Introduction

In today’s fast-paced forex market, having the right tools is crucial for achieving consistent profitability. Enter the Neurogenesis Institutional Trading Engine EA V3.0 MT5, a sophisticated and robust trading solution designed to meet the high demands of institutional traders. With powerful algorithms and precise execution, this expert advisor is poised to revolutionize the way you trade on MetaTrader 5.

Overview of Neurogenesis EA V3.0

The Neurogenesis EA V3.0 MT5 is not just another trading bot. It integrates cutting-edge technology and high-performance algorithms that allow it to operate on multiple timeframes and currency pairs with unparalleled accuracy. Designed with institutional-grade performance in mind, this EA optimizes your trading strategy to capture market opportunities while managing risk effectively.

- Platform Compatibility: Exclusively developed for MT5, the Neurogenesis EA offers traders a seamless integration with the MetaTrader ecosystem, unlocking advanced features like automated trade execution, multi-timeframe analysis, and high-speed execution.

- Timeframes: The EA works efficiently across a variety of timeframes, making it adaptable for different trading strategies.

- Currency Pairs: With support for a broad selection of currency pairs, the EA ensures flexibility and a wide market coverage.

Key Features of Neurogenesis Institutional Trading Engine EA V3.0

- Advanced Algorithms: The EA is powered by state-of-the-art algorithms that leverage market data for precision trade execution. Whether you’re trading forex or commodities, the system’s adaptability ensures optimal outcomes in diverse market conditions.

- Institutional-Level Performance: The Neurogenesis EA is designed for institutional traders looking for a powerful tool to automate their strategies. It integrates cutting-edge AI and machine learning technologies to anticipate market movements and make accurate predictions, leading to reduced slippage and higher profitability.

- Multi-Timeframe Support: With the ability to operate across multiple timeframes, the EA allows for a more refined trading approach. It analyses long-term trends while still capitalizing on short-term market movements, providing a well-rounded approach to forex trading.

- Risk Management Features: Protect your trading capital with advanced risk management settings. The EA includes stop-loss, take-profit, and trailing-stop functionalities, ensuring your trades are executed with the right risk parameters.

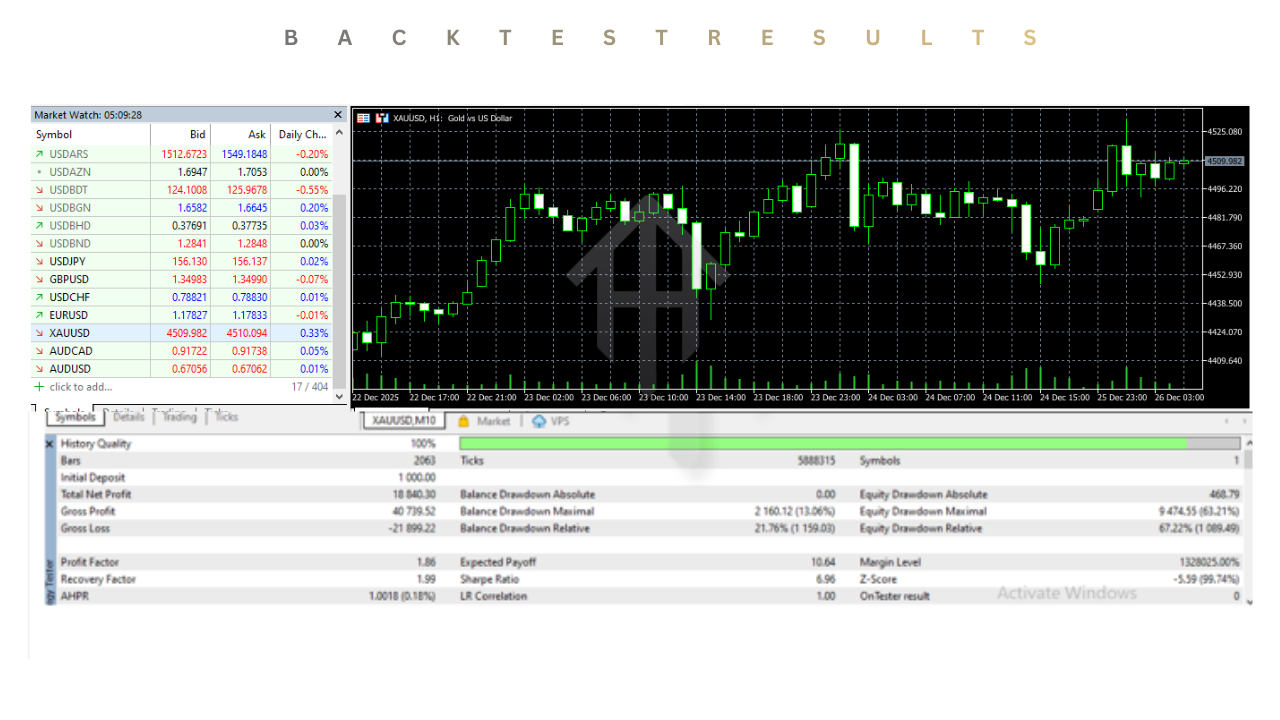

- Backtesting and Optimization: The EA supports extensive backtesting, enabling traders to evaluate its performance across historical data. This allows users to fine-tune their settings for optimal performance before going live.

How Does Neurogenesis EA Work?

The Neurogenesis EA V3.0 MT5 works by using real-time market data, executing trades automatically based on pre-defined criteria set by the trader. It scans the market for high-probability trading setups, ensuring that every trade placed has the highest chance of success.

- Data-Driven Approach: Unlike traditional discretionary trading, Neurogenesis makes decisions based on data rather than intuition. The system processes market data at lightning speeds, enabling real-time trade execution without the delays or emotional biases that human traders face.

- Trading Strategy: The EA applies various trading strategies depending on market conditions, including trend-following, breakout, and mean-reversion strategies. Traders can customize the strategies based on their risk tolerance and trading preferences.

The Advantages of Using Neurogenesis EA V3.0 MT5

- Speed and Accuracy: By automating trading decisions, the EA eliminates delays and human errors, executing trades instantly and with high accuracy.

- Consistent Profits: With its data-driven approach, the EA can capitalize on even the smallest market movements, leading to a more consistent profit stream.

- User-Friendly Interface: Despite its institutional-grade capabilities, the EA is designed with ease of use in mind. Traders can set it up quickly and customize it according to their preferences without needing advanced programming knowledge.

- 24/7 Operation: The EA runs continuously without the need for manual intervention, allowing you to trade round-the-clock and take advantage of opportunities in any timezone.

- Minimal Drawdown: The intelligent risk management features of Neurogenesis EA minimize drawdowns while maximizing gains, making it ideal for both new and experienced traders alike.

Installation and setup guide

Step 1: Download the EA

Obtain the EA File:

You should have received the Neurogenesis EA V3.0 file, usually in

.ex5or.mq5format. If you haven’t received it yet, download it from the official website or authorized vendor.

Save the EA File:

Make sure to save the downloaded

.ex5or.mq5file in a location you can easily access, such as your desktop or download folder.

Step 2: Install the EA on MetaTrader 5 (MT5)

Open MetaTrader 5:

Launch your MetaTrader 5 platform where you want to install the EA.

Access the Data Folder:

On the top menu of MT5, click on File > Open Data Folder. This will open the MT5 data folder where all the platform files are stored.

Navigate to the

MQL5Folder:

- Inside the data folder, locate the MQL5 folder and open it.

- Within the MQL5 folder, open the Experts folder. This is where all Expert Advisors (EAs) are stored.

Copy the EA File:

Copy the downloaded Neurogenesis EA V3.0 file (the

.ex5or.mq5file) into the Experts folder.

Restart MetaTrader 5:

After copying the EA file, close and reopen MetaTrader 5 to ensure the platform recognizes the newly installed EA.

Step 3: Attach the EA to a Chart

Open the Navigator Panel:

In MetaTrader 5, go to the View menu and select Navigator (or press Ctrl+N) to open the Navigator panel.

Locate the EA:

In the Navigator panel, expand the Expert Advisors section. You should see Neurogenesis Institutional Trading Engine EA V3.0 listed there.

Drag the EA onto a Chart:

Simply drag and drop the Neurogenesis EA onto the chart of your chosen currency pair (e.g., XAUUSD, GBPUSD).

Note: Ensure that the currency pair and timeframe selected are compatible with the EA’s strategy.

Step 4: Configure EA Settings

EA Settings Window:

Once the EA is applied to the chart, the EA Properties window will appear. Here, you can configure the various settings of the Neurogenesis EA.

Adjust Trading Parameters:

In the Common tab:

- Allow live trading: Ensure this is checked to enable the EA to execute trades.

- Allow DLL imports: If required, check this option to allow the EA to import external libraries.

In the Inputs tab:

- Set the trading parameters such as risk management (e.g., stop-loss, take-profit), trading hours, and specific trading pairs.

- Lot Size: Set the fixed or dynamic lot size according to your risk tolerance.

- Risk Level: Configure the maximum risk percentage per trade (e.g., 1% or 2% of account balance).

Expert Advisor Settings:

Customize any specific trading strategies, algorithm preferences, and timeframes as needed. This EA supports multiple timeframes, so ensure you set the preferred ones.

Click OK:

Once you have adjusted all settings, click OK to apply them.

Step 5: Enable Auto-Trading

Turn On Auto-Trading:

On the top toolbar of MT5, you’ll see an Auto-Trading button. Make sure this button is green (enabled). If it's red, click on it to enable auto-trading.

Check the "Experts" Tab:

Once auto-trading is enabled, check the Experts tab at the bottom of the MT5 platform. It should display messages such as "Neurogenesis EA V3.0 started" and confirm that the EA is running.

Monitoring Trades:

Once the EA is active, it will automatically begin scanning the market for potential trade opportunities based on its pre-configured algorithm.

You will see trades executed in the Terminal window under the Trade tab.

Step 6: Monitor and Optimize

Monitor EA Performance:

- Continuously monitor the performance of the Neurogenesis EA by observing the trade results in the Trade and History tabs.

- Ensure that the EA is executing trades correctly and adhering to the set parameters.

Backtest the EA:

Before going live with large amounts of capital, backtest the EA using MT5’s Strategy Tester. This will allow you to assess its performance over historical data and adjust settings accordingly.

Optimize:

- If necessary, adjust trading parameters such as risk level, lot size, and stop-loss/take-profit values based on your preferences and trading goals.

- Consider running optimization on MT5 to find the best-performing settings for your trading strategy.

Step 7: Live Trading

- Once you are satisfied with the backtesting and optimization results, you can proceed with live trading.

- Keep an eye on the account balance and ensure that the EA is executing trades as expected.

Troubleshooting Tips

- EA Not Executing Trades: Ensure that Auto-Trading is enabled in both the MT5 platform and the EA settings. Also, check if there are any errors in the Experts tab.

- Lag or Slow Execution: Verify that your internet connection is stable and that there is no heavy load on your computer that could cause delays in trade execution.

- Ensure Proper Timeframe: Make sure the EA is applied to a timeframe that it supports, such as M1, M5, M15, etc.

Conclusion

The Neurogenesis Institutional Trading Engine EA V3.0 MT5 offers unparalleled precision and performance for forex traders. With advanced algorithms, multi-timeframe support, and robust risk management features, it is the ideal tool for institutional traders looking to automate their strategies and gain a competitive edge in the market. Whether you're a professional trader or just starting, this EA will elevate your trading experience to new heights.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer:

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment