Saviour Gold EA V1.0 MT5 – Smart Automation for XAUUSD Traders

If you’ve been glued to the screen trying to catch every spike on XAUUSD, you already know how brutal gold trading can be. Volatility is amazing for profit, but it’s also the reason many accounts blow up when emotions kick in or entries are late. That’s exactly where Saviour Gold EA V1.0 MT5 comes in – an automated MT5 Expert Advisor designed specifically to handle the chaos of gold on your behalf.

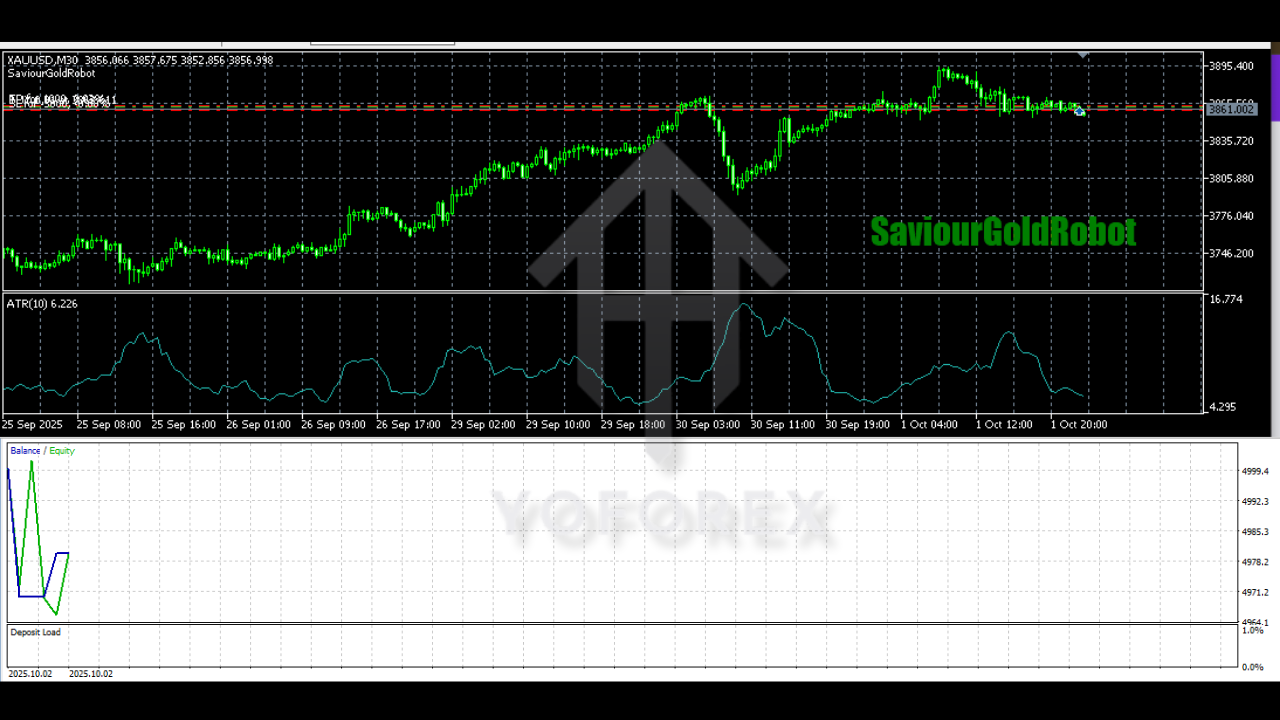

This EA is built for XAUUSD (Gold) on the M30 timeframe, combining several powerful tools like Price Channels, Pivot Levels, Price Action logic, and filters such as Renko-based confirmation and news suppression. The idea is simple: let the algorithm handle the heavy lifting, while you focus on risk control and overall strategy.

With a recommended minimum deposit of just $100, Saviour Gold EA is ideal for small to medium accounts, prop firm challenges, and traders who want stable, hands-free gold trading instead of random gambles.

What Is Saviour Gold EA V1.0 MT5?

Saviour Gold EA V1.0 MT5 is a fully automated trading robot developed for MetaTrader 5, tailored only for the XAUUSD pair. It’s optimized for the M30 timeframe, which is a sweet spot between noisy scalping charts and very slow swing setups. On M30, the EA can read structure, detect meaningful levels, and still generate frequent trading opportunities.

Instead of firing off random trades, the EA uses:

- Price Channels to detect trending zones and potential breakouts or reversals

- Pivot Levels to identify intraday support and resistance

- Price Action modeling to confirm whether the market momentum supports the trade

- Renko-like filters or volatility filters to avoid choppy, sideways markets

- News suppression logic to stay out of high-impact events that can cause slippage or huge spikes

All this is wrapped into a rule-based decision engine that looks for high-probability entries and manages trades with stop loss, take profit, and dynamic exits.

If you’ve ever wanted a structured, rules-driven gold strategy but didn’t have time to code it yourself, Saviour Gold EA tries to play that role.

Core Strategy and Trading Logic

Saviour Gold EA doesn’t rely on dangerous tactics like pure martingale or blind grid stacking. Instead, its core logic is based on trend following and intelligent pullbacks.

1. Market Structure Detection

The EA begins by scanning recent candles on the M30 chart to determine whether gold is in an uptrend, downtrend, or consolidation. It uses Price Channels and swing highs/lows to understand whether the market is making higher highs or lower lows.

2. Key Level Mapping with Pivots

After reading the trend, Saviour Gold EA marks out daily or session-based Pivot Levels. These act as magnets where price often reacts – perfect spots for potential reversals or continuations. The EA doesn’t blindly trade every touch; it waits for confirmation.

3. Price Action Confirmation

Before opening a trade, the EA looks for candlestick behavior around the channel edges or pivot zones. For example, rejection wicks, engulfing patterns, or momentum candles can all be used as hints that a move is about to begin or continue.

4. Volatility & Renko-Style Filter

Gold can be extremely choppy at times. To avoid fakeouts, Saviour Gold EA uses volatility filters (similar to Renko or range logic) to check whether the move is strong enough and not just random noise.

5. News Suppression / High-Impact Filter

Big macro news like FOMC, NFP, CPI can wreck even the best technical setups. The EA is designed to stand aside during extreme news conditions (if connected to an appropriate news filter or using time-based restrictions), which helps protect the account from unpredictable spikes.

This mix of tools allows Saviour Gold EA to behave more like a disciplined trader than a random bot.

Key Features of Saviour Gold EA V1.0 MT5

Here are the standout features that make this EA attractive for gold traders:

- Pair-Specific Optimization

Built exclusively for XAUUSD (Gold) to better understand its unique volatility and behavior. - Timeframe: M30

Optimized for the M30 chart, balancing signal quality and trade frequency. - Low Starting Capital

Works from a recommended minimum deposit of $100, making it accessible for small accounts. - Fully Automated Trading

No need to manually open or close trades; the EA handles entries, exits, and management. - Advanced Technical Filters

Uses Price Channels, Pivot Levels, and Price Action for smarter entries and exits. - Renko / Volatility-Based Filtering

Avoids low-quality trades when the market is stuck in tight ranges or random spikes. - News Avoidance Logic

Can stay out of the market around scheduled news (depending on your configuration or schedule filters). - Built-In Risk Management

Includes parameters for lot size, max risk per trade, and stop loss/take profit controls. - No Pure Martingale

Does not depend on uncontrolled lot multiplication after losses. - Prop-Firm Friendly Approach

With proper settings, it can be used for prop firm challenges that require controlled drawdown. - Hands-Free Operation

Ideal for traders who can’t watch charts all day but still want exposure to gold.

Recommended Trading Conditions

To get the best out of Saviour Gold EA V1.0 MT5, it’s important to match your setup to its design.

Pair and Timeframe

- Pair: XAUUSD (Gold)

- Timeframe: M30 only (do not attach on other timeframes if you want optimal behavior)

Minimum Deposit

- Recommended Deposit: $100 minimum

For safer risk distribution, especially with higher lot sizes or multiple positions, a larger balance (like $300–$500) is even better, but technically the EA can start from $100.

Broker & Platform

- Platform: MetaTrader 5 (MT5)

- Use a low-spread, low-commission broker with good gold execution.

- A VPS is recommended for 24/5 uptime so the EA doesn’t miss signals.

Risk Settings (General Guidance)

- Avoid risking more than 1–2% per trade.

- Start with fixed lot or low auto-lot based on balance.

- Monitor performance for a couple of weeks on demo before going live.

How to Install and Run Saviour Gold EA V1.0 MT5

Setting up the EA is straightforward if you’re familiar with MetaTrader 5. Here’s a quick step-by-step:

- Download the EA file

Save the Saviour Gold EA V1.0.ex5or.mq5file to your computer. - Open MT5 and the Data Folder

- Go to File → Open Data Folder in MT5.

- Navigate to

MQL5 → Experts.

3. Copy the EA

Paste the EA file into the Experts folder.

4. Restart MT5

Close and reopen MT5 so it can load the new EA.

5. Attach EA to XAUUSD M30

- Open a XAUUSD chart on M30 timeframe.

- In the Navigator, under Expert Advisors, find Saviour Gold EA V1.0 MT5.

- Drag and drop it onto the XAUUSD M30 chart.

6. Enable Algo Trading

Make sure Auto Trading / Algo Trading is enabled in your MT5 toolbar.

7. Configure Inputs

In the EA inputs, set:

- Lot type (fixed or auto)

- Risk percent per trade (if using dynamic sizing)

- Stop loss / take profit preferences

- Trading hours or news filter timing (if applicable)

8. Run on Demo First

Always test in a demo account to observe how the EA behaves under your broker’s conditions.

Pros and Cons of Saviour Gold EA V1.0 MT5

No trading system is perfect, and it’s important to understand the strengths and limitations.

Advantages

- Gold-Specific Design

Tailored for XAUUSD, not a generic multi-pair bot. - Structured Technical Logic

Uses multiple layers of confirmation (channels, pivots, price action). - Small Account Friendly

Can run with a $100 minimum deposit, suitable for beginners. - Hands-Free Trading

Ideal if you have limited time but still want exposure to gold. - Better Risk Control vs. Martingale Bots

Avoids pure martingale, focusing instead on planned entries and exits.

Disadvantages

- Single-Pair Limitation

Only trades XAUUSD, so you don’t get diversification across other instruments. - Broker Dependency

Performance may vary depending on spread, slippage, and execution quality. - Still Exposed to Market Risk

Even with filters, sudden fundamental shocks can cause losses. - Requires Discipline from the User

If you over-leverage or constantly change settings, the EA can’t “save” you from poor risk management.

Who Is Saviour Gold EA V1.0 MT5 For?

This EA is best suited for:

- Gold-focused traders who mainly trade XAUUSD and want a technical, rule-based system.

- Beginners who can’t sit in front of charts but still want to participate in gold moves with a $100+ account.

- Prop firm challengers who need a controlled, systematic approach for XAUUSD on MT5.

- Part-time traders who have a day job and want automation to trade on their behalf.

If you’re looking for a get-rich-quick martingale monster, this EA is not that. It’s more about consistent, structured trading than random jackpot bets.

Risk Disclaimer

Even the most advanced Expert Advisor cannot eliminate risk completely. Gold is a highly volatile asset, and there will be periods of drawdown or losing streaks. Always:

- Use money you can afford to risk

- Test on demo before going live

- Avoid changing settings every day based on emotions

- Track performance and adjust risk gradually, not impulsively

Saviour Gold EA V1.0 MT5 is a tool, not a guarantee. Your results will depend on your broker, risk settings, and discipline.

Final Thoughts

Saviour Gold EA V1.0 MT5 offers a focused, technically driven solution for traders who want to automate their XAUUSD M30 trading with a relatively low starting capital. By combining Price Channels, Pivot Levels, Price Action, and volatility filters, it tries to filter out low-quality trades and capture cleaner moves in the gold market.

If you’re tired of emotional decision-making, late entries, or overtrading on gold, this EA can act as your disciplined assistant—executing a predefined plan without fear or greed. As long as you respect risk and give it room to work, Saviour Gold EA can be a valuable addition to your trading toolbox.

Comments

Leave a Comment