Ninja FX EA V6.04 MT4 — precision, risk control, and consistency for your trades

If you’ve been stuck between over-promising robots and over-complicated manual systems, Ninja FX MT4 might be the straight-shooting solution you were hoping for. It’s a powerful automated trading Expert Advisor designed for MetaTrader 4, built around three pillars that actually matter in live markets: precise entries, disciplined risk control, and repeatable consistency. Instead of chasing “moonshot” wins, Ninja FX aims for solid, defendable trades on popular forex majors—and even extends to BTCUSD and the US30 index—across the H1 to M30 time frames.

Below, you’ll find a practical overview of how Ninja FX EA V6.04 works, how to install and configure it, what pairs and setups it’s best at, and the risk management philosophy that keeps your account guardrails in place. No fluff; just the stuff you can actually use.

What is Ninja FX EA V6.04 MT4?

At its core, Ninja FX is a multi-market algorithm that looks for high-quality setups during stable volatility windows. It balances trend-following confirmation with mean-reversion logic: think “join strong moves when they’re healthy, fade exhaustion when the math supports it.” It then wraps everything in risk control—hard stop losses, dynamic position sizing (if you prefer), and optional trade management, so you’re not left guessing in the middle of a news spike.

Supported time frames: M30 to H1

Markets: GBPUSD, EURUSD, BTCUSD, AUDCAD, NZDCAD, and US30 (Dow Jones CFD)

Why these? Because they give a mix of liquidity profiles, session behaviors, and volatility types. GBPUSD and EURUSD are your liquid majors; AUDCAD/NZDCAD add cross-pair mean-reversion behavior; BTCUSD introduces crypto momentum; US30 gives index pace and overnight gaps you can plan around.

Key features you’ll actually use

- Precision entries on M30–H1: Less noise than M1/M5, more signals than H4/D1; a sweet spot for “active, not frantic.”

- Strict risk controls: Hard SL on every trade, no martingale, no grid averaging that quietly balloons exposure.

- Dynamic position sizing (optional): Risk a fixed % per trade (e.g., 0.5%–1%) for consistent equity curve shape.

- Multi-symbol engine: Run the same template across GBPUSD, EURUSD, BTCUSD, AUDCAD, NZDCAD, and US30.

- Volatility filters: Avoids chasing moves during erratic spikes; favors stable, tradeable ranges.

- Time/session filter: Focus your trading during the most reliable sessions (London/NY overlap, for example).

- Breakeven + trailing stop: Lock in winners, reduce open-risk once the trade moves in your favor.

- Partial take-profit options: Scale out systematically to realize gains and let runners run.

- News awareness (optional): Pause entries around high-impact events if your broker provides appropriate data via a news utility.

- VPS-friendly & ECN-ready: Built to run 24/5 with low latency and stable execution.

How Ninja FX decides when to trade

Ninja FX V6.04 blends two complementary ideas:

- Trend confirmation: Identify direction using higher-timeframe structure and momentum cues (e.g., slope, swing points, or MA alignment). If the path of least resistance is up, long signals get priority; if it’s down, shorts take the lead.

- Quality filters: Volatility bands and range detection avoid entries when price is too wild or too dead. The EA looks for “just right” conditions—enough movement to get paid, not so much chaos that stops get clipped for no reason.

This combo is why M30–H1 works so well: you get meaningful candles with less noise, while still capturing multiple opportunities per session.

Recommended instruments & time frames

- GBPUSD & EURUSD (M30/H1): Best balance of liquidity and follow-through. Great for trend continuation and clean reversals.

- AUDCAD & NZDCAD (M30/H1): Often mean-reverting; Ninja FX’s filters seek high-probability rotations.

- BTCUSD (H1): Crypto is fast; H1 slows the noise. Use tighter risk % (e.g., 0.25%–0.5% per trade).

- US30 (H1): Index momentum can be explosive around NY open. Consider the session filter and a conservative risk cap.

Tip: Start with majors (GBPUSD/EURUSD) to learn the EA’s rhythm; then phase in BTCUSD and US30 with smaller risk.

Installation & first-run setup (MT4)

- Add the EA: Copy the

ex4/mq4file toFile > Open Data Folder > MQL4 > Experts, then restart MT4. - Enable trading: In MT4, allow algorithmic trading (AutoTrading on).

- Attach to a chart: Open, say, GBPUSD H1, drag Ninja FX EA V6.04 from the Navigator > Experts onto the chart.

- Load inputs:

- Risk per trade: start small (0.5% or fixed lot like 0.01 for every $1k).

- Stop loss / TP: keep the default logic first; tweak after collecting data.

- Breakeven & trail: enable breakeven at +1R, gentle trailing thereafter.

- Trading hours: align to London + NY overlap for majors; US session for US30; 24/5 is okay for crypto but consider a cooldown before/after major releases.

5. Run on VPS: For best stability, use a reputable VPS close to your broker’s server.

Risk & money management (where the edge sticks)

- Risk small, survive long: 0.25%–1% per trade is plenty. Compounding will do the heavy lifting over time.

- Use portfolio thinking: Running the EA on 3–4 symbols spreads opportunity and reduces dependency on any one market’s mood.

- Daily loss cap: Consider halting new entries after -2R or -3R in a day. This avoids “death by chop.”

- No martingale ever: Ninja FX doesn’t average losers; please don’t override that with manual add-ons.

- Slippage reality: BTCUSD and US30 can gap; expect occasional slip—price it into your risk %.

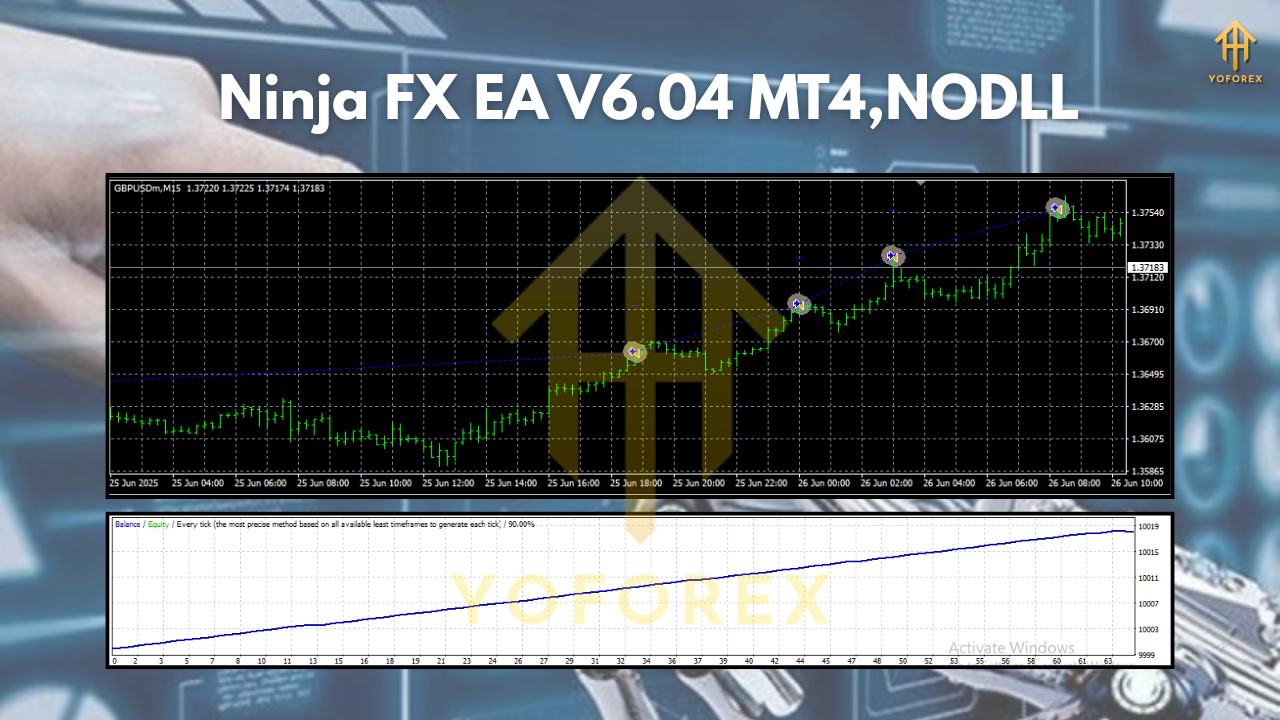

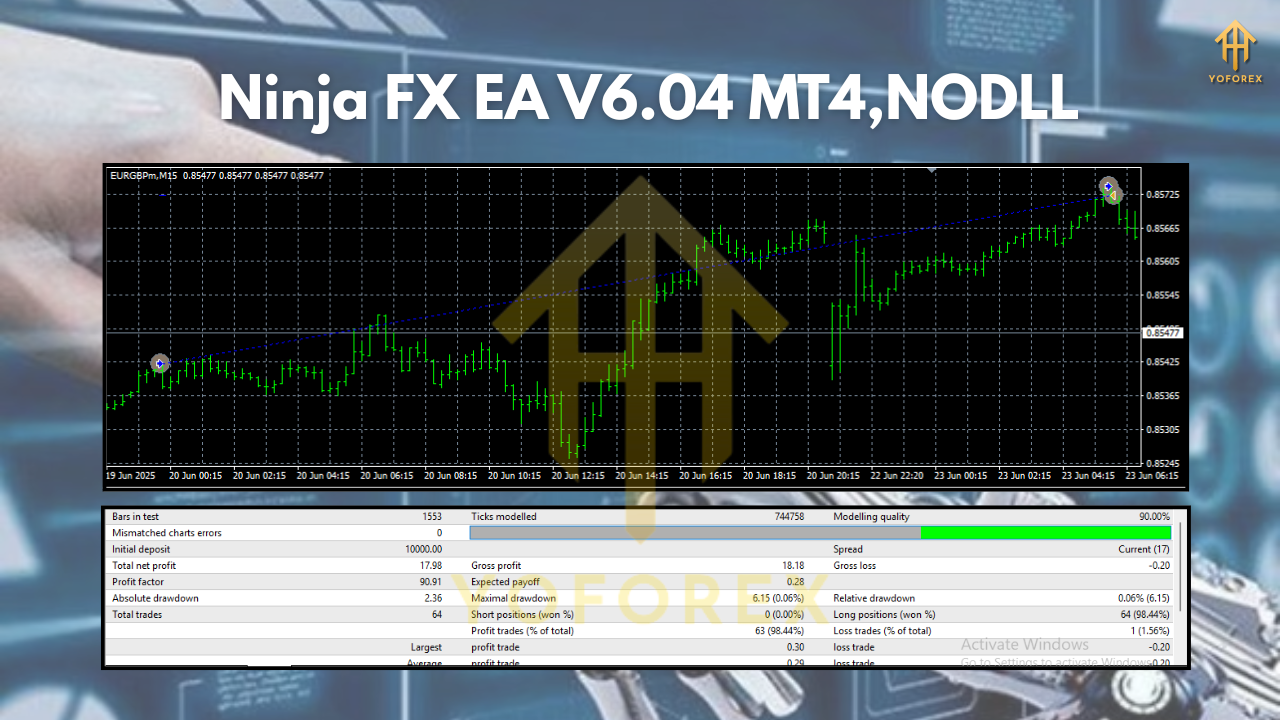

Backtesting & forward testing (the right way)

- Model data per symbol: Backtest each pair/time frame separately (e.g., GBPUSD H1 over 3–5 years). You want to see:

- Consistent equity curve (no huge saw-teeth).

- Max drawdown contained relative to your risk (e.g., <15% at 1%/trade).

- Stable win/loss distribution (not 95% winners with huge tail risk).

- Forward test on demo: Run at least 2–4 weeks on demo or a tiny live account. Validate fills, spreads, and broker behavior.

- Walk-forward mindset: Markets evolve. Plan to re-optimize minor toggles (sessions, filters) quarterly if needed—without curve-fitting.

Broker, spreads & execution

- ECN or low-spread accounts make a noticeable difference, especially during high-impact periods.

- Reasonable commissions: A fair commission structure beats “zero-commission but wide spreads” every time.

- Server proximity: A VPS near your broker’s data center keeps execution sharp.

- Symbol names: Some brokers append suffixes (e.g.,

EURUSD.a). Make sure the EA recognizes your broker’s symbol names.

Best practices & troubleshooting

- One chart = one EA instance: Attach Ninja FX separately to each symbol/time frame you want to trade.

- Magic numbers: Keep unique magic numbers if you run multiple instances to avoid trade management conflicts.

- News filter approach: If you choose to pause trading for major events (CPI, NFP, FOMC), do it consistently.

- Logs are your friend: If something looks off, check the Experts and Journal tabs for clues.

- Don’t over-tweak: Let the default logic run long enough to gather statistically meaningful data before changing parameters.

Who benefits most from Ninja FX?

- Busy professionals who want hands-off entries/exits but with sober risk management.

- System traders who prefer M30–H1 rhythm over hyper-scalping.

- Diversifiers looking to spread risk across FX majors, CAD crosses, crypto, and an index—without learning five different systems.

Final word (and a friendly nudge)

Ninja FX EA V6.04 MT4 is built for the real world: it seeks clear setups, respects risk, and favors steady compounding over lottery-ticket thinking. Start small, think in R-multiples, and give it enough runway to prove itself. You’ll likely appreciate how “quietly competent” trading can feel when an EA sticks to its job.

Comments

Leave a Comment