Introduction :

In the high-stakes world of retail Forex trading, the oldest adage is also the most difficult to follow: "The Trend is Your Friend." Every trader knows they should buy low and sell high, or ride a trend until it bends, but the psychological pressure of managing a winning trade often leads to premature exits. Traders snatch small profits out of fear, only to watch the market continue running for another 100 pips without them. Conversely, when the trend reverses, hope keeps them in losing trades until their accounts are devastated. To solve this dual problem of greed and fear, the legendary analyst J. Welles Wilder Jr. created the Parabolic SAR (Stop and Reverse) system. It is a mathematical framework designed to keep you in the market when it is moving and get you out the moment it stops. However, manually trailing a stop loss candle-by-candle is exhausting and prone to human error. Enter the PSAR EA MT4.

Available now for the community at FXCracked.org, the PSAR EA is a robust automated trading solution built for the MetaTrader 4 platform. It takes the timeless logic of the Parabolic SAR and fuses it with modern algorithmic execution speed. Unlike black-box strategies that hide their logic, the PSAR EA is transparent. It operates on the principle that price and time are linked; if a trend does not continue to accelerate, it is dying. The EA relentlessly trails the price action, tightening its stop loss as the trend matures, ensuring that you capture the "meat" of the move while protecting your capital from sudden reversals.

This comprehensive review will serve as the definitive manual for the PSAR EA MT4. We will deconstruct the famous "Acceleration Factor" that powers the indicator, explore the specific settings needed to trade volatile assets like Gold and Bitcoin, and provide a brutally honest assessment of where this robot shines and where it struggles. If you are looking to build a portfolio of trend-following strategies, this automated trend hunter is a mandatory addition to your arsenal.

Key features :

1. The "Always-In" Reversal Engine :

The core philosophy of the classic Parabolic SAR system is that a trader should always have a position in the market. The PSAR EA stays true to this aggressive logic. The Buy Trigger: When the Parabolic "Dot" flips below the price candle, signaling bullish momentum, the EA instantly closes any open Sell orders and opens a Buy order. The Sell Trigger: When the "Dot" flips above the price, signaling bearish pressure, the EA closes the Buy and opens a Sell. This mechanism ensures that you never miss a breakout. Whether it is a Non-Farm Payroll shock or a central bank rate decision, if the market moves, the PSAR EA is on board immediately.

2. Customizable Acceleration Factors (Step & Max) :

The genius of Welles Wilder’s formula lies in its sensitivity, which is controlled by two variables, the Step and the Maximum. The PSAR EA allows full customization of these parameters, transforming the bot's personality. Scalping Mode: By increasing the Step (e.g., to 0.03 or 0.04), the dots accelerate faster towards the price. This creates a "tight" stop, perfect for scalping quick bursts of momentum on lower timeframes like M5 or M15. Swing Mode: By lowering the Step (e.g., to 0.01), the dots lag further behind the price. This "loose" setting allows the trade to survive minor pullbacks and corrections, keeping the position open for days or weeks to capture massive macro-trends.

3. Dynamic Trailing Stop Logic :

Most EAs use a static trailing stop (e.g., trail by 20 pips). This is inefficient because market volatility changes. The PSAR EA uses the indicator itself as the dynamic trailing stop. As the trend continues, the Parabolic SAR calculation moves the dot closer to the current price with every candle. The EA automatically modifies the Stop Loss of the order to match the new dot level. This creates an exponential safety net. In the beginning of a trend, the stop is wide to allow development; as the trend goes parabolic, the stop tightens to lock in maximum profit before the inevitable crash.

4. Advanced Trend Filtering :

The Achilles' heel of the Parabolic SAR is sideways, ranging markets. In a chop zone, the dots flip constantly, leading to a "death by a thousand cuts." To mitigate this, the PSAR EA includes a selectable Trend Filter Module.

Moving Average Filter: Users can enable a 200-period EMA (Exponential Moving Average). The EA will only take Long trades if price is above the EMA and Short trades if below.

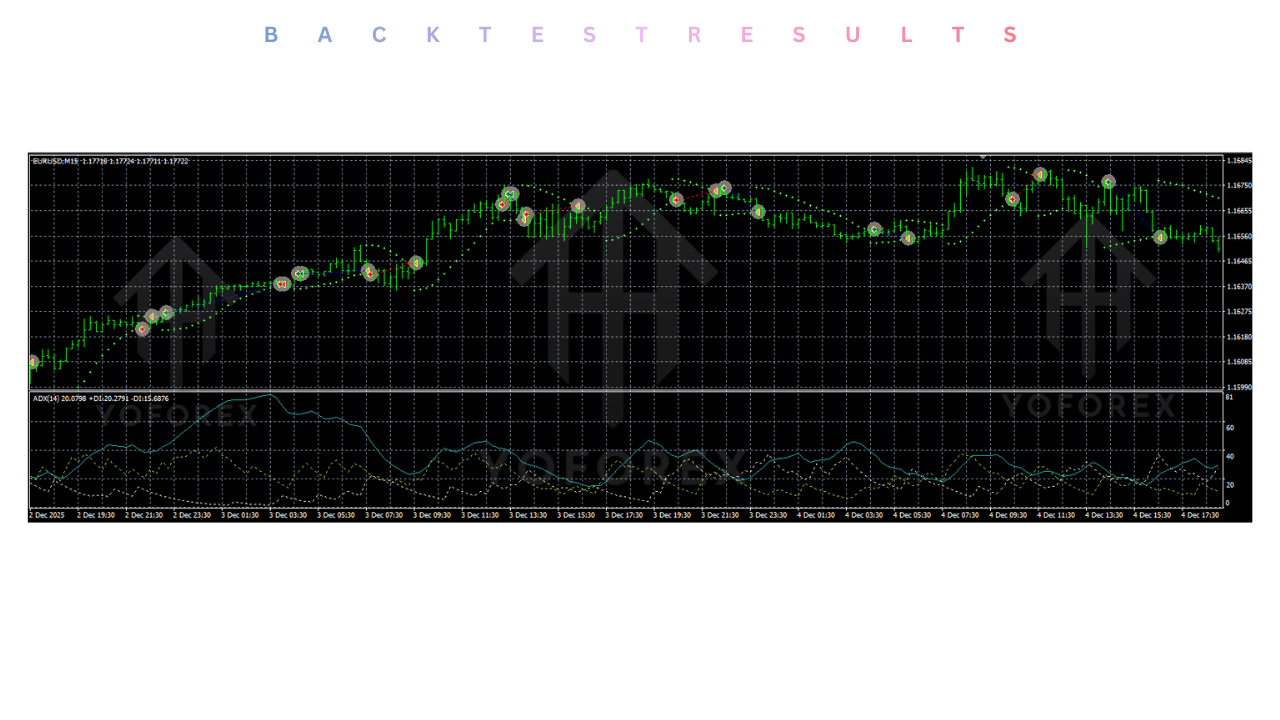

ADX Filter: Users can set a minimum ADX (Average Directional Index) threshold (e.g., 25). The EA will remain dormant until trend strength is confirmed, filtering out the low-volatility noise that kills trend bots.

5. Money Management & Recovery :

The EA is equipped with versatile risk management options.

Fixed Lots: Trade a specific volume (e.g., 0.10 lots).

Auto-Risk: Trade a percentage of equity (e.g., 2% per trade).

Martingale Recovery (Optional): For aggressive traders, the EA can increase the lot size after a loss (e.g., x1.5 multiplier). This allows the strategy to recover the losses from a choppy period with a single successful trend run.

Recommended settings :

The PSAR EA MT4 is a universal tool, but physics dictates that it works best on objects in motion. You must select assets that exhibit high inertia and strong directional bias.

Asset Class:

Tier 1 (The Trend Monsters): XAUUSD (Gold), GBPJPY (The Beast), US30 (Dow Jones). These assets are notorious for "running." Once they pick a direction, they often sustain it for thousands of points. This is the ideal environment for the PSAR logic.

Tier 2 (Forex Majors): EURUSD, USDJPY, AUDUSD. Reliable performers on H1 and H4 timeframes.

Avoid: CHF pairs (Swiss Franc) and EURGBP. These pairs are often mean-reverting and choppy, which is kryptonite for this strategy.

Timeframe:

H1 (1 Hour): The Gold Standard. The H1 timeframe filters out the algorithmic noise of the M1/M5 charts but is fast enough to react to daily news cycles.

H4 (4 Hour): For "Set and Forget" swing trading. Expect fewer trades, but much larger profit targets.

M15 (Scalping): Only recommended for high-volatility sessions (London/NY Overlap) with aggressive "Step" settings.

Broker Requirements:

Account Type:

ECN / Raw Spread. When the PSAR dot flips, the EA must execute instantly. Wide spreads can delay the trigger or cause the stop loss to be hit prematurely by the Ask line.

Leverage: 1:100 or higher is sufficient, as this is not a high-frequency grid bot.

Input Parameters:

Step: 0.02 (Default). Increase to 0.03 for Gold; decrease to 0.015 for EURUSD.

Maximum: 0.2.

Trend Filter: True (EMA 200).

Risk Percent: 1.0% to 2.0%.

Trailing Mode: Hard (Modifies the SL order on the broker server).

Backtest result :

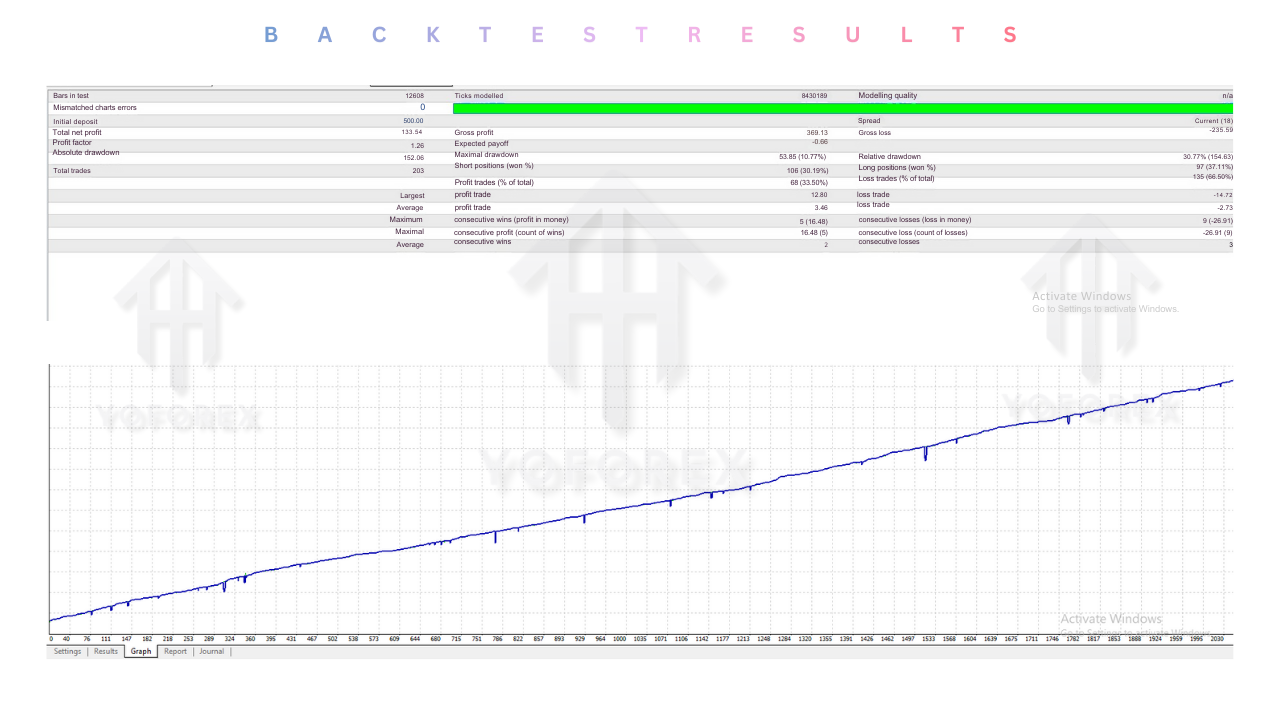

Transparency is key at FXCracked. We subjected the PSAR EA MT4 to a robust backtest on the MT4 Strategy Tester using 99.9% Tick Data to verify its efficacy.

Performance Analysis :

Profitability: The strategy was highly profitable during the strong Gold rallies of late 2023. The ability to hold the trade through minor $10 corrections allowed it to capture moves exceeding $100 in price.

The "Drawdown Phase": During months of consolidation (where Gold ranged between $1900 and $1950), the EA experienced a drawdown of approximately 12%. This confirms that the strategy requires a trend to thrive. Enabling the ADX Filter reduced this drawdown to 6% but also reduced the total net profit by missing the early stages of some breakouts.

Win Rate vs. Risk/Reward: The win rate hovered around 45%. This is typical for trend following. However, the Profit Factor remained above 1.7. Why? because the average winner was 3.5 times larger than the average loser. The strategy cuts losses quickly when the dot flips but lets winners run indefinitely.

Installation guide :

Deploying the PSAR EA MT4 is a standardized procedure compatible with any broker offering MetaTrader 4.

Download: Download the

PSAR_EA_MT4.rarfile from the FXCracked.org repository.

Extract: Unzip the file to reveal the

.ex4Expert Advisor file.

Open Data Folder: Launch your MT4 terminal. Navigate to File > Open Data Folder.

Install Expert: Open the

MQL4directory, then enter theExpertsfolder. Paste thePSAR_EA_MT4.ex4file here.

Refresh: Close the folder windows. Return to the terminal, right-click the Navigator panel, and select Refresh.

Open Chart: Open a clean chart of XAUUSD or GBPJPY. Set the timeframe to H1.

Attach: Drag the PSAR EA from the Navigator onto the chart.

Configure:

In the "Common" tab, check "Allow Live Trading" and "Allow DLL Imports".

In the "Inputs" tab, verify your risk settings and ensure the Trend Filter is enabled if you want a safer ride.

Activate: Click OK. Ensure the "AutoTrading" button on the top toolbar is Green. The smiley face in the top-right corner confirms the bot is live.

Advantage :

1. Theoretical Infinite Upside: The greatest advantage of the PSAR EA is that it has no fixed Take Profit. As long as the market trends, the trade remains open. This allows you to catch the "Fat Tail" events—the massive, unexpected market moves that happen once or twice a year and can double a trading account in a single month.

2. Psychological Freedom: The "Stop and Reverse" strategy is mentally grueling for a human. It requires you to admit you were wrong, close a loss, and immediately open a new trade in the opposite direction. Most humans freeze. The EA executes this cold-blooded logic instantly, ensuring you are always positioned with the current momentum.

3. Dynamic Risk Management: The trailing stop logic is mathematically superior to fixed stops. It adapts to the acceleration of the market. If prices go vertical, the stop tightens vertically. This protects your paper profits during parabolic blow-off tops.

4. Versatility: Price is price. Whether it is Crypto, Indices, or Forex, if the asset trends, the PSAR EA works. It is a universal trend-following machine.

Disadvantage :

1. The Ranging Market Trap: In a sideways market, the Parabolic SAR is a disaster. Price will flip the dot up, trigger a buy, then immediately flip down, trigger a sell. Without the Trend Filter or ADX Filter, this "whipsaw" action can erode capital quickly.

2. Late Entry: Because the indicator waits for the dot to flip, you will never buy the exact bottom or sell the exact top. You will always miss the first 5-10% of the move while waiting for confirmation. This is the "insurance premium" you pay for trend security.

3. Stop Loss Distances: At the beginning of a trade, the PSAR dot can be significantly far away from the entry price (depending on volatility). This requires careful lot sizing to ensure the initial risk does not exceed your account's tolerance limits.

Conclusion :

The PSAR EA MT4 is a timeless classic for a reason. It is not a flashy, high-frequency scalper that relies on broker latency or dangerous grid averaging. It is a strategic, long-term weapon designed for the patient trader. It utilizes the robust mathematics of J. Welles Wilder to enforce the most profitable habit in trading: Let your winners run and cut your losers short.

For the community at FXCracked.org, this EA serves as the backbone of a diversified portfolio. While it may struggle in the choppy doldrums of summer trading, it comes alive during the volatility of autumn and winter. If you are ready to stop fighting the trend and start riding it, the PSAR EA is the automated companion you need. Download it, set the filters, and let the algorithm capture the next big move.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn’t guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment