The forex trading world is always hungry for tools that provide a competitive edge. Among the latest discussions in trading communities, the Quant Analyzer EA V4.9.2 MT4 has been making waves. This Expert Advisor is presented as a way to evaluate strategies, manage risks, and potentially automate aspects of decision-making. But what exactly does it do, and how reliable is it? In this post, we’ll explore the features, benefits, risks, and practical considerations you need to know before using it.

Understanding Quant Analyzer EA V4.9.2

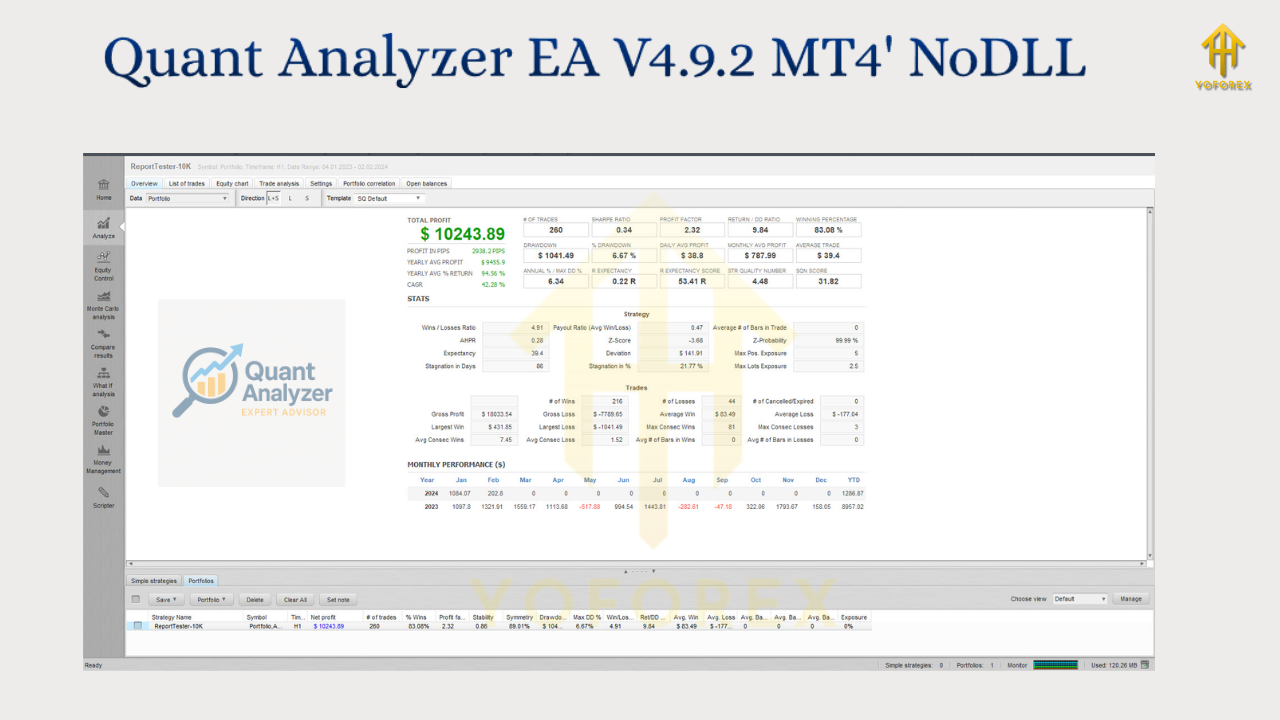

Quant Analyzer EA is designed for traders who rely on MetaTrader 4. Unlike basic indicators that simply provide signals, this EA aims to dig deeper into strategy performance. It focuses on analyzing historical results, identifying strengths and weaknesses, and helping traders refine their systems. The V4.9.2 build is often described as an upgrade, giving users access to more performance metrics and a more polished experience.

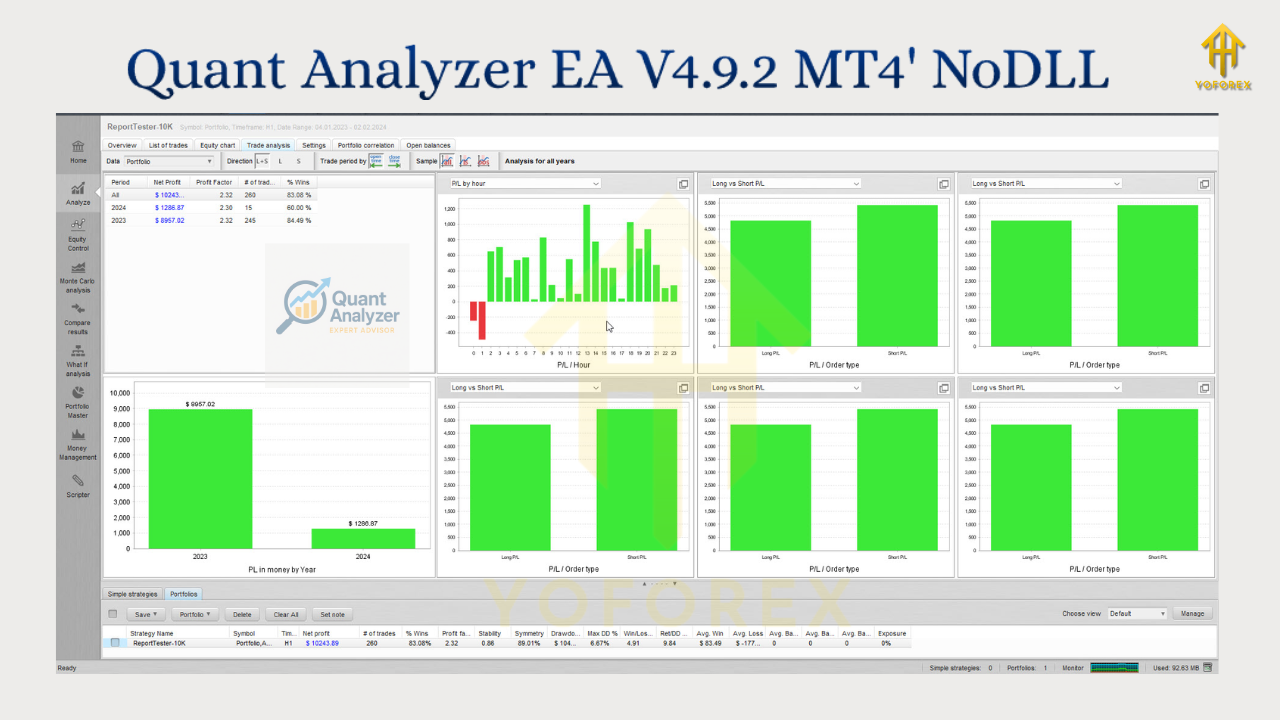

Many traders find themselves struggling with one central problem: they know their strategy has worked in the past, but they cannot clearly evaluate if it will survive changing market conditions. This is where the idea behind Quant Analyzer comes in. By breaking down performance into measurable statistics, it offers insights into profit factors, drawdowns, correlations, and consistency. The goal is to help traders avoid blind spots and improve their trading plans.

Core Features and Advantages

One of the most attractive aspects of Quant Analyzer EA V4.9.2 is its emphasis on risk awareness. Markets are unpredictable, and no matter how strong a system looks on paper, hidden weaknesses can lead to losses. This EA claims to highlight those vulnerabilities through simulations and performance breakdowns.

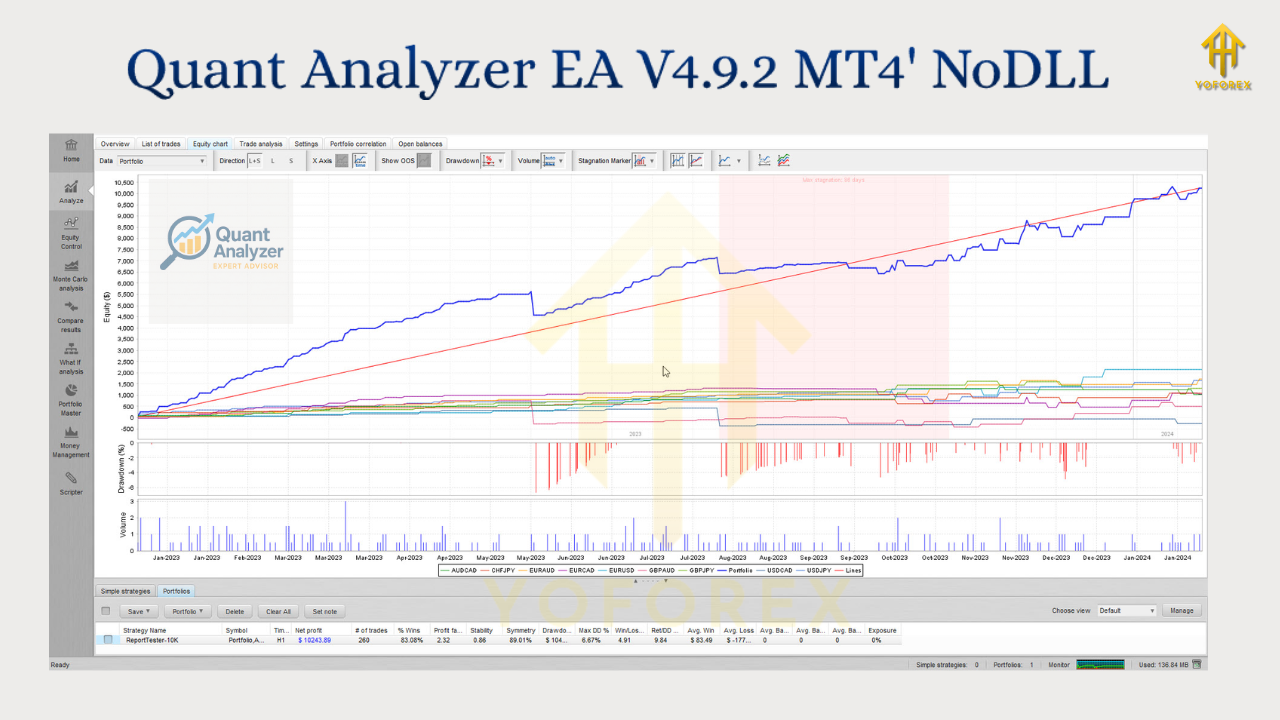

The portfolio analysis element is another selling point. Many traders run multiple strategies simultaneously, but without proper analysis, combining them can increase risk instead of reducing it. The EA is designed to assess how different strategies interact, showing whether they balance each other or amplify potential losses.

Risk management also plays a major role. The EA provides tools to evaluate how much drawdown a system might face, what happens under extreme volatility, and how position sizing affects outcomes. Having this information allows traders to make adjustments before risking large amounts of capital.

Adaptability is yet another benefit. The EA is said to allow backtesting and scenario testing across different market conditions. By analyzing past performance under various setups, traders can estimate how strategies may behave during shifts in volatility, news events, or long periods of consolidation.

Why Traders Are Interested

The growing interest in Quant Analyzer EA V4.9.2 MT4 can be traced to a simple fact: traders want clarity. Instead of relying only on gut feelings, they want measurable statistics. Having an EA that automatically calculates those statistics, generates performance insights, and gives warnings about risks can feel like a professional upgrade.

Another reason is the challenge of prop firm trading. Many retail traders are trying to pass evaluation phases where strict drawdown limits and risk rules apply. A tool that helps monitor equity, simulate outcomes, and manage exposure has clear appeal in that environment.

Potential Risks and Concerns

While the features sound impressive, there are important warnings to consider. First, the legitimacy of this exact version is not widely confirmed. Some sources online advertise it under different names, and not all providers appear trustworthy. Before spending money or installing any file, traders should carefully verify the source.

Second, even if the EA performs as advertised, it cannot guarantee profits. Market conditions change without warning. An analyzer can highlight probabilities, but it cannot eliminate risk. Unexpected events, sudden price spikes, or broker execution issues can still hurt results.

Third, support and updates are another area of concern. If the EA does not come from a well-documented developer, updates may be limited or non-existent. In the fast-paced forex world, software that goes without maintenance quickly becomes outdated.

Finally, there is always the risk of overconfidence. Traders may feel that because the EA provides professional-looking reports and simulations, they no longer need to monitor the market closely. In reality, tools are only useful when combined with discipline, testing, and active risk management.

Best Practices for Traders

If you are considering Quant Analyzer EA V4.9.2 MT4, approach it with caution and preparation. The safest way to begin is on a demo account. Running it in a risk-free environment gives you the chance to observe how it behaves, how the statistics are generated, and whether it adds value to your decision-making.

Risk management should always come first. No matter how promising an EA appears, never risk more than you can afford to lose. Keep position sizes small in the early stages, and let data build up over time. This way, you can see whether the EA’s analysis aligns with your trading goals.

Make sure to also keep detailed records. Note the version of the EA you are using, the account type, and the strategies being tested. If results shift suddenly, having records makes it easier to identify whether the problem comes from the EA, the broker, or the market environment.

It is also wise to run the EA on a secure environment, such as a virtual private server (VPS). This ensures stability, reduces downtime, and keeps your trading platform protected from unexpected shutdowns.

Finally, always treat Quant Analyzer EA V4.9.2 as a supporting tool. It can help you analyze and refine strategies, but it cannot replace your own judgment, testing, and long-term planning.

Final Thoughts

Quant Analyzer EA V4.9.2 MT4 stands out because it aims to give traders a more scientific approach to strategy evaluation and risk control. For those who want more than simple entry and exit signals, it offers features that dig deeper into performance. It encourages traders to think in terms of probabilities, correlations, and equity protection—concepts that separate professionals from beginners.

However, it is equally important to recognize its limitations. Without verified sources or guaranteed support, this version carries uncertainty. Traders should approach it carefully, test it thoroughly, and use it as part of a broader system rather than relying on it completely.

In the end, the EA should be seen as an upgrade to the way you view your trading—not as a shortcut to profits. By combining its analytical features with your own strategy, discipline, and continuous learning, you can make better decisions and protect your capital in a challenging market.

Comments

Leave a Comment