Struggling with entries that feel late, choppy, or random? You’re not alone. Markets shift mood—fast—and many EAs either overtrade into noise or freeze when conditions change. MOOD EA V2.0 MT4 is built to read market conditions (the “mood”) and adapt its behavior accordingly. Instead of a one-size-fits-all script, it aims to keep you aligned with dominant direction, filter low-quality setups, and manage risk in a practical way. No hype. Just a structured, rule-based Expert Advisor you can backtest, forward test, and then scale when you’re ready.

In this guide, you’ll learn what MOOD EA V2.0 MT4 does, the logic it follows, the features you can tweak, recommended setup, and a step-by-step install. I’ll also share a risk plan and a realistic workflow so you can avoid the classic mistakes—coz blowing up after a few winners is no fun, right?

What Is MOOD EA V2.0 MT4? (Overview)

- Read trend vs. range conditions;

- Enter only when price structure and momentum agree;

- Exit with clear logic (R:R targets and/or trailing stops);

- Keep risk per trade modest and scalable.

Who benefits the most?

- Day traders & swing traders who like top-down alignment (e.g., H4/H1 bias, enter on H1/M30).

- Prop-firm candidates who need controlled drawdown and consistent rules.

- Busy traders who prefer alerts and automation rather than manual over-analysis.

How MOOD EA Thinks (Strategy Logic)

Market State Detection

It assesses whether the market is trending or ranging. When trend conditions dominate, the EA biases toward pullback-entries in trend direction. In ranges, it tightens filters or sits out to avoid chop.

Momentum Confirmation

Entries trigger only when momentum aligns with structure—think break-and-retest or pullback-continuation, not blind chasing. This reduces false starts and late entries.

Risk-First Execution

Each trade uses a predefined stop-loss, position sizing (fixed lots or risk-percent), and clear take-profit targets. Optionally, a trailing stop manages runners.

Session Awareness (optional)

You can limit trading to active sessions (London/New York overlap) to focus on higher-quality volatility windows.

Key Features (Why Traders Like It)

- Adaptive Market Filter — Shifts behavior when conditions change (trend vs. range).

- Clean Entry Logic — Waits for structure + momentum alignment; fewer FOMO trades.

- Risk % Position Sizing — Set 0.5%–1% per trade so you scale safely.

- No Martingale / No Grid — Each trade stands on its own; clarity over complexity.

- Multi-Pair Ready — Works on majors, minors, and XAUUSD (broker dependent).

- Timeframe Flexible — Popular choices: H1 for entries, H4 for bias; M30 for refinement.

- Built-In Filters — Spread filter, minimum distance to recent swing, session filter.

- Alerts & Logging — Optional push/email alerts and detailed logs for post-analysis.

- Partial Close (optional) — Lock in partial profits while letting a runner trail.

- Equity Protection — Daily loss cap / pause-after-loss streak to protect psychology.

- VPS-Friendly — Lightweight processing, stable on common MT4 VPS setups.

- Beginner-Friendly Defaults — Sensible presets to start quickly, then optimize.

Recommended Pairs, Timeframes & Setup

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD

- Entry Timeframe: H1 (refine on M30 if you’re active)

- Higher-TF Bias: H4 (or H1 if you want more trades; just expect more noise)

- Account Type: ECN/Raw spread where possible

- Leverage: 1:100 to 1:500 (risk % matters more than leverage)

- Minimum Deposit: $200–$500 for conservative risk usage

- VPS: Recommended, with <20 ms to broker if you scalp newsy hours

Risk Template

- Risk per trade: 0.5%–1%

- Max open risk: 2%

- Daily loss cap: 3%–4% (EA auto-pause after cap)

- Target R:R: 1:1.5–1:2 base, trail if momentum is strong

How to Install & Configure (Step-by-Step)

- Download the EA file (EX4 or MQ4).

- Open MT4 → File → Open Data Folder.

- Go to MQL4 → Experts, then paste the EA file.

- Restart MT4 or right-click Navigator → Refresh.

- Drag MOOD EA V2.0 onto your chart (H1 recommended).

- Enable Algo Trading and check “Allow live trading” in the EA’s Common tab.

In Inputs, start with these balanced defaults (you can customize later):

RiskPercent = 0.75StopLoss_Pips = 25–45(pair-specific)TakeProfit_RR = 1.8UseTrailingStop = true,TrailStart_RR = 1.0,TrailStep_Pips = 10–20MaxSpread = your pair’s average * 1.2TradeSessions = London, NYTradeDirection = Auto (follow detected bias)PauseAfterDailyLoss = true,DailyLossCapPercent = 3.0

Click OK. Watch the Experts tab for “ready” messages

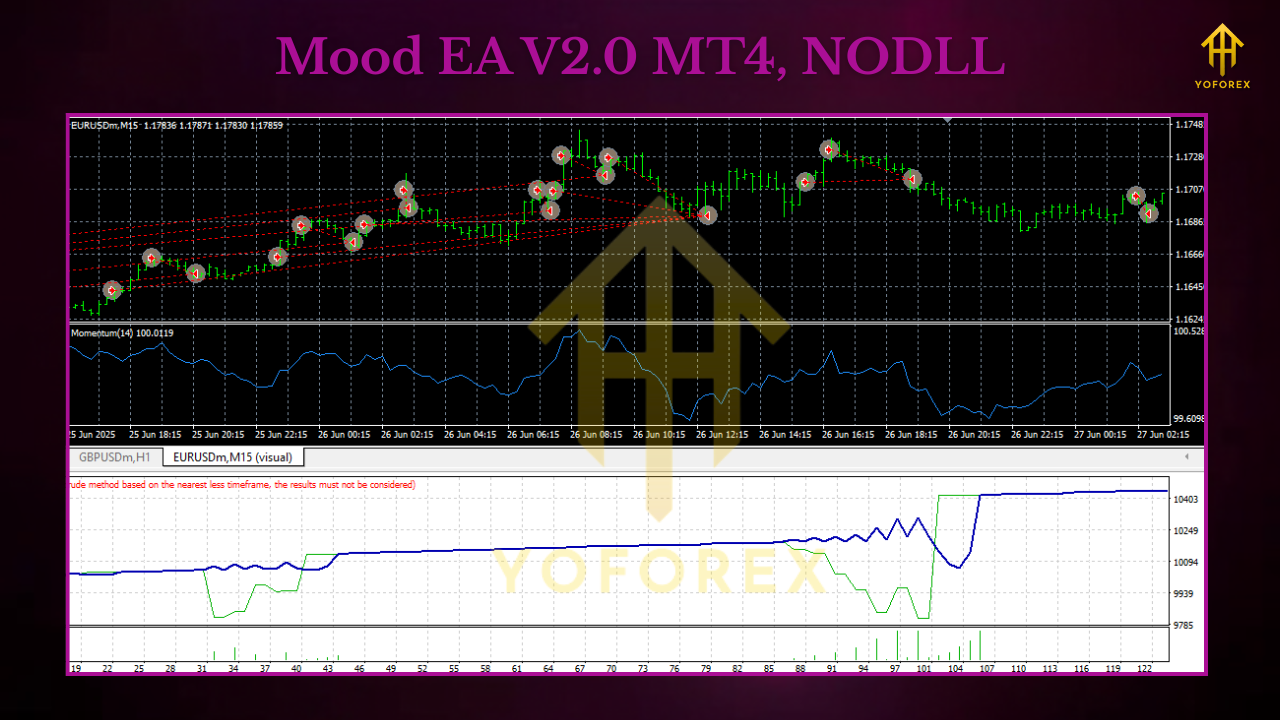

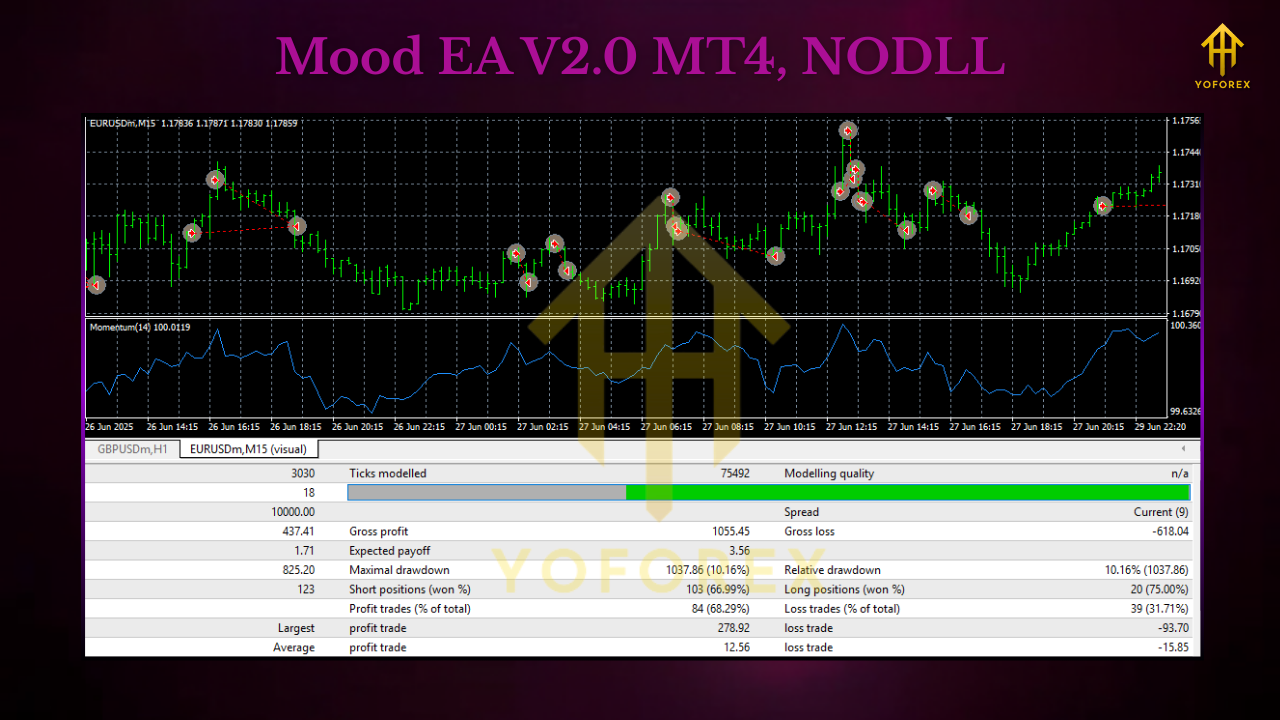

Backtest & Forward-Test Workflow

Backtest (3–12 months):

- Use your broker’s data.

- Keep settings constant for one full pass; avoid curve-fitting.

- Track metrics: win rate, average R:R, max drawdown, profit factor, streaks.

- Note differences by session (London vs. NY) and day-of-week.

Forward Test (demo 2–4 weeks):

- Run on your intended pairs with the same settings.

- Journaling is key—mark news days, whipsaws, missed entries.

- If slippage/spread hurts results, tighten spread filter or skip low-liquidity hours.

Go Live (small):

- Start with half your intended risk for 1–2 weeks.

- If performance aligns with forward test, scale to your standard plan.

Practical Trade Examples (Conceptual)

Trend-Continuation (Buy):

- H4 is bullish; H1 pulls back to prior structure.

- Momentum flips back up (bullish candle close + internal break).

- EA opens a long with SL under the pullback low; TP at ~1:1.8 R:R.

- Trailing stop activates once 1R is reached to secure the move.

Range Filter (Sit Out):

- H4 signals range; H1 oscillates without directional follow-through.

- EA blocks trades or reduces frequency until trend criteria return.

- Your equity curve stays steadier, avoiding death-by-chop.

Optimization Ideas (When You’re Ready)

- More Signals: Reduce momentum threshold slightly; allow M30 confirmations (watch spread).

- Cleaner Signals: Increase lookback or momentum/structure thresholds to filter chop.

- Gold/XAUUSD: Widen SL; keep TP in R:R terms rather than fixed pips.

- News Sensitivity: Add a manual news pause (or time-window block) around NFP/CPI/Fed.

Troubleshooting

- Too many small losses? Increase SL a bit, use fewer trades, and raise momentum threshold.

- Late entries? Allow M30 trigger but still require H1/H4 bias alignment.

- Spread spikes? Raise MaxSpread filter or avoid illiquid session tails.

- Hit daily loss cap often? Lower risk per trade or skip range conditions.

FAQ

Does it use martingale or grids?

No. Each position is independent with a defined SL/TP.

Can I scalp on M15 or M5?

You can, but results vary by broker and spread. Start H1; experiment later.

Works on indices and gold?

Yes, if your broker supports them on MT4. Adjust SL/TP to instrument behavior.

Do I need a VPS?

If you trade multiple pairs or want 24/5 uptime, yes—a VPS is recommended.

Risk & Money Management (Mini-Plan)

- Risk 0.5%–1% per trade, never more than 2% total open risk.

- Cap daily drawdown to protect your psychology.

- Withdraw profits periodically; growth isn’t linear, and that’s okay.

- Keep a journal—screenshots + notes improve your edge more than you’d think.

Call to Action

Want an EA that respects market mood and your risk plan? Download MOOD EA V2.0 MT4, start with the balanced preset, and run a clean 6–12 month backtest before you deploy on live. If you’re new, start on one pair, one timeframe, for two weeks—then expand. Consistency wins.

Comments

Leave a Comment