Pro Gold EA V1.0 MT4 — Portfolio Exit Power for Serious XAUUSD Traders

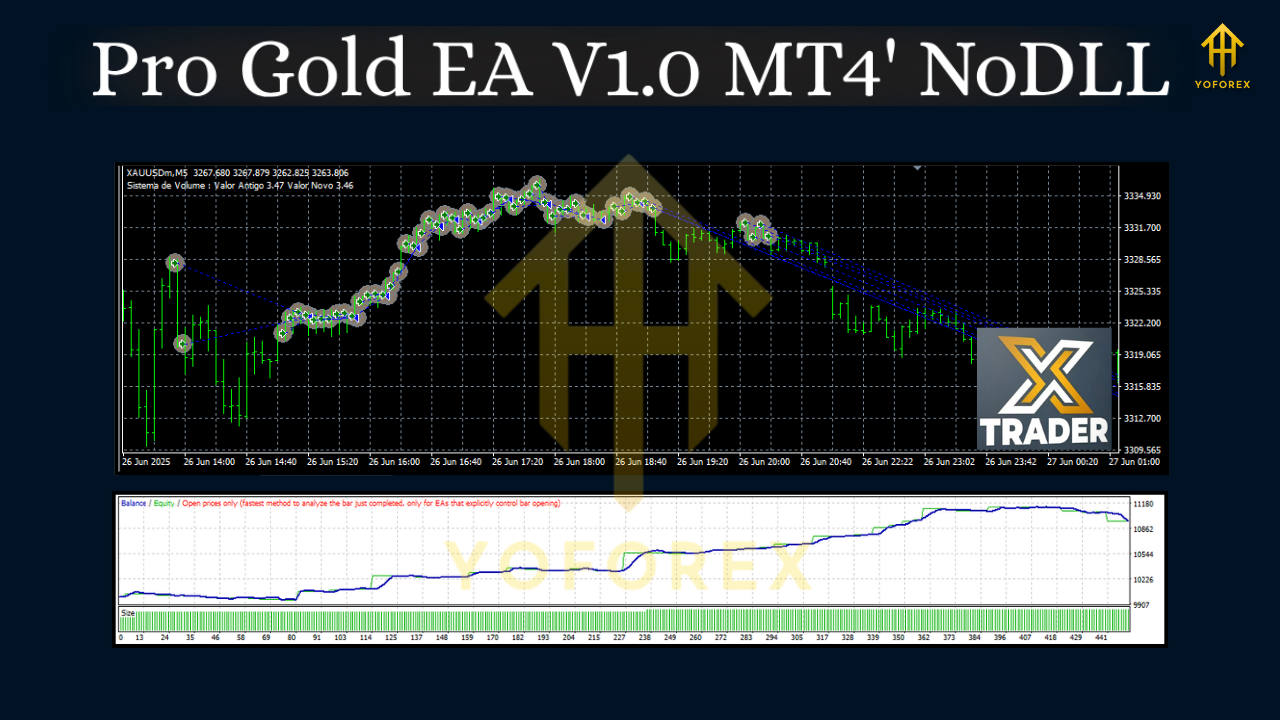

If you’ve been grinding through gold trades one by one—only to watch “that one” position ruin an otherwise good day—this is for you. Pro Gold EA V1.0 MT4 takes a different path: it manages all XAUUSD positions as a single, coordinated basket and times exits as a collective rather than closing positions in isolation. The result? A strategy designed to smooth the chaos, optimize overall equity swings, and lean into momentum when it counts.

According to live results shared by the team, the system has achieved 287.92% verified gains with an 85% win rate, while carrying a 57.68% maximum drawdown—a clear sign it’s an aggressive, high-octane profile. If you’re seeking a calm, ultra-conservative bot, this one probably isn’t it. But if you want controlled aggression with a rules-based exit engine, keep reading…

Why Pro Gold EA’s Basket Exit Logic Matters

Most EAs treat each trade like an island—its own stop loss, take profit, and fate. That works… until volatility rips, spreads widen, or a partial retrace flips your book. Pro Gold EA flips the mental model:

- One portfolio, many entries: The EA can layer entries (based on its logic) but evaluates exits at the basket level.

- Net equity focus: Instead of sweating each ticket’s P/L, the algorithm focuses on net floating P/L and market context to decide when to flatten the basket.

- Better alignment with XAUUSD behavior: Gold often trends, then whips back; basket exits attempt to capture the meat of the move and avoid death-by-a-thousand-cuts.

- Fewer “almost” wins: With unified exits, you’re not letting one laggard cancel a good sequence… which happens annoyingly often, coz gold is gold.

In short: You get a coordinated playbook that treats your XAUUSD exposure as one story rather than several conflicting mini-plots.

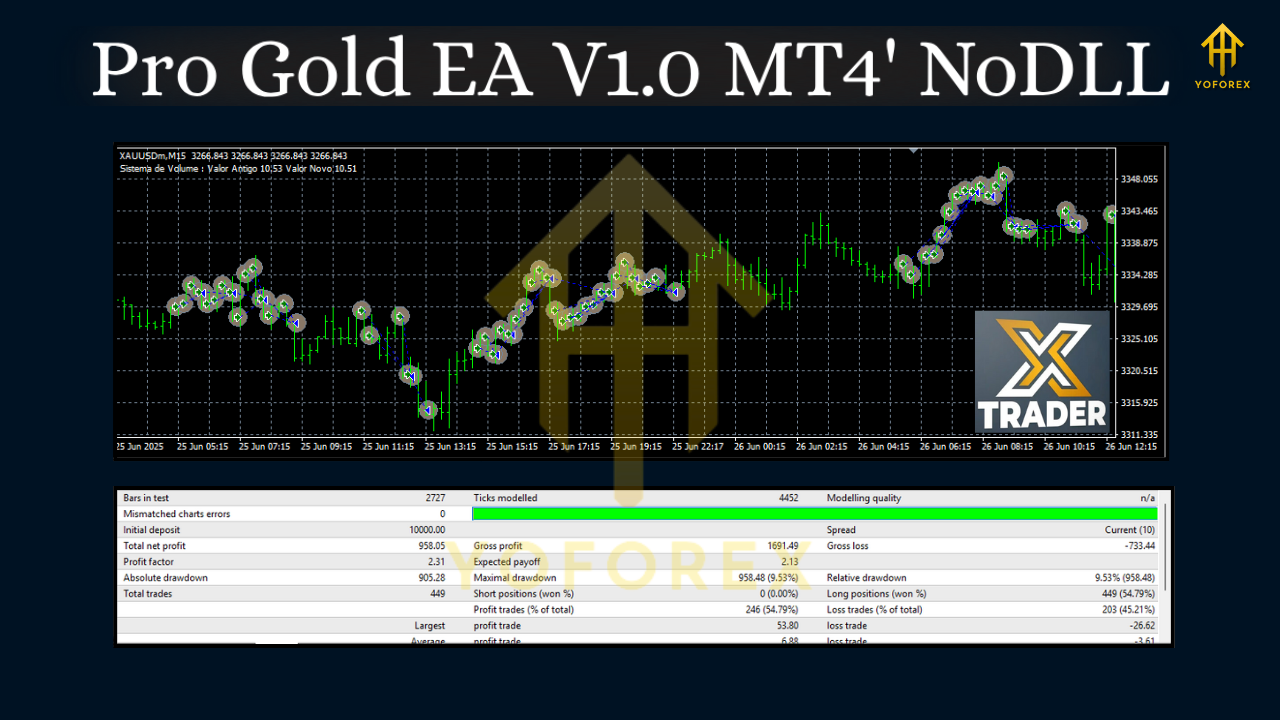

Performance Snapshot (What’s Claimed)

- Total Verified Gains: 287.92%

- Win Rate: 85%

- Max Drawdown: 57.68% (aggressive)

These stats paint a bold picture: high reward potential with material risk. The high win rate and big cumulative return suggest the basket logic is doing its job during favorable cycles; the drawdown tells you volatility will bite—so position sizing, buffers, and discipline are non-negotiable. Past performance isn’t a promise of future results, of course; use this EA with a sober plan.

The Trading Philosophy, in Plain English

- Let gold be wild—without letting it wreck you.

Pro Gold EA rides momentum when it’s there and controls exits as a group, seeking to avoid death spirals triggered by micro-managing single trades. - Play the sequence, not the scatter.

Because wins and losses cluster in gold, basket management tries to harness that clustering to amplify net outcomes. - Be honest about risk.

With a drawdown near 58%, this is not a “sleep-easy 2% monthly” robot. It’s a professional-grade approach for traders who understand that risk capital means actually risk capital.

Who Pro Gold EA Is (and Isn’t) For

Great fit if you:

- Trade XAUUSD and accept its volatility.

- Prefer rules-first automation to remove emotion.

- Understand basket/portfolio exit logic and want a cohesive exposure approach.

- Have the stomach (and account planning) for deep drawdowns in pursuit of higher upside.

Not ideal if you:

- Need a super-low-risk curve with tiny drawdowns.

- Want to micro-tweak each individual position every minute.

- Hate the idea of letting a coordinated basket play out.

Setup & Practical Considerations

- Platform: MetaTrader 4 (MT4).

- Symbol: XAUUSD (Gold).

- Account Type: ECN/RAW or tight-spread recommended; gold spreads and swaps can eat returns.

- Execution: A fast VPS helps—latency matters on gold.

- Risk: Start small. Scale only after you’ve observed behavior across several market cycles.

- Broker Conditions: Prioritize low spreads, low slippage, and reliable gold liquidity, especially during news hours.

Pro tip: Forward-test on demo first to understand basket behavior in real time. Then consider a small live account before committing more.

How the Basket Exit Can Help (and When It Hurts)

Helps when:

- Trends extend and your entries layer into a move; a unified exit books the net move cleanly.

- Choppy phases resolve into breakouts; collective management helps avoid premature partial closes.

- News spikes produce a strong directional impulse; the basket exit captures the thrust as a whole.

Hurts when:

- Markets range and mean-revert endlessly; baskets can balloon in size and time-under-water.

- Liquidity gaps widen spreads; exit timing can slip, impacting the net basket result.

- You oversize; drawdowns feel bigger and you’ll second-guess the logic (which defeats the purpose).

Risk Management (Non-Negotiables)

- Define Max Equity DD Per Account:

Decide on a hard stop at the account level (e.g., 20–25% for a sub-account). If breached, you pause and reassess. Discipline > bravado. - Use Capital Segmentation:

Consider a separate sub-account just for Pro Gold EA. That way, the EA’s risk profile doesn’t contaminate your low-risk strategies. - Scale In, Don’t Jump In:

Begin at minimum risk. Let at least 30–60 trading days pass before altering lot steps or exposure caps. - Respect News Windows:

Gold reacts violently to CPI, NFP, FOMC, and geopolitics. Either embrace the volatility (with a plan) or stand down during those windows. - Accept the Character of the Bot:

This EA’s edge lives in coordinated exits. If you keep interfering, you’re kneecapping its edge.

Daily & Weekly Routine That Works

- Daily (5 min): Check spreads, swaps, VPS uptime, and if any broker notices are flagged. Skim the basket’s net P/L, don’t micromanage.

- Twice Weekly: Review equity curve and exposure cadence. Are baskets forming during certain sessions? Are exits aligning with trend breaks?

- Monthly: Evaluate account-level drawdowns vs. plan. If the realized DD is consistently above your comfort zone, reduce risk or pause.

Final Take

Pro Gold EA V1.0 MT4 is a specialist tool with a clear, coherent logic: manage XAUUSD as a single portfolio and exit in one coordinated strike. The reported performance suggests meaningful edge when markets cooperate; the drawdown reminds you that gold plays rough. If you value a rules-based, basket-exit approach and accept the high-risk/high-reward profile, this EA can be a powerful addition to a segmented, professional trading stack.

Comments

игры https://mailsco.online/ - это всеобщее занятие, кое-что связывает персон.

Leave a Comment