The landscape of algorithmic trading has shifted dramatically in recent years. Retail traders are no longer satisfied with simple moving average crossovers or basic grid systems. The demand for sophisticated, institutional-grade logic has given rise to a new breed of Expert Advisors. Among the most discussed tools in this new wave is the NTRon 2OOO EA V2.30 for MetaTrader 5. This automated trading system has captured the attention of the community by claiming to integrate advanced Artificial Intelligence with deep market analysis, specifically tailored for the XAUUSD (Gold) pair.

In this detailed review and guide, we will explore what makes the NTRon 2OOO EA V2.30 stand out, how its unique hybrid engine operates, and how you can configure it for optimal performance on your own trading accounts.

Understanding the Core Mechanism

The NTRon 2OOO EA V2.30 is not a general-purpose trading robot. It is a specialized tool designed exclusively for Gold. Gold is known for its high volatility and susceptibility to macroeconomic news, which often destroys standard technical indicators. To combat this, the NTRon 2OOO utilizes a dual-engine approach that separates it from standard scalpers.

The first engine is the Fundamental Analyzer. The developer claims this system leverages GPT technology to process economic news data in real-time. Instead of simply avoiding news, the EA attempts to understand the sentiment behind the data. For example, if the US Federal Reserve announces a rate decision, the EA assesses whether the language is hawkish or dovish. This sentiment score helps the EA determine the overall bias of the market—whether it should be looking for buy setups or sell setups. This is a significant leap forward from older EAs that merely paused trading during news events.

The second engine is the Micro-Structure Analyzer, often referred to as the DOM (Depth of Market) simulator. While true Depth of Market data is hard to come by in the retail Forex space, this EA simulates order flow pressure by analyzing tick volume and price velocity. It looks for liquidity clusters where institutional orders are likely resting. By combining the fundamental bias from the first engine with the entry precision of the second engine, the NTRon 2OOO aims to enter trades only when both the macro and micro pictures align.

What is New in Version 2.30?

Software in the algorithmic trading space must evolve or die. Version 2.30 of the NTRon 2OOO brings several critical updates that traders need to be aware of. The most notable change is the refinement of the sensitivity parameters for the tick analysis. Previous versions were sometimes criticized for being too aggressive in low-volume markets, leading to drawdown during the Asian session. Version 2.30 appears to have a stricter filter for volatility, ensuring that trades are taken only when there is sufficient market momentum to carry the price to the take-profit level.

Another update in V2.30 is the improved handling of the WebRequest function. Since the news analysis relies on external data, a stable connection is vital. The latest version has optimized how it queries the news server, reducing the likelihood of missed data packets during high-traffic times. This ensures that the fundamental filter remains active and accurate even when the market is moving fast.

Installation and Configuration Guide

Setting up the NTRon 2OOO EA V2.30 requires more attention than a standard plug-and-play bot. Because it relies on external news data, you must configure your MetaTrader 5 terminal correctly.

First, you need to enable web requests. Open your MT5 terminal, go to the Tools menu, and select Options. Navigate to the Expert Advisors tab. Check the box that says Allow WebRequest for listed URL. You will need to add the specific news URL provided in the EA documentation. Without this step, the GPT-powered news filter cannot function, and the EA will be trading blind.

Once the web requests are active, load the EA onto a 30-minute (M30) chart of XAUUSD. The M30 timeframe is hard-coded into the logic of the strategy, so placing it on a 5-minute or 1-hour chart may lead to erratic behavior or no trades at all.

The input settings allow for customization, but the default settings are generally tuned for the current market conditions. The most important parameter to adjust is the Lot Size or Risk setting. The EA offers an Auto-Lot feature which calculates the trade size based on your account balance. For those testing the software for the first time, it is highly recommended to use a fixed lot size initially to gauge the frequency and risk profile of the trades.

Risk Management and Expectations

While the marketing for the NTRon 2OOO focuses heavily on high accuracy, risk management remains the trader's responsibility. Gold is a volatile asset that can move hundreds of pips in minutes. The NTRon 2OOO is designed to capitalize on these moves, but it is not immune to losses.

