Algorithmic trading has evolved rapidly over the last decade. What once depended on rigid rule-based systems has gradually shifted toward adaptive, probability-driven models that attempt to respond intelligently to changing market conditions. In this evolving landscape, Medallion X EA V5.31 MT4 positions itself as a modern Expert Advisor designed to blend automation, discipline, and statistical logic into one trading system.

This in-depth guide explores Medallion X EA V5.31 MT4 from a trader’s perspective. Rather than focusing on marketing promises, the goal here is to explain how the system is intended to operate, what type of trader it may suit, and how it fits into a realistic forex trading workflow.

Understanding the Philosophy Behind Medallion X EA

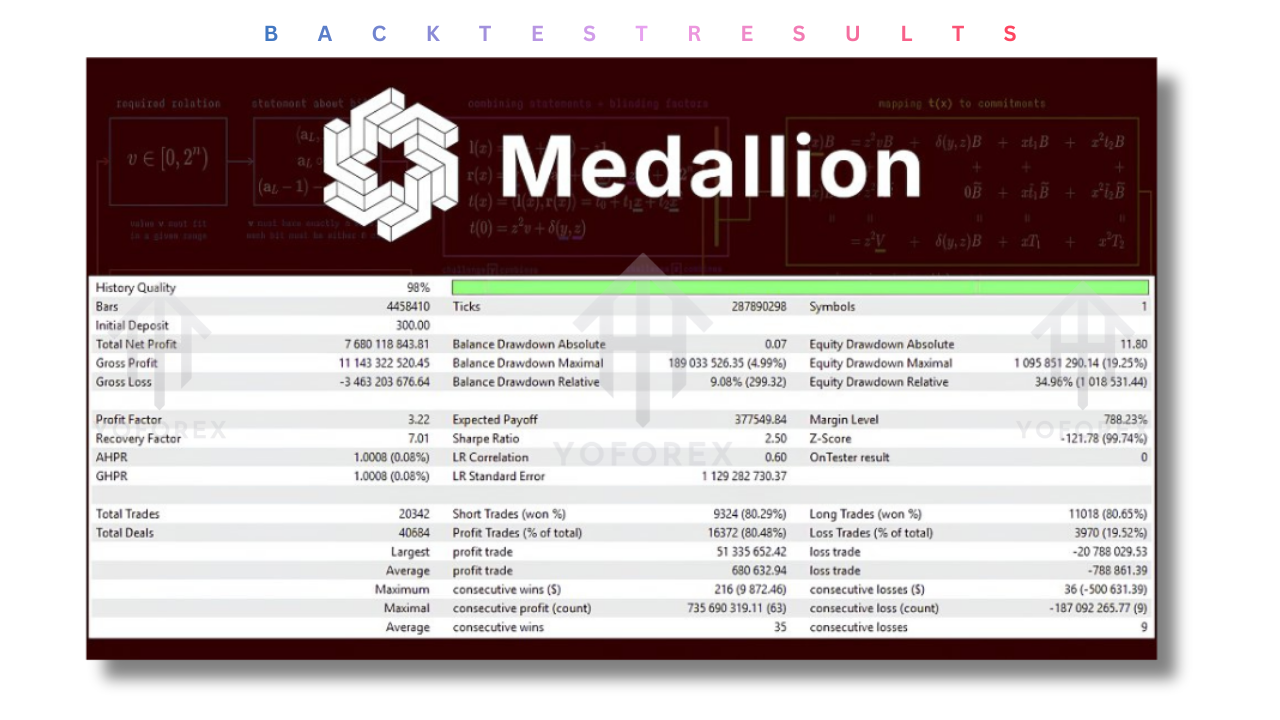

At its core, Medallion X EA is built around the idea that markets are not static. Price behavior shifts across sessions, volatility regimes, and macroeconomic environments. Instead of relying solely on fixed technical indicators, this EA attempts to interpret price movement using probability-based logic and adaptive modeling.

The philosophy is simple but demanding: allow the algorithm to analyze patterns, measure statistical likelihoods, and execute trades only when conditions align with its internal confidence thresholds. This approach is particularly appealing to traders who value consistency, risk awareness, and rule enforcement over emotional decision-making.

Platform Compatibility and Trading Environment

Medallion X EA V5.31 is developed exclusively for the MetaTrader 4 platform. MT4 remains one of the most widely used trading terminals due to its stability, execution speed, and support for automated strategies.

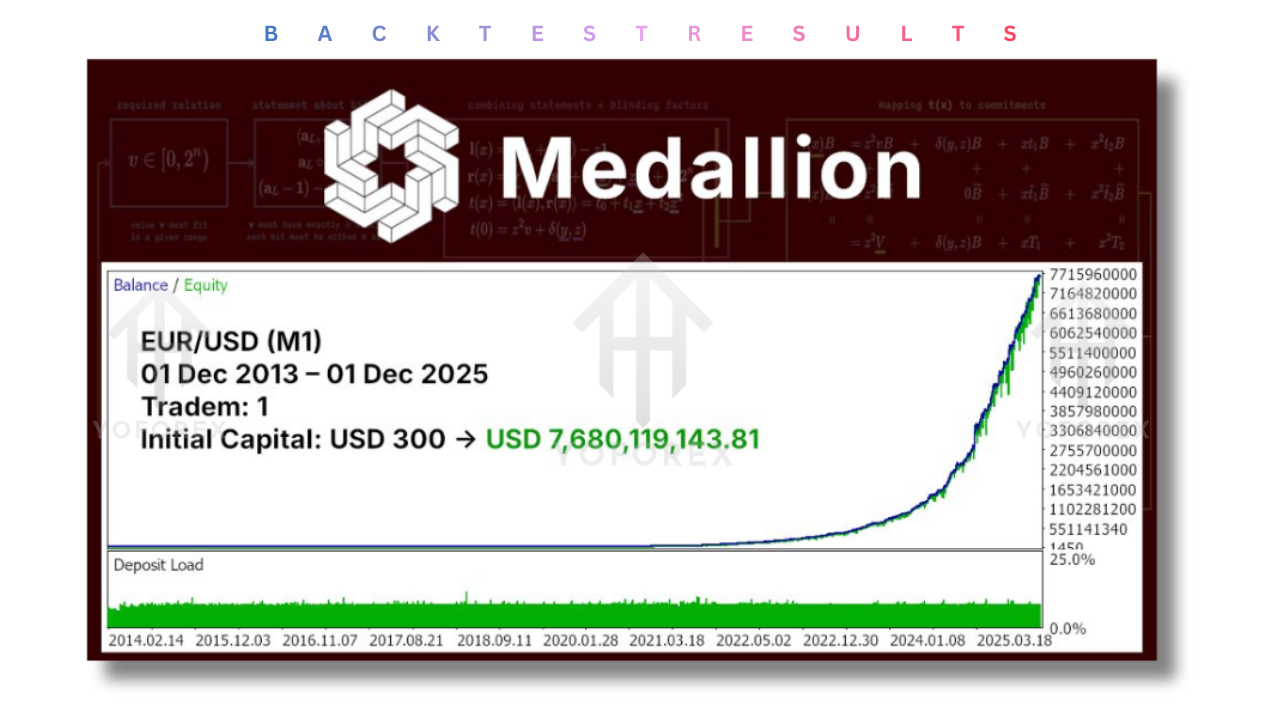

The EA is primarily optimized for the EUR/USD currency pair. Focusing on a single major pair allows the algorithm to specialize in specific liquidity conditions, spreads, and behavioral tendencies rather than spreading logic thin across multiple instruments.

While the EA can technically operate on multiple timeframes, it is designed to be time-agnostic. This means the algorithm reads underlying price behavior rather than reacting purely to candle formations on a specific chart interval.

Strategy Logic and Trade Execution

Medallion X EA does not follow a traditional indicator-stacking strategy. Instead of relying on multiple oscillators or trend lines, it emphasizes probabilistic evaluation and signal confirmation.

The system evaluates historical price movement, volatility distribution, and directional bias before committing to a trade. Once a position is opened, the EA actively manages it rather than leaving it unattended. Trade exits are not arbitrary; they are influenced by dynamic market feedback, trailing logic, and internal risk calculations.

Importantly, the EA is designed to avoid grid trading and martingale techniques. This means it does not continuously add positions against drawdown or multiply lot sizes to recover losses. For many traders, this alone significantly reduces long-term account risk.

Risk Management Approach

Risk control is one of the most critical components of any automated system, and Medallion X EA places strong emphasis on this area.

The EA incorporates structured position sizing relative to account balance and leverage. Rather than exposing the account to uncontrolled risk, it aims to maintain proportional exposure that aligns with sustainable trading principles.

Trailing logic is used to protect unrealized profits when the market moves favorably. This adaptive trailing approach adjusts based on price behavior rather than relying on static pip distances, allowing the system to lock gains while still giving trades room to breathe.

While no automated system can eliminate drawdowns entirely, the design philosophy behind Medallion X EA prioritizes capital preservation alongside growth.

Broker and Account Considerations

For optimal performance, Medallion X EA is intended to run on a hedging-enabled account. While netting accounts may still function, hedging allows the EA to manage positions more flexibly.

A leverage of at least 1:100 is recommended to ensure sufficient margin flexibility during active market phases. The minimum suggested deposit aligns with responsible risk exposure rather than aggressive over-leveraging.

The EA also requires high-quality historical data for accurate internal calculations. Traders are encouraged to load sufficient M1 price history to allow the algorithm to analyze deeper statistical patterns.

Installation and Setup Process

Installing Medallion X EA follows the standard MT4 procedure. After placing the EA file into the Experts directory, traders should restart the terminal or refresh the Navigator panel.

Once attached to a EUR/USD chart, the EA should be allowed to initialize fully before trading begins. It is recommended to enable automated trading and confirm that all required permissions are active.

Although the EA is designed to operate with minimal user intervention, traders should still review input parameters carefully to ensure they align with their account size and risk tolerance.

Demo Testing and Forward Evaluation

Before deploying Medallion X EA on a live account, demo testing is essential. Forward testing allows traders to observe how the EA behaves in real-time market conditions, including spread variation, slippage, and execution speed.

A demo phase of several weeks helps validate whether the trading frequency, drawdown profile, and profit behavior align with expectations. This step is especially important for traders who prioritize capital protection over aggressive growth.

Forward testing also helps identify whether broker conditions are suitable for the EA’s execution style.

Who Should Consider Medallion X EA

Medallion X EA V5.31 is best suited for traders who:

Prefer structured, rules-based automation

Avoid high-risk recovery strategies

Value consistency over short-term spikes

Understand that automation still requires monitoring

Are willing to test before committing capital

It is not designed for traders seeking instant profits or ultra-high-frequency scalping. Instead, it targets disciplined traders who understand the importance of statistical edge and patience.

Realistic Expectations and Trading Discipline

One of the most common mistakes traders make with automated systems is unrealistic expectation. Medallion X EA is not positioned as a miracle solution or a guaranteed profit generator.

Like any algorithmic strategy, performance will vary based on market conditions, broker execution, and account configuration. Drawdowns are part of trading, even with well-designed systems.

Traders who treat the EA as a long-term trading assistant rather than a shortcut are more likely to use it effectively.

Maintenance and Ongoing Use

Although Medallion X EA is automated, periodic monitoring is still necessary. Market conditions evolve, and traders should stay aware of major volatility events, platform updates, or changes in broker execution policies.

Running the EA on a stable VPS environment can improve execution reliability and reduce downtime caused by connectivity issues.

Consistency in setup and disciplined account management remain key factors in long-term success.

Final Thoughts

Medallion X EA V5.31 MT4 represents a modern approach to automated forex trading, emphasizing probability, adaptability, and risk control. Its focused design, avoidance of aggressive recovery techniques, and disciplined execution logic make it a compelling option for traders who value sustainability over speculation.

As with any Expert Advisor, success depends not only on the software but also on the trader’s approach to testing, risk management, and expectations. Used responsibly, Medallion X EA can function as a structured trading tool within a broader, well-planned trading strategy.

Upgrade

For traders seeking a disciplined, automated trading framework that prioritizes logic and risk control, Medallion X EA V5.31 MT4 offers a structured path toward algorithmic participation in the forex market.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment