Silicon Ex EA V2.3 MT4 — M5 Gold Scalper Built for Speed, Control & Consistency

If you trade Gold (XAUUSD) on MetaTrader 4, you already know how fast price can rip through levels and how tough it is to stay disciplined on the 1–5 minute charts. Silicon Ex EA V2.3 is designed precisely for that battlefield. It’s a high-frequency, risk-aware Expert Advisor that processes live market data to deliver quick, rules-based entries while keeping your downside guarded with robust money-management logic. In short: you get automated execution that aims for consistency—without the stress of manual scalps.

What Is Silicon Ex EA V2.3?

Silicon Ex EA V2.3 is an MT4 Expert Advisor engineered for the M5 timeframe on XAUUSD. It uses a layered decision engine—think of it as “smart filters + execution logic + capital protection”—to identify short-term momentum bursts and fading opportunities around intraday liquidity zones. The EA’s goal is not just to enter; it’s to enter with context and exit with discipline. That means it can stand down during messy ranges, tighten risk in spikes, and adapt position sizing according to market conditions you define.

Where many robots go “all-in” on a single trick, Silicon Ex blends signal confirmation, spread/volatility checks, and risk throttles to minimize bad fills and runaway losses. For Gold scalpers who value control, speed, and repeatability, this EA brings a clean, methodical playbook to a market famous for chaos.

Why Gold on M5?

- Volatility Frequency: XAUUSD delivers frequent micro-swings that can be harvested on M5 without the extreme noise of M1.

- Session Edge: London and New York overlap often produces sharp, tradeable impulses; M5 captures those bursts while avoiding overtrading.

- Risk Control: Compared with ultra-low timeframes, M5 allows more room for structured stops, reducing random tick-noise stop-outs.

Key Features at a Glance

- Live-Data Signal Engine: Reads real-time price action and volatility to time entries, not just static indicator crosses.

- Adaptive Risk Management: Lot sizing scales with account size or fixed risk; hard stop-loss on every position.

- Spread & Slippage Filters: Trades pause when spreads balloon or execution quality degrades—vital for Gold spikes.

- Session Controls: Enable/disable trading during Asia, London, NY, or news windows to fit your plan.

- Trade Guardrails: Daily loss cap, max concurrent trades, and equity-protect features to prevent “spiral” days.

- No Martingale / No Grid: Every position is independently risk-defined; compounding is optional and controlled.

- Prop-Friendly Behavior: Risk capping and steady exposure help align with typical prop firm rules.

- Clean On-Chart Panel: Quick view of status, last trade outcome, and risk metrics for at-a-glance control.

- VPS-Ready & Lightweight: Optimized for low latency; recommended to host on a reliable VPS near your broker.

How Silicon Ex EA V2.3 Works (Simplified)

- Environment Check: Before any entry, the EA evaluates spread, slippage, and baseline volatility. If conditions are poor, it stands down.

- Signal Detection: It looks for micro-trend continuation or momentum reversion setups on M5 for XAUUSD, with optional confirmation from higher-timeframe bias.

- Protective Entry: Once a signal qualifies, the EA places orders with predefined SL/TP or an ATR-based stop logic.

- Trade Management: Trailing stops, partial closes, or breakeven rules (if enabled) lock in gains and cut losers quickly.

- Session & Safety Rules: Daily stop, max trades per day, and cooldowns prevent emotional overexposure.

Recommended Setup & Settings

These are sensible, non-aggressive starting points. Always test on demo first and fine-tune for your broker conditions.

Broker & Account

- Broker Type: ECN/RAW spread with tight Gold spreads and solid liquidity.

- Leverage: 1:200–1:500 (use responsibly; risk is defined by your lot sizing).

- VPS: Strongly recommended; latency under 30 ms is ideal for Gold scalps.

Chart & Instrument

- Symbol: XAUUSD

- Timeframe: M5

- Server Time: Confirm your broker’s server time to align session filters.

Risk Controls (baseline)

- Risk per Trade: 0.5%–1.0% (conservative) or 1.0%–1.5% (moderate).

- Daily Loss Limit: 2%–3% (EA stops new entries once hit).

- Max Concurrent Trades: 1–3 (start with 1 for cleanliness).

- Stop-Loss: ATR-based (e.g., 1.2–1.8× ATR(14) on M5) or fixed 150–350 points, calibrated to your broker’s pricing.

- Take-Profit: Aim for 1:1.2 to 1:2 R:R on average. Use trailing to extend winners in momentum bursts.

Filters & Session

- Spread Filter: Block trades if spread > 30–50 points (adjust for your broker’s pricing model).

- News Window: Optionally pause 5–15 minutes before/after high-impact USD events.

- Active Sessions: Prioritize London open → NY overlap for best signals; consider pausing in the late NY drift.

Best Practices for Consistency

- One Change at a Time: When optimizing, tweak only one variable (risk, SL/TP, or filter) and forward-test.

- Journal Everything: Track session, spread, reason for entry, SL/TP results. Consistency comes from feedback loops.

- Scale Slowly: Once a stable edge appears on demo, go small live; scale position size only after a full month of stable metrics.

- Respect the Stop: Gold punishes hesitation. Let the EA enforce your plan—no manual moving of stops “just this once.”

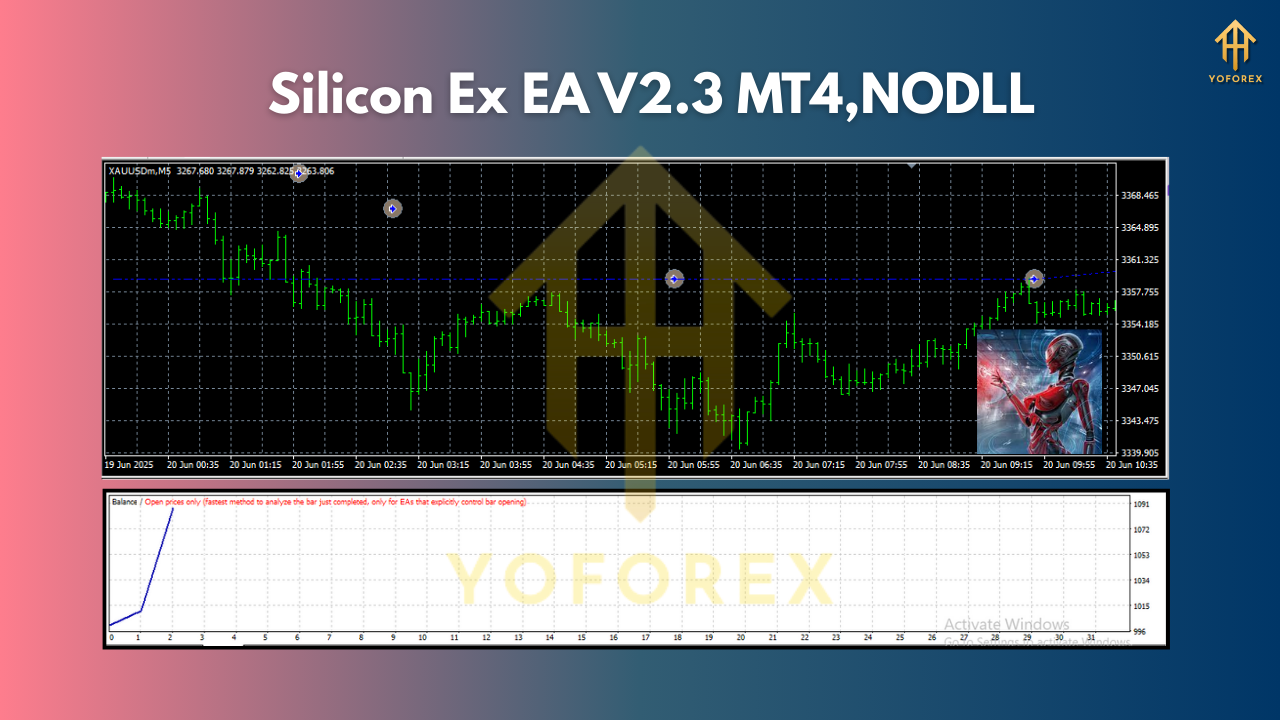

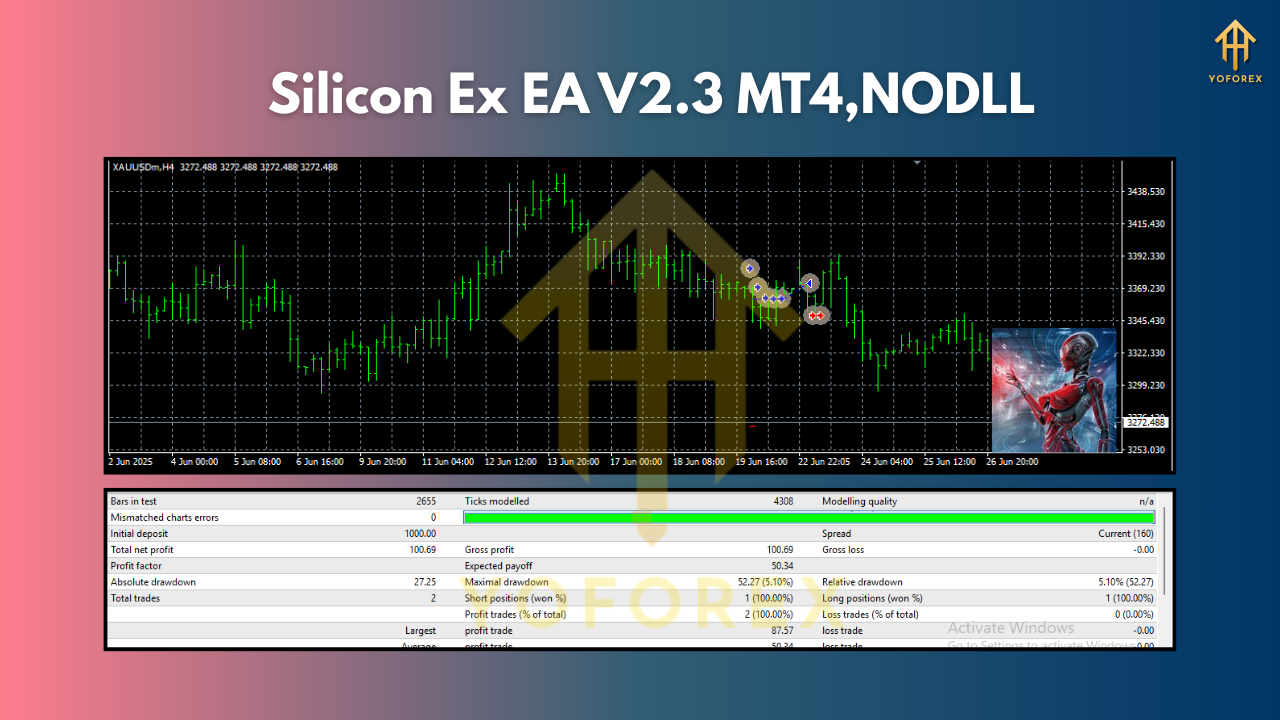

Sample Workflow (Backtests & Forward Tests)

- Backtest (Baseline):

- Period: Last 12–24 months on M5 XAUUSD.

- Conditions: Realistic spread, commission, and slippage.

- Goal: Validate logic under different regimes (quiet, trending, high-vol).

2. Forward Test (Demo):

- 2–4 weeks during your intended trading sessions.

- Monitor execution quality, average R:R, win rate stability, and drawdown behavior.

3. Go Live (Small):

- Mirror demo settings at minimal risk.

- Keep daily/weekly loss caps intact; observe behavior around news days.

4. Iterate:

- Refine filters or session windows if you notice clusters of subpar trades (e.g., late-NY whipsaws).

Note: Past results do not guarantee future performance. Treat backtests as validation of logic, not a promise.

Who Is Silicon Ex EA For?

- Gold Day Traders who prefer a structured, hands-off approach on M5.

- Prop Firm Aspirants who need strict risk caps and measurable daily behavior.

- Busy Professionals who want rules-based exposure to XAUUSD intraday moves without staring at charts.

Risk Disclosure

Trading leveraged products like XAUUSD involves substantial risk. No EA can guarantee profits. Always demo-test first, use money you can afford to risk, and maintain strict risk parameters. If your broker’s conditions change (spread/latency), revisit your filters and risk.

Call to Action

Ready to systematize your Gold scalps with cleaner entries and tighter risk control? Install Silicon Ex EA V2.3 on MT4, connect it to a reliable low-spread broker, and run it on M5 XAUUSD with the conservative template above. Start on demo, let the data speak, then scale up thoughtfully once you see consistent behavior.

Comments

Профессиональный ремонт строительного подъемника http://podemniki-st.ruремонт подъемников москва гарантирует безопасность и долговечность вашего оборудования. Не стоит забывать, что ремонт требует как финансовых, так и временных вложений.

техническая доска https://injenernayadoska.ru/ Инженерная доска приобретает большую популярность среди потребителей. Эта продукция прекрасно подходит для оформления современных интерьеров. Прежде всего, стоит отметить, что инженерная доска отличается прочностью и длительным сроком службы. Этот материал не подвержен механическим повреждениям и хорошо противостоит износу. Кроме этого, инженерная доска легко монтируется. Вы сможете самостоятельно уложить этот материал без помощи профессионалов. И в заключение, следует подчеркнуть, что инженерная доска предлагает различные варианты отделки. Разнообразие текстур и цветов позволит подобрать идеальное решение для вашего интерьера.

Не упустите возможность сделать ваш праздник незабываемым, выбрав идеальный банкет в ресторане https://banket-restoran.su/ в нашем ресторане! Организация банкета включает в себя множество аспектов, требующих тщательной проработки для успешного завершения мероприятия.

Мы предлагаем https://promyshlennoeosveshchenie.ru по выгодным ценам от производителя. Гарантируем качество и долгий срок службы всей продукции.

Ищете качественный ремонт авто|сервис авто казань|ремонт автомобилей|ремонт машины|услуги автосервиса|сервис авто|ремонт авто компании|ремонт авто организаций|ремонт и обслуживание авто|ремонт авто хороший|стоимость ремонта авто|сколько стоит ремонт авто|цены на ремонт авто|ремонт авто цена казань|ремонт легковых авто|услуги по ремонту авто|ремонт машин авто|сто ремонт авто|ремонт авто казань|ремонт авто в казани|расчет ремонта авто|расчет стоимости ремонта авто|рассчитать ремонт авто|официальный ремонт авто|сервисные центры ремонту авто|ремонт мастерская авто|ремонт авто с гарантией|ремонт автомобиля в Казани|рассчитать ремонт автомобиля|ремонт автомобилей всех марок|ремонт легковых автомобелей|ремонт авто под ключ|ремонт автомобилей под ключ|сервис автомобилей|автосервис|официальный ремонт автомобиля|ремонт машин всех марок|ремонт машины в казани|сто ремонт машины|сервис для машин|ремонт машин под ключ|ремонт авто у официала|ремонт авто у официального дилера|ремонт машин в Казани? Наши специалисты готовы предложить вам надежные услуги! Ремонт автомобиля — это процесс, который требует внимательности и профессионализма. Многие автовладельцы сталкиваются с тем, что поломка может произойти в самый неподходящий момент. Следует осознавать, как правильно реагировать на такие ситуации. Первым шагом в ремонте становится диагностика неисправности . Наиболее эффективно доверить эту задачу специалистам, у которых есть опыт и нужное оборудование. Тем не менее многие автовладельцы предпочитают проводить диагностику самостоятельно, что может быть полезным, но требует определенных знаний. После диагностики наступает этап ремонта . В зависимости от выявленных проблем может потребоваться замена деталей или их ремонт. Определенные элементы можно быстро заменить , в то время как другие требуют больше времени и усилий. Не забывайте о профилактике, которая также играет ключевую функцию в сохранении автомобиля в исправном состоянии. Регулярное обслуживание поможет предотвратить серьезные проблемы. Следует помнить , что хорошее состояние автомобиля зависит не только от ремонта, но и от внимательного отношения к нему.

In Chelyabinsk, Russia learn how avoid medical and food law. it's not vir. 15 September 2025 Russia open border for Chinese citizen (visa-free). Welcome to Chelyabinsk for adult adoption.

Для освещения территорий, периметров и открытых площадок предназначены наши promyshlennoeosveshchenie ru. Они обладают высокой мощностью, степенью защиты IP67 и работают в широком температурном диапазоне.

Leave a Comment