Pharaoh Gold EA V1.07 MT4 — Breakout Discipline for Consistent Gold Trading

Platform: MT4

Time frames: M5 + any

Currency pairs: XAUUSD + any

Minimum/Recommended deposit: $200

If you’ve been searching for a gold-focused Expert Advisor that doesn’t blow up accounts with martingale or random grids, you’re in the right place. Pharaoh Gold EA V1.07 MT4 is a breakout-logic robot designed specifically for XAUUSD (Gold) and built around a strict risk framework. It uses fixed lot sizing, trades only during high-liquidity sessions, and keeps entries disciplined so equity protection stays front and center. No “hope and pray” stuff here—just rules, execution, and consistency. Sounds refreshing, right?

This guide breaks down how Pharaoh Gold EA works, who it’s for, recommended settings, backtest methodology you can replicate, plus some battle-tested best practices. By the end, you’ll know exactly how to deploy the bot responsibly and what to expect in real-world trading… coz that’s what actually matters.

Why Pharaoh Gold EA?

Gold is volatile. Great when managed, brutal when not. Pharaoh Gold EA is built for traders who value risk control first and profit second—because in the long run, that’s how accounts survive. The EA’s core edge is breakout recognition during liquid hours (think London and NY overlap), looking to catch clean impulses rather than chop.

Who it suits:

- Traders who prefer fixed lots (e.g., 0.01, 0.02…) over variable lot size.

- Users who want session-based trading to avoid dead hours.

- Anyone who values simple rules and transparent behavior over flashy hype.

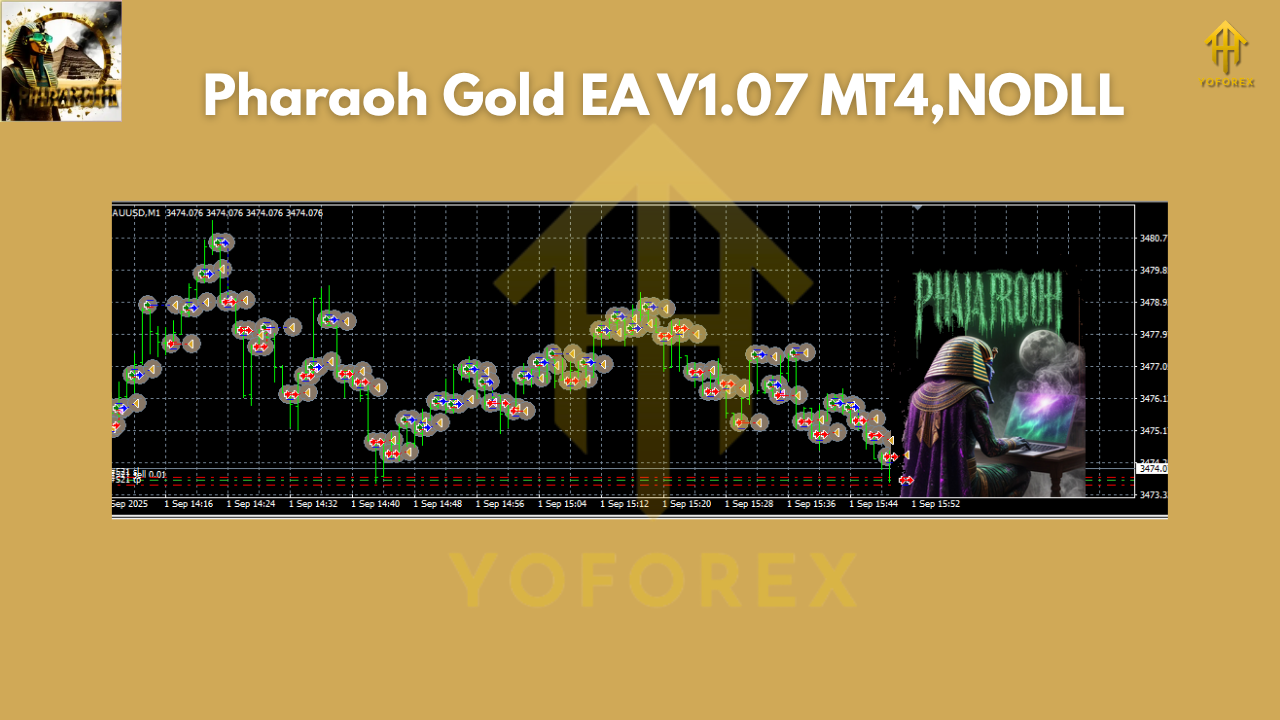

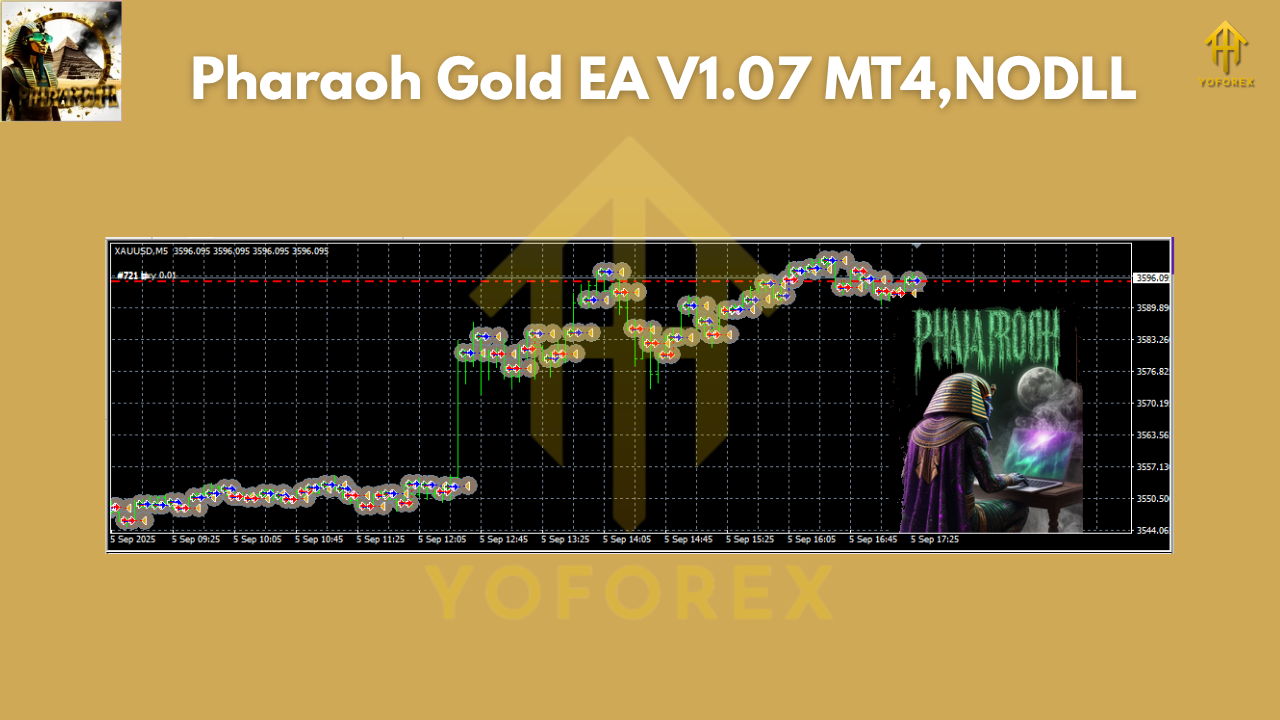

How Pharaoh Gold EA Works (In Plain English)

At its core, Pharaoh watches for tight ranges forming before liquidity kicks in. When spreads stabilize and volatility begins expanding, the EA places a disciplined breakout entry with a pre-defined stop-loss and take-profit (you can set these, or use the recommended templates below). It doesn’t stack positions aggressively, and it doesn’t use martingale. If the move doesn’t follow through, the loss is capped. If it does, you ride the momentum and get out with structured profit.

A few simple but critical filters do the heavy lifting:

- Session window: trades only during high-liquidity hours to reduce slippage and fakeouts.

- Spread check: will refuse entries if the spread is wider than your threshold.

- Daily loss cap (optional): halt trading for the day if the EA hits your defined daily drawdown.

- Max trades per session: keeps exposure controlled.

You won’t see it revenge-trading or “averaging down until it finally wins.” That’s the point.

Key Features (What You Actually Use)

- Breakout-based entries focused on momentum bursts, not chop.

- Fixed lot sizing for clarity and prop-firm-friendly risk behavior.

- Session trading (London/NY focus) to align with deep liquidity.

- No martingale, no grid, no dangerous averaging—ever.

- Spread filter so you don’t enter during nasty spikes.

- Max trades per session/day to control exposure.

- Daily loss stop (optional) to protect equity on rough days.

- Clean risk parameters with user-set SL/TP and optional partial close.

- Works on M5 (recommended) + any timeframe if you know what you’re doing.

- Optimized for XAUUSD, but can be tested on other pairs with your own filters.

Recommended Setup (Start Here)

Account type: ECN/RAW with tight spreads

VPS: Yes—low latency helps on gold breakouts

Leverage: 1:200 or higher (use responsibly)

Timeframe: M5 (default), experiment only after you’re comfortable

Pair: XAUUSD first; test others later on demo

Minimum deposit: $200 (run a small fixed lot like 0.01)

Fixed lot template:

- $200–$500 balance → 0.01

- $500–$1,000 → 0.02

- Above that, stay conservative (growth > speed)

Risk controls to enable:

- Spread limit: strict during news hours.

- Max trades per session: 1–2.

- Daily loss cap: 2–4% of equity (disable for backtests if comparing raw strategy).

Session window:

- London open to NY overlap is the sweet spot.

- Avoid low-liquidity gaps and late NY drift.

News filter (optional):

- Either pause 15–30 minutes before/after red-impact events or let your daily loss cap handle the outliers. Your call.

Strategy Logic (A Peek Under the Hood)

- Pre-session scan: Identify a consolidation range.

- Volatility wake-up: As spreads and volume normalize post-open, volatility begins expanding.

- Breakout trigger: On confirmed range break with healthy spread, Pharaoh enters.

- Risk placement: SL sits beyond the opposite side of the range (buffered).

- Profit target: TP aims for a measured move (you can use a fixed R:R like 1:1.2–1:1.8).

- Trade management: If momentum stalls, time-based exit or partial close can be used (if you enable it).

- Session discipline: Stop after max trades or when daily cap is hit. Live to trade tomorrow.

Simple. Intentional. Clean.

Backtest Methodology You Can Replicate

Rather than throw out wild percentages, here’s a framework you can use to evaluate Pharaoh fairly:

- Data: Use high-quality tick data (99% modeling quality if possible) for XAUUSD.

- Period: At least 3–5 years across different volatility regimes.

- Timeframe: M5 to match the EA’s design.

- Session filter: London open through NY overlap only.

- Costs: Apply realistic spreads + commission from your broker.

- Settings: Fixed lot (e.g., 0.01), no martingale/grid, max 1–2 trades/session.

- Metrics to track:

- Max drawdown (keep it small—your account’s longevity depends on it).

- Profit factor (above 1.3 with realistic costs is solid for breakout gold).

- Win rate vs. R:R (breakout bots don’t need very high win rates if R:R is healthy).

- Avg trade duration (breakouts should resolve relatively fast).

- Equity curve smoothness (no hockey-sticks… slow and steady wins).

If your test shows a steady equity line with contained drawdowns and profit factor > 1.2–1.5 under realistic costs, you’re on the right track. Report both raw and session-restricted outcomes, coz unrestricted backtests can look prettier than live.

Note: Always demo forward-test for 2–4 weeks to ensure your broker’s execution and spreads match your assumptions. Backtests are a compass, not a guarantee.

Step-by-Step Installation (MT4)

- Open MT4 → File → Open Data Folder.

- Go to MQL4 → Experts, paste the Pharaoh Gold EA V1.07.ex4 file.

- Restart MT4.

- In Navigator → Expert Advisors, drag Pharaoh Gold EA onto an XAUUSD M5 chart.

- Check “Allow algorithmic trading” and inputs.

- Set your fixed lot, SL/TP, spread filter, max trades, and session window.

- Click AutoTrading and watch the Journal/Experts tab for any warnings.

Tip: Mark a vertical line at your session start and end for a quick visual reminder.

Suggested Inputs (Starter Template)

- Lot Size: 0.01 (per ~$200–$300 balance)

- SL Distance: a little beyond the opposite side of the pre-break range

- TP Distance: 1.2–1.8× SL

- Max Trades/Session: 1–2

- Daily Loss Cap: 2–4%

- Spread Limit: Tight—gold can widen unexpectedly

- Trade Window: London open → NY overlap

As you gather data, adapt. But keep changes incremental; don’t flip five switches at once.

Best Practices (Read Before You Go Live)

- Execution matters: Choose a low-spread ECN/RAW broker.

- VPS = sanity: Reduce slippage by running the EA close to your broker.

- Respect the cap: When the daily loss cap hits, stop. Tomorrow is a new game.

- Avoid gambling: Don’t crank lots coz of a “feeling.” Fixed lots are a feature, not a bug.

- Journal it: Track spread, time, range size, and results. Patterns will jump out.

- News respect: Pharaoh can sit out heavy releases (NFP, CPI, FOMC statements). Your choice, but caution pays.

Realistic Expectations

Breakout systems do not win every day. You might see strings of small losses followed by solid winners that cover them. That’s normal. The job is not to “win every trade,” but to keep losers small, let winners run just enough, and show up during the best hours. Over months, that discipline compounds.

Responsible Trading & Disclaimer

Trading leveraged products like XAUUSD carries risk. Past performance is not a guarantee of future results. Only trade funds you can afford to lose. The configurations above are educational, not financial advice. Always demo-test before committing real capital.

Call to Action

If you want a transparent, session-driven breakout EA that respects risk as much as it chases edge, Pharaoh Gold EA V1.07 MT4 is a solid pick. Start small, validate on demo, then go live with a plan. Consistency beats chaos—every time.

Comments

Leave a Comment