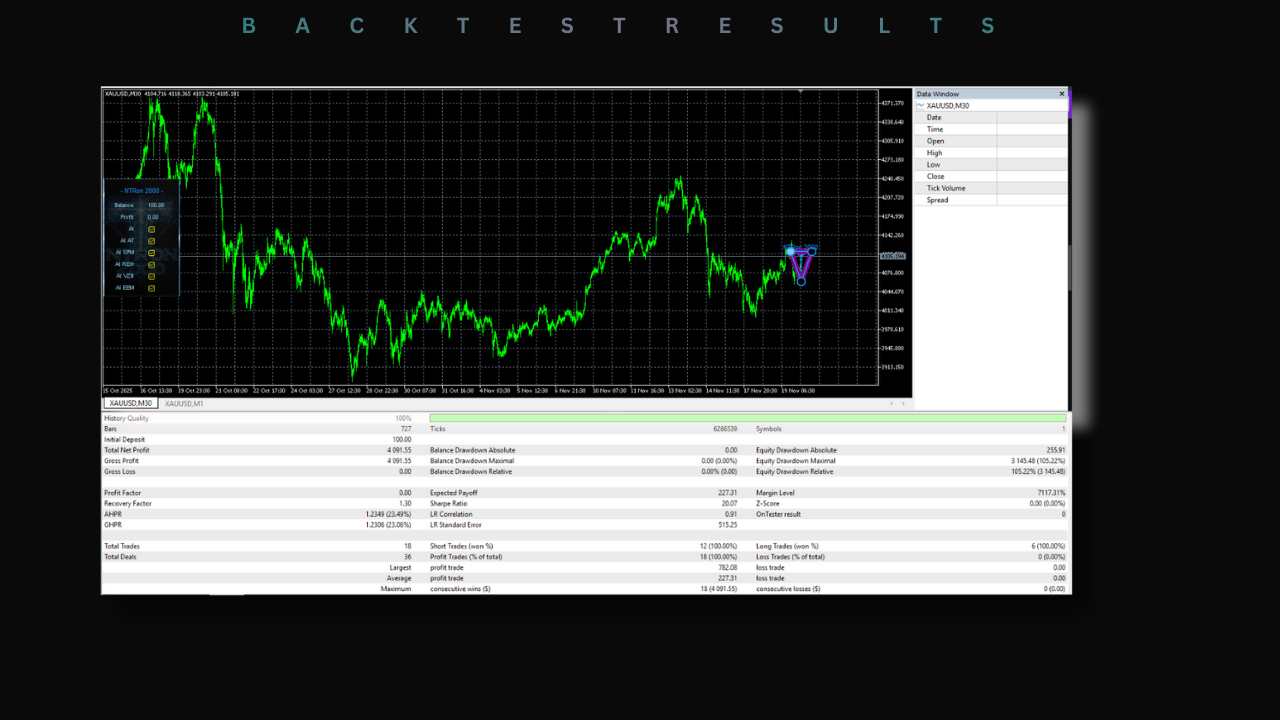

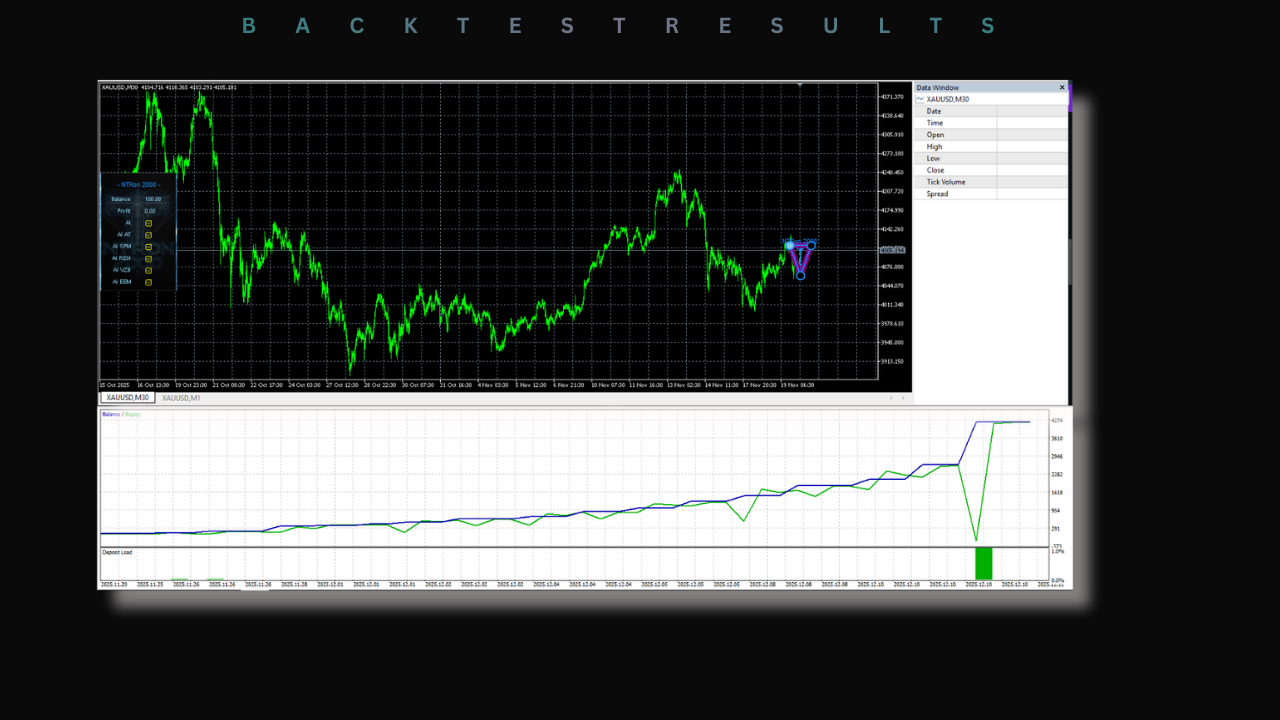

The strategy does employ a recovery mechanism. If a trade goes against the initial entry, the EA may open additional positions to average out the entry price. This is often referred to as a grid approach, though the NTRon utilizes a smart grid that spaces orders based on market structure rather than fixed pip distances. While this increases the win rate, it also increases the drawdown potential. Traders should ensure they have adequate capitalization. A minimum balance of $1000 is recommended for a standard account, or $100 for a cent account, to allow the strategy enough breathing room to operate.

It is also crucial to use a low-latency VPS (Virtual Private Server). Because the entry logic depends on tick analysis, a delay of even a few hundred milliseconds can result in a difference in entry price. Over time, this slippage can turn a winning strategy into a losing one. Ensure your VPS is located close to your broker's data center to minimize ping.

Why Traders are Switching to Hybrid EAs

The popularity of the NTRon 2OOO V2.30 signals a broader shift in the retail trading community. Purely technical strategies are struggling in the current geopolitical climate where news dominates price action. Traders are realizing that a chart pattern is meaningless if a sudden war breaks out or inflation data surprises the market.

Hybrid EAs like NTRon offer a middle ground. They provide the automation and discipline of a robot but include the fundamental awareness that was previously only possible with manual trading. This "best of both worlds" approach is why many are adding NTRon to their portfolio. It serves as a diversifier, often finding trades that standard trend-following or mean-reversion bots miss.

Troubleshooting Common Issues

If you have installed the EA and are not seeing any trades, there are a few common culprits to check. First, verify that the smiley face in the top right corner of the chart is blue. If it is gray, automated trading is disabled globally. Second, check the Experts tab in the terminal toolbox. This log will display any error messages. A common error is "Error 4014," which indicates that the WebRequest URL is not authorized. Double-check the URL in your options menu.

Another issue can be the broker suffix. Some brokers list Gold as "Gold" instead of "XAUUSD," or have a suffix like "XAUUSD.m". The NTRon 2OOO usually auto-detects the pair name, but if it fails, you may need to manually type the pair name in the EA settings if that input is available.

Conclusion

The NTRon 2OOO EA V2.30 MT5 represents a sophisticated attempt to tame the Gold market using modern technology. Its claim of GPT integration and DOM simulation places it at the cutting edge of retail trading tools. While no EA is a guaranteed money printer, the logic behind NTRon is sound and addresses the specific challenges of trading XAUUSD in a news-driven environment.

For traders looking to automate their Gold trading, this EA offers a compelling solution that goes beyond basic technical analysis. However, success depends on proper setup, the use of a high-quality VPS, and sensible risk management. As with all trading tools, thorough backtesting and forward testing on a demo account are essential steps before committing real capital. The NTRon 2OOO is a powerful tool in the right hands, offering the potential for consistent growth in one of the world's most exciting markets.

Support and Community

If you encounter issues during installation or need advice on the best set files for your specific broker, joining a community of like-minded traders can be invaluable. You can reach out for support or join the discussion groups to share results and optimization tips.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Reference

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges, join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment