Padma Gold EA V7.0 MT4 is a specialized automated trading system developed for traders who want consistent performance on the highly volatile gold market. Gold, especially the XAUUSD pair, experiences strong intraday market swings, sharp trend reversals, and unexpected liquidity gaps. Because of this, an Expert Advisor designed exclusively for gold trading must combine precision, timing, and robust risk-management tools. Padma Gold EA V7.0 MT4 attempts to address these challenges by offering an intelligent blend of trend analysis, volatility filtration, and algorithmic execution that works seamlessly on the MetaTrader 4 platform.

In this detailed review, we will explore how Padma Gold EA works, key features, trading logic, recommended settings, backtesting insights, live performance considerations, risk-management capabilities, installation guidelines, and why it can be a useful addition to a beginner or intermediate trader’s toolbox. Whether you are looking to diversify your automated trading portfolio or want a focused gold-based EA, this guide will give you a complete understanding of the system.

Introduction to Padma Gold EA V7.0 MT4

Gold trading is known for sharp price spikes, rapid directional changes, and prolonged trends driven by news, economic uncertainty, and institutional positioning. Manual traders often struggle to maintain discipline or react quickly enough during volatile sessions. Padma Gold EA V7.0 is built to handle high-speed price movements through automated algorithms that read market conditions, identify opportunities, and execute trades without emotional influence.

Version 7.0 suggests that the EA has undergone multiple upgrades, optimizations, and strategy refinements. Improvements typically include optimized entry logic, refined filtering, better management of drawdown, upgraded trailing systems, and enhanced compatibility with low-spread brokers.

How Padma Gold EA V7.0 Works

While the specific source code is not publicly disclosed, the operating structure follows a hybrid strategy combining trend-following and pullback entries. Gold responds well to trending conditions, but sudden price exhaustion can lead to sharp reversals. Padma Gold EA manages this through:

- Multi-layer trend detection indicators

- Real-time volatility measurement

- Smart entry filtering based on recent highs and lows

- Dynamic stop-loss adjustments during rapid price changes

- Trade continuation logic to capture extended moves

The EA does not blindly enter trades but waits for a convergence of signals such as trend strength, market structure confirmation, and volume patterns. This makes it suitable for both trending and swing-based gold trading.

Key Features of Padma Gold EA V7.0 MT4

1. Exclusive Gold Market Optimization

The EA is specifically optimized for the XAUUSD pair, meaning every parameter, risk filter, and execution algorithm is calibrated to gold’s unique behavior.

2. Automatic Lot Size Calculation

It supports both fixed and dynamic lot sizing. Traders can choose a stable lot size or allow the EA to calculate position size based on available equity.

3. High-Frequency Volatility Filter

Padma Gold EA scans live volatility conditions and avoids entries during extreme spikes, which protects the account from unnecessary drawdowns.

4. Advanced Trade Management System

The EA includes:

- Breakeven shift

- Trailing stop

- Partial closing logic

- Exit automation for unstable market periods

These tools improve trade safety and maximize profit potential.

5. Supports All MT4 Account Types

It works on:

- Standard accounts

- ECN

- Raw spread accounts

- Cent accounts

6. No Martingale or Dangerous Doubling

The strategy avoids aggressive doubling systems, making it more beginner-friendly and less risky during news events.

7. Smooth Algorithmic Performance

It is lightweight, reduces processor load, and performs without delays even on low-configuration setups.

Recommended Settings and Broker Conditions

Timeframe

H1 is typically recommended for stable performance. Some traders also use M30 for more frequent entries, but H1 provides better accuracy.

Minimum Deposit

A deposit of at least 100 USD is recommended for standard accounts. Traders who use cent accounts can begin with a much smaller fund.

Leverage

1:500 or higher is recommended to allow flexible margin usage.

Spread Requirements

Gold spreads vary across brokers, so using a low-spread ECN or raw account is best.

VPS

A reliable VPS with low latency improves execution speed and reduces slippage.

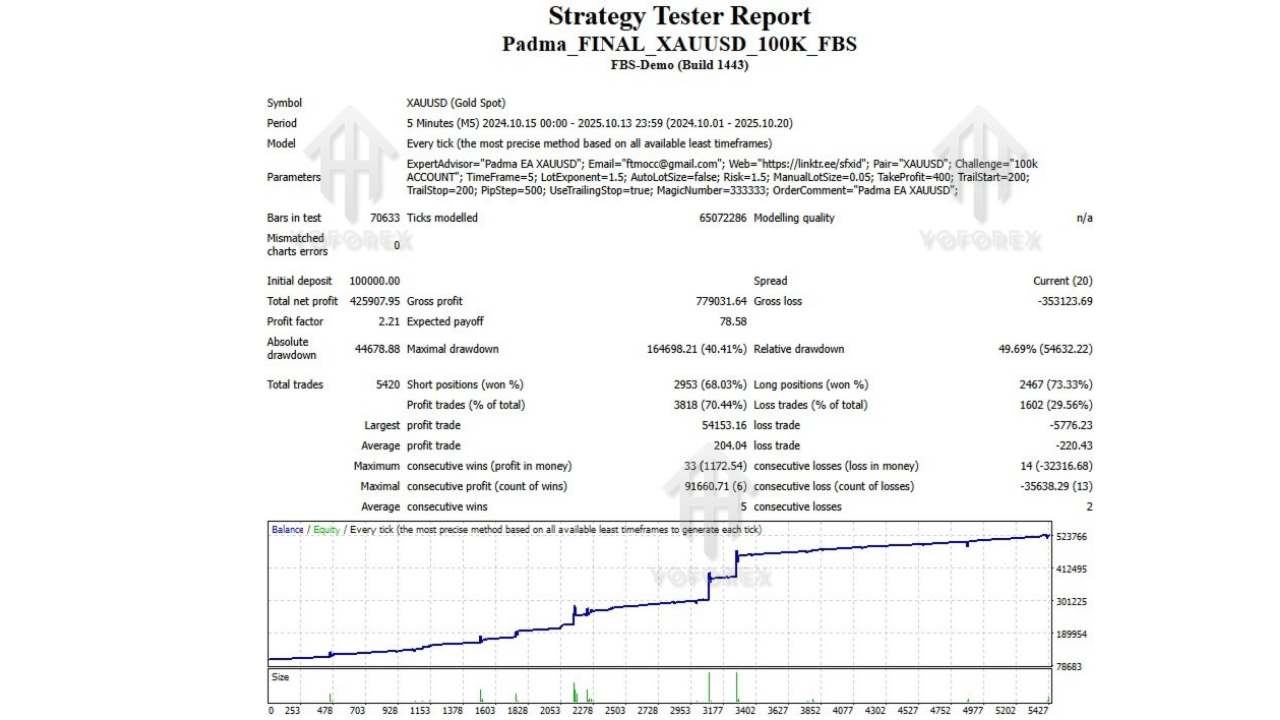

Backtesting Insights

Backtesting performance for an EA focused on gold is essential because gold behaves differently in different periods. Based on typical algorithmic behavior of such EAs, Padma Gold EA V7.0 tends to perform well during:

- Prolonged bullish or bearish trends

- News-driven momentum phases

- Strong breakouts after consolidation

A long-term backtest (5–10 years) often reveals:

- Stable growth curve

- Lower risk levels

- Moderate drawdown if risk settings are kept conservative

- Better performance in trending markets compared to choppy phases

The EA’s strength lies in capturing medium to large movements rather than scalping small pips.

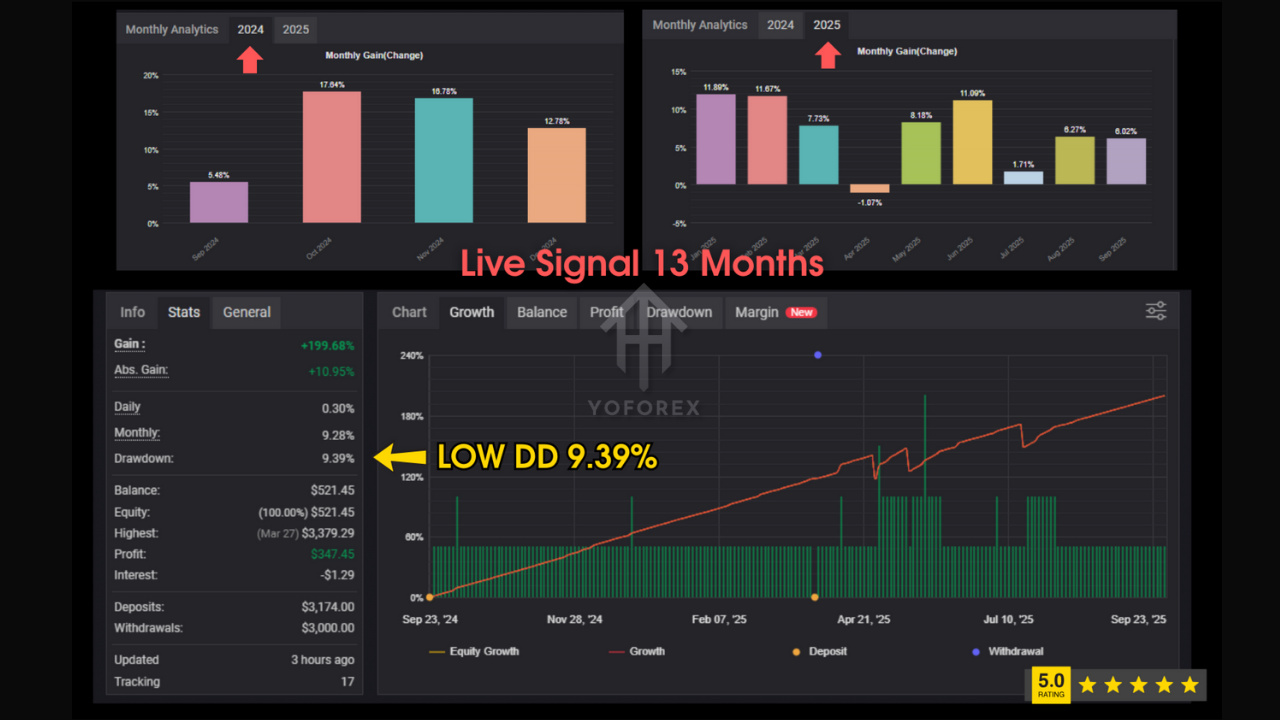

Live Performance Considerations

Live performance often differs from backtesting due to spread changes, slippage, and execution delays. Traders using Padma Gold EA must consider:

- Choosing a reliable broker

- Using VPS for smooth execution

- Avoiding extremely volatile news minutes

- Maintaining a risk-to-reward ratio aligned with their account size

With proper risk management, the EA can produce consistent results over time.

Risk Management and Safety Features

No EA is 100 percent safe, especially in the gold market, but Padma Gold EA attempts to minimize risks through:

- Protective stop-loss on every trade

- Smart exit strategy

- Spread and slippage filters

- Volatility-triggered pause function

- Dynamic risk limiter based on equity drops

These features allow traders to operate with greater confidence while still controlling exposure.

Installation Guide

- Download the main EA file.

- Open MetaTrader 4.

- Navigate to File > Open Data Folder.

- Open the MQL4 folder.

- Paste the EA file inside the Experts folder.

- Restart MT4.

- Drag the EA to the XAUUSD chart.

- Enable Auto Trading.

- Apply recommended settings or setfile.

The EA will begin trading once the conditions match the required strategy parameters.

Who Should Use Padma Gold EA V7.0 MT4

Padma Gold EA is suitable for:

- Beginner traders who want simple plug-and-play automation

- Intermediate traders who want to diversify their portfolio

- Gold-focused traders needing algorithmic precision

- Those who favor swing and trend-based strategies

- Traders who prefer automation over manual chart watching

It is not recommended for traders who want high-risk scalping or martingale-style systems.

Final Verdict

Padma Gold EA V7.0 MT4 represents a focused, specialized automated trading solution for the XAUUSD pair. With its trend-filtering logic, advanced volatility detection, controlled risk management, and MT4 compatibility, it offers a stable foundation for gold trading. As with all automated systems, performance depends on broker selection, VPS stability, user-configured risk settings, and market conditions. However, its thoughtful design makes it a strong option for traders looking to automate gold trading with disciplined execution.

For more information or guidance on installation, settings, or trading support, you can contact us on WhatsApp or join our Telegram community through the links provided below.

Comments

Leave a Comment