Introduction

Scalping sounds simple on paper: grab small moves, repeat often, and let the math do the heavy lifting. In reality, scalping is one of the most execution-sensitive styles in forex. A tiny spread change, a few milliseconds of delay, or a broker with aggressive slippage can flip a “good scalper” into a drawdown machine.

That’s exactly why MicroTrend Scalping EA V2.0 for MT4 is positioned as a “micro-move hunter”—an automated scalping Expert Advisor built to detect short-term trend impulses and ride them for quick, controlled targets. If you’re a trader who likes fast entries, frequent opportunities, and structured risk rules, MicroTrend Scalping EA V2.0 is designed to match that tempo—provided you use it with the right broker conditions and realistic expectations.

What is MicroTrend Scalping EA V2.0 MT4?

MicroTrend Scalping EA V2.0 MT4 is an automated trading robot that focuses on short-term trend bursts (micro-trends) and attempts to scalp during moments of momentum. Instead of holding trades for hours, it targets shorter sessions and smaller price swings, typically aiming for modest profits per trade while maintaining consistency through repeatable setups.

Most scalping EAs rely on one of these approaches:

- Impulse scalping (momentum bursts)

- Mean-reversion scalping (snap-back trades)

- Spread/inefficiency scalping (very broker-dependent, risky)

- Hybrid logic (trend filter + entry trigger + protective rules)

MicroTrend Scalping EA V2.0 generally falls into the trend/momentum scalp category: it tries to enter when price starts moving with intent, and exit before the move fades.

Why Scalping EAs Need the Right Environment

Before we even talk about features, here’s the truth: a scalping EA is only as good as your trading conditions.

If you run MicroTrend Scalping EA V2.0 on:

- high spreads,

- unstable execution,

- slow VPS,

- brokers that widen spreads aggressively around sessions, you’ll often see missed entries, worse fills, and profit targets that don’t match reality.

So this EA is best used with:

- low spreads (preferably raw/ECN-style)

- fast execution

- tight slippage control

- stable server/VPS near broker location

If your setup is solid, scalping systems can shine. If your setup is weak, you’ll end up blaming the EA when the real issue is execution.

Key Features of MicroTrend Scalping EA V2.0 MT4

Here are the features most traders look for in a scalping EA like this—and how MicroTrend Scalping EA V2.0 typically aligns with them in real-world use.

1) Micro-Trend Detection Logic

The EA aims to identify short-lived trend direction and enter with momentum instead of guessing reversals. This is a practical approach because micro-trends can be more “clean” than random chop—especially when liquidity is strong.

2) Scalping-Friendly Trade Management

Scalping EAs usually depend on:

quick take-profits,

strict trade timing,

reduced holding time.

MicroTrend Scalping EA V2.0 is designed to keep positions from becoming long-term baggage. The goal is: in, out, repeat.

3) Risk Controls & Lot Sizing Options

A usable EA must support:

fixed lot mode (simple + stable)

risk-based lot mode (percentage risk)

max lot caps (prevents oversizing)

If you’re running scalping logic, fixed lots are often safer at first, then you scale carefully once you confirm behavior.

4) Spread Filter & Safety Rules (Important)

If the EA includes a spread filter (many scalpers do), it helps avoid trading when spreads are widened—like during rollover or major news spikes. This is crucial for scalpers.

If your version includes:

- max spread filter

- max slippage filter

- trade delay protections those are big positives.

5) Session / Time Filters

Scalping works best during liquid sessions (London / New York overlaps). A time filter can reduce random trades during low-liquidity periods where spreads widen and price “fakes out.”

Recommended Settings & Best Practices

Even a good EA can fail if traders force it into the wrong market conditions. Use this practical setup approach:

Best account type

- ECN / Raw spread accounts are typically best for scalpers.

- Avoid “fixed spread” accounts unless you’ve tested execution quality.

Suggested leverage

- Scalping doesn’t require extreme leverage.

- 1:100 to 1:500 is common, but risk should stay conservative.

Recommended deposit

There’s no universal number because lot size matters, but for realistic safety:

- Start testing with $100–$300 on cent/micro if available

- For standard live accounts with stable lots: $500–$1,000 is more comfortable

Best pairs to run

Micro-trend scalping works best on pairs with:

- tight spreads

- strong liquidity

- smooth movement

Common options:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

- XAUUSD (only if spreads are consistently tight)

If your broker’s gold spread is wide, don’t force XAUUSD scalping.

Best timeframes

Even if the EA works “on any timeframe,” scalpers usually perform most consistently on:

- M5

- M15

Sometimes M1 (high risk, very broker-sensitive)

How to Install MicroTrend Scalping EA V2.0 in MT4

- Download the EA file (usually

.ex4or.mq4) - Open MT4 → File → Open Data Folder

- Go to MQL4 → Experts

- Paste the EA file there

- Restart MT4

- Drag the EA onto a chart

- Enable AutoTrading

- “Allow live trading”

- “Allow DLL imports” (only if EA requires it)

Then run it on demo first to confirm:

- entries appear logically

- spreads/slippage are acceptable

- trading frequency matches your expectation

Who Should Use MicroTrend Scalping EA V2.0?

This EA is typically best for:

Traders who want automated scalping without sitting on charts

Traders with access to low spreads + fast execution

Traders who understand risk settings and won’t over-leverage

Traders willing to demo test and adjust small settings

Not ideal for:

Traders using brokers with wide spreads or slow execution

Traders who expect “set and forget” profits without monitoring

Traders who increase lot sizes after a few wins (classic blow-up behavior)

Execution Quality Checklist (Broker + VPS)

If you want MicroTrend Scalping EA V2.0 to behave properly, check these:

- Average spread during your trading session

- Spread widening at rollover time

- Slippage on market orders

- Whether broker uses:

- requotes,

- stop level restrictions,

- execution delays

And for VPS:

- choose a VPS location close to broker server

- stable latency matters more than fancy specs

Strategy Tips to Improve Consistency

Here are simple but powerful ways to run a scalper more safely:

1) Use a max spread filter

If the EA has it: enable it.

If it doesn’t: consider changing broker or limiting sessions.

2) Trade only during liquid sessions

London + NY overlap is usually best for scalping behavior.

3) Don’t run too many pairs at once

Scalpers can open multiple trades quickly. Start with 1–2 pairs, then expand.

4) Avoid major news spikes

Scalping around high-impact news is where many accounts get wrecked.

5) Keep risk boring

If you want to become profitable long-term, your risk settings should look “too boring” to gamblers.

Conclusion

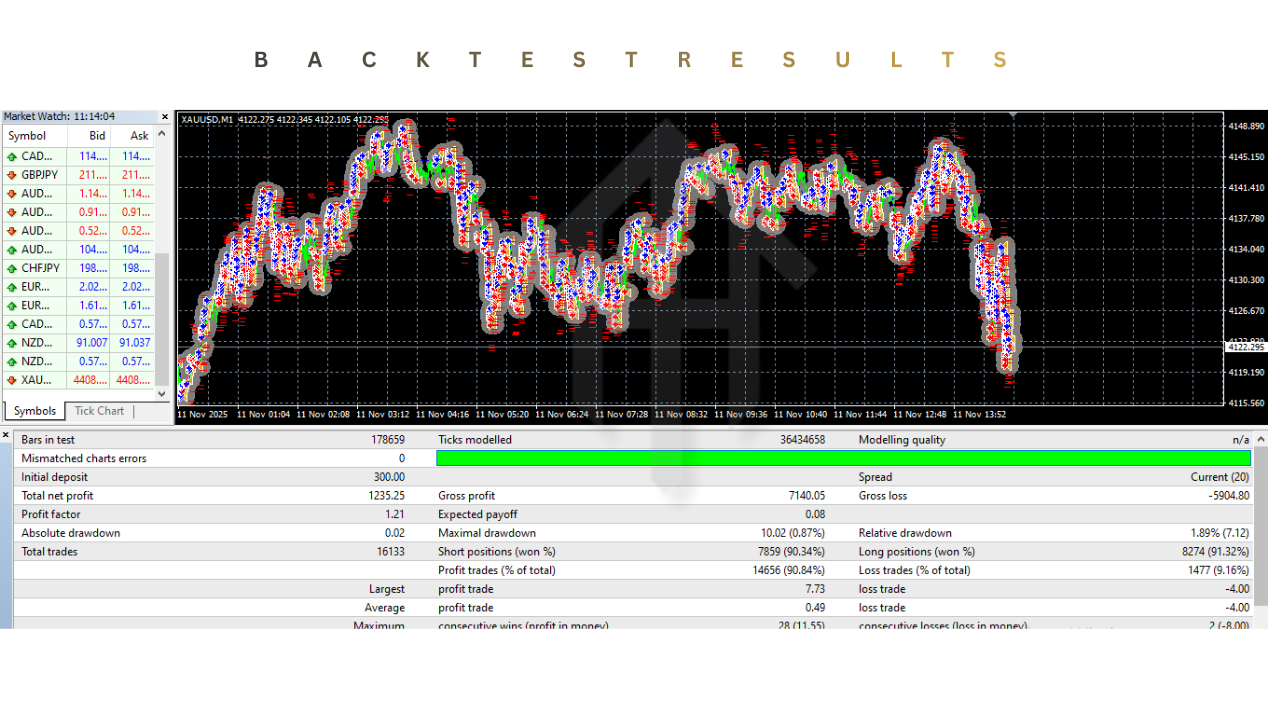

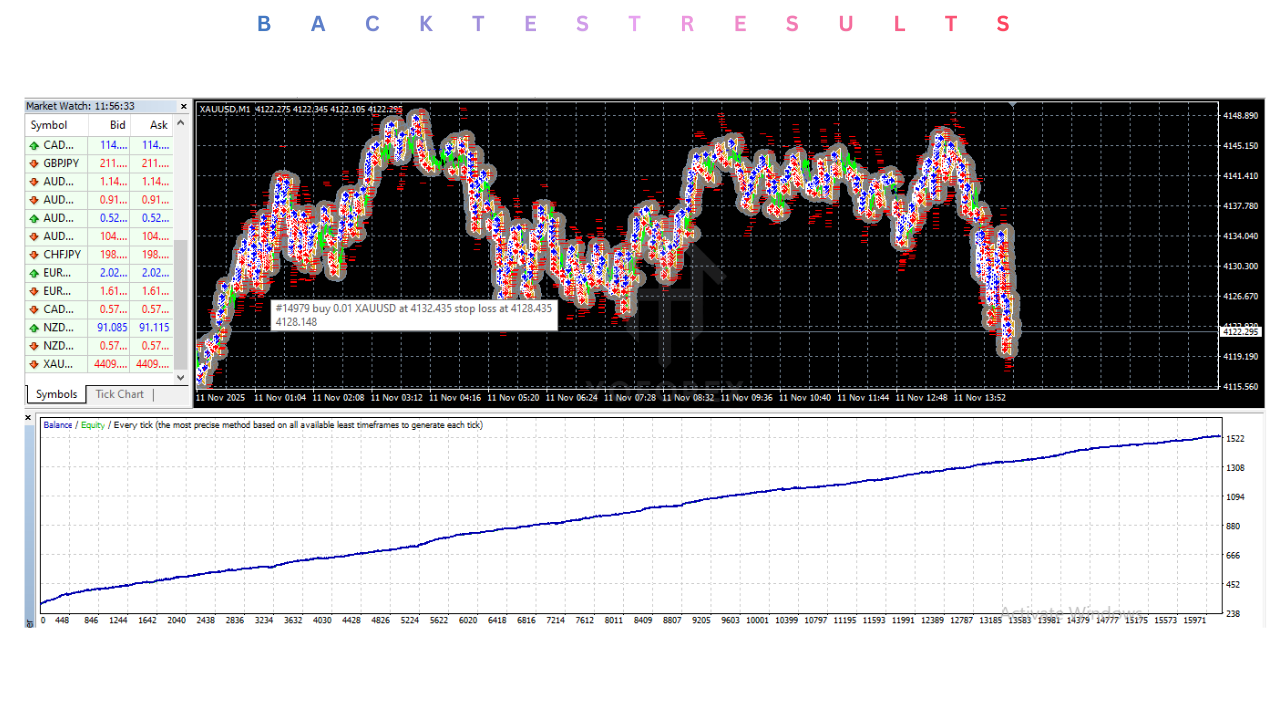

MicroTrend Scalping EA V2.0 MT4 is best viewed as a micro-momentum scalper—an EA that tries to take advantage of short, fast trend bursts rather than holding trades for long swings. That approach can work well in forex because micro-trends often appear during high-liquidity sessions (London, New York, and overlap periods), where spreads are tighter and price moves with more “clean intent.” But the same thing that makes scalping attractive—small targets and frequent trades—also makes it brutally sensitive to execution quality.

If you run this EA on the right conditions—low spreads, fast order execution, stable server connection/VPS, and a broker that doesn’t widen spreads aggressively—it has a fair chance to behave consistently. If you run it on a random high-spread account, trade during rollover, or ignore slippage/spread spikes, the exact same EA can look “broken,” not because the strategy is wrong, but because the environment is wrong for scalping.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

HAPPY TRADING

Comments

Leave a Comment