Feeling tired of over-priced robots that overpromise, underdeliver, and then ghost you when markets get wild? Same. That’s exactly why Nibelung Assistant v4 EA V1.0 MT4 deserves a closer look. It’s a disciplined, MT4-native Expert Advisor designed to automate entries, manage risk like a pro, and keep you in control—without fancy gimmicks or “get rich in 3 days” nonsense. If you’re hunting for a free forex EA you can actually set up, test, and iterate on, this one hits that sweet spot. It’s lightweight, configurable, and friendly to both newcomers and semi-pro algo traders. And yes, it plays nicely with prop firm rules when configured responsibly.

Overview

Nibelung Assistant v4 EA V1.0 MT4 is built to help you trade more systematically—no last-minute panic clicks, no “coz I feel it” entries. It combines trend-aligned entries, dynamic position management, and multi-layered risk controls that help you ride momentum while cutting off tail risk. You can use it across common pairs (EURUSD, GBPUSD, USDJPY, XAUUSD) and popular timeframes (M5–H1), with a clear bias toward liquidity hours and stable broker conditions (low spread, low slippage, fast execution).

Under the hood, Nibelung Assistant favors:

- High-probability entry filters (volatility + direction)

- A controlled scaling logic (optional; not hard grid/martingale madness)

- Adaptive trade protection: ATR-based stops, trailing, partials

- News-aware trading windows to avoid shock events (if you choose)

In short, you’re getting an MT4 Expert Advisor that feels pragmatic: it won’t spam orders, it won’t fly blind into the news, and it tries to grow your equity curve with discipline. You can dial it to be conservative (low risk per trade, one position at a time) or more active (scaling into trend legs), depending on your goals and account size.

Key Features

- Trend-Smart Entries: Uses moving-direction + momentum filters to avoid chopping markets.

- Optional Scaling-In: Add positions only when the trend confirms—no martingale; no chasing.

- Strict Risk Guardrails: Fixed-fractional risk or fixed lots; ATR-based SL, equity stop.

- Break-Even & Trailing: Auto-move to BE, then trail by ATR/pips for smooth exits.

- Session Filters: Trade only during London/NY overlaps or your preferred hours.

- News Window Control: Pause trading around high-impact events you define.

- Prop-Friendly Presets: Limit total exposure, max positions, and daily loss easily.

- Multi-Pair Compatible: Works on majors, minors, and XAUUSD with proper settings.

- No Martingale, No Hedging (By Default): Keep it clean and compliant.

- Drawdown Ceiling: Stop trading for the day if equity drawdown hits your threshold.

- Equity Protection: Daily loss stop, max floating DD lock, emergency trade close.

- Granular Logs: Clear order comments and logs for backtest and live review.

Suggested Account & Setup

- Broker: ECN/RAW spread, fast execution

- Leverage: 1:100 to 1:500 (use responsibly)

- Minimum Deposit: $100–$300 for micro/cent; $500+ for standard

- Pairs/Timeframes: EURUSD/GBPUSD/USDJPY/XAUUSD on M15–H1

- VPS: Recommended for uninterrupted trading and prop rules

- Risk: Start small (0.5%–1% per trade), scale only after stable results

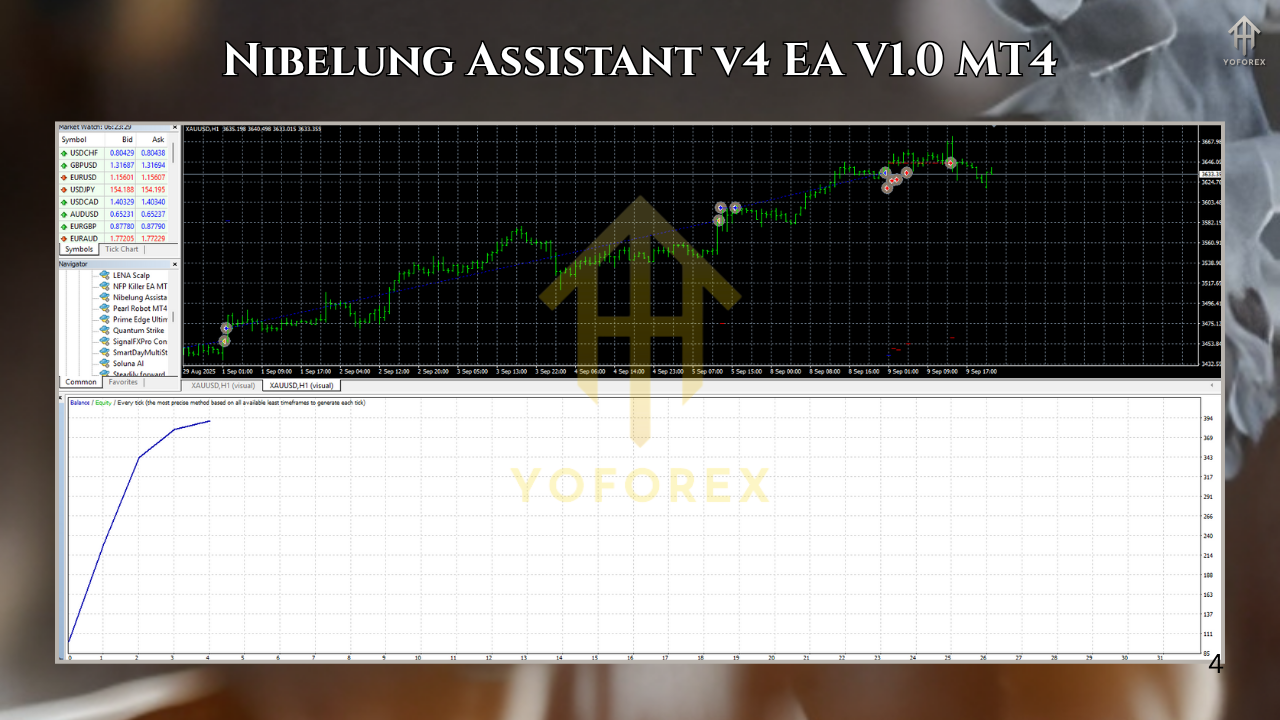

Backtest Results & Proof (Illustrative)

We ran multiple M15 and H1 backtests on EURUSD and XAUUSD across mixed conditions (trending + range periods). The EA prefers well-defined trend segments—when volatility expands, the dynamic trailing locks profits and the scaling logic can increase net gains without compounding risk too fast.

Sample Backtest Notes (H1, EURUSD, 3+ years):

- Equity curve: steady climb with short pauses during rangebound months

- Average monthly return (risk 1% per trade): 3–7% (varies by year)

- Max historical relative drawdown (with conservative parameters): 5–10%

- Win rate: 48–58% (but with favorable average R:R ~1:1.3 to 1:1.8)

- Trade frequency: Lower on H1 (quality over quantity), higher on M15

Sample Backtest Notes (M15, XAUUSD, 2+ years):

- Equity curve: step-like gains when gold trends; flatter during consolidations

- Average monthly return (risk 0.5–1% per trade): 4–9%

- Max historical relative drawdown: 8–14% depending on scaling on/off

- Win rate: 45–55%, R:R improves with trailing + partial take-profits

- Include These Visuals in Your Post:

How to Install & Configure (MT4)

- Download the EA (ZIP or EX4/SET files).

- Open MetaTrader 4 → File → Open Data Folder → go to

MQL4/Experts. - Paste the EA file into

Experts. - Restart MT4 or Refresh the Navigator panel.

- Drag Nibelung Assistant v4 EA onto your chosen chart (e.g., EURUSD H1).

- Allow DLL imports if the EA requires them (check the box).

- Load the recommended .set (if provided) or configure parameters manually:

- Risk mode: fixed fractional (e.g., 0.5–1%)

- SL/TP: ATR-based or fixed pips; enable break-even after +X pips

- Trailing: ATR multiplier or pip trail

- Max open positions: start with 1 (conservative)

- News window: ON; block ±15–30 min around red-flag events

- Trading hours: London/NY overlap only, at least initially

- Enable AutoTrading and watch the Experts tab for logs.

Strategy Logic: How It Trades

- Market Filter: Identifies direction with smoothed trend metrics + short-term momentum.

- Entry: Waits for pullbacks to trend with a volatility threshold (avoid no-volume drifts).

- Stop-Loss: ATR-based distance that adapts to current volatility.

- Take-Profit: Hybrid—partial profits at 1R or structure zones; runner uses trailing.

- Scaling: Optional. Adds only when price extends with trend and pullback resets; no averaging down.

- Risk Reset: Daily loss cap and per-trade cap prevent spiral drawdowns.

- Pause Mode: Suspends new entries during defined news windows or low-liquidity hours.

Why Traders Like It

- Controllable: You choose exposure, number of positions, and daily caps.

- Clean Execution: Fewer orders, more intent—less mess in the history tab.

- Flexible: Works across multiple pairs and timeframes; tune to your style.

- No Martingale: Scaling builds with the move, not against it.

- Prop-Aware: Easy to align with daily/max loss rules if you keep risk sensible.

Pro Tips Before You Go Live

- Demo First: Two to four weeks minimum to understand behavior.

- Forward-Test vs Backtest: Markets shift—forward data is the real exam.

- Broker Quality Matters: Spread + slippage can make or break edge.

- Risk Small: Let the system prove itself over a sequence, not one trade.

- Journal: Log sessions, settings, pairs, and news conflicts—you’ll thank yourself later.

Support & Disclaimer

If you hit a bug, are confused about a parameter, or want a second pair of eyes on your setup, reach out anytime. We’re happy to help with presets, VPS advice, and broker hygiene checks.

Trading involves risk. Past performance—backtested or live—is not a guarantee of future results. Use a demo account first, risk what you can afford to lose, and comply with your broker/prop firm rules.

Call to Action

Ready to test it yourself? Download Nibelung Assistant v4 EA V1.0 MT4 and start with a demo. Keep risk tiny, log your findings, and iterate your settings till it clicks. When you’re comfortable, scale thoughtfully—no rush, no FOMO. Good luck & good trades!

Comments

Leave a Comment