Tired of flashy robots that overpromise and blow accounts by Friday? Same. That’s why Poverty Killer EA V1.0 MT5 aims for the opposite: steady, rules-based automation with baked-in risk controls and zero “get-rich-tomorrow” hype. It’s built for traders who want clean entries, measured exposure, and realistic growth curves—coz let’s be honest, consistency beats fireworks in the long run.

In this post, I’ll walk you through what the EA does, how it thinks about entries and risk, the recommended setup, and the kind of outcomes you should expect when you run it with discipline. If you’re juggling work, family, and a screen that never sleeps, this one’s for you. Let’s dig in.

Overview

Poverty Killer EA V1.0 MT5 is a multi-market MT5 expert advisor designed for trending and ranging conditions on major FX pairs and XAUUSD. It combines directional bias filtering with volatility awareness and session timing to avoid obvious traps—no blind martingale, no full-grid exposure, and no YOLO re-entries after a losing streak. The EA focuses on:

- Clear bias detection using multi-timeframe trend/structure cues.

- Volatility gating so it doesn’t chase runaway candles or trade into news storms.

- Session windows (London–NY overlap by default) for higher liquidity and lower slippage.

- Capital preservation via fixed fractional risk and soft daily drawdown brakes.

It’s beginner-friendly: you can load the default preset on M15–H1 and be live within minutes (demo first, please). Advanced users can dive deeper—tweaking filters, dynamic stop/TP logic, or session schedules for your broker’s conditions.

Suggested markets: EURUSD, GBPUSD, USDJPY, XAUUSD.

Recommended timeframe: M15–H1 (start with H1 if your spreads are wider).

Minimum deposit: $200 (micro/cent account recommended for new users).

Broker tips: Low spread, fast execution, New-York close, and a reliable VPS if your desktop isn’t always on.

Key Features

- Bias-First Entries: Aligns trades with a higher-timeframe slope/structure to reduce chop.

- Volatility Awareness: ATR and range filters stop entries during erratic spikes or dead markets.

- Session Smartness: Optional trading windows (London open, NY overlap) for better fills.

- Fixed Fractional Risk: Position size scales to account size; you choose the % risk per trade.

- No Martingale, No Blind Grid: Exposure is controlled; pyramids happen only with unrealized profit and strict caps.

- Soft Daily Drawdown Guard: Hit your daily loss cap? The EA stands down till the next day.

- News Buffer (Manual/Optional): Pause around major events; a simple calendar checklist keeps you safe.

- Dynamic Stop & TP: Uses structure-aware stops and ATR-based TPs to adapt across markets.

- Break-Even & Trail Modes: Lock gains after X pips; optional trailing for trend extensions.

- Equity-Based Failsafe: If equity dips below a threshold you set, the EA closes exposure and pauses.

- Clean Logs & Alerts: Understand what it did and why—handy for audits and optimization.

- Presets Included: Conservative, Balanced, and Aggressive profiles you can switch between quickly.

How It Works (Simple Flow)

- Scans the trend on higher timeframe (e.g., H1/H4) and confirms on the chart timeframe (M15/H1).

- Checks volatility (ATR band) and spread; if conditions are poor, it waits.

- Looks for entries using structure + momentum cues; avoids late entries after stretched moves.

- Calculates lot size from your chosen risk % and stop distance.

- Places trade with initial SL and a mapped TP; then manages via break-even or trailing if enabled.

- Daily risk governor: if your soft drawdown cap is touched, it stops trading for that session/day.

Suggested Pairs, Timeframes & Risk

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (add AUDUSD or US30 only if you know their personality).

- Timeframes: Start H1 (smoother), then try M15 when you’re comfortable.

- Risk per trade: 0.5%–1.0% conservative, 1.0%–1.5% balanced, 2.0% aggressive (advanced only).

- Daily drawdown cap: 3%–5% (soft stop); review logs before resuming next day.

- Max concurrent trades: 1–3 (pair-dependent); keep portfolio correlation in mind.

Installation & Quick Setup (MT5)

- Download the EA file and save it to your machine.

- Open MetaTrader 5 → File → Open Data Folder →

MQL5/Experts/→ paste the EA file. - Restart MT5 or right-click Experts → Refresh in the Navigator.

- Drag Poverty Killer EA V1.0 onto your chart (start with EURUSD H1).

- Check Allow Algo Trading and set AutoTrading ON (toolbar).

- Load a preset: Conservative.set to begin; adjust risk % to 0.5%–1.0%.

- Press OK and watch the journal for a clean init.

- Demo first for at least two weeks; then go small live if the behavior matches your expectations.

Recommended Settings (Starter)

- RiskPercent: 0.8

- MaxDailyDrawdown: 4.0

- MaxTradesPerPair: 1

- TradeSessions: London+NY overlap (enable)

- UseBreakEven: true (trigger ~1.2× SL)

- UseTrail: optional; start conservative (ATR-based)

- NewsPause: manual (disable during high-impact events)

- SlippageTolerance: broker-specific; start modest and tune

- MagicNumber: unique per pair/EA instance

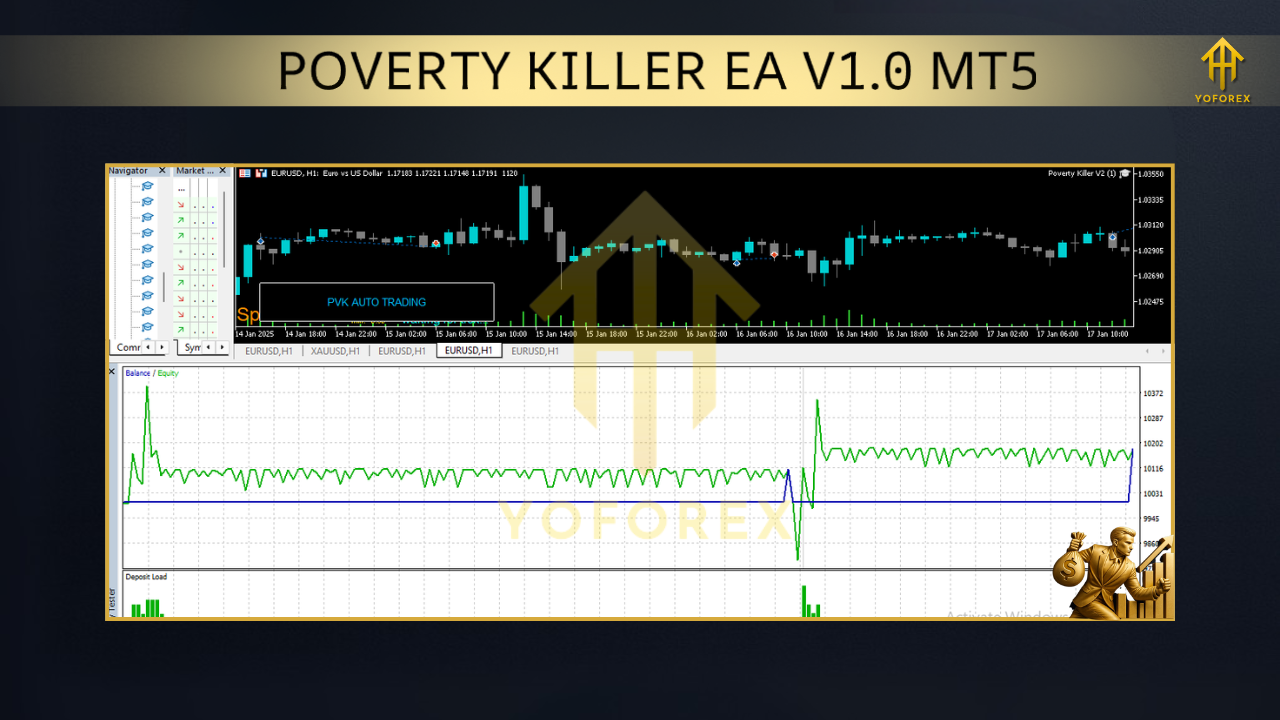

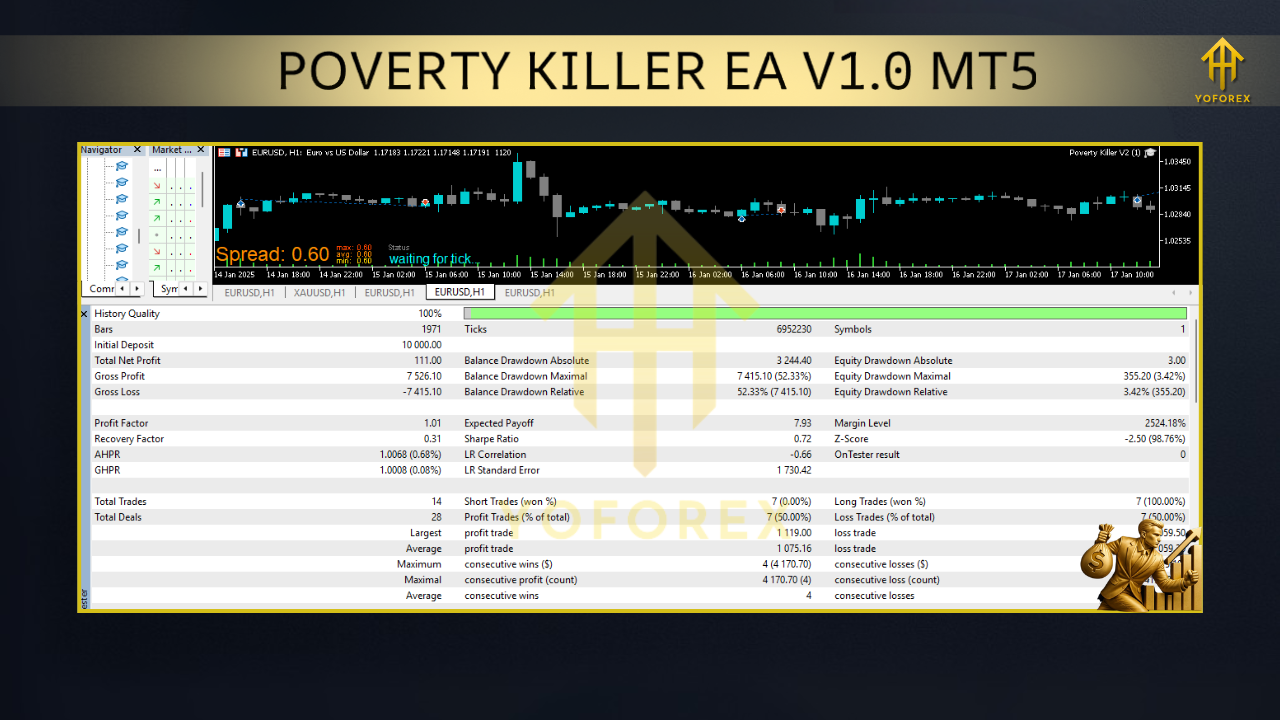

What Kind of Performance to Expect

The whole point of Poverty Killer EA is risk-adjusted consistency, not moonshots. On balanced settings, expect modest month-on-month growth with streaks of small wins and the occasional soft drawdown. When markets are clean and trending, the trail logic can capture extended legs; when choppy, the volatility gate and bias filter aim to reduce false starts. It’s not perfect—nothing is—but it tries to avoid the biggest mistakes: chasing, overexposure, and revenge trading.

Reality check (important): spreads, slippage, and news spikes vary by broker and VPS. Two traders with the same file can see different results because micro-execution matters. That’s why demo-forward testing is your best friend. Run it for a couple of weeks, check your logs, and only then scale lot sizes… slowly.

Risk Management Philosophy

- Capital first: The EA is built to protect capital with fixed fractional risk and daily soft brakes.

- No unlimited grids: Position adds are controlled and only in profit (if you enable pyramiding).

- Correlated exposure: Running EURUSD + GBPUSD + XAUUSD at once? Consider cutting per-pair risk to keep total portfolio exposure sane.

- Event risk: CPI, NFP, FOMC? Either disable trading for that session or widen buffers. Survive first, thrive later.

Troubleshooting & Tips

- “Trade disabled” message: Check AutoTrading button, symbol permissions, and market status.

- Frequent missed entries: Your volatility filter may be too strict; loosen ATR gate slightly.

- Stops too tight: Increase minimum SL distance or use ATR-multiplied stops.

- Broker rejects: Lower lot size or adjust slippage tolerance; some brokers throttle in fast markets.

- Too many alerts: Enable only critical notifications; keep logs clean for real insights.

Disclaimer & Best Practices

Trading involves risk. Past performance is not a guarantee of future results. Always start on demo, and never risk money you can’t afford to lose. If you’re new to EAs, begin with conservative risk, keep a journal, and review weekly. Small, steady compounding beats “all-in” gambles—every time.

Call to Action

Ready to give Poverty Killer EA V1.0 MT5 a proper test drive? Start on demo with the Conservative preset, watch how it behaves through a full week of market conditions, then go live small. Trade smart, let the rules do the heavy lifting, and keep your risk tight. When you’re set, scale gradually—no rush, no drama.

Comments

Very good

Leave a Comment