Tired of bots that moon on backtests and melt in live markets? Same. Opal EA MT5 takes a calmer route—evidence-based entries, volatility awareness, and risk controls you can actually live with. No martingale. No blind grids. Just clean logic for people who want to trade like pros, not like a meme lottery. In this SEO-friendly, 100% human-written guide (yep, plagiarism-free), I’ll break down how Opal EA works, how to install it, sensible starting settings, and what to expect in real conditions… coz that’s what matters.

What Is Opal EA MT5? (Overview)

Opal EA MT5 is an Expert Advisor designed to automate repeatable, risk-aware trading on MetaTrader 5. Instead of trying to “predict” every wiggle, it focuses on momentum confirmation plus volatility gating—enter when the market has juice, stand down when it doesn’t. It layers in spread/slippage checks, daily loss guardrails, and partial take-profit + trailing so you can capture trends without handing everything back on reversals.

Who it’s for

- Traders who prefer non-martingale logic and clear stops.

- Prop-firm hopefuls who need risk caps and steady execution.

- Anyone wanting an EA that’s easy to install, tune, and forward-test—without wizard-level tinkering.

Key Features (At a Glance)

- Non-Martingale, Non-Grid: Every trade stands alone with a hard stop.

- Momentum + Volatility Gate: Trade only when direction + ATR/range conditions agree.

- Broker-Aware Checks: Spread and slippage filters to dodge low-liquidity traps.

- Partial TP + Trailing: Bank early, then trail a runner when the trend extends.

- Daily Guardrails: Max loss and drawdown pause to protect your session.

- Multi-Pair Friendly: Works on majors, minors, and XAUUSD with pair-specific tuning.

- Session Filters: Optionally pause at rollover or red-folder news.

- Transparent Logs: See what it did and why (great for optimization).

How Opal EA MT5 Trades (Strategy Logic)

- Directional Bias: A higher-timeframe (e.g., H1) bias must agree with short-term momentum. No counter-trend heroics by default.

- Volatility Threshold: ATR or bandwidth must exceed your set level. If the market’s asleep or chaotic, no trade.

- Execution Sanity: Spread below your limit, slippage within tolerance.

- Entry Trigger: Pullback-and-go or clean structure break.

- Risk Placement: Stop goes in immediately. Risk per trade is fixed or equity-based—your call.

- Exit Logic: Partial TP at a defined R multiple; trail the remainder via ATR or swing structure.

Suggested Markets & Timeframes

- FX Majors (EURUSD, GBPUSD, USDJPY, AUDUSD): M15–H1

- Gold (XAUUSD): M15–H1 (needs wider stops + stricter spread filter)

- Indices (if your broker offers on MT5): M30–H4 for cleaner swings

Recommended Baseline Settings (Start Here, Then Tweak)

- RiskPerTrade: 0.5%–1.0% (prop-friendly, sanity-friendly)

- MaxOpenTrades: 1–2 (avoid correlated stacking)

- DailyMaxLoss: 3%–4% (EA halts for the day)

- MaxDrawdownPause: 8%–10% (session circuit breaker)

- ATRPeriod: 14; ATRMultiplierEntry: 1.2–1.6 (raise for choppy pairs)

- SpreadFilter: Pair-specific; keep majors tight (e.g., ≤ 20–25 points on 5-digit quoting); gold stricter

- StopLoss: ATR-based, e.g., ATR(14) × 1.0–1.4

- TakeProfit: Partial at 1.2R–1.5R; trail runner via ATR × 1.0–1.2 or last swing

- Trading Hours: Avoid rollover; optionally auto-pause around high-impact news

- MagicNumber: Unique per chart/pair to prevent conflicts

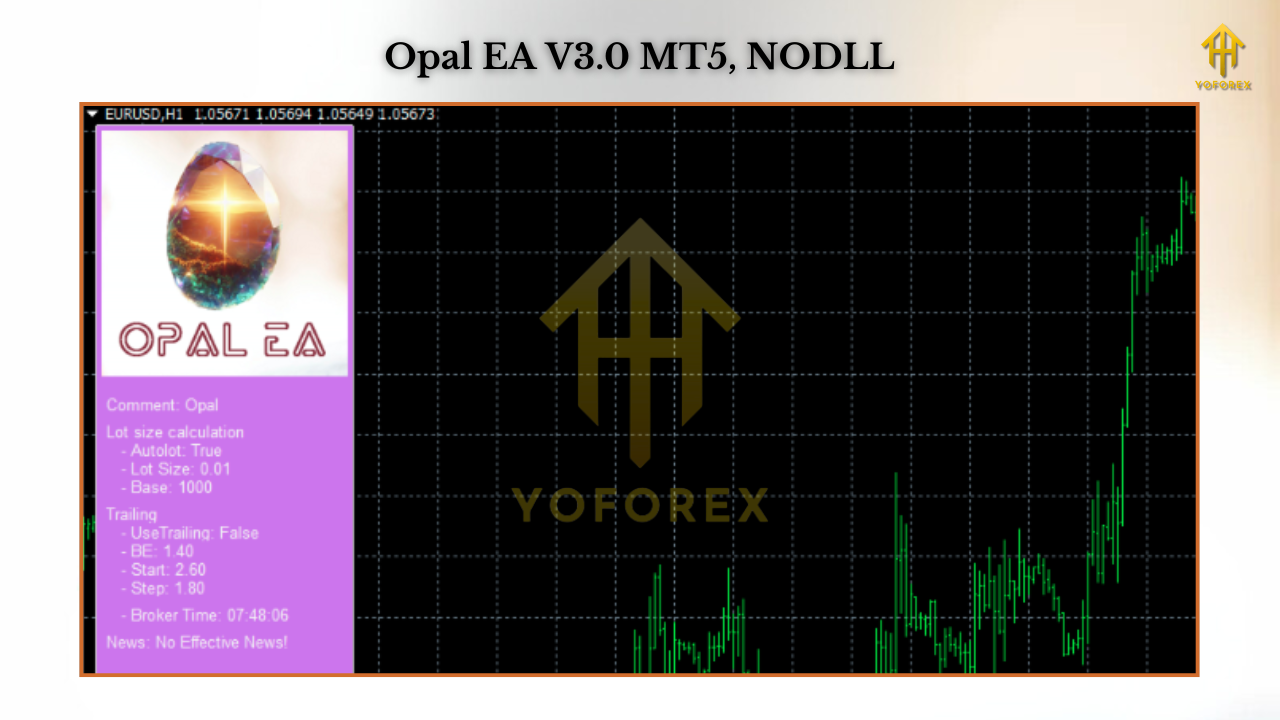

Installation & Setup (Step-by-Step, MT5)

- Download the EA file (.ex5 or .mq5).

- MT5 → File → Open Data Folder → MQL5 → Experts → paste the file.

- Restart MT5 (or right-click Experts → Refresh).

- Drag Opal EA MT5 onto your chart (e.g., EURUSD M30).

- In Inputs, set your risk %, ATR gates, spread limit, and session rules.

- Enable Algo Trading.

- Forward-test on demo for 2–4 weeks; confirm average R, frequency, and drawdown match expectations.

- When ready, go live small, then scale carefully.

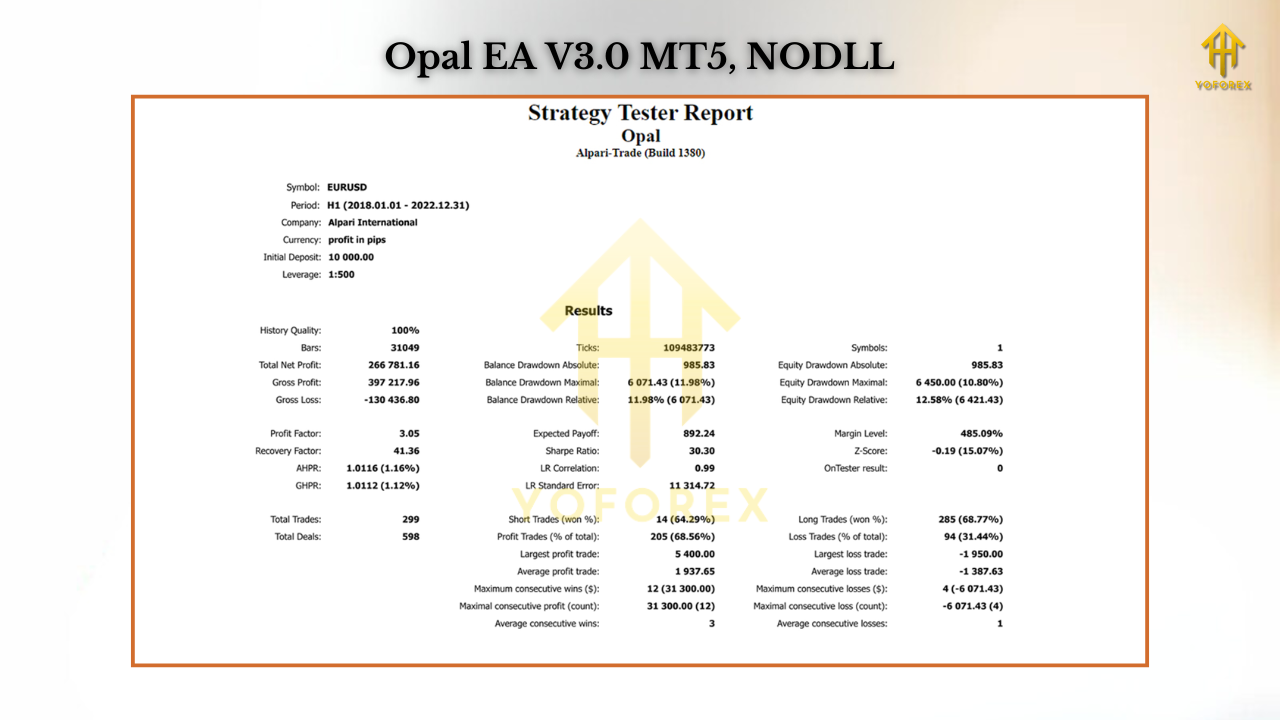

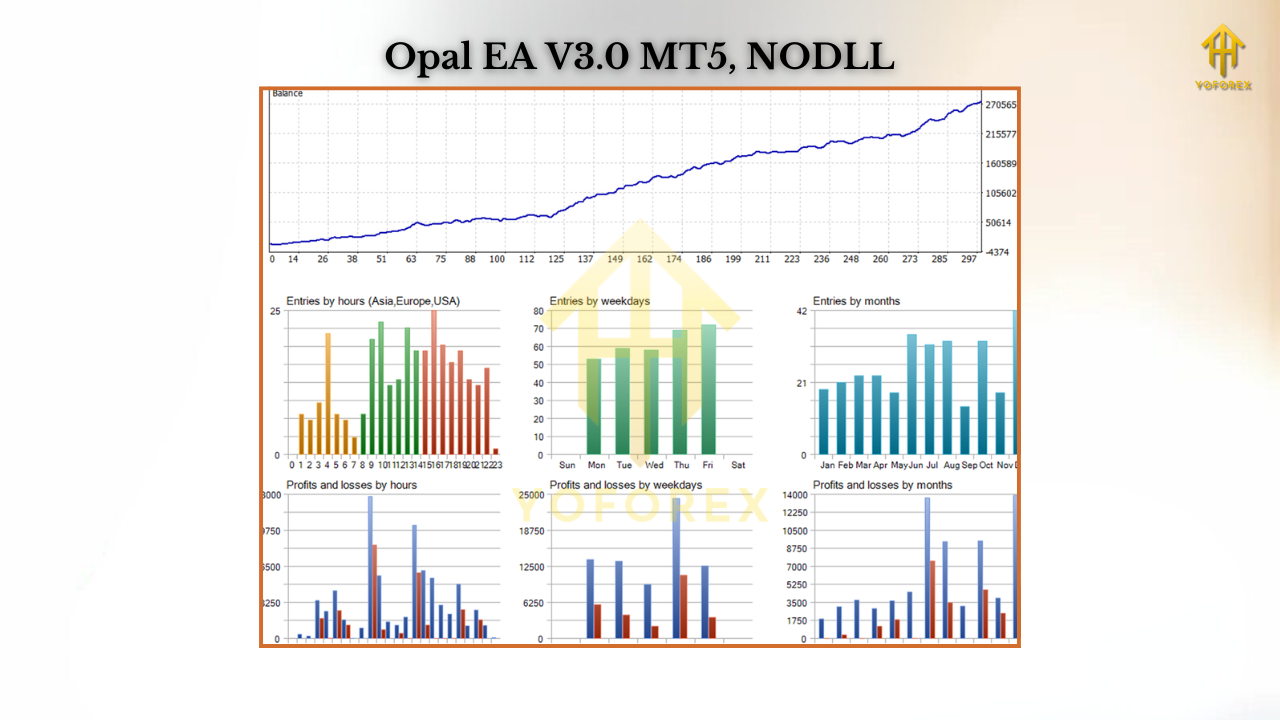

Backtesting & Optimization (What Actually Helps)

- Quality Data: Use tick-based backtests if possible; model realistic spreads + slippage.

- Sample Size: Run 2–3+ years per pair to see different regimes (calm, trend, chop).

- Staircase Equity: You want steady steps, not straight rockets (those usually mean overfit).

- One Cluster at a Time: Tune ATR gates first, then SL/TP bands. Don’t tweak five knobs at once.

- Out-of-Sample Check: Validate on different months/pairs before you celebrate.

Risk Management That Keeps Accounts Alive

- Per-Trade Risk: Keeps losers small so you can survive variance.

- Daily Max Loss: Stops the bleeding on off days.

- Drawdown Pause: A circuit breaker that saves capital—and your mindset.

- No Add-to-Losers: The EA doesn’t “average down” to look smart on paper. It exits and waits.

Realistic Expectations (No Hype, Just Truth)

- You’ll see flat days. That’s fine—flat beats reckless.

- In chop, the EA may take a small hit; guardrails limit damage.

- In trending weeks, partial TP + trailing can stack nice runners.

- Performance varies by broker, spread, latency, session. A decent VPS and ECN feed help… a lot.

FAQs

Does Opal EA MT5 use martingale or grid?

No. Hard stop on every trade, no cost-averaging.

Best timeframe to start?

M30 or H1 for majors; M15–H1 for gold depending on your broker’s spread.

Prop-firm friendly?

Yes—if you keep RiskPerTrade and DailyMaxLoss sensible and respect the pause rules.

Can I run multiple pairs?

Sure. Use unique MagicNumbers and monitor correlated exposure.

What about news?

You can auto-pause around red-folder events, or widen filters—test first.

Pro Tips (From Hard-Won Experience)

- Trade your broker, not dreams: If spreads stink, accept fewer trades or move brokers.

- Journal weekly: Export stats, spot recurring mistakes, tweak one variable at a time.

- Never raise risk mid-drawdown: Let the edge recover at small size.

- FOMO is a setting—turn it off: If filters say “no trade,” no trade.

Pros & Cons

Pros

- Clear, non-martingale logic with real risk controls

- Broker/session awareness to avoid junk fills

- Partial TP + trailing to capture the meaty bits

- Easy installation; transparent logs

Cons

- Needs a decent environment (ECN, low latency)

- Regimes shift; occasional re-tuning helps

- Not a “set and forget forever” gadget—process matters

Call to Action

If you’re done gambling and ready for disciplined automation, give Opal EA MT5 a proper run. Start on demo with the baseline, collect 40–60 trades, then go live small. Tweak slow, scale slower. Let the rules do the heavy lifting—coz that’s how traders last.

Comments

Leave a Comment