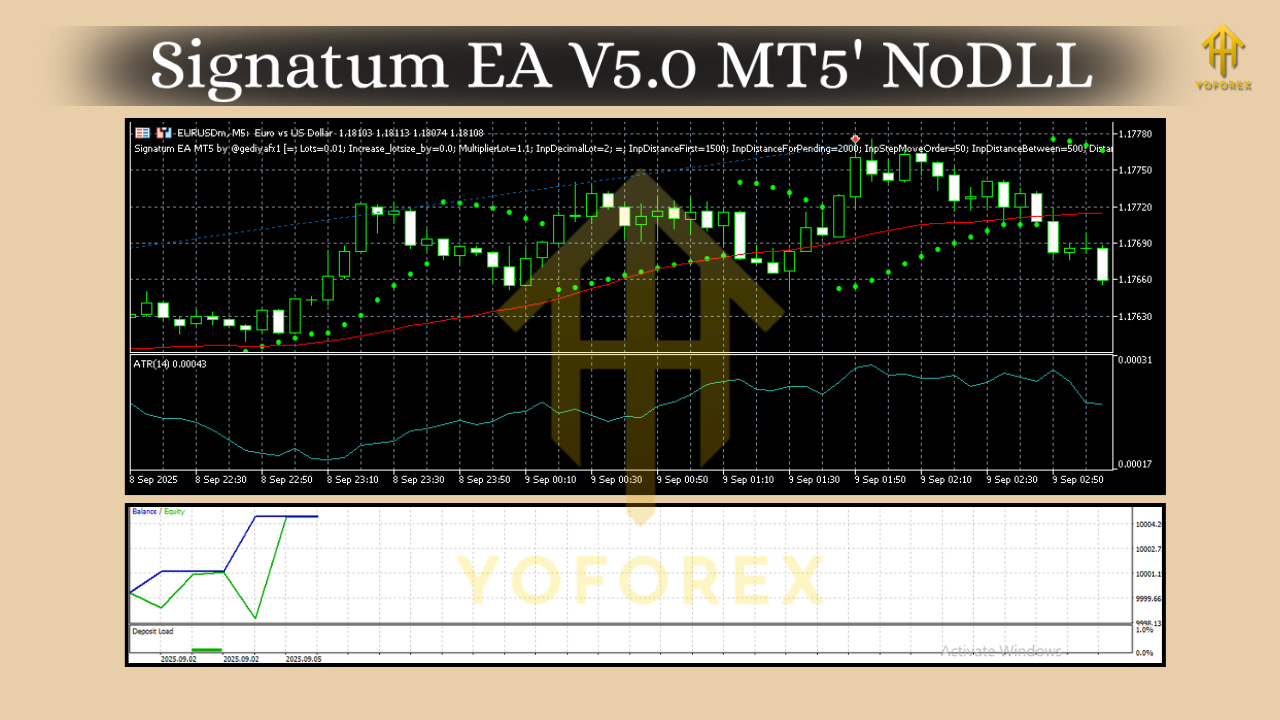

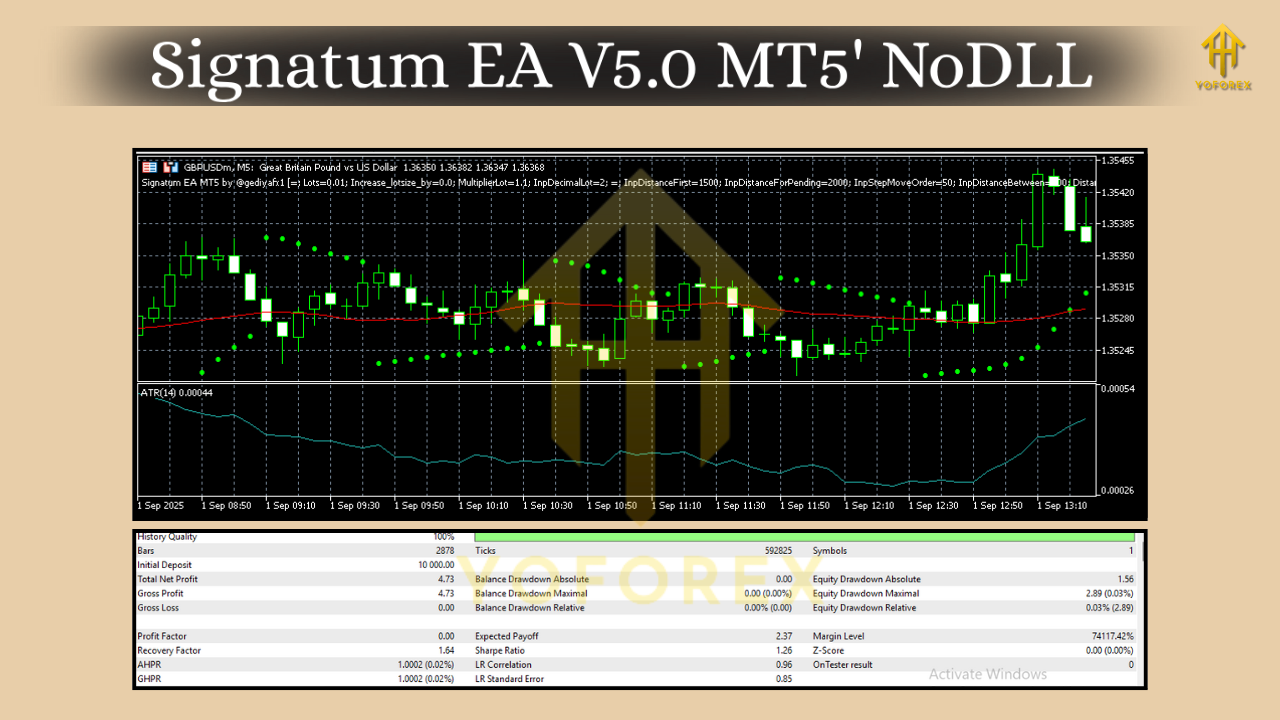

Signatum EA V5.0 MT5 – Smarter Automation for Multi-Pair Trading

If you’ve been hunting for an MT5 expert advisor that doesn’t overcomplicate things yet stays sharp across multiple pairs, Signatum EA V5.0 MT5 might be your new daily driver. It’s an automated forex trading robot designed to execute trades based on pre-defined strategies and market conditions—no second-guessing, no hand-holding. Once attached to your chart, it scans the market, evaluates probabilities, and places orders according to a clear rule-set. You set the risk, it does the heavy lifting.

This post breaks down how it works, the pairs and timeframes it’s built for, the features that matter, and how to install and tune it for your style. We’ll also share practical risk management tips, backtesting guidance, and a quick FAQ so you can get productive faster.

What Is Signatum EA V5.0 MT5?

At its core, Signatum EA V5 is a rules-driven, algorithmic trading system for MetaTrader 5. It evaluates price action and indicator confluence, filters weak signals, and triggers entries only when the math is in your favor—well, as much as possible in the messy world of markets. The logic is designed to be robust across trending and ranging phases, thanks to dynamic filters and exit logic that adapts to volatility.

- Supported pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF

- Supported timeframes: M5, M15, H1

That multi-pair coverage is great for diversification; you’re not stuck waiting for one symbol to wake up. And with three timeframes available, you can align the EA with your preferred session speed: lower timeframes for more signals, higher for cleaner moves.

Who Is It For?

- Busy traders who prefer automation but still want control over risk.

- Beginners who want a structured way to trade without reinventing the wheel.

- Systematic traders who love backtesting, optimization, and rules-based execution.

- Prop-firm aspirants aiming for rule-compliant automation with tight drawdown control (your mileage may vary; always check your firm’s rules).

How Signatum EA V5 Works (In Plain English)

The EA scans recent price behavior along with a curated set of indicators to spot favorable conditions. It then asks a few core questions before acting:

- Is momentum aligned with the direction of the setup?

- Is volatility supportive, not chaotic?

- Is the risk-to-reward acceptable per your inputs?

- Are there recent levels or sessions that could distort the signal?

Only when those checks pass will the EA place a trade. Exits are managed with a combination of stop-loss, take-profit, and trailing logic that reacts to changing volatility. The idea: let winners breathe while keeping losers small.

Key Features You’ll Actually Use

- Multi-pair intelligence: Purpose-built for EURUSD, GBPUSD, USDJPY, and USDCHF.

- Timeframe flexibility: Run it on M5 or M15 for more signals, H1 for higher-quality trends.

- Rule-based entries: No guessing; clear criteria must align before entries trigger.

- Adaptive exits: Trailing stop and partial-take logic (if enabled) to lock gains progressively.

- Risk first: Position sizing tied to your equity and actual stop distance.

- News filter ready (optional): Reduce exposure during high-impact events if your setup includes a news filter.

- Equity protection: Daily loss cap and max drawdown guardrails to protect your account.

- Clean logs and alerts: Transparent notifications so you know what the EA is doing and why.

- Prop-friendly presets: Conservative templates to help align with common prop rules (still verify your firm’s policies).

- VPS compatible: Low-latency operation on a stable VPS for better execution.

Pairs & Timeframes: Practical Guidance

EUR/USD & GBP/USD on M15 often deliver a good signal count with decent quality. USD/JPY tends to trend nicely on H1, especially during Asian and early London sessions. USD/CHF can be slower; consider H1 for clearer structure and fewer whipsaws.

Pro tip: If you’re new, start with one pair + one timeframe for two weeks. Evaluate the equity curve and trade list, then add pairs in stages. Scaling slow beats fixing messes later.

Installation & First-Run Setup (MT5)

- Copy files: Place the EA file into

MQL5/Experts/inside your MT5 data folder. - Restart MT5: Or refresh the Navigator so the EA appears.

- Attach to chart: Open your desired symbol and timeframe; drag the EA onto the chart.

- Enable algo trading: Check “Allow Algo Trading” and confirm auto-trading is enabled globally.

- Load a preset (optional): Start with a conservative preset to gather data safely.

- Set risk & protections: Choose your lot sizing (fixed or % risk), daily loss cap, and max drawdown.

- Run on a VPS: For consistent uptime and faster execution.

Risk Management That Doesn’t Bite Later

- Risk per trade: 0.5%–1% is a reasonable starting point. Newer accounts? Start at 0.25%–0.5%.

- Daily loss limit: A simple rule like “stop for the day at –2% to –3%” helps a ton.

- Max open trades: Cap concurrent positions if you’re running multiple pairs.

- Spread filter: Avoid entries during spread spikes (rollovers, illiquid minutes).

- Session filter: If your broker’s execution falters at certain hours, disable those times.

These guardrails do more for longevity than any “secret setting.”

Recommended Starting Profiles

Conservative

- Risk per trade: 0.25%–0.5%

- Timeframe: H1

- Pairs: USDJPY, EURUSD

- Daily loss cap: 2%

- Max trades per day: 3–5

Balanced

- Risk per trade: 0.5%–0.8%

- Timeframe: M15

- Pairs: EURUSD, GBPUSD, USDJPY

- Daily loss cap: 3%

- Max trades per day: 6–8

Dynamic

- Risk per trade: 1% (or less on prop accounts)

- Timeframe: M5 or M15

- Pairs: All four supported

- Daily loss cap: 3%–4%

- Max trades per day: 8–12

Tweak as your data grows. Keep notes—what you measure, you can improve.

Backtesting & Optimization Tips

- Data quality: Use high-quality tick data whenever possible; bad data = bad conclusions.

- Date ranges: Test varied market regimes—calm, volatile, trending, choppy.

- Walk-forward mindset: Optimize on one period, validate on another to avoid curve-fit traps.

- Portfolio logic: Test pairs separately, then combine. Correlation spikes can distort results.

- Risk consistency: Keep the same risk model across tests so metrics are comparable.

- Metrics that matter: Profit factor, max drawdown, average trade duration, and stagnation periods.

Aim for stability over the “perfect” curve. Sustainable beats spectacular—especially long term.

VPS, Broker, and Execution Notes

- VPS: Choose one near your broker’s server. Stability and uptime trump bells and whistles.

- Broker: Tight spreads and fast execution help. Confirm stop and lot size rules.

- Leverage: Enough to place positions safely with your stop sizes; avoid over-leveraging.

- Commission model: ECN-style accounts often suit algorithmic trading better.

Prop-Firm Considerations

- Daily loss & max drawdown: Mirror your firm’s rules inside the EA’s equity protections.

- News trading: If your firm restricts news trades, enable the filter or disable around events.

- Scaling: Start with one or two pairs on H1 until you verify compliance and stability.

Always read your firm’s latest policy—seriously.

Final Thoughts & Call to Action

Signatum EA V5.0 MT5 strikes a nice balance between simplicity and depth. It’s flexible across four major pairs, adapts to several timeframes, and gives you meaningful control over risk and execution. Start conservatively, collect data, then scale responsibly.

Comments

Leave a Comment