MicroTrend Scalping EA V3.0 MT4 is a modern automated trading solution designed specifically for traders who focus on short-term opportunities in the gold market. Built exclusively for MetaTrader 4, this expert advisor is engineered to operate on the XAUUSD pair using precise micro-trend detection on the M1 timeframe. As gold remains one of the most volatile and liquid instruments in the forex market, MicroTrend Scalping EA V3.0 MT4 aims to take advantage of rapid intraday price movements while maintaining structured risk control.

Unlike traditional scalping robots that rely solely on raw momentum or indicator crossovers, MicroTrend Scalping EA V3.0 MT4 is designed around the concept of micro-trend continuation with controlled pullback entries. This approach allows the EA to avoid impulsive entries and instead focus on price behavior that confirms short-term directional intent. The result is a trading system that prioritizes precision, consistency, and disciplined execution rather than over-trading.

At its core, MicroTrend Scalping EA V3.0 MT4 is developed for traders who want automation without unnecessary complexity. The system operates fully automatically, making it suitable for both beginners exploring algorithmic trading and experienced traders looking to diversify their gold trading strategies with an M1 scalper.

How MicroTrend Scalping EA V3.0 MT4 Works

The trading logic of MicroTrend Scalping EA V3.0 MT4 is centered around identifying short-lived trends that appear frequently on the one-minute chart. These micro-trends often emerge due to liquidity injections, session overlaps, or temporary imbalances between buyers and sellers. The EA continuously monitors price behavior on each new M1 candle and waits for specific conditions before placing trades.

Rather than entering trades at the exact candle open, the system waits for a controlled pullback from the initial price movement. This reduces exposure to false breakouts and helps the EA align entries with more favorable pricing. Additional internal calculations evaluate tick momentum to confirm that the market still supports continuation in the detected direction.

One of the defining characteristics of MicroTrend Scalping EA V3.0 MT4 is its strict position control. The EA is designed to maintain a maximum of two open positions at any time, one buy and one sell. This structured exposure model allows the system to remain active while preventing uncontrolled trade stacking. Each trade is protected by a predefined stop loss, ensuring that risk is capped on every position.

Instead of using fixed take profit targets, the EA relies on dynamic trailing stop logic. Once a trade moves into profit by a defined threshold, the trailing mechanism activates and locks in gains as price advances. This allows profitable trades to run during strong intraday moves while still protecting capital when momentum fades.

Focus on Gold Trading (XAUUSD)

MicroTrend Scalping EA V3.0 MT4 is optimized exclusively for gold trading. XAUUSD behaves differently from standard currency pairs, often showing sharp price movements, rapid retracements, and high intraday volatility. The EA’s logic is tailored to these characteristics, making it unsuitable for other instruments but highly specialized for gold.

By focusing solely on XAUUSD, the system avoids the pitfalls of multi-pair EAs that attempt to apply generic logic across different market structures. This specialization allows MicroTrend Scalping EA V3.0 MT4 to adapt more effectively to gold’s price dynamics, including spread behavior, volatility spikes, and session-based movement patterns.

Risk Management Philosophy

Risk management is a critical component of any scalping strategy, especially on lower timeframes. MicroTrend Scalping EA V3.0 MT4 incorporates predefined stop losses on all trades, ensuring that no position is left unprotected. This design choice helps traders avoid the prolonged drawdowns often associated with grid or martingale-based systems.

The EA does not rely on position averaging, recovery trading, or lot escalation techniques. Each trade is treated independently, with risk determined at the time of entry. The trailing stop mechanism further enhances risk control by gradually securing profits once the market moves favorably.

Traders should still ensure that proper account sizing is used. Although the minimum starting capital is relatively accessible, maintaining sufficient margin and using appropriate leverage is essential for stable performance, especially during periods of increased volatility.

Installation and Setup on MT4

Installing MicroTrend Scalping EA V3.0 MT4 is straightforward and does not require advanced technical knowledge. After downloading the EA file, traders can place it into the Experts folder of their MetaTrader 4 directory and refresh the platform. Once attached to an XAUUSD M1 chart, the EA begins monitoring market conditions automatically.

It is recommended to allow automated trading and ensure that the platform remains connected during active trading hours. Since the EA operates on very short timeframes, consistent execution speed is important. Running the system on a stable internet connection or a low-latency environment can help maintain optimal performance.

Who Should Use MicroTrend Scalping EA V3.0 MT4

MicroTrend Scalping EA V3.0 MT4 is suitable for traders who prefer short-term trading strategies and want exposure to the gold market without manual execution. Beginners may appreciate the automated nature and predefined risk controls, while more advanced traders can use the EA as part of a diversified trading portfolio.

The system is best suited for traders who understand the nature of scalping and are comfortable with frequent trades and smaller profit targets per position. It is not designed for long-term swing trading or passive investment strategies.

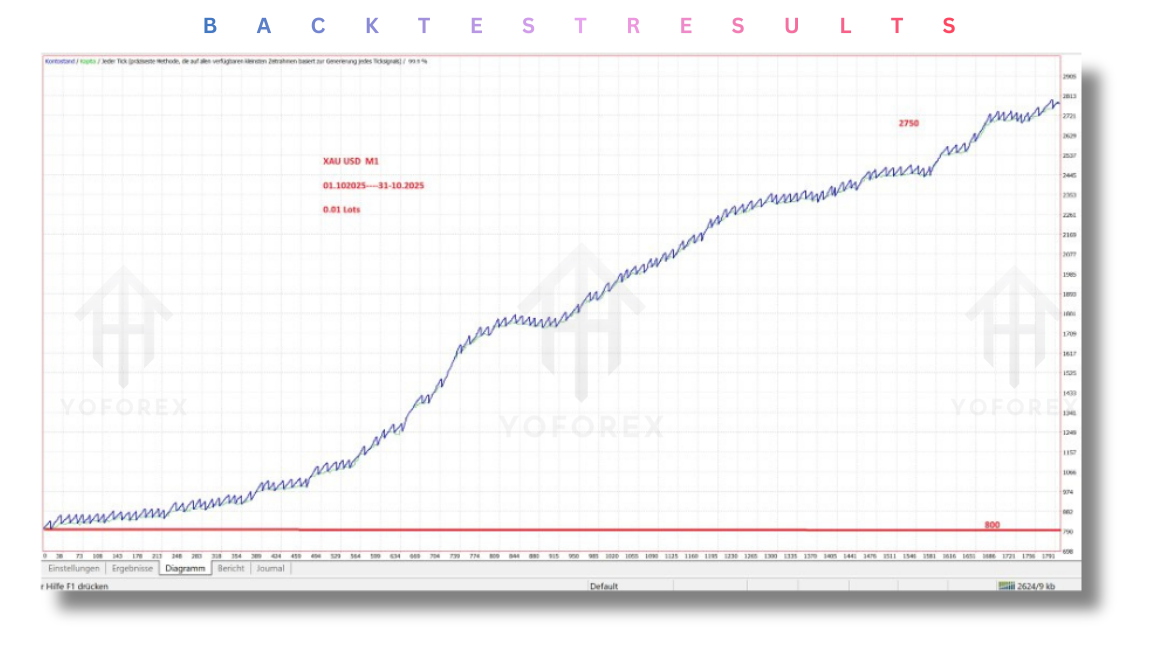

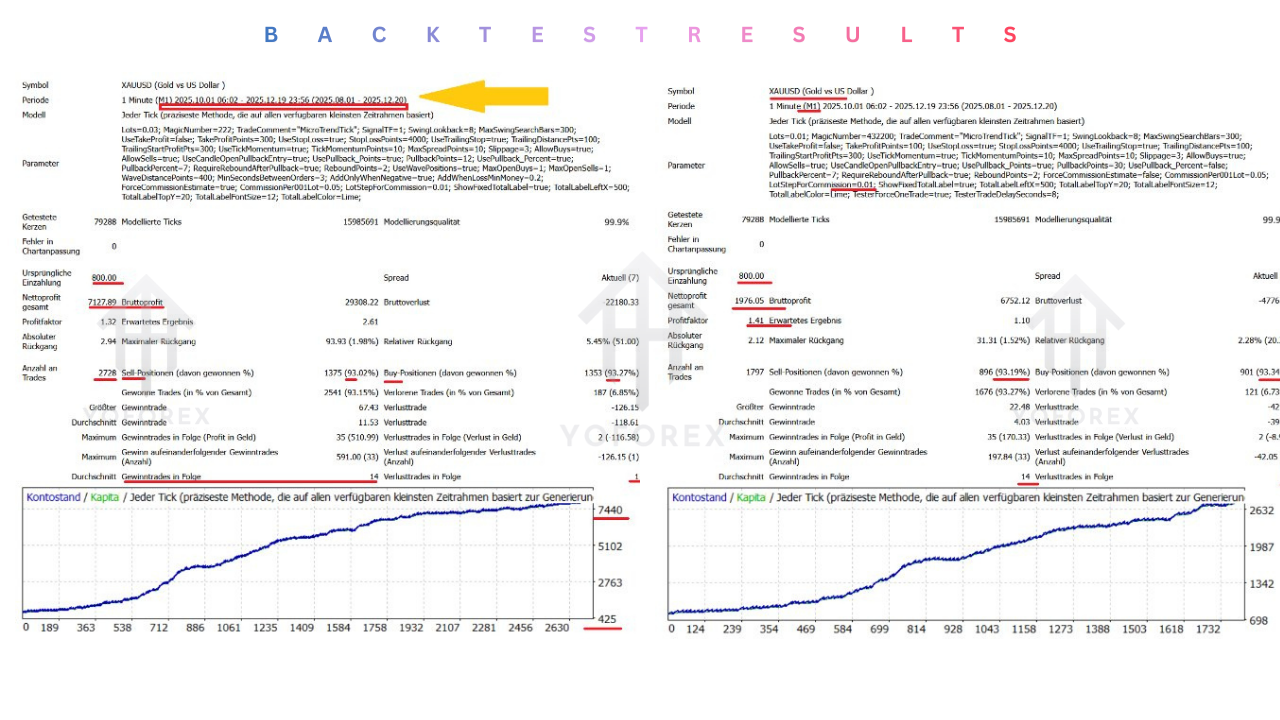

Performance Expectations and Realistic Outlook

As with any automated trading system, results depend heavily on market conditions, broker execution quality, and account configuration. MicroTrend Scalping EA V3.0 MT4 is designed to perform best during active market sessions when gold exhibits sufficient volatility and liquidity.

Traders should avoid unrealistic expectations and understand that drawdowns are a natural part of algorithmic trading. The EA’s structured risk management helps control losses, but no system can eliminate risk entirely. Forward testing on a demo account is always recommended before deploying the EA on a live account.

Advantages of MicroTrend Scalping EA V3.0 MT4

The EA offers a focused and disciplined approach to gold scalping. Its micro-trend detection logic, combined with pullback entries and trailing stop management, provides a balanced framework for short-term trading. The absence of martingale or grid strategies makes it more transparent and easier to evaluate compared to many high-risk scalping robots.

Limitations to Consider

MicroTrend Scalping EA V3.0 MT4 is not a universal trading solution. Its exclusive focus on XAUUSD means it cannot be applied to other instruments. Additionally, as an M1 scalper, it requires reliable execution conditions. Traders using brokers with wide spreads or frequent slippage may experience reduced efficiency.

Final Verdict

MicroTrend Scalping EA V3.0 MT4 presents a specialized automated trading approach tailored specifically for gold scalping on the MetaTrader 4 platform. By combining micro-trend analysis, controlled pullback entries, fixed stop losses, and dynamic trailing stops, the EA aims to deliver consistent short-term trading opportunities while maintaining disciplined risk control.

For traders seeking an automated gold scalping system without aggressive recovery tactics, MicroTrend Scalping EA V3.0 MT4 offers a structured and transparent solution worth evaluating through proper testing and risk management.

Comments

Leave a Comment