MasterAIV2 EA V1.0 MT4 — Trade Smarter with AI-Assisted Precision

If you’ve been hunting for a MetaTrader 4 expert advisor that blends AI-style signal filtering with strict risk control, MasterAIV2 EA V1.0 MT4 is worth a serious look. The idea behind MasterAIV2 is simple: keep the playbook clean, cut the noise, and let the bot do the heavy lifting—entries, exits, and risk—so you can focus on the bigger picture. No hype, no wild promises; just a thoughtfully designed EA that aims to be consistent, prop-firm friendly, and easy to operate even if you’re not a full-time coder. And yes, it’s MT4-native, so you can roll it out on practically any broker that supports EAs.

What makes MasterAIV2 EA different? It combines a momentum-plus-mean-reversion bias with an adaptive filter (think: AI-inspired rules that react to volatility and session conditions). In simple terms, it tries to play with the market when trend structure is clear, and it chills when spreads widen or the news calendar threatens to throw a curveball. Result? Fewer random zaps, more curated setups. You’ll find it particularly solid on liquid majors and XAUUSD, with configurable profiles for conservative, moderate, or higher-octane risk.

What is MasterAIV2 EA V1.0 for MT4?

MasterAIV2 EA is an algorithmic trading system for MetaTrader 4 that automates entries, exits, and protective logic. Its goal is steady performance under realistic constraints—slippage, spreads, and occasional fast markets—coz that’s real life. The engine scans for trend alignment first, then validates the entry with a pattern/volatility check to reduce false triggers. Exits are split between protective stops and dynamic profit management (partial closes + trailing logic), which helps “harvest” winners without overstaying.

Designed for:

- Traders who want rule-based execution with minimal babysitting.

- Prop-firm challengers who must control drawdown and daily loss.

- Anyone who needs reproducible behavior (clear settings, repeatable results).

Core Strategy at a Glance

Market Model

- Bias Filter: Looks for directional structure (HH/HL or LH/LL) and confirms with a volatility gate.

- Session Awareness: Prefers London/NY overlaps for majors; stands down in unusually thin conditions.

Entry Logic

- Break-and-Retest or Micro-Pullback: Waits for price to nudge beyond a micro-structure level; no blind chasing.

- Spread & Slippage Gate: Skips entries when trading conditions worsen to protect fills.

Exit Logic

- Hard SL/TP: Always on, always clear.

- Dynamic Trail: Trails only when price velocity confirms; otherwise holds TP.

- Partial Take-Profit: Locks in a slice at a predefined RR, letting the remainder run if momentum persists.

Protection

- Max Daily Loss & Max Trades per Day: Helps maintain discipline (prop-firm friendly).

- Equity Guard: Pauses new entries if equity drawdown breaches your threshold.

Key Features

- • AI-style signal filter that adapts to volatility and session conditions

- • Strict risk controls: fixed SL/TP, equity guard, daily loss stop

- • Partial close + trailing stop combo for smoother equity curves

- • News-aware pause window (time-based; you can define news blackout periods)

- • Spread/Slippage check to avoid poor fills

- • Max simultaneous positions with FIFO-friendly close logic

- • Multi-pair support: majors + XAUUSD, configurable per symbol

- • Preset risk profiles: Conservative, Moderate, Aggressive

- • Prop-firm conscious: daily cap, no martingale, no grid by default

- • Lightweight execution: designed to be VPS-friendly

- • Clean inputs panel: readable names, comments, and defaults

- • Detailed on-chart panel: current bias, open risk, session status

Recommended Settings

Pairs & Timeframes

- EURUSD, GBPUSD, USDJPY: M5–M15 for intraday, H1 for calmer swing entries

- XAUUSD (Gold): M5/M15 for active sessions; H1 if you want fewer trades with wider stops

Account Type & Leverage

- ECN/Raw spread recommended; fast execution helps.

- Leverage: 1:100 to 1:500 is fine—risk is based on % of balance, not leverage.

Risk Profiles (suggested starting points)

- Conservative: 0.25–0.5% per trade, max 2 trades/day, max daily loss 1.5–2%

- Moderate: 0.75–1% per trade, max 3 trades/day, max daily loss 2.5–3%

- Aggressive: 1.25–1.5% per trade, max 4 trades/day, max daily loss 4%

(Tweak lot sizing via “RiskPercent” or fixed lot if you prefer.)

Stops & Targets (typical)

- SL: ATR-based (e.g., 1.5–2.2× ATR on entry timeframe)

- TP: Split target—first portion at ~1.2–1.8R, remainder trailed when momentum confirms

Installation & Setup (MT4)

- Copy the EA file into

MQL4/Experts/in your MT4 data folder. - Restart MT4, enable “AutoTrading,” and allow DLL imports if required by your broker.

- Attach the EA to your chosen chart(s) and timeframe(s).

- Set risk inputs: RiskPercent, MaxDailyLoss, MaxTradesPerDay, etc.

- Define trading sessions (e.g., only London/NY); set your news blackout time windows if you use them.

- Whitelist symbols you want active and set per-symbol overrides if needed (lot cap, max positions).

- Run on a VPS close to your broker for lower latency and fewer disconnects.

Pro tip: Start with Conservative preset for 2 weeks on demo, then scale settings only after you like the behavior.

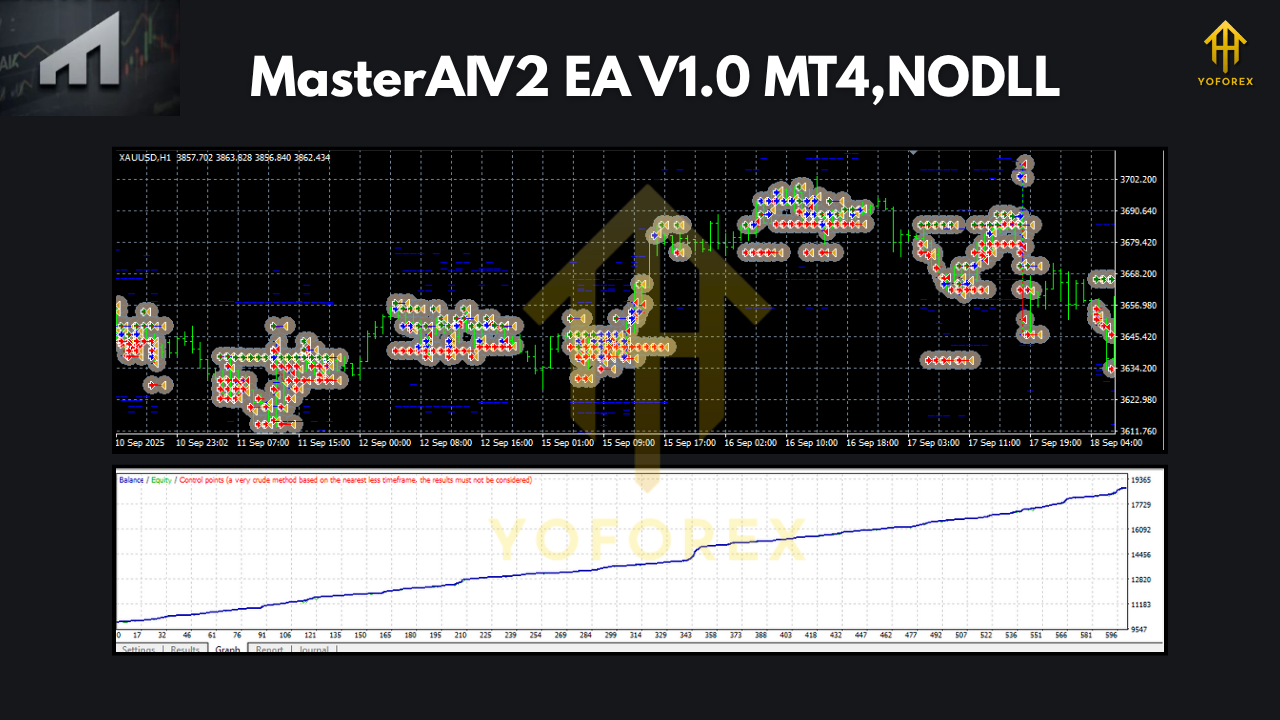

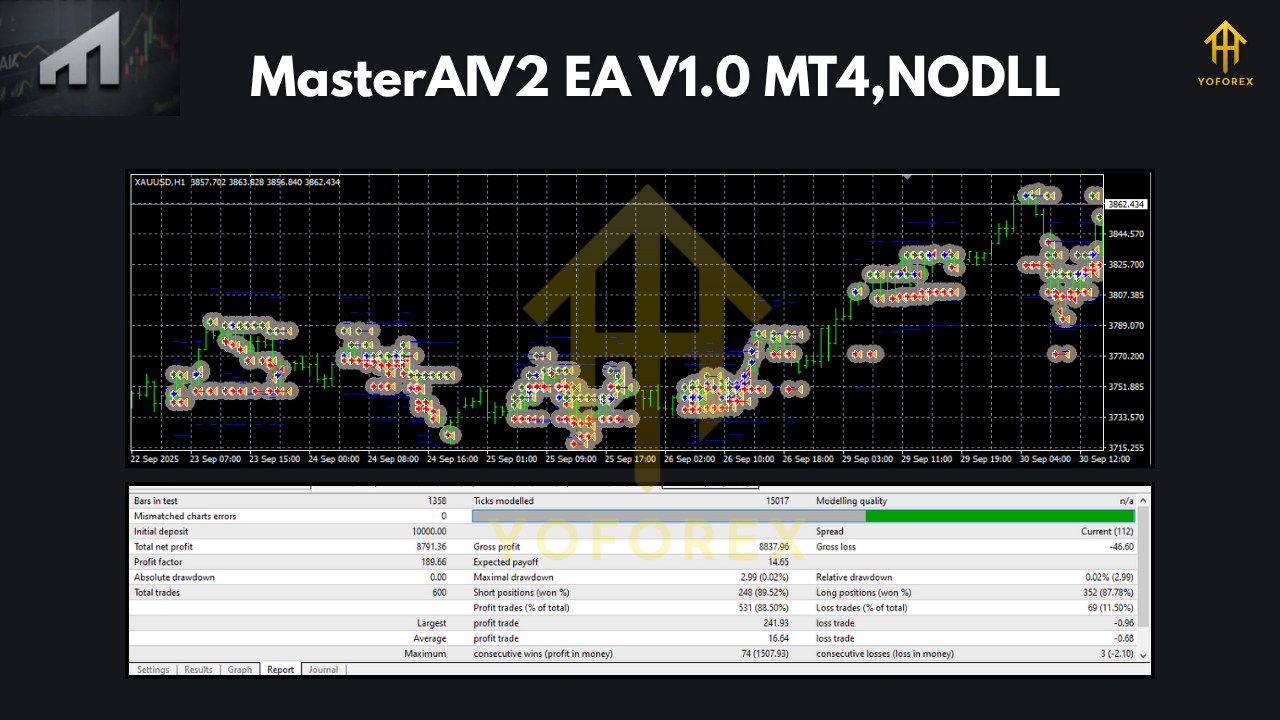

Backtesting & Optimization

To get meaningful tests, use Every tick based on real ticks (if available) or high-quality tick data with accurate spreads and commissions. Backtest each symbol separately:

- EURUSD & GBPUSD: Focus on the last 12–24 months to reflect current volatility regimes.

- USDJPY: Include Asian session behavior; consider a slightly different trailing logic.

- XAUUSD: Test both M5 and M15 with a wider SL; gold can “jump,” so spread filters matter.

What to watch:

- Win rate versus average R multiple (you want positive expectancy, not just a high hit rate).

- Max drawdown (equity, not just balance).

- Sensitivity to spread (re-run the same test with +0.5–1.0 pips added spread).

- Performance by session (London vs. NY).

Avoid over-optimizing dozens of knobs. Instead, tune 3–5 parameters that matter (ATR multiple, partial-TP level, trail trigger, session windows). Then validate your picks on a different time period—if results hold, you’re good.

Live Trading Playbook

- VPS: Keep latency low and uptime high; it’s boring but crucial.

- Broker Choice: ECN with fair commissions and stable gold spreads if you plan to trade XAUUSD.

- News Discipline: If you trade gold, consider pausing 5–10 minutes before/after high-impact releases.

- Position Limits: Respect MaxTradesPerDay and MaxOpenPositions; consistency beats over-trading.

- Scaling Up: Increase account size or risk slowly after at least 4–6 weeks of stable behavior.

Prop-Firm-Friendly? Here’s the Checklist

- No Martingale / No Hidden Grid: Default logic avoids pyramiding risk.

- Daily Loss Stop: Cut the day if your cap is hit; the EA will oblige.

- Max Positions: Firm caps help with rule compliance.

- Equity-based Guard: Pauses new trades during a rough patch—helps prevent “death by a thousand cuts.”

- Time-based Pauses: Disable around scheduled news to avoid slippage spikes.

(Always read the specific firm’s rules—some have quirky constraints like max lot per symbol or minimum trading days.)

Final Thoughts

MasterAIV2 EA V1.0 MT4 aims for that sweet spot: enough intelligence to avoid dumb trades, strict controls to cap risk, and just the right flexibility so you can adapt it to your routine. Keep your expectations realistic, track its behavior for a few weeks, and adjust presets to fit your tolerance. If you’re chasing a steady, rules-first workflow on MT4—without wrestling 100 inputs—this EA makes a compelling case. Trade safe, test thoroughly, and let the bot do what bots do best: execute the plan without emotion.

Comments

Leave a Comment