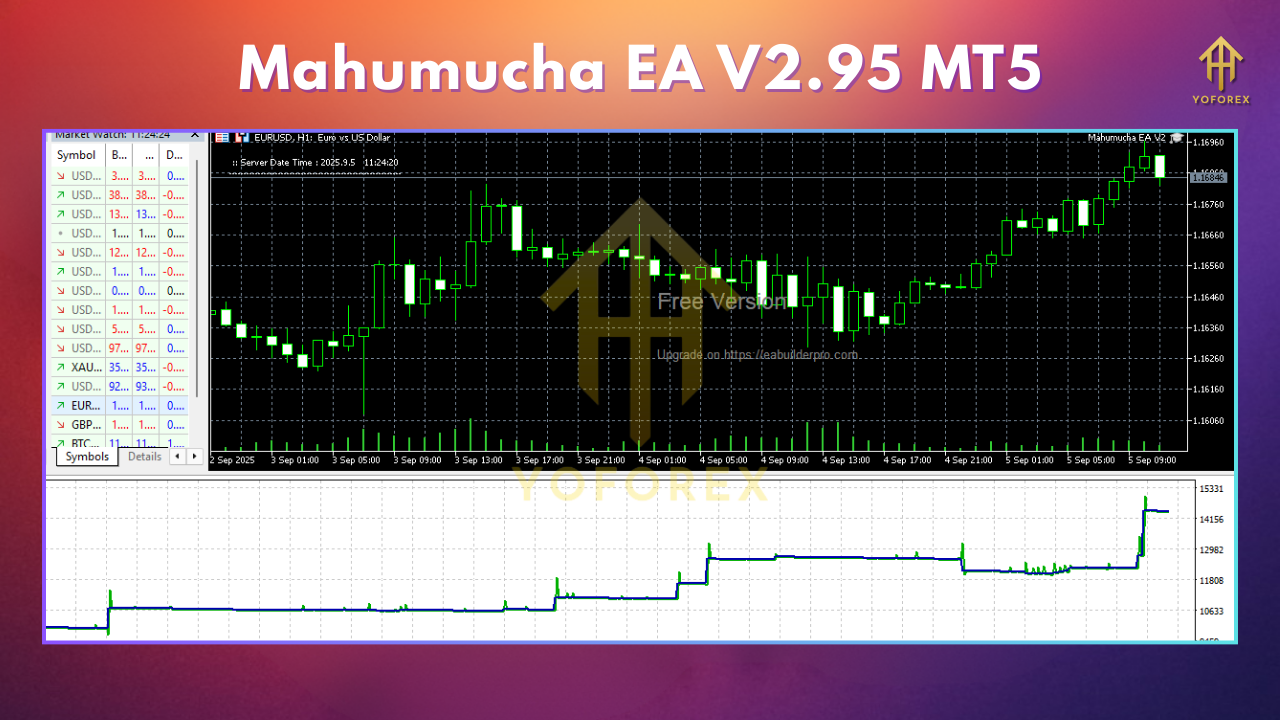

If you’re looking for an MT5 expert advisor that intelligently combines trend-following and mean-reversion strategies, Mahumucha EA V2.95 MT5 might be just the tool for you. This EA is designed to catch both momentum during trending markets and pullbacks during consolidation phases, ensuring that you can profit in various market conditions without needing to monitor trades all the time.

The Mahumucha EA V2.95 utilizes advanced algorithms to adjust its trading style according to the market’s current state. It's designed to be adaptive and can be used across multiple timeframes and forex pairs. Let’s take a deeper look at the features, strategies, installation process, and how to get the most out of this powerful EA.

What Is Mahumucha EA V2.95 MT5? (Overview)

Mahumucha EA V2.95 MT5 is a dual-mode automated trading system for MetaTrader 5 that implements a combination of trend-following and mean-reversion strategies. The EA dynamically adjusts its approach based on market conditions, switching between the two strategies to capture the best market opportunities.

- Trend-following logic for breakouts and momentum continuation.

- Mean-reversion logic for counter-trend trades during consolidations or pullbacks.

- Flexible risk management with dynamic stop-loss and take-profit based on ATR (Average True Range).

- Adaptable entry and exit strategies to optimize performance across various timeframes and pairs.

- Complete automation to handle trading without manual intervention.

Who it’s for:

- Traders who want an EA that can adapt to both trending and ranging markets.

- Those who seek consistent trading with risk management in mind, without the need to constantly adjust settings.

- Perfect for both intraday traders and those who want to automate their swing trading strategies.

