Nexus EA V9.20 MT5: Low-Risk, Math-Driven Trading Across Multi-Pairs

If you’ve been burned by flashy robots that stuff your charts with ten indicators and still miss obvious moves, you’ll like this one. Nexus EA V9.20 MT5 takes a cleaner path: it uses simple mathematical calculations to read price behavior and execute trades—especially in choppy, non-directional markets where many indicator-heavy EAs get confused. It’s positioned as low risk, high reward, able to run with a minimum deposit of $20 (tho most traders will prefer $100+ for smoother money management). And because it ships with nine distinct strategies, you can dial in a mix that suits your pair, your session, and your risk appetite.

Below is a practical, no-fluff look at how Nexus EA works, who it’s for, and how to install and configure it on MetaTrader 5—plus honest notes on risk so you don’t get tripped up by the usual pitfalls.

Why Nexus EA V9.20 MT5 is Different

Most EAs lean on lagging indicators or complex neural something-something; Nexus goes the opposite way. It’s built on lightweight math models—think distance, range, velocity of price—so it reacts fast and behaves predictably. That’s a big deal when the market is sideways: spreads can chew you, fakeouts are common, and complex filters can overfit or stall. Nexus’s logic is deliberately lean, helping it:

- Identify micro-ranges and exploit mean-reversion bounces

- Measure volatility to avoid entering during noisy spikes

- Scale entries intelligently without resorting to dangerous martingale tactics

- Lock profits with math-based trailing and step-trailing logic

You get multi-pair freedom, which means you can run it on majors, minors, even metals (if your broker conditions are good). And thanks to the nine strategies, you can turn modules on/off per symbol for a custom feel.

Who Should Use Nexus EA?

Beginners will appreciate the ready-to-run presets and the low minimum balance. Intermediates can tweak the strategies and risk settings for specific pairs/sessions. Advanced traders can run a diversified, multi-chart portfolio with pair-specific logic and equity protection rules. If you trade ranging pairs or you’re often frustrated by whip-saws, Nexus is worth a look.

Core Features at a Glance

- Nine modular strategies you can enable/disable per pair

- Math-based logic designed for choppy or range-bound conditions

- Multi-pair ready for majors, minors, and selected commodities

- Low capital entry: minimum $20 (best experience from $100+)

- Equity protection with daily stop, per-trade stop, and soft martingale-free scaling

- Dynamic SL/TP derived from current market structure and volatility

- Break-even & trailing options to lock in profits methodically

- Session filters to target London/NY overlap or avoid thin Asian liquidity (configurable)

- News-time pause (if you choose to enable calendar integration or manual time windows)

- Clean logs & alerts for transparency and quick troubleshooting

Note: Nexus doesn’t require martingale or grid. If you see “scaling,” it’s typically a tempered progression tied to volatility and equity rules, not a reckless doubling scheme.

The Nine Strategies (Plain-English Overview)

You won’t find marketing fluff like “Ultra Quantum Engine.” Nexus leans into common-sense math:

- Micro-Range Bounce – Buys near the lower range edge, sells near the upper, with measured stops beyond range breaks.

- Pullback Entry – Enters on controlled retracements after a directional impulse; looks for snap-back math signals.

- Volatility Squeeze Break – Waits for compression, then takes measured breakouts, not every random tick.

- Session Bias – Adjusts thresholds by session (e.g., tighter logic in London open).

- Impulse-Exhaustion Fade – Fades overextended spikes with strict fail-safes.

- Pivot Reaction – Watches mathematically derived pivot/zone reactions without heavy indicator baggage.

- Step-Trailing Runner – Keeps a small portion of a winner running with step-trail logic for those rare big rides.

- Drawdown Dampener – Softly reduces new risk after a loss cluster to avoid cascading drawdowns.

- Equity-Curve Protector – Daily stop and cool-down so the account lives to fight another day.

You can toggle any of these per symbol, which means EURUSD can be micro-range + pullback, while XAUUSD runs squeeze + step-trailing. That flexibility is where a lot of the edge comes from.

Recommended Setup (Quick Start)

Capital & Leverage

- Can start from $20, but $100–$300 gives the EA room to breathe.

- Standard leverage like 1:100–1:500 is fine; choose a broker with tight spreads and stable execution.

2. Pairs & Timeframes

- Start with EURUSD, GBPUSD, USDJPY on M15–H1.

- Add pairs gradually once you’re comfortable with behavior and broker costs.

3. Risk Per Trade

- Keep it conservative: 0.5%–1% per trade initially.

- If trading multiple pairs, consider an equity-based cap (e.g., daily loss limit).

4. Platform & VPS

- Use MetaTrader 5 with AutoTrading enabled.

- Prefer a low-latency VPS if your home PC isn’t always on.

Installation & Configuration (MT5)

- Copy Files: MT5 → File → Open Data Folder →

MQL5/Experts→ paste Nexus EA files. - Restart MT5: Or hit Refresh in the Navigator pane.

- Attach to Chart: Drag Nexus EA V9.20 onto your chosen symbol/timeframe.

- Allow Algo Trading: Tick “Allow algorithmic trading”; enable AutoTrading on the toolbar.

- Inputs & Presets: Load the default set (or pair-specific sets if provided).

- Risk & Filters: Set lot mode (fixed or % of equity), enable session filters, and configure trailing/BE.

- Portfolio Build-Out: Run on 1–2 pairs first. After a week or two of observation, add more charts.

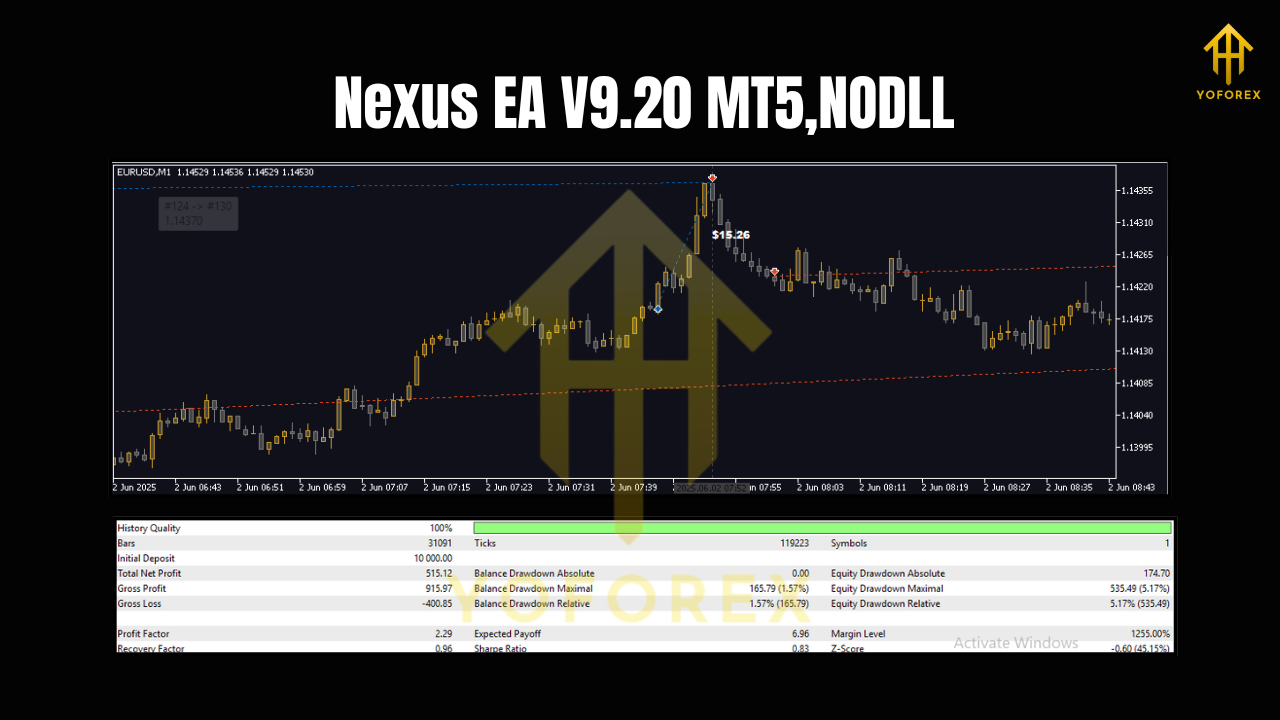

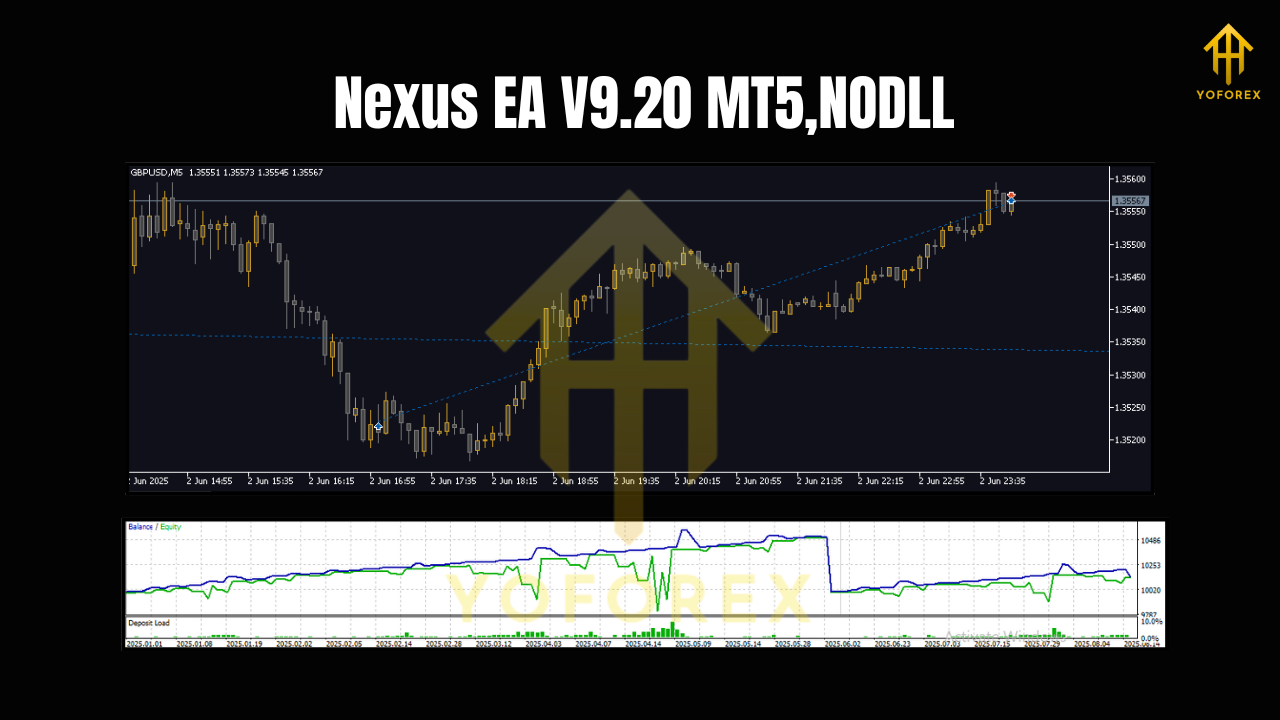

Backtesting & Forward Testing Tips

- Use high-quality tick data if available and simulate realistic spreads/commissions.

- Test per pair and enable only 2–3 strategies at a time to see what actually drives results.

- Run at least 6–12 months of history for a realistic sample of ranges, spikes, and news.

- Follow with a demo forward test for 2–4 weeks, then go small live before scaling.

- Track profit factor, win rate, average trade duration, and max drawdown—don’t chase perfect equity lines; chase robustness.

Risk Management: Where Traders Win (or Lose)

No EA, not even a math-smart one, can escape bad risk habits. Keep these in your playbook:

- Daily Loss Limit: Stop for the day after, say, 2R–3R loss. Recovery attempts on the same day usually dig deeper holes.

- Pair Limits: Don’t load 10 pairs out of the gate. Start with 1–3, then scale as your equity curve stays smooth.

- Avoid News Landmines: Use the built-in pause window or manually disable around high-impact releases if your strategy mix is sensitive.

- Broker Fit: Wide spreads or slow execution can sabotage mean-reversion and squeeze-break plays. Test your broker first.

Common Mistakes to Avoid

- Over-optimization: Cranking every input to fit one year of EURUSD is a recipe for future pain.

- Too-high risk: 2–3% per trade across multiple pairs stacks risk faster than you think.

- Ignoring costs: Commission + spread + swaps matter, especially for shorter-duration strategies.

- All pairs, all at once: Signal collision can spike drawdown and ruin discipline.

Final Thoughts & Call-to-Action

Nexus EA V9.20 MT5 is refreshing in a crowded field: math-first logic, lightweight execution, and the flexibility of nine plug-and-play strategies. If your biggest headache is sideways markets and you prefer predictable, transparent rules over indicator spaghetti, it’s a strong candidate. Start small, collect data, and let the numbers guide your scaling—not vibes.

Join our Telegram for the latest updates and support

Comments

Продвинутые инструменты контроля рабочих смен помогают оптимизировать эффективности . Удобный интерфейс минимизирует неточности в планировании графиков. Администраторам становится проще рабочие графики с детализацией. https://daftarnx303.com/finance/remote-work-control-best-practices/ Персонал имеют удобный учёт при оформлении отпусков. Переход на автоматизацию значительно ускоряет управленческие задачи в кратчайшие сроки. Практика формирует доверие в коллективе , сохраняя лояльность команды .

токарный чпу станок http://tokarnyi-stanok-s-chpu.ru - http://tokarnyi-stanok-s-chpu.ru

Leave a Comment