The forex market is filled with countless expert advisors promising steady profits, but only a few stand out with a focused approach to a single asset. Quantum Baron EA V2.8 MT5 is one such trading robot that has gained popularity among oil traders. Unlike multi-asset bots, this EA is designed specifically to trade Crude Oil (XTIUSD) on the MetaTrader 5 platform.

This article explores the features, performance, pros and cons, and overall reliability of Quantum Baron EA so traders can make informed decisions before using it in live markets.

Introduction

Trading crude oil requires more than just basic forex knowledge. Oil prices are influenced by complex global factors such as OPEC decisions, geopolitical conflicts, supply-demand imbalances, and economic reports. Manual trading can be challenging, which is why many traders look for automated systems like Quantum Baron EA.

The V2.8 version of Quantum Baron EA brings improvements in stability, money management, and execution. It is particularly attractive to traders who want systematic exposure to the oil market without constantly monitoring the charts.

What is Quantum Baron EA V2.8 MT5?

Quantum Baron EA is an algorithmic trading system that operates exclusively on MetaTrader 5 (MT5). Unlike many forex robots that attempt to handle multiple currency pairs, this EA is built solely around oil trading on the M30 timeframe.

It uses a grid trading mechanism where additional buy positions are opened when prices move against the initial trade. This allows the EA to capture profits once prices rebound. However, it should be noted that grid strategies carry inherent risks if strong downtrends persist for long periods.

Core Features

- Optimized for Oil: Trades only XTIUSD, making it highly specialized.

- Timeframe: Works best on the M30 chart.

- Strategy: Long-only grid strategy with filters to improve entry accuracy.

- Money Management: Includes adjustable risk settings for lot sizing and trade frequency.

- Positive Swap Usage: Takes advantage of swap benefits on long positions when supported by brokers.

- Latest Version Improvements: V2.8 offers refined stability and better handling of volatile markets.

Recommended Setup

To achieve maximum efficiency, users are advised to follow certain guidelines when running Quantum Baron EA:

- Initial Deposit: A starting balance of at least $5,000 is recommended.

- Leverage: Best suited with 1:500 leverage.

- Broker Type: Accounts with raw or ECN spreads are preferred.

- Hosting: A reliable VPS ensures continuous operation without interruptions.

- Account Mode: Hedge accounts are required for proper execution.

Performance Overview

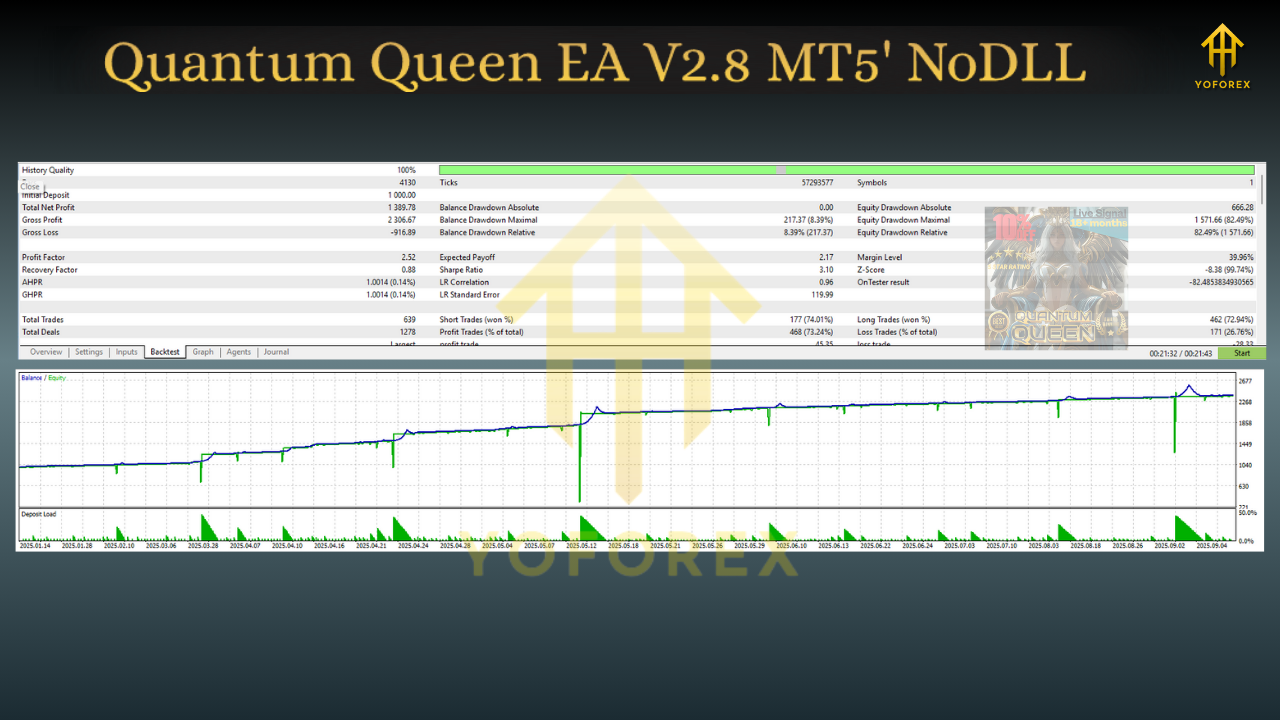

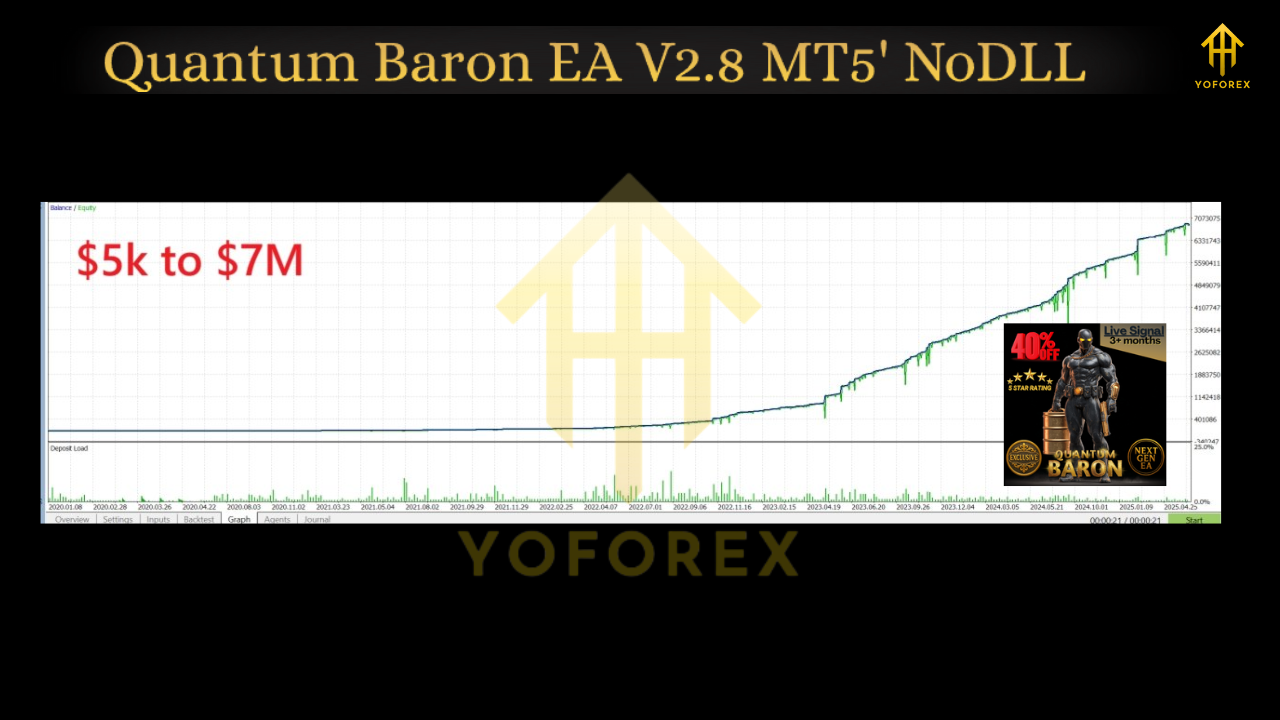

In market phases where oil prices are bullish or moving sideways, Quantum Baron EA demonstrates steady profit growth. The grid structure allows it to scale into trades and recover from temporary drawdowns.

Backtests on historical oil price data show that the EA can generate consistent results over extended periods. Traders who have tested it on live accounts report stable growth, provided sufficient capital is available.

However, caution is necessary. A prolonged bearish trend in oil prices can result in larger floating losses, and recovery may take time. This makes money management and patience critical when using this EA.

Pros and Cons

Advantages

- Specialization in a single asset ensures targeted optimization.

- Fully automated, reducing the need for manual trading.

- Grid strategy provides multiple opportunities during volatile price swings.

- Positive swap support enhances profitability when holding trades overnight.

- Long-term stability when used with proper capital and risk management.

Disadvantages

- Vulnerable during strong and extended downtrends.

- Requires significant starting capital to handle drawdowns.

- Performance depends heavily on spreads, swaps, and execution quality.

- Not suitable for traders looking for quick scalping results.

Who Can Benefit from Quantum Baron EA?

This EA is not meant for every trader. It is most beneficial for:

- Traders with intermediate to advanced knowledge of automated systems.

- Investors who want exposure to oil trading through automation.

- Those willing to allocate larger starting capital to withstand volatility.

- Individuals who prefer medium to long-term trading strategies rather than high-frequency scalping.

Risk Management Considerations

Since grid systems inherently carry drawdown risk, traders should take certain precautions:

- Always use adequate capital to support multiple open positions.

- Monitor fundamental oil market events, as they can trigger sudden price drops.

- Avoid using the EA on brokers with high spreads or poor execution.

- Consider diversifying across different strategies instead of relying on a single EA.

Final Thoughts

Quantum Baron EA V2.8 MT5 is a specialized trading robot that brings a structured approach to trading Crude Oil. Its long-only grid strategy, when paired with proper risk management and broker setup, has the potential to generate steady returns.

However, traders must remain aware of the risks, especially during bearish oil markets where floating losses can escalate. For those with sufficient capital, patience, and an interest in commodity trading, Quantum Baron EA can be a valuable addition to their trading toolkit.

Comments

Leave a Comment