Introduction

Prop firm trading has changed the way modern traders approach the forex and commodities market. Instead of risking large personal capital, traders now focus on passing strict evaluation challenges offered by proprietary trading firms. However, trading under prop firm rules is not easy—especially when it comes to volatile instruments like gold (XAUUSD). Tight drawdown limits, daily loss restrictions, and consistency requirements often eliminate traders long before profitability is achieved.

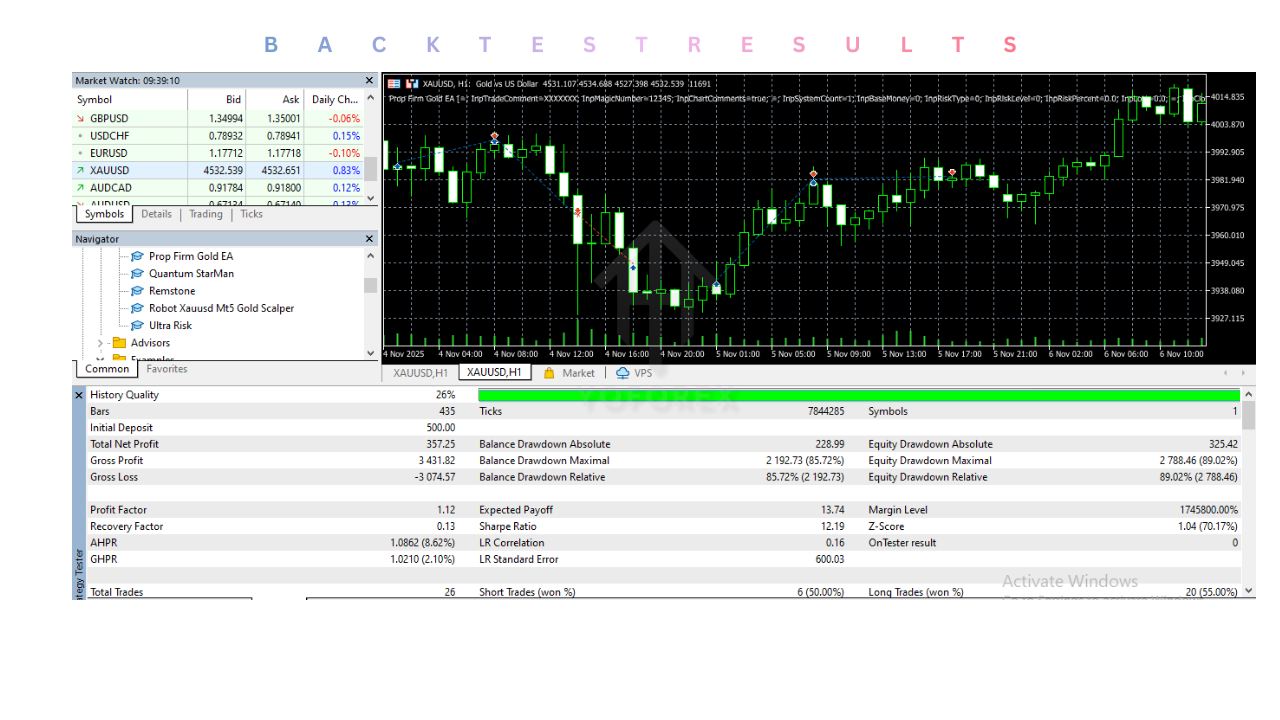

This is where Prop Firm Gold EA V2.0 MT5 positions itself as a specialized solution. Designed exclusively for MetaTrader 5, this Expert Advisor focuses on disciplined, rule-compliant gold trading with logic tailored to prop firm environments. Rather than chasing aggressive profits, it emphasizes risk control, structured entries, and systematic trade management—key factors for passing funded account challenges.

In this in-depth guide, we will explore how Prop Firm Gold EA V2.0 MT5 works, its core trading philosophy, installation process, risk management structure, and why it has become a strong choice for traders targeting prop firm success in gold markets.

Overview

Prop Firm Gold EA V2.0 MT5 is an automated trading system built specifically for XAUUSD traders who operate under proprietary trading firm rules. Unlike generic gold robots that rely on aggressive grid or martingale strategies, this EA uses a controlled execution model with predefined risk parameters.

The system is optimized to trade gold during high-liquidity sessions while avoiding erratic price behavior caused by news spikes or low-volume periods. Its internal logic is structured to align with common prop firm conditions such as:

- Maximum daily drawdown limits

- Overall account drawdown thresholds

- Consistency rules

- Lot size restrictions

This makes the EA particularly useful for evaluation phases, verification stages, and even funded accounts where capital preservation is as important as profitability.

Key Features of Prop Firm Gold EA V2.0 MT5

1. Prop Firm–Compliant Trading Logic

Prop Firm Gold EA V2.0 MT5 is engineered specifically to align with proprietary trading firm rules. It avoids risky techniques such as martingale or grid systems and focuses on controlled exposure, helping traders stay within daily and overall drawdown limits during evaluations and funded phases.

2. Dedicated XAUUSD (Gold) Strategy

This Expert Advisor trades only gold (XAUUSD), allowing its algorithm to be fully optimized for gold’s volatility, liquidity patterns, and institutional price behavior. By specializing in a single instrument, the EA delivers more refined and stable execution compared to multi-pair robots.

3. Built-In Stop Loss and Take Profit

Every trade executed by the EA comes with predefined stop loss and take profit levels. This ensures that risk is always calculated before entry, which is a critical requirement for prop firm trading environments and long-term account protection.

4. Strict Risk Management System

The EA includes advanced risk controls such as controlled lot sizing, exposure limits, and loss protection logic. These features help prevent overtrading and reduce the likelihood of breaching prop firm risk rules during volatile market conditions.

5. Consistency-Focused Trade Execution

Rather than chasing large, unstable profits, Prop Firm Gold EA V2.0 MT5 is designed to deliver consistent and steady account growth. This consistency-based approach aligns well with prop firm scoring systems that reward smooth equity curves.

6. No Martingale or Grid Techniques

The EA does not use martingale, grid, or recovery-based strategies. This makes it safer for prop firm challenges and more suitable for traders who want long-term sustainability instead of high-risk account flipping.

7. Session-Optimized Trading

Prop Firm Gold EA V2.0 MT5 operates during optimized market sessions where gold liquidity is strongest. By avoiding low-volume or erratic periods, the EA improves trade quality and reduces unnecessary drawdowns.

8. Emotion-Free Automated Trading

By automating the entire trade execution process, the EA removes emotional decision-making such as fear, greed, and revenge trading. This is especially valuable for traders who struggle with discipline during prop firm evaluations.

9. MetaTrader 5 Native Compatibility

The EA is built exclusively for MetaTrader 5, ensuring smooth integration, faster execution, and compatibility with modern brokers and prop firm platforms that support MT5 infrastructure.

10. Suitable for Evaluation and Funded Accounts

Prop Firm Gold EA V2.0 MT5 can be used in both evaluation phases and funded prop firm accounts. With conservative settings, it supports long-term account survival while aiming for rule-compliant profitability.

Trading Strategy and Core Logic

At its core, Prop Firm Gold EA V2.0 MT5 follows a precision-based gold trading strategy rather than high-frequency scalping or averaging techniques.

Market Structure Analysis

The EA continuously evaluates gold’s intraday market structure, identifying zones of potential liquidity shifts, retracements, and momentum continuation. Trades are only initiated when multiple internal conditions align, reducing random entries.

Session-Based Execution

Gold behaves differently across trading sessions. The EA is optimized to focus on periods where institutional activity is strongest, avoiding low-probability setups that often occur during illiquid hours.

Single-Direction Exposure

One of the most prop-firm-friendly aspects of this EA is its avoidance of overexposure. It limits simultaneous trades and avoids stacking positions in the same direction, helping traders stay within drawdown rules.

Stop Loss and Take Profit Discipline

Every trade is executed with predefined stop loss and take profit levels. This ensures risk is always quantified before entering the market, a critical requirement for prop firm compliance.

Why Prop Firm Gold EA V2.0 MT5 Is Suitable for Prop Firms

Many Expert Advisors fail prop firm evaluations because they prioritize fast gains over controlled risk. Prop Firm Gold EA V2.0 MT5 is built differently.

Drawdown-Focused Design

The EA’s risk algorithms are tuned to keep both daily and overall drawdowns within conservative ranges. This helps traders avoid sudden account violations due to a single losing streak.

Consistency-Friendly Performance

Prop firms often analyze not just profit, but consistency. The EA aims for steady equity growth rather than sporadic spikes, which aligns well with evaluation scoring systems.

No Martingale or Grid

Prop firms strongly discourage martingale and grid systems. This EA uses neither, relying instead on calculated entries and controlled position sizing.

Psychology-Free Trading

Emotional mistakes are one of the biggest reasons traders fail prop firm challenges. By automating execution, the EA removes fear, greed, and overtrading from the equation.

Installation and Setup Guide

Installation and Setup Guide

Setting up Prop Firm Gold EA V2.0 MT5 is straightforward and does not require advanced technical knowledge.

Step 1: Download and Extract

Download the EA file and extract it using standard archive software.

Step 2: Install in MetaTrader 5

- Open MT5

- Click on File → Open Data Folder

- Navigate to MQL5 → Experts

- Paste the EA file

- Restart MetaTrader 5

Step 3: Attach to Chart

- Open an XAUUSD chart

- Select the recommended timeframe (as specified in the EA settings)

- Drag the EA onto the chart

- Enable AutoTrading

Step 4: Configure Risk Settings

Adjust lot size, risk percentage, and session filters according to your prop firm’s rules. Conservative settings are recommended during evaluation phases.

Risk Management Framework

Risk management is the foundation of Prop Firm Gold EA V2.0 MT5.

Dynamic Position Sizing

The EA calculates position size based on account balance and predefined risk parameters, ensuring no single trade can cause excessive damage.

Daily Risk Protection

Built-in logic helps prevent excessive trading after a series of losses, reducing the chance of violating daily drawdown limits.

Equity Safety Controls

The system continuously monitors account equity and adapts trading behavior during unfavorable conditions.

This structured approach allows traders to survive market volatility while remaining compliant with strict prop firm requirements.

Recommended Trading Conditions

For optimal performance, traders should follow these best practices:

- Use a low-spread, fast-execution broker

- Trade only XAUUSD

- Avoid running the EA during major high-impact news events if required by your prop firm

- Use a VPS for uninterrupted execution

- Start with conservative risk during evaluation stages

Advantages

- Designed specifically for prop firm challenges

- Focused exclusively on gold (XAUUSD)

- No martingale or grid strategies

- Predefined stop loss and take profit

- Consistency-oriented performance logic

- Suitable for evaluation and funded accounts

Disadvantages

- Not designed for aggressive account flipping

- Requires patience and discipline

- Performance depends on broker conditions and spreads

- Works best with proper risk configuration

Understanding these limitations helps traders set realistic expectations and use the EA effectively.

Who Should Use This EA

Prop Firm Gold EA V2.0 MT5 is ideal for:

- Traders preparing for prop firm evaluations

- Funded traders seeking disciplined gold automation

- Traders struggling with emotional decision-making

- Those who prefer systematic, rule-based trading

It may not suit traders looking for ultra-high-risk strategies or short-term account flipping.

Conclusion

Prop firm trading is no longer about taking extreme risks—it is about control, discipline, and consistency. Prop Firm Gold EA V2.0 MT5 reflects this shift perfectly. By focusing on structured gold trading, strict risk management, and prop firm compliance, it offers traders a realistic path toward passing evaluations and maintaining funded accounts.

While no Expert Advisor can guarantee success, using a system designed specifically for prop firm conditions significantly improves a trader’s odds. With proper setup, conservative risk parameters, and realistic expectations, Prop Firm Gold EA V2.0 MT5 can serve as a valuable tool in any serious prop firm trader’s strategy.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer:

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment