely keep.

And yes, it’s opinionated in the best way: minimal lag, no bloated indicators, and hard rules around entries/exits so your emotions don’t hijack the plan. You bring the broker and the VPS, ParthOP brings the speed. Simple as that… coz that’s all you need on M1.

What Is ParthOP EA V2.0 (MT4)?

At its core, ParthOP EA V2.0 is a momentum-scalping algorithm for MetaTrader 4 that analyzes micro-structure on the M1 timeframe—think short bursts around session opens, volatility pops, and clean micro-trends that often last a few minutes. The EA reads order-flow proxies (through price velocity, candle body/wick behavior, and spread filters), then times entries during low-latency windows where the risk-to-reward makes sense. The logic is rule-based, repeatable, and explicitly tuned to avoid some classic scalper pitfalls like chasing every tiny tick or over-trading during dead liquidity.

Who it’s for:

- Traders comfortable with tight risk, small targets, and frequent trades.

- Users who can run a VPS and connect to a low-spread ECN broker (this matters a LOT for M1).

- Anyone who wants mechanical, repeatable execution without second-guessing every click.

What it’s not:

- A martingale grid monster hoping to get lucky.

- A “set it and forget it” bot for illiquid pairs or wide-spread environments.

- A guarantee of riches—sorry, no magic here; just clean engineering and risk control.

How the Strategy Works (In Plain English)

1) Session & Volatility Awareness

ParthOP focuses on times when spreads are tight and the market is actually moving—usually London/NY sessions. It throttles back during low-liquidity chop.

2) Micro-Momentum Detection

It measures immediate price velocity (how quickly a candle forms and closes), the relationship of wick/body, and whether momentum aligns across the last few bars. When multiple micro-signals align, it primes for entry.

3) Spread & Slippage Filters

Before placing orders, the EA checks current spread and rejects trades if the cost is too high. This alone can save a ton of bad fills on M1.

4) Risk-First Entries

Each entry uses a predefined SL (hard stop) and TP (scalp target); trailing logic can kick in when price jets in your favor. If conditions fade, the EA cuts losers fast and scales winners only within strict caps—no “praying and hoping.”

5) Trade Frequency, Not Over-Frequency

ParthOP trades often but not constantly. V2.0 added cooldown logic and better “no-trade zones” to reduce noise and revenge trading.

Key Features (Why Traders Like It)

- Built for M1: The logic is genuinely optimized for one-minute charts—no lazy port from H1.

- Tight Risk Controls: Hard SL per position; optional equity-protect (daily stop).

- No Martingale: Position sizing stays sane; no doubling down into oblivion.

- Spread-Aware Entries: If your spread widens, ParthOP sits out—smart.

- Broker-Agnostic (ECN Recommended): Works on most ECN brokers; lower costs = better edge.

- VPS-Friendly: Lightweight, minimal CPU footprint; deploy and forget the OS overhead.

- Session Filters: Focuses on high-liquidity hours by default (configurable).

- News Guard (Optional): Skip high-impact events; avoid “slip ‘n’ whip.”

- Partial Close + Trailing: Banks profits methodically when momentum cools.

- Risk Templates: Conservative, Moderate, and Aggressive presets to match your goals.

- Prop-Firm Aware: Daily loss caps, lot limits, and max trade filters to respect rules.

- Clear Logs/Alerts: Know exactly why a trade did—or didn’t—trigger.

Recommended Pairs & Conditions

- Pairs: EURUSD, GBPUSD, USDJPY (tight spreads, deep liquidity). Many traders also like XAUUSD for momentum, but only with razor-thin spreads—be selective.

- Broker: True ECN with raw spreads + commission; fast execution.

- Time to Trade: London open through early NY; avoid rollover and lunch-hour drifts.

- Infrastructure: New York or London-based VPS with <5–10 ms latency to your broker.

- Account Type: Hedging OK; micro/standard lots fine; 1:100 to 1:500 leverage is typical (use responsibly).

Settings That Matter (And Why)

- Lots: Start tiny (e.g., 0.01 per $1,000) and scale only after forward results.

- Max Concurrent Trades: 1–3 per pair; keeps risk stacked but capped.

- SL/TP: Typical M1 scalps aim for small TP (4–12 pips) with tight SL (6–15 pips)—adjust to your pair’s spread/ATR.

- Spread Filter (pips): Set your personal “no trade above X spread” rule; e.g., 1.2 pips on EURUSD.

- News Filter: Block entries 5–15 minutes before/after high-impact events.

- Session Window: Enable only the hours you truly want to trade; let sleep be sleep.

- Daily Loss Limit: E.g., −2% to −3% equity; when hit, the EA stops for the day. Discipline > ego.

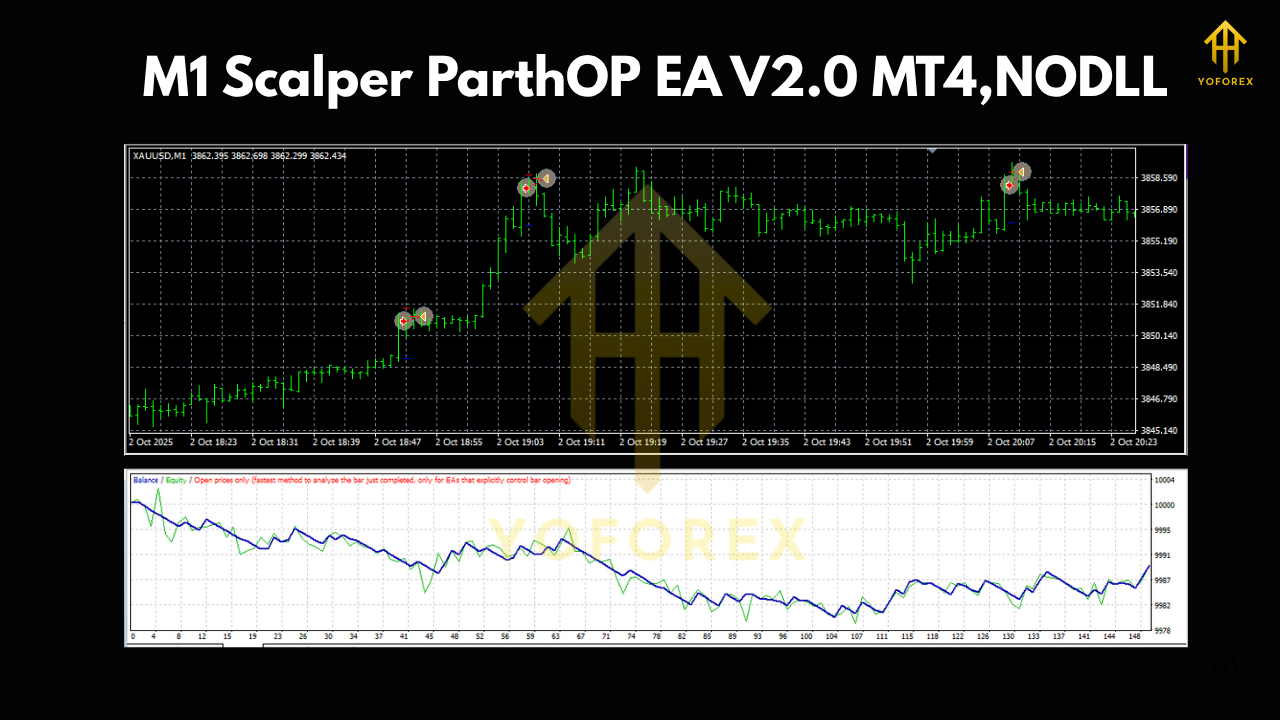

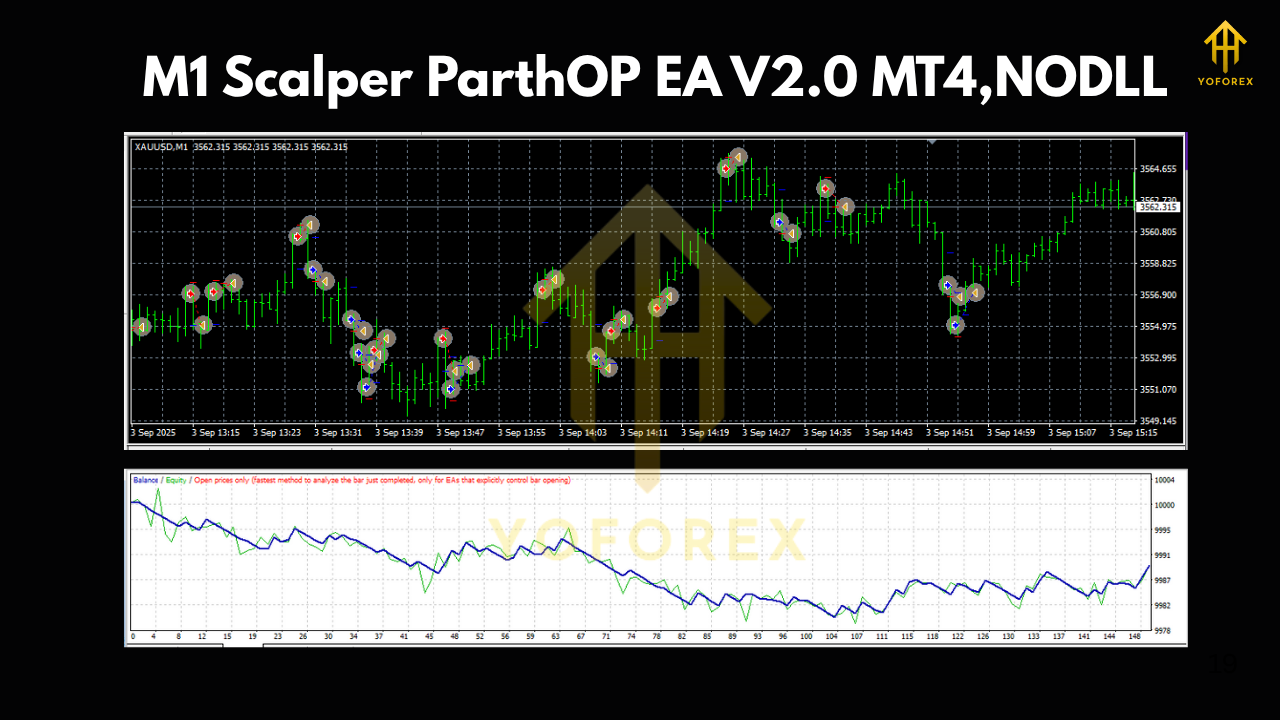

Backtesting & Forward Testing Tips

Backtests on M1 are notoriously sensitive to tick quality, spread assumptions, and modeling precision. Use 99% tick-data quality with real variable spreads if possible. Even then, let backtests guide, not rule. Focus on:

- Stability over time: not just one golden month.

- Drawdown behavior: how deep, how long, and how it recovers.

- Sensitivity checks: try worse spreads/commission; see if the edge survives.

- Forward test on demo/cent accounts for at least 2–4 weeks before going live.

- Journal every change—settings, broker, VPS location—so good results can be replicated, not “guessed.”

Prop-Firm Considerations

ParthOP’s risk templates help you operate within common prop rules:

- Daily Loss Cap (e.g., 4–5%): The EA can stop trading automatically at your threshold.

- Max Lot Size / Max Open Trades: Set hard ceilings.

- News Restrictions: If the firm bans news trading, keep the filter on.

- Consistency: M1 scalping can produce many small wins—great for “consistency” scoring.

Installation & Setup (MT4)

- Download & Copy Files: Place the EA in

MQL4/Experts/. - Restart MT4: Or hit Refresh in the Navigator.

- Enable Algo Trading: Check the “AutoTrading” button is ON.

- Attach to Chart: Open M1 chart (EURUSD to start), drag the EA onto it.

- Load a Preset: Start with “Conservative” until you’re comfortable.

- Broker Check: Verify live spread/commission; widen spread filter if your broker is slightly higher.

- VPS Deployment: Keep MT4 running 24/5 on a low-latency VPS; log in remotely to monitor.

Risk Management (Non-Negotiables)

- Cap daily risk; walk away when reached (EA can enforce).

- Withdraw regularly if you’re up; squirrels store nuts, be a squirrel.

- Avoid over-pairing—too many pairs = correlated risk spikes.

- Keep leverage sensible; more leverage ≠ more edge, it’s just more exposure.

- Never martingale “to fix a bad day.” ParthOP won’t; neither should you.

Common Questions (Quick Answers)

Does it use grid or martingale? No. Fixed risk per trade with optional partial scaling within limits.

Can I run it on multiple pairs? Yes, but start with one pair to learn the behavior.

Minimum deposit? Depends on your lot size. Many start at $200–$500 with micro lots to forward-test.

Does VPS matter? On M1 it’s huge. The lower the latency, the better your fills.

Will it pass a prop challenge? It’s designed with prop rules in mind, but passing depends on execution quality, spreads, and your risk template.

Pros & Cons

Pros

- Fast, disciplined execution tailored to M1.

- Spread-aware logic avoids terrible fills.

- Prop-firm-friendly risk caps and filters.

- Lightweight, stable on VPS.

- No martingale or reckless grids.

Cons

- Broker quality and spreads can make or break it.

- Requires a VPS and some setup time.

- Not ideal for low-liquidity hours or exotic pairs.

- Demands trader patience—ironically, even for scalping.

Final Take

M1 Scalper ParthOP EA V2.0 (MT4) is for traders who crave speed and discipline. It won’t sugarcoat fills or magically beat wide spreads; it will filter, fire, and manage small edges consistently—exactly what M1 demands. If you’re willing to treat infrastructure (broker + VPS) as part of the strategy, this EA can be a legit addition to your playbook. Test it, tune it, and let the rules do the heavy lifting. You focus on the plan.

Comments

Leave a Comment