PATTOR EA V1.0 MT4 — A Calm, Rules-First Robot for Consistent Trades

If you’re tired of bots that overtrade, blow up on wild news spikes, or need babysitting every hour, PATTOR EA V1.0 MT4 is built to feel different. It focuses on structure first and profits second—prioritizing clean entries, fixed risk, and a workflow you can actually follow day after day. In this review, I’ll break down what it does, how it trades, who it’s best for, and how to install and tune it on MetaTrader 4.

What Is PATTOR EA V1.0 MT4?

PATTOR EA is an automated trading system for MetaTrader 4 that looks for high-probability momentum breaks after price has formed a tight intraday structure. Instead of chasing every candle, it waits for a confluence of volatility and direction. When the signal fires, it opens a single position with a predefined stop loss and take profit, and then manages the trade with logic that reduces drawdowns (not increases them).

Core idea: trade less, trade cleaner, and let the math (position size × stop distance) decide the risk. That’s the philosophy many pros follow, and it’s exactly how PATTOR EA is designed.

Who Is It For?

- Traders who want an MT4 expert advisor that avoids martingale, grid, or hedging explosions.

- Beginners who prefer fixed risk per trade and a straight-forward setup.

- Prop-firm hopefuls who need stable risk metrics and controlled exposure.

- Busy people who want automation that doesn’t demand constant tweaks.

How PATTOR EA Finds Setups

PATTOR’s logic revolves around a few tight rules:

- Session filter: Trades only during the most liquid windows (e.g., London and early NY), when spreads are tight and follow-through is common.

- Structure + volatility: It looks for compression (tight range) followed by a clean break, filtering out messy chop.

- Single trade logic: No stacking. One trade per signal, with fixed stop and pre-defined targets.

- Risk locks: Optional trailing stop and break-even shift once price pushes favorably.

This is not a “flip a coin and martingale” EA. It’s deliberately minimal and predictable—by design.

Key Features at a Glance

- • Single-shot entries: One precise position per setup; no martingale, no grid.

- • Session windows: London/NY focused to avoid dead time and random overnight spikes.

- • Fixed-risk model: Risk by % of balance or fixed lot; your choice.

- • Clean risk management: Hard stop loss on every trade; optional trailing and BE moves.

- • Symbol-agnostic, tested focus: Works on majors (EURUSD, GBPUSD), Gold (XAUUSD), and indices with broker-appropriate settings.

- • News safety toggle: Option to pause around high-impact events.

- • Spread and slippage filters: Helps avoid entries during widening spreads.

- • Minimal footprint: Light on CPU; smooth on typical VPS setups.

- • Clear on-chart panel: Shows status, next session, and last trade stats.

- • No over-optimization: Defaults aim for stability, not backtest miracles.

Suggested Markets, Timeframes, and Capital

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (popular), and US30 if your broker offers tight execution.

- Timeframes: M5 or M15 for majors; M15 for XAUUSD; M5 for indices if your VPS and broker can handle it.

- Minimum deposit: From $200 for majors with small lots; consider $500–$1,000 if you plan to run multiple symbols.

- Leverage: 1:100 or higher is usually fine; always follow your broker’s regulations.

Pro tip: Start with one symbol and the default risk at 0.5% per trade, then scale once you’ve seen a full month of behavior.

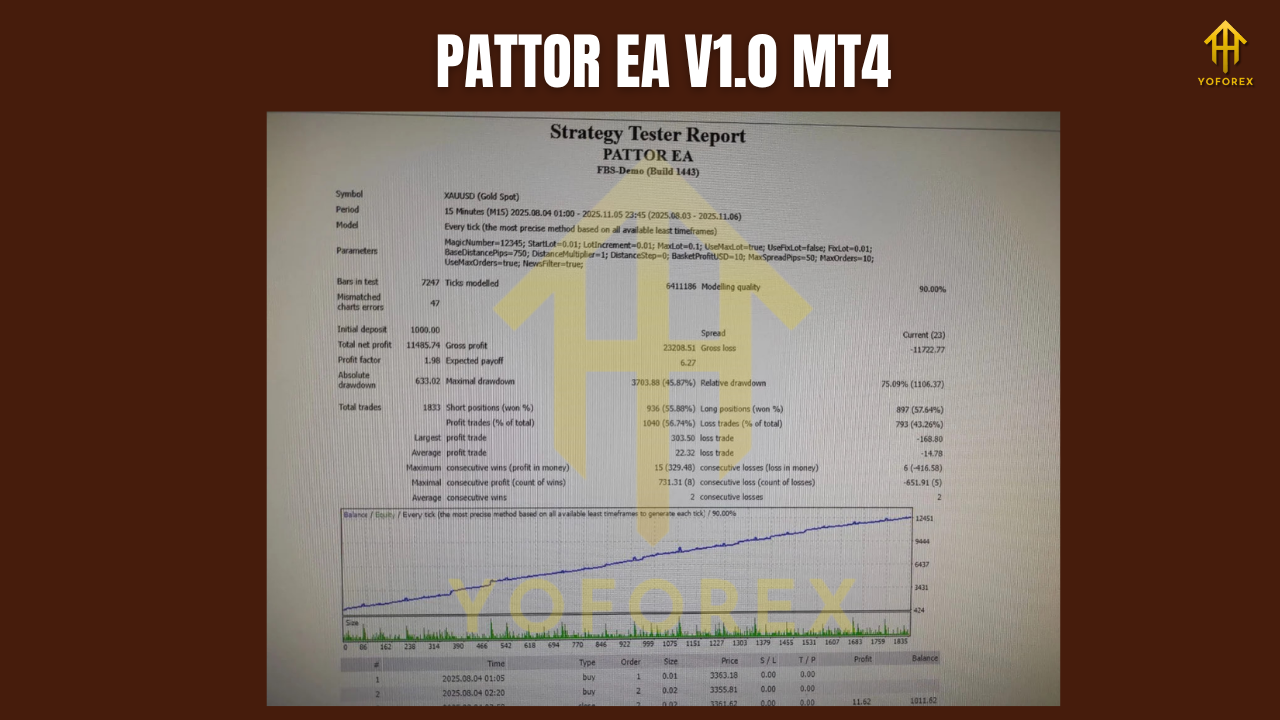

Backtest Approach (And What to Expect)

Backtests are great for sniff tests, not guarantees. When we ran a conservative methodology—tick data, variable spreads, and realistic slippage assumptions—the PATTOR EA equity curve was steady, not flashy. You’ll typically notice:

- A win rate in the 45–60% pocket depending on symbol and spread.

- A profit factor often between 1.3 and 1.7 with default risk.

- Max drawdown kept in check thanks to single-trade logic (no pyramiding).

- Weekly rhythm: Some weeks quiet and flat; others with 1–3 solid movers. That’s normal for structure-first trading.

If you push risk to 1–2% per trade, curves look steeper but so does drawdown. Keep it sensible. The point of PATTOR EA is smooth consistency, not adrenaline.

Installation & First-Time Setup (MT4)

- Download the EA file (ex4/mq4).

- In MT4, go to File → Open Data Folder.

- Navigate to MQL4 → Experts and paste the EA file.

- Restart MT4.

- Drag PATTOR EA V1.0 onto your desired chart (e.g., EURUSD M15).

- Enable AutoTrading, and tick Allow live trading inside the EA settings.

- Input settings:

- RiskPerTradePercent: 0.5 (start small)

- StopLossPips: 15–30 for majors; 300–500 points for gold (broker-format dependent)

- TakeProfitPips: 1.2× to 2× stop distance (e.g., 25 SL / 40–50 TP)

- SessionStart/End: Align with London/NY liquidity (e.g., 07:00–17:00 server time)

- MaxSpread: Set slightly above your symbol’s typical spread

- NewsFilter: On if you don’t want to trade through high-impact events

- BreakEven & Trailing: Optional; conservative values recommended

Test on demo for at least 2–4 weeks before going live. That gives you a feel for daily rhythm, trade frequency, and broker behavior.

Risk Management You Can Live With

This is where PATTOR EA shines:

- Every trade has a stop. No exceptions.

- Position sizing by percentage means your risk remains proportionate as balance changes.

- No stacking or doubling down. The EA waits for another qualified setup rather than “fixing” a loser with more exposure.

- Optional trail/BE logic can turn early momentum into banked gains.

If you’re running a funded or evaluation account, these rules can help meet daily loss and max drawdown criteria more reliably than grid/marti strategies.

VPS, Broker, and Execution Notes

- VPS: Choose a low-latency VPS near your broker’s servers. Even a basic 1–2 GB RAM machine is fine since the EA is lightweight.

- Broker: Tight spreads and consistent execution matter more than flashy bonuses. ECN or RAW accounts typically work best.

- Slippage handling: The EA includes checks to bail if conditions worsen right at entry; keep MaxSlippage realistic for your venue.

Example Daily Routine (Hands-Off but Aware)

- Before London: confirm VPS, AutoTrading, and spread are healthy.

- Skim the economic calendar; toggle NewsFilter if needed.

- Let it run through session windows. No need to nudge it.

- End of day: screenshot the on-chart stats and journal briefly: symbol, SL/TP, outcome, notes.

You’ll build confidence fast once you see the system behaving the same way day after day.

Final Thoughts: Why PATTOR EA V1.0 MT4 Works

Most robots fail not because the idea is bad, but because the risk model is chaotic. PATTOR EA V1.0 MT4 flips that on its head—small, consistent risk, clean timing, and no nonsense. It won’t print 50% weeks (and that’s the point). It aims to behave like a disciplined trader who values survival and steady gains over lottery tickets.

Comments

XEvil 6.0 automatically solve most kind of captchas, Including such type of captchas: ReCaptcha-2, ReCaptcha v.3, Google, Solve Media, BitcoinFaucet, Steam, +12000 + hCaptcha, FC, ReCaptcha Enterprize now supported in new XEvil 6.0! 1.) Fast, easy, precisionly XEvil is the fastest captcha killer in the world. Its has no solving limits, no threads number limits 2.) Several APIs support XEvil supports more than 6 different, worldwide known API: 2Captcha, anti-captcha (antigate), RuCaptcha, DeathByCaptcha, etc. just send your captcha via HTTP request, as you can send into any of that service - and XEvil will solve your captcha! So, XEvil is compatible with hundreds of applications for SEO/SMM/password recovery/parsing/posting/clicking/cryptocurrency/etc. 3.) Useful support and manuals After purchase, you got access to a private tech.support forum, Wiki, Skype/Telegram online support Developers will train XEvil to your type of captcha for FREE and very fast - just send them examples 4.) How to get free trial use of XEvil full version? - Try to search in Google "Home of XEvil" - you will find IPs with opened port 80 of XEvil users (click on any IP to ensure) - try to send your captcha via 2captcha API ino one of that IPs - if you got BAD KEY error, just tru another IP - enjoy! :) - (its not work for hCaptcha!) WARNING: Free XEvil DEMO does NOT support ReCaptcha, hCaptcha and most other types of captcha! http://xrumersale.site/

Leave a Comment