PythonX M1 Scalper XAUUSD EA V5.0 MT5 — Lightning-Fast Gold Scalping on the 1-Minute Chart

If you’ve been hunting for a no-nonsense gold scalper that actually fits the pace of live markets, meet PythonX M1 Scalper XAUUSD EA V5.0 (MT5). This Expert Advisor is built for high-frequency execution on the M1 timeframe, with a price-action core: it detects engulfing candlestick patterns to catch short bursts of momentum in volatile sessions. The goal is straightforward—fast entries, tight risk, clean exits—so you can ride micro-moves without exposing the account to oversized drawdowns. No fluffy promises here; just a structured approach to short-term gold trading that prioritizes precision, risk control, and execution speed.

Below, you’ll find a full breakdown of how the EA works, the filters you should care about, recommended settings, installation steps, and a few practical tips from real-world intraday trading on XAUUSD. Let’s get you scalping smarter—not harder.

What Makes PythonX Different?

PythonX M1 Scalper XAUUSD doesn’t overcomplicate the core logic. It focuses on engulfing patterns—one of the most reliable price-action signals for momentum continuation and sharp reversals—then wraps that logic in safeguards so you’re not firing entries in poor conditions.

Core Ideas at a Glance

- Timeframe: M1 (1-minute), designed for fast, reactive trading.

- Instrument: XAUUSD (Gold) only, laser-focused for depth instead of breadth.

- Method: Engulfing pattern detection with volatility and spread checks.

- Philosophy: Many small, controlled trades > few oversized gambles.

How It Works (Plain English)

1) Pattern Detection

The EA continuously scans for bullish or bearish engulfing candles. A valid engulf usually signals that one side just took control—perfect for scalpers aiming to ride the next 5–30 pips (or points on gold) quickly.

2) Market-Quality Filters

To avoid “random chop,” PythonX layers conditions that keep you out of trouble:

- Spread Filter: Blocks entries when spreads widen (common during rollovers or news spikes).

- Volatility Gate: Requires a minimum candle range or ATR threshold so you’re not trading dead markets.

- Session Awareness: Optional filters to prefer high-liquidity windows (e.g., London/NY overlap).

- Direction Confidence: Optional MA or structure checks to reduce counter-trend scalp attempts.

3) Risk & Exit Logic

- Hard Stop-Loss: Every trade is protected—no martingale, no grid, no “it’ll come back” thinking.

- Dynamic Take-Profit: Targets scale with volatility or a fixed pip/point value.

- Breakeven + Trailing: Lock profit once the move starts; trail stops to let runners breathe.

- Max Concurrent Trades: Caps open exposure so one bad minute doesn’t ruin your day.

Recommended Environment (Don’t Skip This)

Broker & Account

- Low-spread, fast-execution ECN accounts are ideal. Skip anything that widens spreads at random.

- Leverage: 1:200 to 1:500 is common for gold scalpers, but size responsibly.

- Commission Model: Per-lot commission is fine if the raw spread stays tight.

VPS & Latency

- VPS is strongly recommended (low-latency < 20ms to your broker). On M1 scalping, execution speed matters more than you think.

Capital & Position Sizing

- Starting Balance: Many M1 gold scalpers prefer $500+ so position sizing doesn’t get too tight. You can run smaller, but be conservative.

- Risk Per Trade: 0.25%–0.5% is a smart baseline. Push to 1% only when you have data backing your settings.

Installation & Setup (MT5)

- Copy Files: Place the EA file into MQL5 → Experts inside your MT5 data folder. Restart MT5.

- Attach to Chart: Open XAUUSD, set timeframe to M1, drag PythonX M1 Scalper onto the chart.

- Enable Algo Trading: Make sure Algo Trading is turned on in MT5 and in the EA’s inputs (if toggled).

- Set Inputs (Baseline):

- Lots: Start with a small fixed lot or a conservative risk-based lot (e.g., 0.25% per trade).

- Stop-Loss/TP: For Gold M1, consider SL 300–700 points and TP 300–1000 points depending on your broker’s “points” definition; adjust to recent volatility.

- Spread Guard: Set a max spread that blocks entries during spikes (e.g., 30–60 points on raw accounts—calibrate to your broker).

- Session Filter: Prefer London and New York overlap. Disable during dead Asian hours if your tests show poor performance.

- News Handling: If the EA version you have doesn’t include a news module, simply pause trading 5–10 minutes before/after red-folder news.

5. Run on Demo First: Forward test for at least one to two weeks. Save good presets. Then go live with the same broker conditions.

Smart Configuration Tips (That Actually Help)

- One Chart, One Job: Keep PythonX on a single XAUUSD M1 chart. Avoid stacking multiple EAs that could compete for margin.

- Avoid Over-Filtering: Too many filters = missed trades. Balance “quality entries” with “enough frequency.”

- Let Winners Run (Sometimes): A modest trailing stop can turn a 1R scalp into 2–3R on trending minutes.

- Daily Max Loss: Decide it up front (e.g., 2%–3%). When you hit it, stop trading. Scalping discipline is everything.

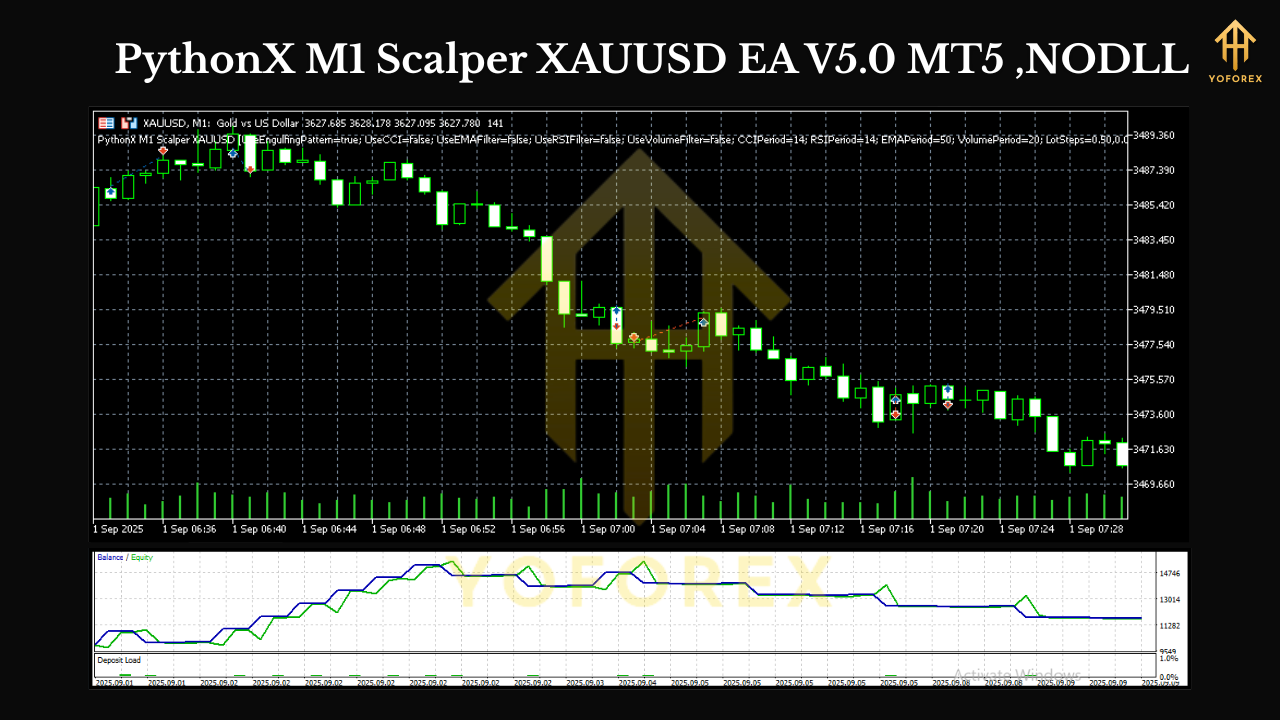

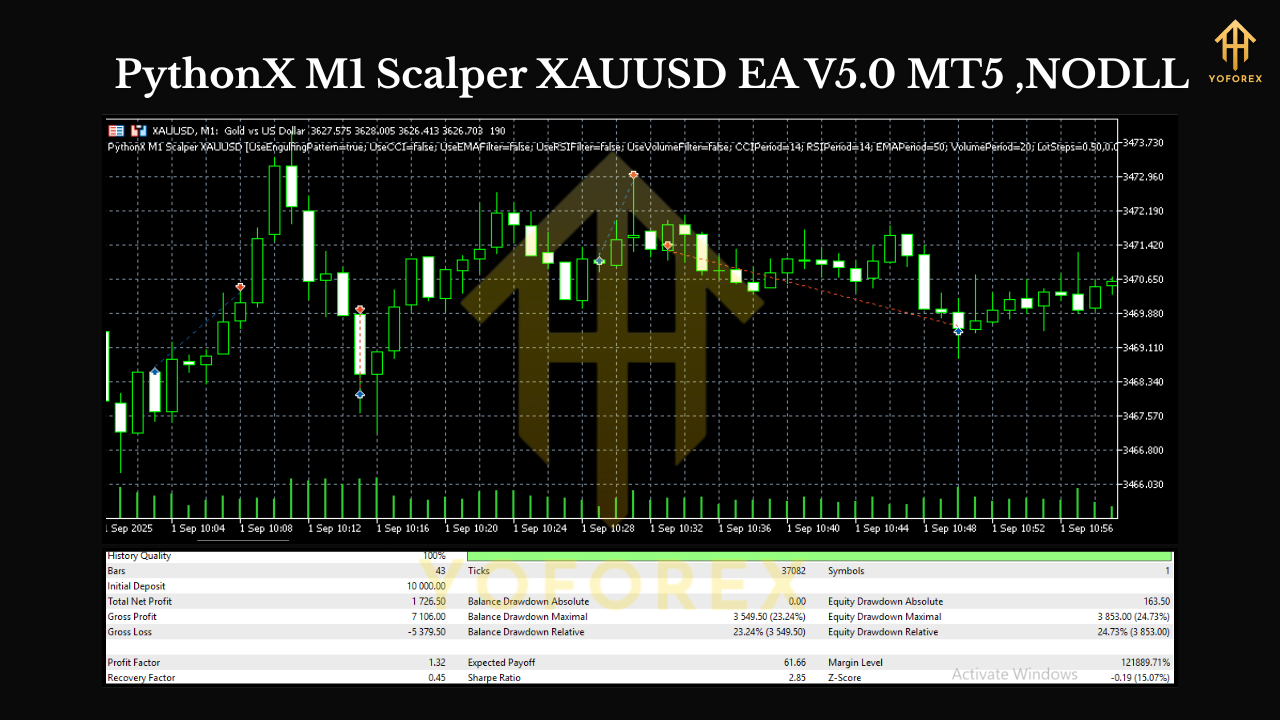

Backtesting & Forward Testing

Backtests on M1 can be tricky due to tick quality and modeling. Use real tick data if possible, and always compare backtest behavior to forward demo results.

What to look for:

- Stable Equity Curve: Slightly choppy is normal for scalpers, but large V-shapes usually mean overfitting or no risk cap.

- Reasonable Win Rate: Engulfing-based scalps often win 45–60% if risk-reward is aligned (e.g., 1:1.2 to 1:2).

- Drawdown Discipline: Keep DD under 10–15% with your chosen lot sizes. If you see higher, trim risk.

Optimization advice:

- Optimize spread guard, session hours, and SL/TP ranges quarterly.

- Re-optimize only if market structure changes (e.g., volatility regime shift), not every other day.

Trading Routine That Pairs Well With PythonX

- Pre-Market Check: Note major levels (previous day high/low, session open) and scheduled news times.

- Execution Window: Focus on London open to NY early session. That’s where gold breathes.

- Stop After Streaks: Three small wins? Great—walk away. Three losses? Also walk away. Protect your mental game.

Prop-Firm Considerations

- Daily Drawdown Rules: Use tight per-trade risk and daily loss caps to fit prop rules.

- Trade Frequency: Scalpers can hit trade limits; check the firm’s policies on frequency and EAs.

- News Trading: Many prop firms ban trading during high-impact news—pause PythonX accordingly.

Final Thoughts

PythonX M1 Scalper XAUUSD EA V5.0 (MT5) is a clean, disciplined take on M1 gold scalping. It marries a time-tested price-action signal (engulfing) with practical execution controls (spread, volatility, and session awareness). If you’ve struggled with overfit robots or complex “do-everything” systems, PythonX feels refreshingly focused. Just remember: your risk settings, session timing, and discipline will make or break results.

Comments

Leave a Comment