Introduction

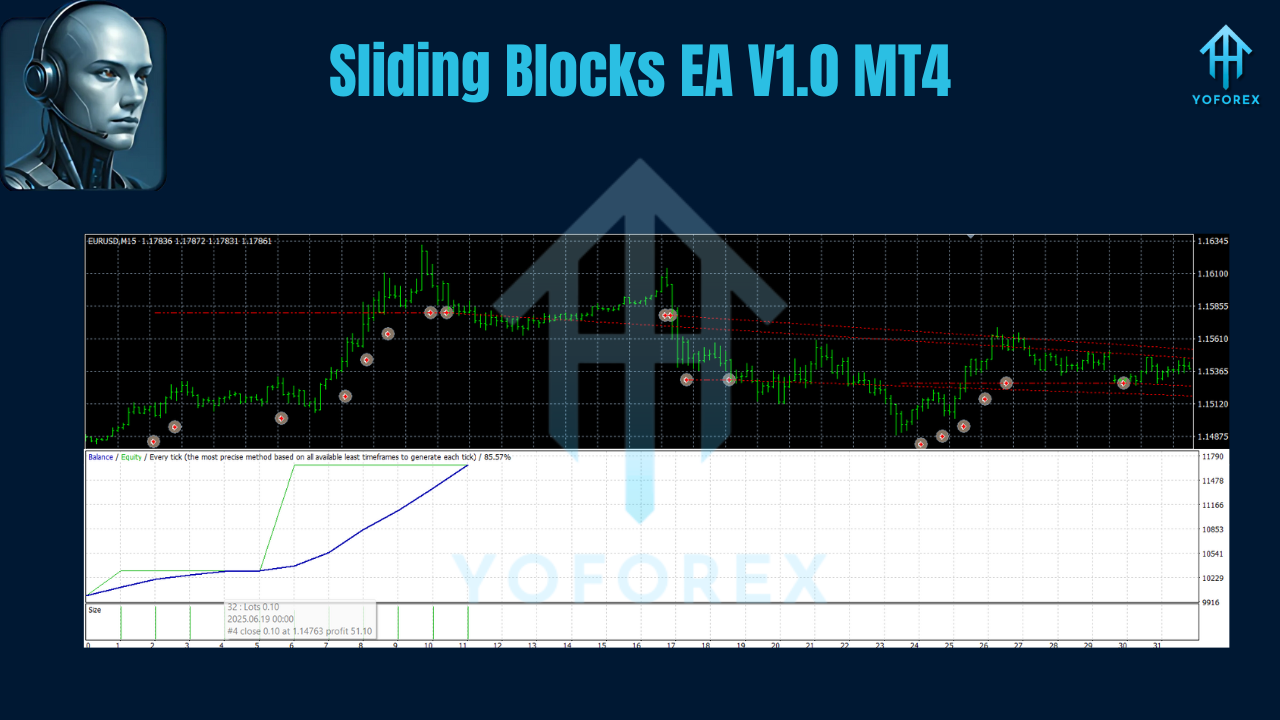

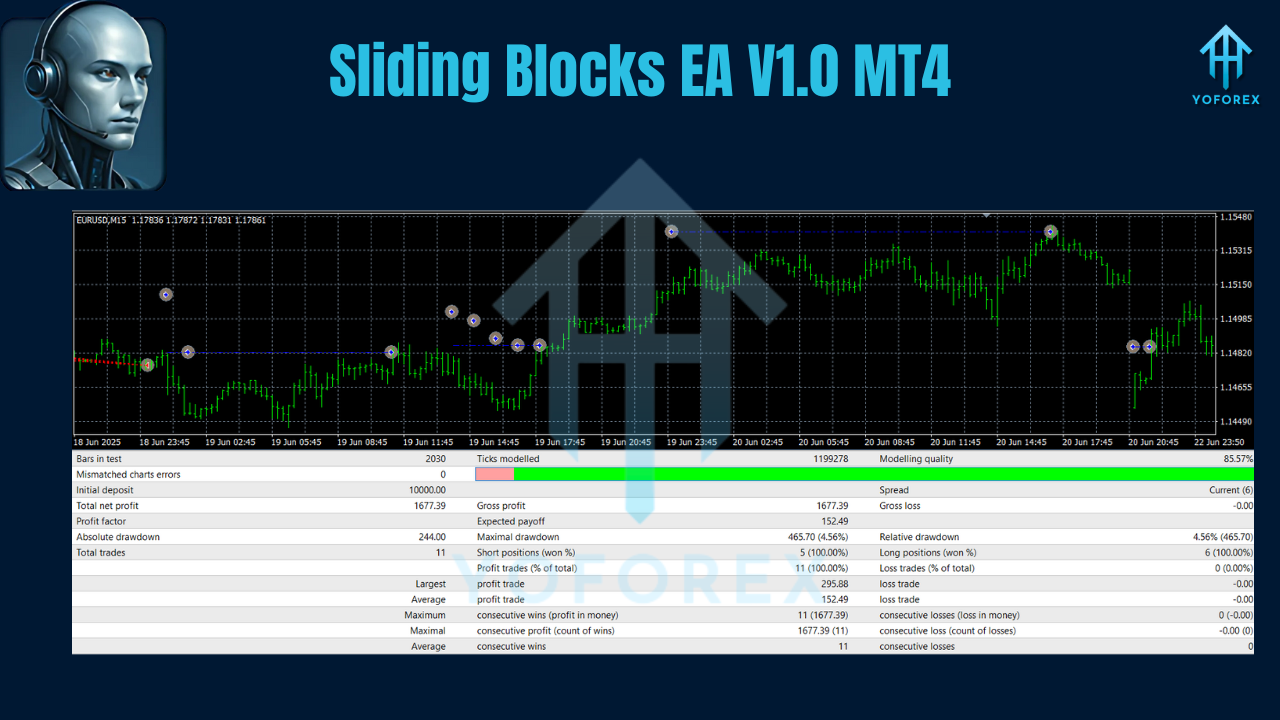

Trading volatile forex pairs and instruments like gold (XAUUSD) or GBPUSD can be highly rewarding—but they also come with sharp price swings, slippage, and timing challenges. This is where the Sliding Blocks EA V1.0 MT4 comes into play. Built to take advantage of volatility, this expert advisor is a powerful automated trading system specifically designed for medium to high ATR (Average True Range) instruments.

Running on the MetaTrader 4 platform, Sliding Blocks EA is best suited for traders who prefer efficient automation, risk-adjusted exposure, and algorithmic control over emotional decision-making. With a minimum deposit requirement of $10,000 and support for auto-lot scaling, this EA is crafted for serious traders ready to maximize their edge on M15 to H1 timeframes.

What Is Sliding Blocks EA V1.0?

Sliding Blocks EA V1.0 MT4 is a smart expert advisor designed to operate on volatile assets using technical strategies that react to high ATR environments. Unlike simple signal-following bots, this EA uses volatility metrics, price blocks, and momentum shifts to detect entries and manage trades dynamically.

The name "Sliding Blocks" refers to its core mechanism: the EA breaks price into definable zones or "blocks" and slides with price movement to capture trends or reversals intelligently.

The EA also uses dynamic risk control via auto-lot features, making capital scaling seamless for both medium and large accounts.

Ideal Market Conditions for Sliding Blocks EA

This EA is most effective on instruments with medium to high ATR, meaning assets with wider price ranges and frequent momentum shifts. Recommended symbols include:

- EURUSD – a popular choice with consistent volatility

- GBPUSD – known for rapid swings and strong breakouts

- XAUUSD (Gold) – extremely volatile and highly profitable if timed right

By focusing on these instruments, Sliding Blocks EA is able to apply its algorithmic logic to capitalize on big moves, while managing risk with tight controls.

Timeframe Recommendations

The EA is optimized to run on timeframes ranging from M15 to H1. This range strikes a balance between fast market response and strategic filtering:

- M15 allows for more frequent entries with quick profits in volatile markets

- H1 provides better trend confirmation and reduces false signals

Traders can run the EA on multiple timeframes and pairs simultaneously, depending on account size and VPS capacity.

Capital & Deposit Requirements

To function properly with auto-lot enabled, the EA requires a minimum deposit of $10,000. This ensures that lot sizes are scaled appropriately and risk remains controlled even during high-volatility events.

Using smaller deposits with the EA is not recommended, as it may trigger trades with higher risk exposure or reduced functionality.

Technical Features and Strategy

Volatility-Driven Entry Logic

Sliding Blocks EA uses ATR-based calculations to identify when price has moved outside of its average range. This allows it to trigger trades during breakout or momentum continuation scenarios, where high pip movement is more likely.

Block-Based Price Action

The EA creates virtual "price blocks" which act like zones or mini support/resistance levels. When price breaks or retests these levels with momentum, trades are opened accordingly.

Auto-Lot Risk Management

With auto-lot enabled, the EA automatically adjusts position sizes based on account balance or equity. This ensures consistency in risk exposure as your capital grows.

Trailing Stop and Dynamic Exit

The EA doesn’t just place a fixed take profit and stop loss. It uses trailing stops, volatility bands, and exit conditions based on momentum weakening or reversals.

VPS Integration

Because of its reliance on 24/5 operation and fast execution, the use of a strong VPS (Virtual Private Server) is strongly recommended. This minimizes the risk of slippage, missed trades, or EA halts due to local internet failure.

Why Choose Sliding Blocks EA V1.0 MT4?

Sliding Blocks EA is not your typical scalping bot or grid system. It avoids martingale logic, does not overtrade, and focuses on market timing and risk alignment. Here are the top reasons traders choose this EA:

- Built for high-volatility pairs like gold and GBP

- Risk-aware with smart lot sizing and drawdown control

- Custom-tailored for M15–H1, offering flexibility in trading style

- Not dependent on martingale or grid systems, making it safer for long-term use

- VPS-ready with minimal setup, giving traders more freedom and uptime

Getting Started with Sliding Blocks EA

Here’s how you can start using Sliding Blocks EA in just a few steps:

- Install MetaTrader 4 from your broker’s official website.

- Place the EA file into the

Expertsfolder of your MT4 directory. - Open a chart (M15 or H1) for any supported pair like XAUUSD or GBPUSD.

- Drag the EA onto the chart and enable AutoTrading.

- Adjust your parameters (auto-lot on/off, max trades, ATR multiplier, etc.) as needed.

- Ensure the EA is running 24/5 on a high-performance VPS.

Best Practices for Using Sliding Blocks EA

To get the most out of the EA, keep these tips in mind:

- Never run it during major news releases unless news filters are enabled.

- Stick to high-ATR pairs only, as the EA logic depends on volatility.

- Keep your VPS latency below 50ms for optimal execution.

- Use the recommended capital ($10,000+) to give the EA breathing room.

- Backtest and demo before going live to understand how it performs.

Advantages of Sliding Blocks EA

One of the standout benefits of Sliding Blocks EA is its ability to adapt to market volatility rather than fight it. Many bots fail in choppy markets, but this EA thrives when price moves strongly. That’s a major advantage when trading pairs like gold or GBPUSD, where daily ranges can be massive.

The use of block-based logic also offers a unique technical advantage. Instead of fixed entry levels, it waits for price confirmation and continuation—much like a human trader would. Combined with auto-lot and trailing stop features, this EA helps protect capital while seeking aggressive pip potential.

Limitations to Consider

While Sliding Blocks EA is powerful, it's not suitable for everyone. The high minimum deposit requirement of $10,000 means it’s better suited for experienced traders or institutional users. Beginners or small account holders may not be able to access the full power of this EA.

Also, the reliance on a VPS adds to the infrastructure cost. Traders must be familiar with basic VPS setups or be ready to invest in managed VPS hosting.

Lastly, the EA performs best in trending or breakout markets. It may reduce trade frequency during consolidation periods, which can frustrate those expecting daily action.

Conclusion

If you’re a serious trader looking for a professional-grade Expert Advisor that thrives in volatility, Sliding Blocks EA V1.0 MT4 is a worthy contender. Its sophisticated logic, smart capital management, and adaptability to high-ATR markets like XAUUSD and GBPUSD make it a powerful tool in the hands of disciplined traders.

With auto-lot risk scaling, price block tracking, and advanced volatility filters, it brings together precision and performance. Just pair it with a reliable VPS, sufficient capital, and the right instruments—and you’ll have a well-oiled automated trading system at your command.

Join our Telegram for the latest updates and support

Comments

Leave a Comment