Key Features (Why Mahumucha EA Stands Out)

- Dual-Mode Strategy

Mahumucha EA V2.95 uses two distinct trading strategies: Trend-following for capturing strong price moves and Mean-reversion for counter-trend entries during pullbacks or consolidation. - ATR-Based Risk Management

The EA calculates dynamic stop-loss and take-profit levels based on the market’s volatility (ATR). This ensures that the EA adapts to varying market conditions, adjusting risk accordingly to protect your capital. - Adaptive Strategy Switching

The EA automatically switches between trend-following and mean-reversion strategies depending on market conditions, optimizing your entry and exit points. - Customizable Inputs for Risk Control

Set your own risk percentage per trade, lot sizes, SL/TP ratios, and daily loss limits. You have full control over how much risk you’re willing to take per trade. - Break-even and Trailing Stop

The EA can automatically move your stop to break-even once a predefined profit threshold is hit, and it can also apply a trailing stop to lock in profits as the price moves in your favor. - Multiple Timeframe Compatibility

Mahumucha EA works across multiple timeframes and can be applied to various pairs, making it versatile for different trading styles. Whether you trade on M5, M15, H1, or H4, Mahumucha adjusts its strategy accordingly. - Full Automation

No need to monitor your trades constantly. Mahumucha EA automatically handles your entries, exits, and risk management in real-time, freeing up your time for other tasks.

Suggested Settings for Optimal Performance

Risk Settings

- Risk per Trade: Start with 0.5%–1% per trade and adjust based on your account balance and risk tolerance.

- Lot Size: You can either use a fixed lot size or enable percent-based risk for dynamic lot sizing.

- Stop-Loss and Take-Profit:

- Use ATR-based stops for better risk-adjusted exits.

- Consider setting a fixed SL of 20-40 pips for smaller timeframes (M5/M15) and 50-100 pips for longer timeframes (H1/H4).

- Take-profit ratios can be set at 1:1.5 or 1:2 for trend-following strategies.

Timeframes:

- Scalping (M5/M15): Works best with shorter timeframes. The EA’s trend-following strategy captures momentum in fast-moving markets, while the mean-reversion strategy helps during pullbacks.

- Intraday (M30/H1): Ideal for moderate trends with longer holding periods.

- Swing (H4): Best suited for slower-moving markets where mean reversion plays a more significant role.

Pairs:

- EURUSD, GBPUSD, USDJPY — Best pairs for consistent movement and tight spreads.

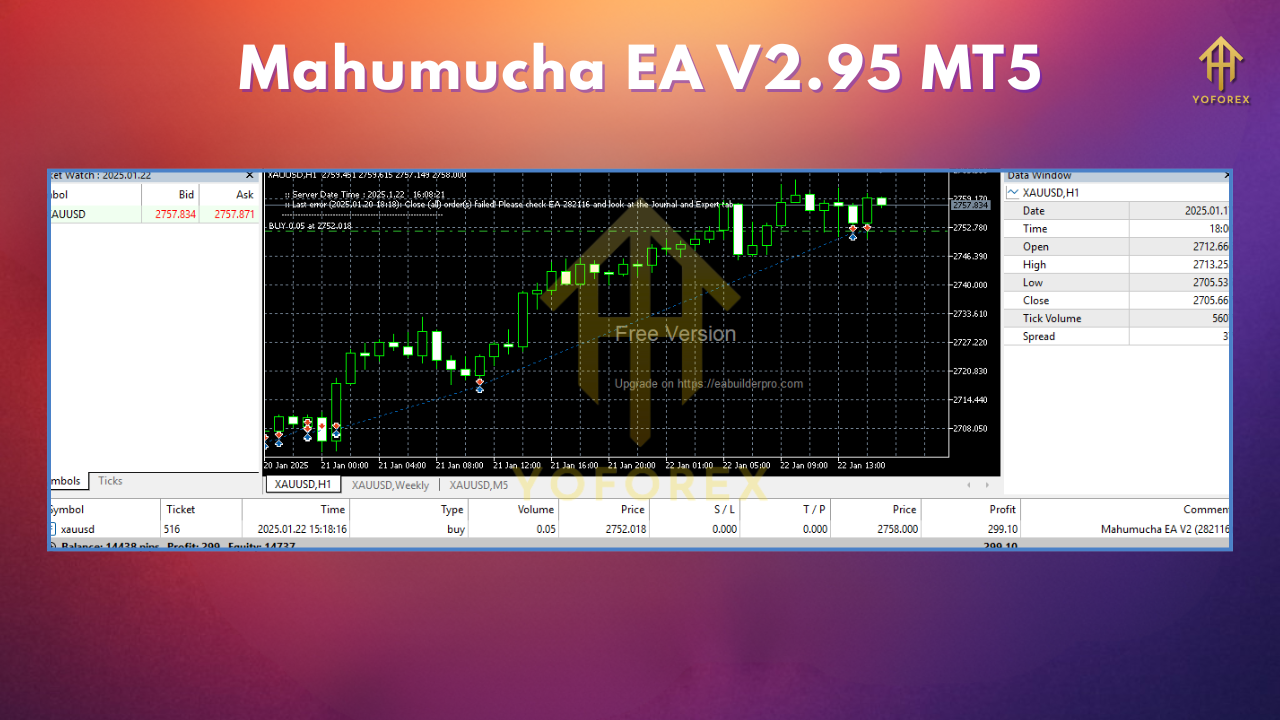

- XAUUSD (Gold) — You can apply Mahumucha EA for gold as well, but make sure to widen your stop-loss to account for higher volatility.

Strategy Logic and How It Works

1) Trend-Following Mode

The trend-following mode kicks in when the market is showing a clear directional movement. The EA waits for the breakout or momentum continuation, then places a trade in the direction of the trend. This strategy uses a moving average crossover or momentum indicator to confirm the direction.

- Entry: When the price breaks a key level (e.g., a support/resistance zone), and the momentum is confirmed by trend indicators.

- Exit: The EA exits once a predefined target is hit or when the price shows signs of a reversal.

2) Mean-Reversion Mode

In mean-reversion mode, the EA takes counter-trend trades during periods of market consolidation or when the price moves away from the average. This strategy is based on the idea that the price will eventually return to the mean.

- Entry: The EA enters the trade when the price moves too far away from the mean (typically based on an ATR threshold or support/resistance).

- Exit: The trade is closed once the price returns to the mean (or central moving average) level.

3) Risk Management

- Dynamic SL/TP: The EA adjusts stop-loss and take-profit levels based on market volatility (ATR).

- Breakeven & Trailing Stop: The EA automatically moves your stop to breakeven after reaching a predefined profit level, and can also trail your stop as the market moves in your favor.

Installation & First-Time Setup (Step-by-Step)

- Copy the EA File:

PlaceMahumucha_EA_V2.95.ex5into your MQL5/Experts folder. - Compile the EA:

Open MetaEditor and click Compile. The EA will now be available in your Navigator window in MT5. - Attach the EA to a Chart:

Open a chart for the pair you want to trade (e.g., EURUSD, XAUUSD) and drag the EA from the Navigator window onto the chart. - Configure the Inputs:

Set your risk parameters, timeframe, and session windows in the input settings. Adjust the stop-loss, take-profit, and lot size according to your preferences. - Enable AutoTrading:

Ensure AutoTrading is enabled in MT5 by clicking the AutoTrading button in the top toolbar.

Backtesting & Forward Testing Tips

Backtest

- Test for at least 6-12 months of market data. Ensure to include periods of high volatility and market reversals.

- Use historical data from your broker, considering both spread and slippage in your backtesting.

- Validate the ATR-based stop-loss and take-profit settings against actual market conditions.

Forward Test

- Use a demo account for 2-3 weeks of forward testing.

- Start with micro lots and check how the EA adapts to live market conditions.

- Monitor spread and slippage, as they can affect your live performance compared to backtesting.

Prop-Friendly Settings

- Risk per Trade: Keep 0.5% to 1% per trade to adhere to most prop-firm rules.

- Max Daily Loss: Set a daily loss limit (e.g., 3%-5%) to ensure compliance with prop-firm guidelines.

- Session Filters: Trade only during high liquidity sessions like London/NY to avoid low-volume choppy conditions.

Troubleshooting & FAQs

No trades?

- Double-check your session window and make sure the EA is allowed to trade during active market hours.

- Verify that spread and slippage conditions are within the limits you’ve set.

EA not placing trades at expected levels?

- Check if your lot size is too small or risk limits are too restrictive.

- Re-check the ATR settings for volatility-based stop adjustments.

Risk Disclaimer

Trading Forex/CFDs involves substantial risk. Past performance does not guarantee future results. Only trade money you can afford to lose. Always validate any settings on demo or with a small live account before scaling.

Call to Action

Ready to trade with a versatile and adaptive system? Download Mahumucha EA V2.95 MT5, configure your settings, and start testing on a demo account. Keep risk low, test consistently, and scale once you see positive results.

Download: (Insert your download link here)

Support: For assistance, drop questions in the comments or reach out to our support team.

Comments

bro, i want to download your EA, send me a decryption key

bro, i want to download your EA, send me a decryption key

bro, i want to download your EA, send me a decryption key

Leave a Comment