The New York session is where markets really wake up—liquidity surges, spreads can tighten (then suddenly widen), and momentum trades either fly… or fail fast. If you’re tired of random entries and “pray & hold” tactics during that 7–10 hour window, NySession EA V2 MT4 is designed to give you structured, rules-based execution that fits the NY rhythm. It looks for directional bias, checks volatility and spread quality, and—only then—pulls the trigger with tight risk control. No martingale pressure, no blind grid stacking. Just consistent logic making consistent decisions.

What Is NySession EA V2 MT4? (Overview)

NySession EA V2 MT4 is an automated trading system for MetaTrader 4 built specifically around the New York session. It combines a trend filter, volatility gates, and time-based execution windows so the bot trades when the US market usually offers the cleanest opportunities. Think of it as a disciplined NY-open specialist: it waits for the right conditions and then executes setups with predefined stop-loss and take-profit logic.

Core idea: pick a directional bias, validate that current volatility and spread conditions are favorable, and execute only during your chosen NY window. The EA can operate in Scalp, Intraday, or Swing-NY templates, each with its own stop/target profile and management rules. You can run one chart or multiple charts (different pairs), as long as you set unique Magic Numbers.

Who it’s for: traders who want a focused, time-boxed strategy that fits after-work routines (India evenings / EU afternoons) or prop-firm rules. It’s also a strong fit if you prefer fewer but higher-quality signals rather than 24/5 noise.

Key Features (At a Glance)

- NY-Session Timer: Trade only during your defined US session window (e.g., 13:00–21:00 UTC; adjust for DST).

- Bias + Volatility Filter: Avoids low-energy chop and filters for actionable momentum or mean-reversion only when justified.

- Strict Risk Control: Fixed lot or % risk per trade; ATR-aware stops and realistic TPs.

- No Forced Martingale: Averaging disabled by default. If enabled, you can cap steps and spacing.

- Equity Protection: Daily loss guard and global drawdown cut-off to protect capital and meet prop rules.

- Spread & Slippage Gate: Sits out when the market is “too expensive” (news bursts, rollover spikes).

- Breakeven / Partial Close: Lock progress early; scale out intelligently to reduce tail risk.

- Magic Number Isolation: Safely run multiple pairs or templates on one account.

- Session-Aware News Pause: Optional cool-down around high-impact US releases (NFP, CPI, FOMC, etc.).

- Clean Logs: Clear order comments and readable logs for post-trade analysis and prop audits.

- Preset Packs: Ready-to-load templates for Scalp, Intraday, and Swing within the NY window.

Recommended Pairs, Timeframes & Risk

Pairs to start with:

- EURUSD, GBPUSD, USDJPY — liquid majors with dependable NY activity.

- XAUUSD (Gold) — tradable during NY hours; use conservative risk and wider stops.

Timeframes:

- Scalp: M5 / M15

- Intraday: M15 / M30

- Swing-NY: H1

Minimum Deposit & Leverage:

- Minimum: ~$100 (a cent account is great for practice)

- Comfortable start: $300–$500+

- Leverage: 1:200 or higher is fine—size your risk, not your leverage.

Baseline Risk Settings (starting point):

- Risk %: 0.5%–1.0% per trade for prop-friendly control

- Fixed lot: 0.01 per $200–$300 equity for scalping; slightly higher for H1 swing if spreads are tight

Execution Environment:

- Broker: ECN with low spreads and transparent commission

- VPS: Recommended (NY scalping benefits from <20ms latency)

- Avoid: Rollover window and just-released high-impact news, especially if you scalp

How NySession EA V2 MT4 Thinks (Strategy Logic)

- Session Check: The bot trades only during your configured NY window.

- Market Quality Gate: It verifies spread, slippage, and minimum volatility thresholds—no decent conditions, no trade.

- Directional Bias: Uses a trend/momentum filter to decide long/short preference (or stand aside if conflict).

- Trigger Confirmation: Looks for price-action alignment (candle structure, micro breakouts or mean-reversion tags) plus ATR-aware buffers to reduce false starts.

- Risk Setup: Places stop and target with either fixed R-multiples (e.g., 1:1.2, 1:1.5) or dynamic trailing.

- Trade Management: Breakeven activates after a predefined move; optional partial close scales out at the first target.

- Equity Protection: If the daily cap triggers, the EA halts new entries for the remainder of the session.

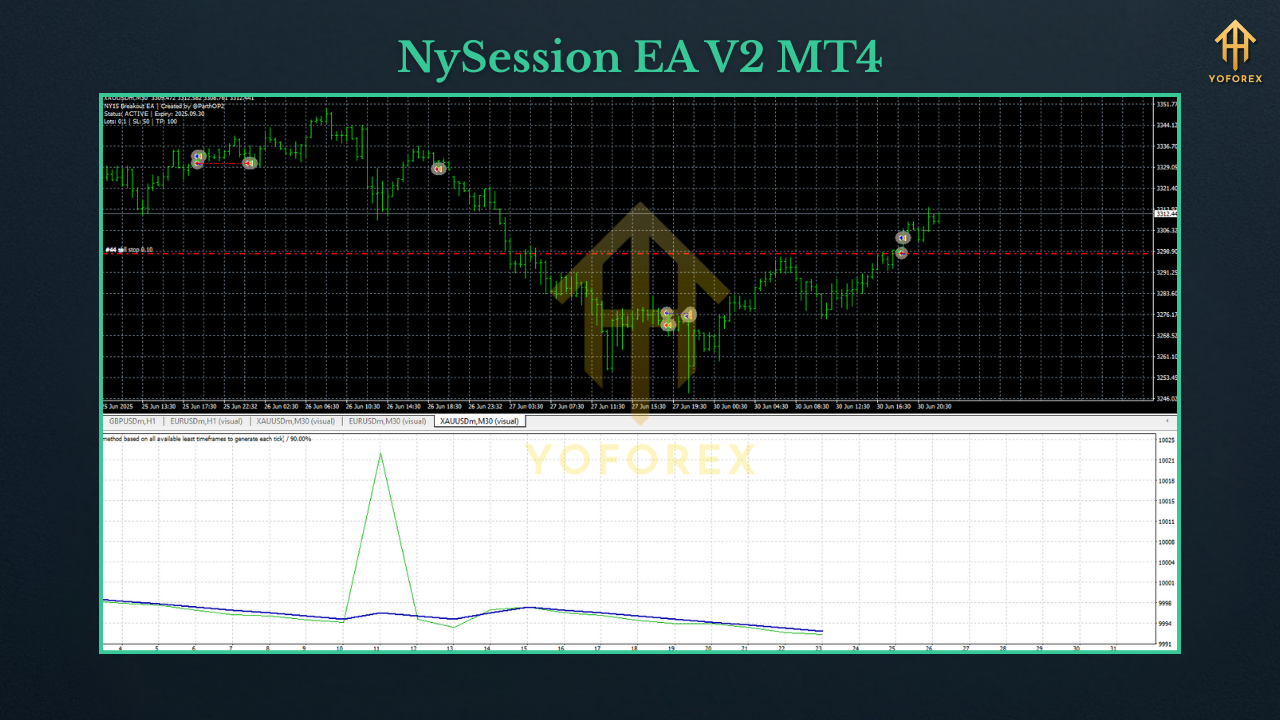

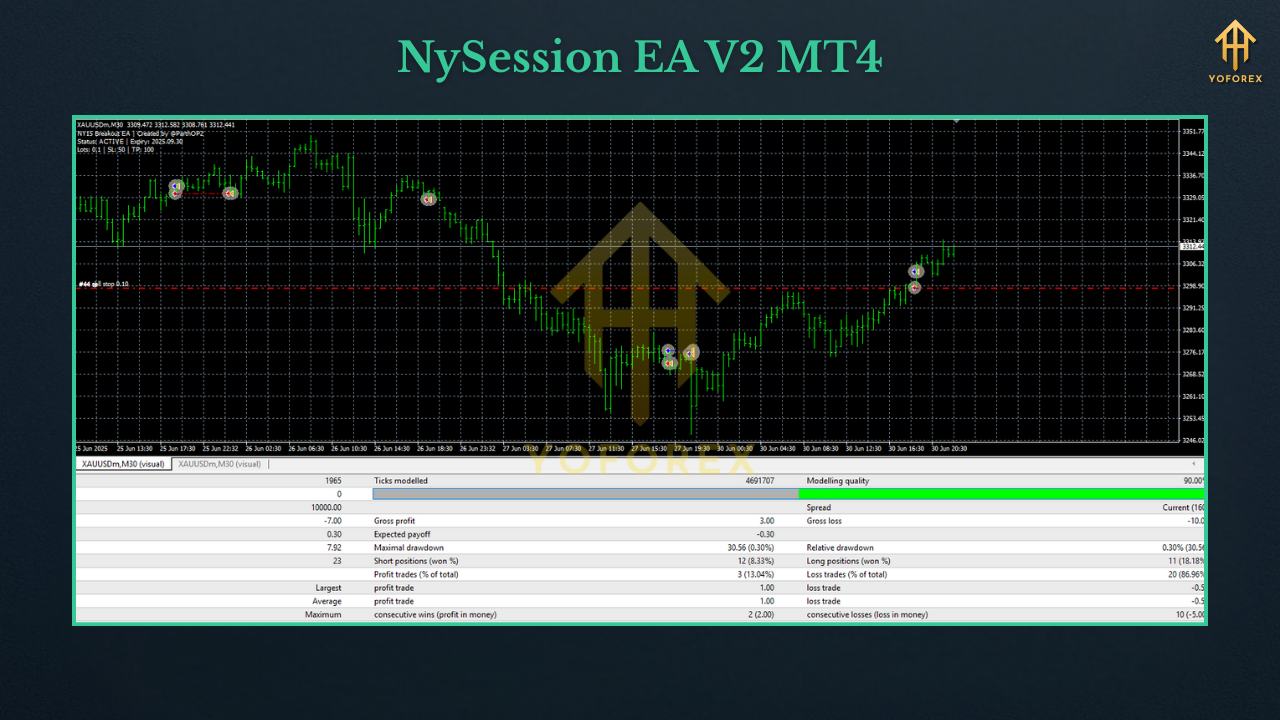

Backtest & Forward-Test Tips (What to Expect)

- Data & Costs: Use high-quality tick data with variable spreads and realistic commission.

- Period: 12–24 months, including messy US events (bank stress headlines, CPI/Fed, NFP).

- Session Window: Match your backtest to the exact NY hours you plan to trade live.

- Risk: Keep it consistent (e.g., 1% per trade) so different pairs/timeframes are comparable.

Key Metrics:

- Max Drawdown (relative) and consecutive losses

- Profit Factor > 1.3 under realistic costs is generally workable

- Expectancy per trade (positive and stable across sub-periods)

- Time in market (lower exposure limits tail risk)

Robustness Checks:

- Slightly perturb stops/targets—robust logic won’t collapse

- Try neighboring timeframes (M5 vs M15)

- Toggle news pause on/off to see sensitivity

Live Dry-Run: Micro lots on a small live account for 2–3 weeks to verify actual spreads/slippage vs backtest.

Installation & First-Run Setup (Step-by-Step)

- File Copy: Place

NySession_EA_V2.ex4(or the provided file) into MQL4/Experts. - Restart MT4: Or right-click Experts in Navigator → Refresh.

- Enable Algo Trading: Turn on “Algo Trading” (AutoTrading) in the MT4 toolbar.

- Attach to Chart: Open, say, EURUSD M15, drag the EA onto the chart.

- Load Preset: Start with a preset like

NYS_Scalp_M15.setorNYS_Swing_H1.setif provided. - Set Session Hours: Define your NY window (e.g., 13:00–21:00 UTC; adjust for DST and your local time).

- Risk Settings: Choose Risk % (start at 0.5%–1%) or a small fixed lot.

- Equity Guard: Configure daily loss limit (e.g., 3%–5%) and enable global drawdown protection.

- Spread/Slippage Gate: Keep defaults strict; only relax if your live fills are consistently clean.

- Unique Magic Numbers: One per pair/timeframe to avoid order conflicts.

- VPS: If you scalp, deploy on a low-latency VPS close to your broker.

Prop-Firm-Friendly Notes

- Daily Loss Buffer: Keep your EA’s daily cap below the prop rule (e.g., if they allow 5%, use 3%–4%).

- Risk Per Trade: 0.5%–0.8% is a comfortable prop baseline during NY hours.

- News Halts: For high-impact events, pause new entries 15–30 minutes before/after—especially for scalping templates.

- Consistency > Hype: Once you pass Phase 1, don’t suddenly double risk; maintain the same profile.

Troubleshooting (Quick Fixes)

- “No trades today” — Check your NY window, ensure it aligned with the actual market hours and DST; confirm spread/volatility gates weren’t blocking.

- “Too many small losses” — Widen stop slightly, raise quality threshold, or switch to Intraday/Swing.

- “Breakeven kicks in too early” — Delay BE activation or use partial close at first target.

- “Whipsaw on news” — Enable the news pause and avoid immediate post-release trades on scalping modes.

- “Duplicate orders?” — Make sure every chart uses a unique Magic Number.

FAQ

Does NySession EA V2 use martingale or grid?

No by default. You control any averaging behavior; most users keep it off.

Can I run multiple pairs?

Yes—assign unique Magic Numbers per chart and monitor total exposure.

Do I need a VPS?

Highly recommended for scalping. Intraday/Swing will still benefit from stability.

Which pairs are best?

Start with EURUSD, GBPUSD, USDJPY; add XAUUSD later with conservative risk.

Is it plug-and-play?

Presets help, but your broker conditions matter. Backtest, then forward-test before scaling.

Risk Disclaimer

Trading Forex/CFDs carries a high level of risk. Past performance does not guarantee future results. Only trade capital you can afford to lose. Always test settings on demo or a small live account first.

Call to Action

Ready to focus your trading on the most active hours of the day? Download NySession EA V2 MT4, load a preset, and run disciplined tests through your preferred NY window. Keep risk tight, be patient on entries, and let the session work for you—not against you.

Download: Add your download link on fxcracked.org here (match the slug below for clean SEO).

Need help? Drop a comment on the post or reach out via your usual support channel.

Comments

Leave a Comment