Meta PX EA V15.0 MT4 has recently surfaced as an Expert Advisor many traders are curious about. While information is limited, its versioning suggests that it has gone through several iterations of refinement. For those searching for automated trading solutions, it’s essential to approach Meta PX EA with proper knowledge, testing, and risk awareness.

This guide provides a comprehensive overview of what Meta PX EA V15.0 might offer, how to evaluate it, and the best practices you should follow before relying on it for real account trading.

Introduction to Meta PX EA V15.0

Meta PX EA V15.0 is presented as an automated trading robot designed to run on MetaTrader 4 (MT4). Like other EAs, its purpose is to eliminate emotional decision-making, automate trading entries and exits, and potentially generate consistent profits.

What makes it stand out is its versioning: “15.0” implies multiple prior updates, which could mean that developers improved algorithms, optimized settings, or added risk controls. However, without official performance data, it’s hard to separate fact from marketing hype.

Why Traders Look for Automated EAs

The attraction of EAs like Meta PX EA lies in automation. Traders can avoid long hours of chart watching while letting the EA execute based on pre-defined rules. Here are some common reasons traders choose EAs:

- Consistency – The EA follows logic without hesitation.

- Efficiency – It can handle multiple currency pairs simultaneously.

- Accessibility – Works 24/5 without breaks.

- Scalability – Can be optimized for different strategies or brokers.

Meta PX EA V15.0 falls into this category, promising automation, but the absence of verifiable records means traders must proceed cautiously.

Possible Strategy Approaches of Meta PX EA

Since exact logic is unknown, we can only speculate on the strategies Meta PX EA might implement based on common EA methods:

- Trend trading – Capturing medium-term moves on popular pairs.

- Scalping – Short bursts of quick trades in low-spread conditions.

- Grid or martingale systems – Risky methods that expand trade sizes.

- Indicator-based logic – RSI, MACD, or Bollinger Band signals.

Understanding which of these approaches is applied is critical. An EA with hidden martingale logic, for instance, can appear profitable for weeks but collapse in high volatility.

Evaluating Meta PX EA V15.0

Before installing Meta PX EA V15.0 on a live account, traders should assess it thoroughly. Here’s how to evaluate it effectively:

1. Demo First

Never start with live funds. Run the EA on a demo account for at least 4–6 weeks.

2. Test Multiple Brokers

Broker spreads and execution speeds can change results drastically. Test on more than one broker before committing.

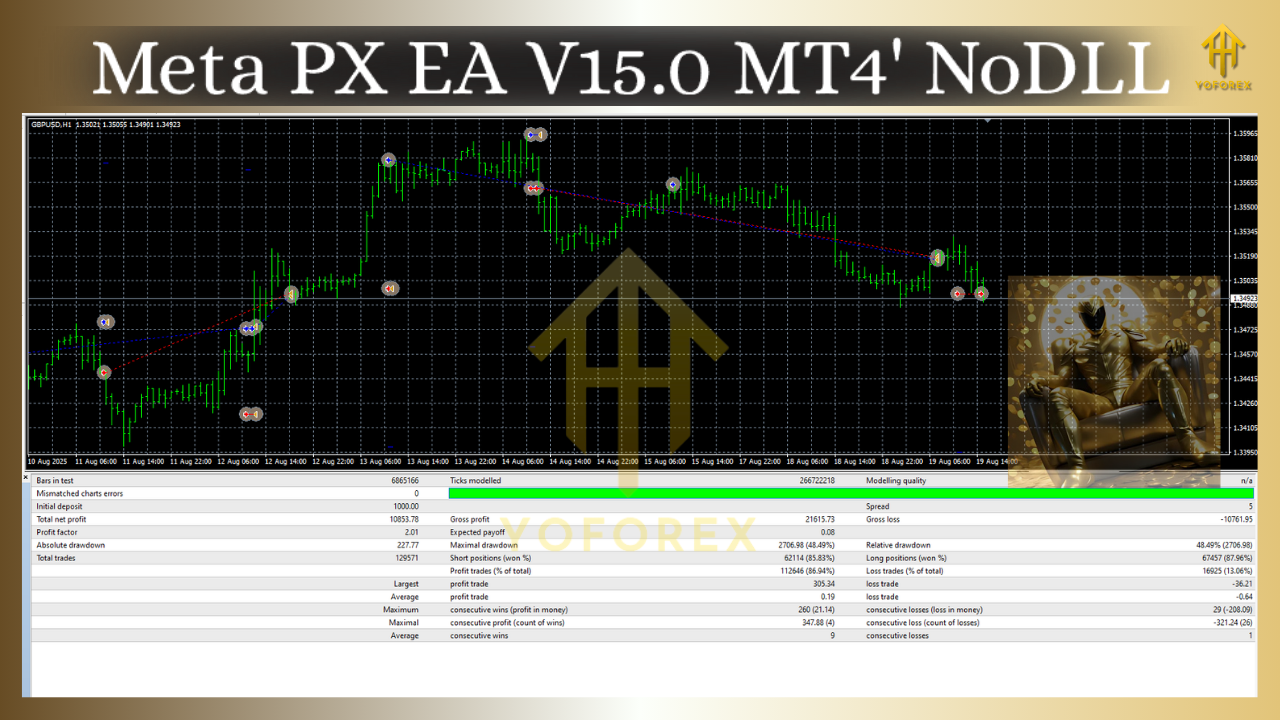

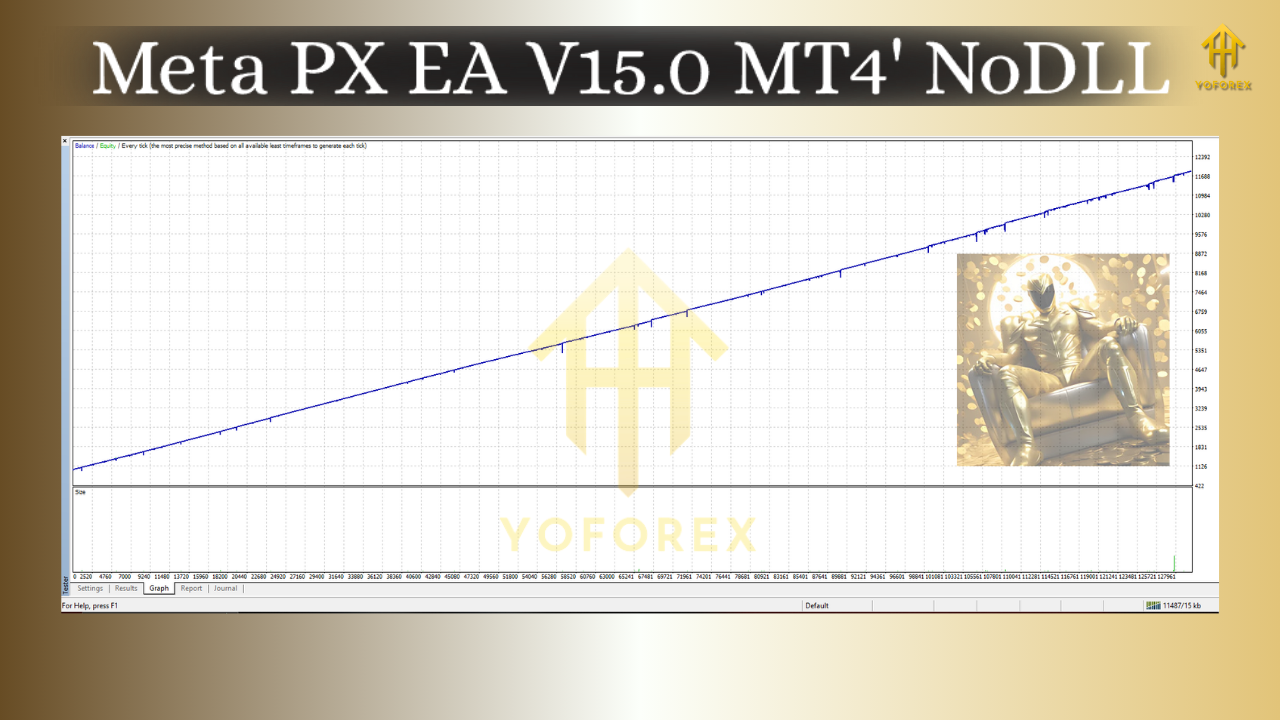

3. Backtest in MT4

Use MT4’s strategy tester with historical data to see how the EA reacts in trending vs ranging conditions.

4. Monitor Drawdown

Profitability is meaningless without understanding risk. Keep track of equity curve and maximum drawdown.

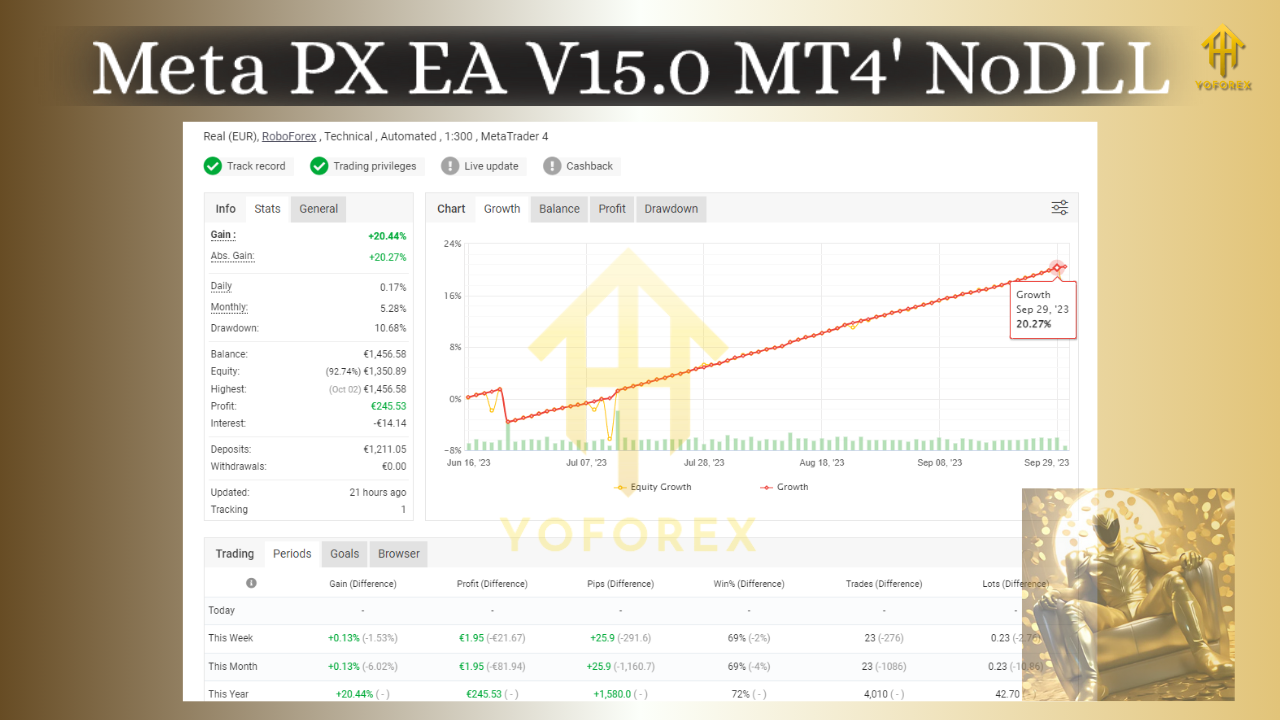

5. Verify Results

Look for independently verified results. If unavailable, treat claims with caution.

Red Flags to Watch For

When researching Meta PX EA V15.0 or similar products, watch for warning signs:

- No official vendor transparency – Reliable EAs usually have documented developer details.

- Too-good-to-be-true claims – Promises of “guaranteed profits” are unrealistic.

- No community reviews – Lack of discussion on major forums can indicate obscurity.

- Unverified backtests – Real account tracking is necessary to prove effectiveness.

Best Practices for Using Any EA

Even if Meta PX EA turns out to be functional, every trader should follow these guidelines:

- Risk Management – Keep risk per trade below 2%.

- VPS Hosting – Ensure uninterrupted execution.

- Manual Oversight – Do not fully rely on “set and forget.”

- Withdraw Profits – Secure earnings regularly to minimize exposure.

These practices help mitigate the risks of relying on an unknown EA.

Hypothetical Use Cases

While we cannot confirm the EA’s exact functions, here are possible scenarios for how traders may attempt to use Meta PX EA:

- Long-term account growth – Focusing on swing trades with low leverage.

- Scalping in tight-spread accounts – Designed for brokers with ultra-low execution delays.

- Aggressive profit chasing – Using martingale or grid, though risky for account safety.

Understanding the approach ensures traders match EA logic with personal risk appetite.

How to Install Meta PX EA V15.0 on MT4

If you obtain the EA, installation typically follows these steps:

- Download the EA file (.ex4 or .mq4).

- Place it inside the

Expertsfolder of MT4. - Restart MT4 and enable AutoTrading.

- Attach the EA to your preferred chart and adjust settings.

- Start with a demo account before going live.

Conclusion

Meta PX EA V15.0 MT4 is a name that sparks curiosity but raises questions due to the lack of transparency and verified results. While it may have potential, traders should treat it cautiously, test thoroughly, and never risk capital without understanding its true strategy.

In Forex, no EA is a guaranteed solution. Tools like Meta PX EA can help, but success ultimately comes from combining automation with smart risk management and continuous evaluation.

Comments

Leave a Comment