Polish EA V1.0 MT4 – a clean, consistent way to automate your trades

If you’ve been hunting for an MT4 robot that doesn’t blow up after a few good days, Polish EA V1.0 MT4 is the kind of “keep-it-tidy” expert advisor you’ll want on your chart. Built to be neat in execution and conservative in risk, it aims for steady gains rather than flashy lottery wins. Fewer emotions, fewer surprises, more clarity. Whether you’re new to EAs or already juggling a portfolio of bots, this one earns a spot thanks to its simple setup, robust filters, and prop-firm-friendly rules. And yep, it runs on the classic MetaTrader 4 environment most traders know like the back of their hand.

What is Polish EA V1.0 MT4?

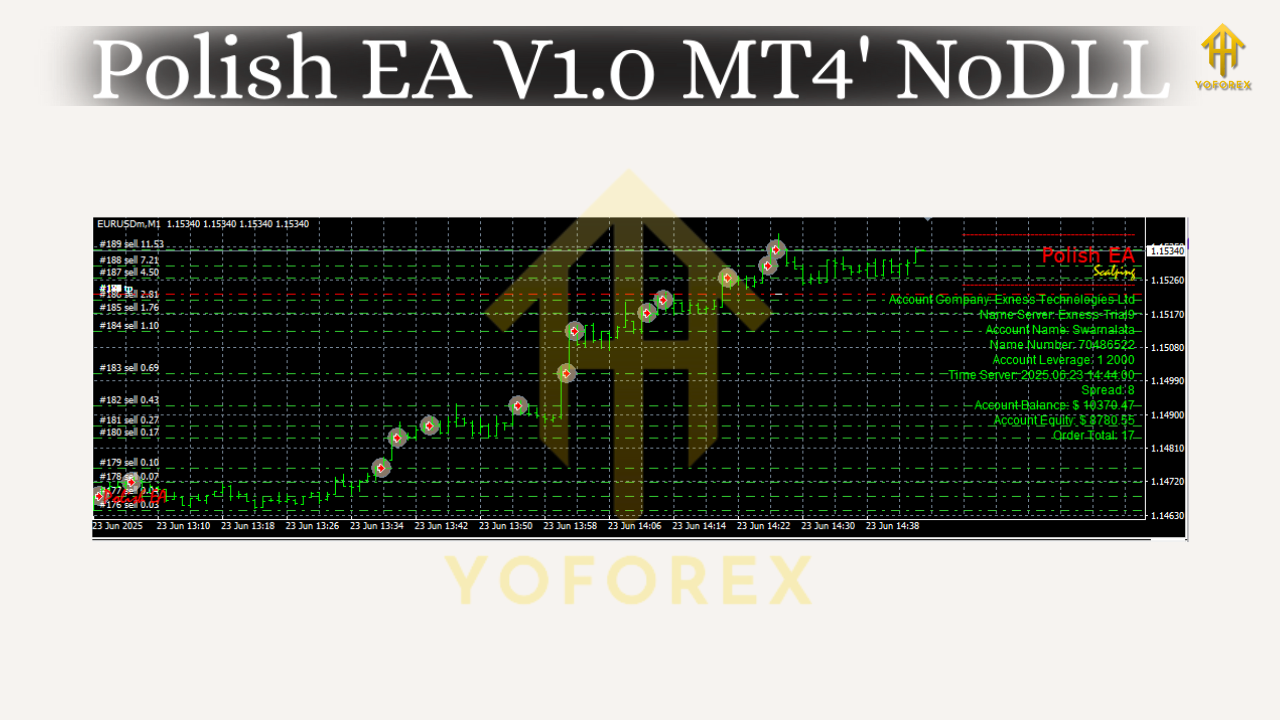

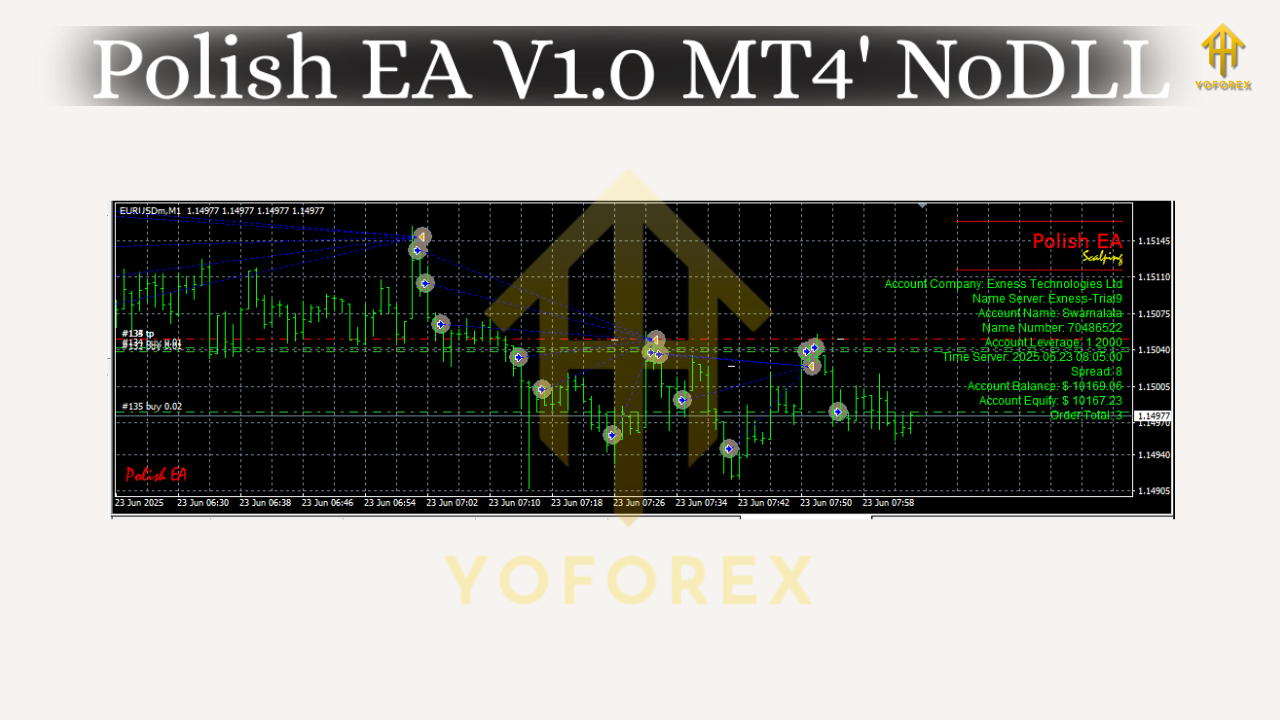

Polish EA V1.0 is an automated trading system for MetaTrader 4 that focuses on two modes most retail traders care about:

- Tactical scalping during quiet to moderate sessions, targeting small, high-probability moves.

- Micro-swing entries on intraday pullbacks when volatility expands.

Instead of martingale or dangerous grids, it keeps risk compact with fixed or proportional position sizing, hard stop losses, and time-based trade management. The EA watches market structure, short-term momentum, and spread/volatility conditions before it pulls the trigger. If conditions degrade (spreads widen, momentum fades, news spikes), it stands down. That’s the “polish”: trimming the mess, leaving the essentials.

Who it’s for:

Traders who want a sensible, low-drama bot that can run on common pairs (EURUSD, GBPUSD, XAUUSD, USDJPY are popular choices) on M15–H1. Beginners will appreciate the straightforward setup; experienced users will enjoy the clean logic and the ability to fine-tune risk.

How Polish EA tries to win (without getting wild)

Under the hood, Polish EA blends short-term trend bias with mean-reversion triggers. Think: identify direction, wait for a pullback into a fair-value zone, confirm with momentum and volatility checks, then enter with a predefined SL/TP and an optional trailing exit. No averaging down, no revenge trades, no “one more entry” when price is clearly misbehaving.

This design helps the EA:

- Avoid trades when spreads are too wide (key for gold and news hours).

- Skip low-quality ranges where price just chops.

- Capture brief continuation moves on days with moderate trend strength.

Key features at a glance

- • Hard risk controls: Fixed SL/TP per strategy profile; ATR-scaled options available.

- • No martingale/unsafe grids: Single position or tight, capped add-ons (optional) only when conditions align.

- • Spread & session filters: Trade only when execution quality is acceptable.

- • Volatility awareness: Sits out when the market is too hot or too cold.

- • Time-based trade management: Optional session close/out to reduce overnight risk.

- • Clean partials & trailing: Scale out at key levels or trail with ATR logic to lock in moves.

- • News avoidance (manual window): Easy inputs to pause pre/post high-impact events.

- • Prop-firm friendly: Drawdown caps, per-symbol limits, and strict position sizing help stay within rules.

- • Multi-symbol ready: Run on majors and gold; attach one chart per symbol/timeframe for clarity.

- • Lightweight & stable: Efficient code, minimal terminal load, straightforward logs.

Recommended setup (quick start)

- Broker & account: ECN/STP, raw spreads preferred; 1:100–1:500 leverage is common.

- Pairs: Start with EURUSD and GBPUSD; add XAUUSD after a week of observation.

- Timeframe: M15 for more signals; H1 for calmer pace.

- VPS: Strongly recommended for 24/5 stability and low latency.

- Minimum deposit: From $200 if you keep lot sizes tiny; $500+ is more comfortable for multi-pair.

- Risk per trade: 0.25%–0.75% per position is a sensible band for prop-style control.

Tip: begin with one pair on demo for 3–5 trading days. If execution and behavior look good, clone the settings onto your second pair. Keep risk identical per symbol.

Installation & configuration (step-by-step)

- Place files: Copy the EA file into

MQL4/Experts/and restart MT4. - Allow algo trading: In MT4, enable “AutoTrading” and allow DLL imports if required by your broker environment.

- Attach to chart: Open the target symbol and timeframe (e.g., EURUSD M15). Drag Polish EA V1.0 onto the chart.

- Inputs to check first:

- RiskMode: FixedLots or PercentRisk.

- SL/TP/ATR options: Choose fixed points or ATR-based scaling.

- Session filter: Select your trading window (e.g., London+NY overlap).

- MaxSpread & MaxSlippage: Keep them strict for scalping.

- MaxDailyLoss / MaxPositions: Set prop-safe limits.

Save as set file: Once tuned, save a

.setso you can reuse on other charts.

Forward test: Watch a few live sessions before going live money; verify logs and broker fills.

Strategy logic in plain English

- Bias: Uses a short/medium bias (EMA stack or structure break) to understand direction.

- Trigger: Waits for a pullback into a fair-value pocket; confirms with momentum (e.g., RSI slope or custom strength) and volatility (ATR/true range) so it’s not chasing.

- Validation: Checks spread and slippage; if either is off, it cancels.

- Exit: Either fixed TP/SL, partials at R-multiples (e.g., 1R, 1.5R), or an ATR trail once price runs.

Because it never stacks recklessly, the equity curve tends to look smoother—less “staircase then cliff,” more “gentle steps.”

Risk management you can actually live with

You’ll get better, calmer results if you plan risk from day one:

- Per-trade risk: Keep it modest. 0.5% is a comfy middle ground.

- Daily stop: A MaxDailyLoss (e.g., 2%–3%) prevents tilt. When hit, the EA stands down.

- Symbol caps: Limit concurrent trades per symbol to one.

- News windows: Pause around CPI, NFP, FOMC, and major rate decisions—especially if you trade gold.

Backtesting & forward-testing workflow (suggested)

Backtests are useful for logic sanity, not for guarantees. Here’s a workflow that keeps you honest:

- Pick your symbol/timeframe: EURUSD M15 and H1.

- Period: At least the last 2–3 years to cover low and high volatility regimes.

- Quality: Use tick-by-tick with variable spread if available; otherwise add a spread buffer to your assumptions.

- KPIs to read, not worship:

- Profit factor and Sharpe (context matters).

- Max drawdown (critical for prop).

- Worst losing streak (build emotional readiness).

- Average trade duration (matches your VPS and execution plan?).

5. Forward test on demo: 5–10 trading days. Compare behavior vs. backtest.

6. Go live small: Start with the lowest sensible lot size. Scale risk only after a month of real fills.

Best practices & “little edges”

- Session alignment: If you’re scalping, focus on London and NY overlap; Asia is quieter but can be okay for micro-swing.

- Broker hygiene: Raw spread + low commission usually beats “zero commission, wider spread.”

- One change at a time: If you tweak inputs, do it on one chart and keep notes.

- Journal quickly: Note spread at entry, slippage, and reason for exit. Small logs lead to big improvements.

Final word

Polish EA V1.0 MT4 isn’t trying to be the loudest robot in the room. It aims to be the tidiest—clear signals, modest risk, sensible filters, and exits you can explain. If you’re after a steady, rules-first EA to complement your manual trading—or to anchor a small portfolio of bots—this one’s a strong pick. Start on demo, keep risk sane, and let consistency do the heavy lifting.

Comments

Leave a Comment