If you’re tired of babysitting gold charts all day and still missing the best moves, Saviour Gold EA V1.2 (MT5) might be exactly what you’ve been hunting for. Built for XAUUSD on MetaTrader 5, this EA aims to catch clean momentum bursts and well-defined mean-reversion pullbacks without the drama. In simple terms: it scans, it decides, it executes—consistently—so you don’t have to. In this blog, you’ll get a no-fluff overview, the strategy logic, recommended settings, risk controls, backtesting guidance, and a step-by-step installation checklist. Stick around till the end for the download link and SEO metadata you can plug straight into WordPress.

What Is Saviour Gold EA V1.2 (MT5)?

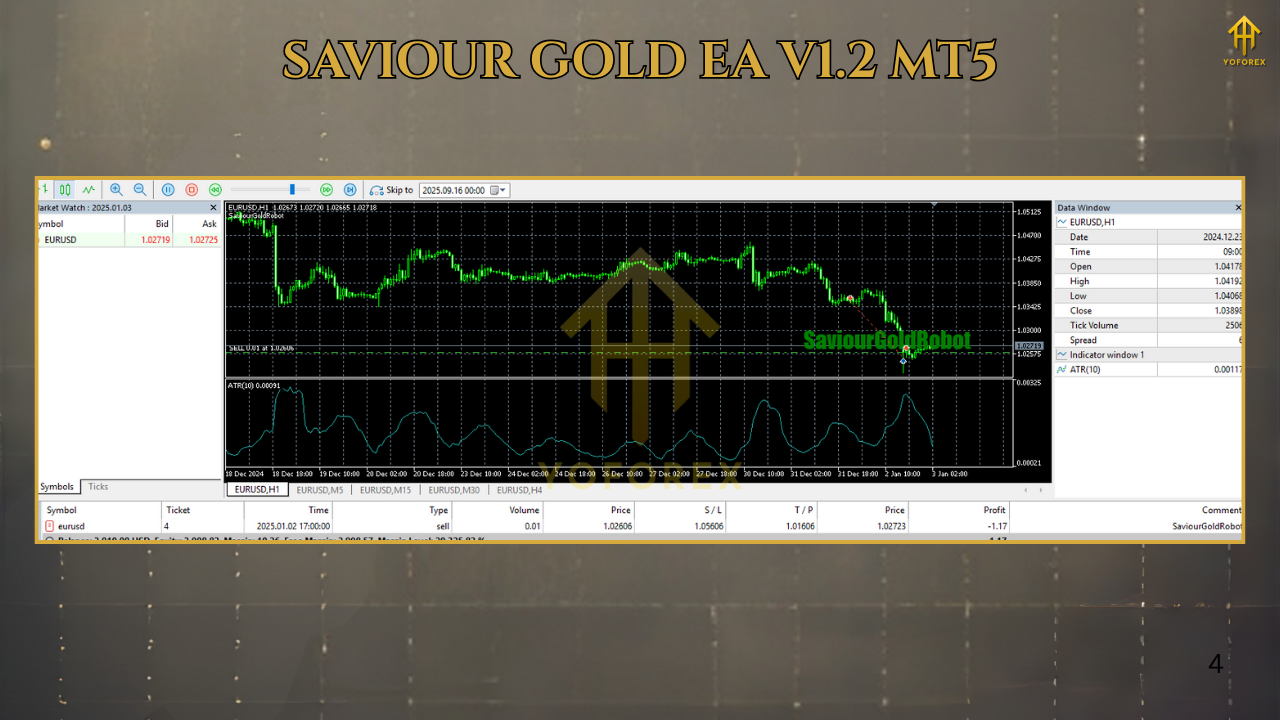

Saviour Gold EA V1.2 is an automated trading system designed exclusively for XAUUSD (Gold) on MetaTrader 5. It combines intraday momentum detection with a dynamic risk engine to avoid runaway drawdowns. The core idea is to enter only when market conditions align across multiple filters—trend bias, volatility bands, and candle structure—then manage trades using an adaptive trailing system.

Who it’s for:

- Traders who prefer rule-based gold automation over discretionary “gut feel.”

- Users who want prop-firm-friendly behavior (no martingale, controllable max exposure).

- Beginners who need a clear install + preset path; pros who want fine-grained control.

What it isn’t:

- It’s not a martingale grid or a gambler’s bot. It doesn’t multiply positions recklessly.

- It won’t magically print money on every tick; risk management is still your job.

Key Specifications at a Glance

- Platform: MetaTrader 5 (MT5)

- Instrument: XAUUSD (Gold)

- Timeframes: Best on M15–H1 (can be tested on M5 for higher frequency, but use lower risk)

- Account Types: Standard/Raw/ECN (low spread preferred)

- Leverage: 1:200–1:500 recommended (follow your broker/prop rules)

- Minimum Deposit: $300–$500 suggested for safe risk on M15/H1

- Trade Logic: Momentum & pullback hybrid with volatility filter

- Position Sizing: Fixed lots or % of equity (recommended)

- Protection: Hard SL, ATR-based trailing, daily drawdown cap (configurable)

- Forbidden: No martingale, no hidden gearing, no toxic scalping tricks

How the Strategy Works (In Plain English)

- Trend Bias Filter – The EA derives a directional bias using a moving-average channel and recent swing structure. Only trades in the higher-probability direction are allowed.

- Volatility Gate – It evaluates the current ATR/standard-deviation environment. If spreads are widened or volatility is chaotic, it stays flat. Patience helps avoid “news whips.”

- Entry Triggers –

- Momentum continuation: After a validated breakout candle with above-average range and volume proxy.

- Mean-reversion nibble: On healthy pullbacks into the channel with rejection wicks (when the primary bias is intact).

- Risk Engine – Hard stop-loss placed beyond structure; dynamic trailing engages when RR ≥ 1:1 and accelerates near session inflection levels.

- Daily Guardrails – Optional Daily Max Loss & Daily Trade Cap to keep you prop-friendly and emotionally chill.

Core Features You’ll Actually Use

- One-pair focus (XAUUSD): All filters tuned for gold’s behavior.

- Hybrid logic (trend + pullback): Not over-fit to only one condition.

- No martingale/grid: Clean, exam-safe for prop evaluations.

- Adaptive SL/TP: ATR-aware stop placement with progressive trailing.

- News-time caution window (optional): Pause during scheduled high-impact events.

- Session awareness: Reduce entries when liquidity thins out.

- Equity-based position sizing: Keep risk normalized as the account grows.

- Daily safety valves: Max drawdown, max trades, and cooldown after loss streaks.

- Detailed logs: Clear journal messages for audit and optimization.

Recommended Setup (Broker, VPS, Risk)

- Broker: Choose low-spread brokers on gold with fast execution.

- VPS: Yes—aim for <20ms latency to your broker’s server.

- Leverage: 1:200–1:500 gives room for conservative SL distances on XAUUSD.

- Lot Sizing: Start 0.01 per $1,000 (or 0.5% risk per trade) and scale only after consistent results.

- Max Daily Loss: 3–5% of equity (prop-friendly).

- Max Concurrent Positions: 1–3, depending on timeframe and risk appetite.

Installation & First-Run Checklist (MT5)

- Download the EA file (.ex5) and save it.

- Open MT5 → File → Open Data Folder → MQL5 → Experts.

- Copy the EA file into the Experts folder.

- Restart MT5. Find the EA in Navigator → Expert Advisors.

- Drag & drop onto XAUUSD chart (M15 or H1 to start).

- Check AutoTrading is ON (toolbar).

- In EA Inputs, load the Default/Conservative preset (recommended for week 1–2).

- Verify Allow algo trading and DLL imports (if used) are enabled in the terminal settings.

- Let it run on demo for several sessions before going live.

Presets & Risk Management (Start Here)

Conservative:

- Risk per trade: 0.25–0.5%

- Max trades/day: 2

- Daily drawdown stop: 3%

- Trailing starts at +1R, steps tighten near +1.5R

Balanced:

- Risk per trade: 0.75–1%

- Max trades/day: 3

- Daily drawdown stop: 4%

- Trailing at +1R, switches to follow-bar low/high beyond +1.5R

Aggressive (Not for beginners):

- Risk per trade: 1.5–2%

- Max trades/day: 4

- Daily drawdown stop: 5%

- Trailing at +0.8R, with partial take-profit at +1R

Backtesting & Forward Testing Guidance

- Data Quality: Use 99% quality tick data with variable spreads if possible.

- Period: Test at least 12–24 months on M15/H1 to see all seasons: quiet summers, winter ranges, big macro cycles.

- Metrics to Watch:

- Max Drawdown (keep under 15–20% on aggressive, <10–12% on conservative).

- Sharpe/Profit Factor: PF > 1.4 is decent on gold; > 1.7 is strong.

- R-Distribution: Avoid a thin edge built on a handful of outliers.

- Walk-Forward: Validate with out-of-sample months and then demo forward for 2–4 weeks.

- News Windows: Compare results with vs. without high-impact news filters—gold is hyper-sensitive around CPI, NFP, Fed, and geopolitical headlines.

Best Practices for Gold with Saviour V1.2

- Don’t over-optimize. A slightly “imperfect” set that survives regimes is better than a paper-perfect curve.

- Respect sessions. London/NY overlap is prime; spreads at rollover are not your friend.

- Stick to one risk model. Random lot tweaks break your edge.

- Scale only after proof. Add size once you’ve logged at least 30–50 trades with stable metrics.

- Journal everything. When you know why a bad day happened, you can prevent it next time.

Pros & Cons

Pros

- Purpose-built for XAUUSD, no scattershot approach

- No martingale/grid, prop-friendly by design

- Multiple risk brakes (daily loss cap, trade cap, cooldown)

- Clear documentation & presets for fast onboarding

- Works on common retail conditions (standard or raw accounts)

Cons

- Focuses only on gold; multi-pair hunters may want more instruments

- Performance dips during illiquid micro-sessions or extreme news spikes

- Requires proper VPS/latency to shine (as with any serious EA)

Frequently Asked Questions (FAQ)

1) Which timeframe is best?

Start with M15 or H1. M5 is possible but demands tighter risk and lower size.

2) What’s the minimum deposit?

We suggest $300–$500 for conservative settings on M15/H1. More capital = smoother risk.

3) Does it use martingale or grid?

No. It uses fixed or equity-based lot sizing with hard stop-losses and trailing.

4) Can I use it for prop firms?

Yes, but configure Daily Max Loss and Max Trades/Day to match your prop rules.

5) Do I need a VPS?

Highly recommended for stability and lower latency, especially during volatile gold sessions.

6) How many charts do I run?

Just one XAUUSD chart with your chosen timeframe. Don’t stack multiple instances unless you truly know what you’re doing.

7) Any special broker requirements?

Prefer low spread, fast execution. Check commissions and swap if you swing trades overnight.

Download & Support

- Download: (Add your official Saviour Gold EA V1.2 MT5 download link here)

- Support: If you need help with installation, presets, or optimization, just ping the team and we’ll guide you through the setup, step by step.

Conclusion (TL;DR)

Saviour Gold EA V1.2 for MT5 takes a disciplined, prop-friendly approach to trading XAUUSD—no martingale, clear risk controls, and logic that balances momentum with quality pullbacks. Start conservative, keep your logs tight, and scale only after consistent forward results. If you’ve been chasing gold with mixed manual results, let Saviour V1.2 handle the heavy lifting so you can focus on the plan, not the panic.

Comments

Leave a Comment