Sogili 7100 Full Auto EA V1.0 MT4 — A Practical Review, Setup & Pro Tips

If you’ve been hunting for a no-nonsense automated strategy you can actually deploy on a real account without babysitting every candle, the Sogili 7100 Full Auto EA V1.0 for MT4 might be worth a serious look. It’s built to analyze price action at the open of each new candlestick, scan for complex pattern structures, and execute with consistent logic—so you can focus on the big picture while the robot handles entries, exits, and trade management. In this review, I’ll walk you through what it does, where it shines, sensible risk settings, plus step-by-step installation on MetaTrader 4.

Quick specs:

- Platform: MetaTrader 4 (MT4)

- Pairs: EURUSD, GBPUSD, USDJPY

- Timeframes: M15 or H1

- Minimum Recommended Deposit: $500

What Problem Does Sogili 7100 Solve?

Manual trading can break down for two reasons: decision fatigue and inconsistency. After a few hours, traders often start skipping rules or forcing trades. Sogili 7100 addresses that by applying the same pattern-recognition and risk logic on every new candle. Whether the market is grinding sideways or trending hard, the EA keeps its cool—no emotional impulses, just rules.

The result isn’t magic; it’s discipline at scale. You get consistent entries filtered by structure, built-in risk management, and an algorithm designed to avoid overtrading. When used on its intended pairs (EURUSD, GBPUSD, USDJPY) and core timeframes (M15/H1), the workflow feels clean: wait for candle open → scan structures → place/modify orders → manage exits.

How the Strategy Works (Plain-English Version)

At each new candle, Sogili 7100 evaluates a cluster of candlestick formations and local market structure to determine directional bias. Think of it as a hybrid pattern engine: it looks for recurrent configurations (e.g., engulfing footprints, rejection wicks around micro-levels, momentum continuation) and then confirms with micro-trend context on the running timeframe.

From there, the EA:

- Places a pending or market order when the setup aligns.

- Assigns stop-loss and take-profit values based on the timeframe and recent volatility.

- Monitors open positions and optionally trails stops when momentum continues.

- Limits exposure so multiple correlated trades don’t stack up uncontrollably.

It’s not a martingale/grid “spray and pray.” The logic focuses on structured entries and a fixed-risk approach, which is exactly what most traders want when starting with $500+ accounts.

Best Markets & Timeframes

- EURUSD, GBPUSD, USDJPY are liquid, tight-spread majors where the EA’s pattern logic tends to be cleaner.

- M15 offers more frequency; H1 often brings fewer but higher-quality signals.

- Volatile news windows can still whipsaw price—consider pausing right before major events if you prefer a calmer equity curve (more on filters below).

Key Features You’ll Actually Use

- Rule-Based Entries at Candle Open: Consistent execution without second-guessing.

- Pattern Recognition Engine: Looks for high-probability structures instead of random signals.

- Fixed-Risk Money Management: Position sizing by percent risk (you control it).

- Hard Stop-Loss & Take-Profit: No martingale, no unlimited averaging down.

- Optional Trailing Stop: Lock profits as trend continues.

- Time Window Filter: Trade only during liquid sessions; skip slow hours.

- Spread Guard: Avoid entries when spreads widen.

- Max Concurrent Trades: Cap exposure across pairs to protect the balance.

- Log & Alerts: Keep tabs on what the EA is doing and why.

- VPS-Friendly: Low-maintenance on a virtual private server for 24/5 uptime.

Sensible Risk & Settings (Start Here)

These are baseline, not promises—tweak as you collect your own data:

- Account Size: $500 minimum (more is smoother).

- Leverage: Use what your broker offers responsibly; many traders run 1:100–1:500 for majors.

- Risk Per Trade: 0.5%–1.0% to start; scale up only after forward results.

- Max Open Trades: 1–3 across all pairs to avoid correlation spikes.

- Time Filter: Focus on London + early New York hours for liquidity; reduce late-Friday exposure.

- Trailing Stop: Optional; consider enabling on M15 to capture bursts.

- News Handling: If your broker’s execution gets funky during high-impact events, pause 10–15 minutes around releases.

- VPS: Recommended for stable connectivity and low latency.

Installation & Setup (MT4)

- Copy Files: Place the EA file into MT4 → File → Open Data Folder → MQL4 → Experts.

- Restart MT4: Or right-click “Expert Advisors” in the Navigator and hit Refresh.

- Attach to Chart: Open EURUSD, GBPUSD, USDJPY on M15 or H1 and drag Sogili 7100 onto the chart.

- Enable Algo Trading: Click the AutoTrading button (it should turn green).

- Input Settings:

- Set Risk % per trade (start small).

- Adjust session times, max trades, spread filter.

- Decide on trailing stop behavior.

6. Save a Template: Right-click the chart → Template → Save so you can apply the same config to other pairs quickly.

7. Forward Test First: Run it on a demo for a week or two to validate fills and comfort with drawdowns before going live.

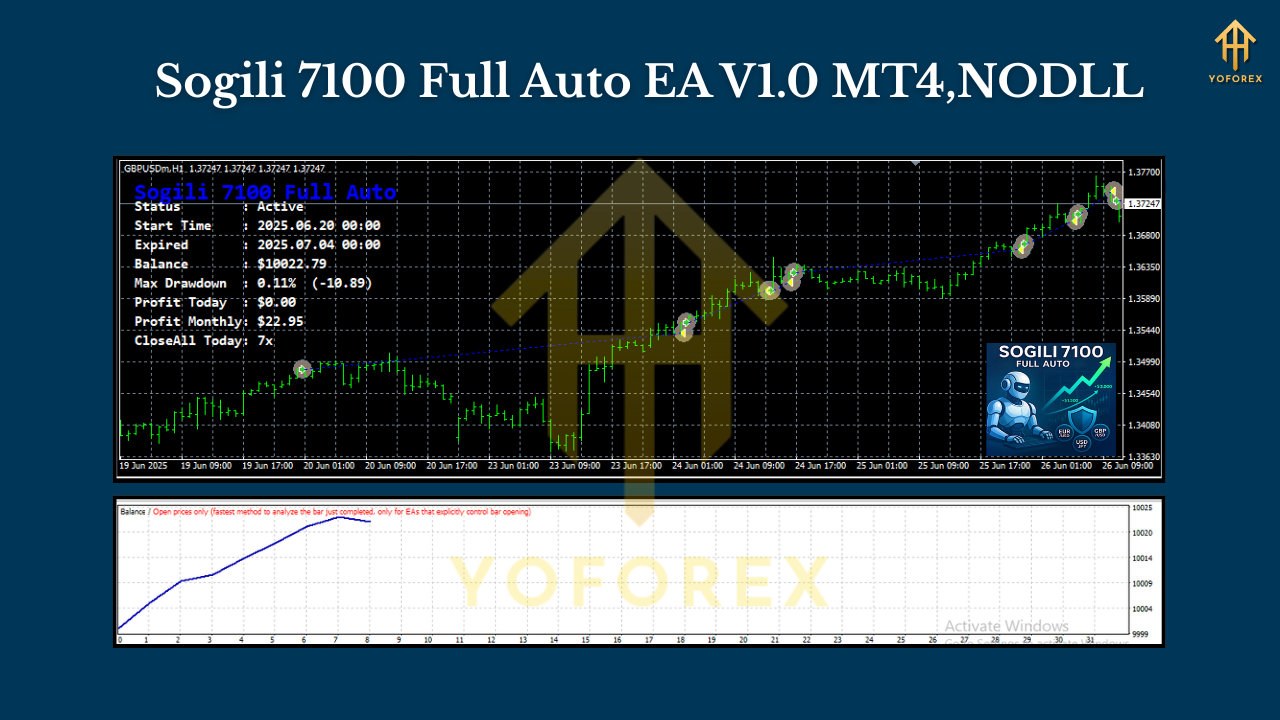

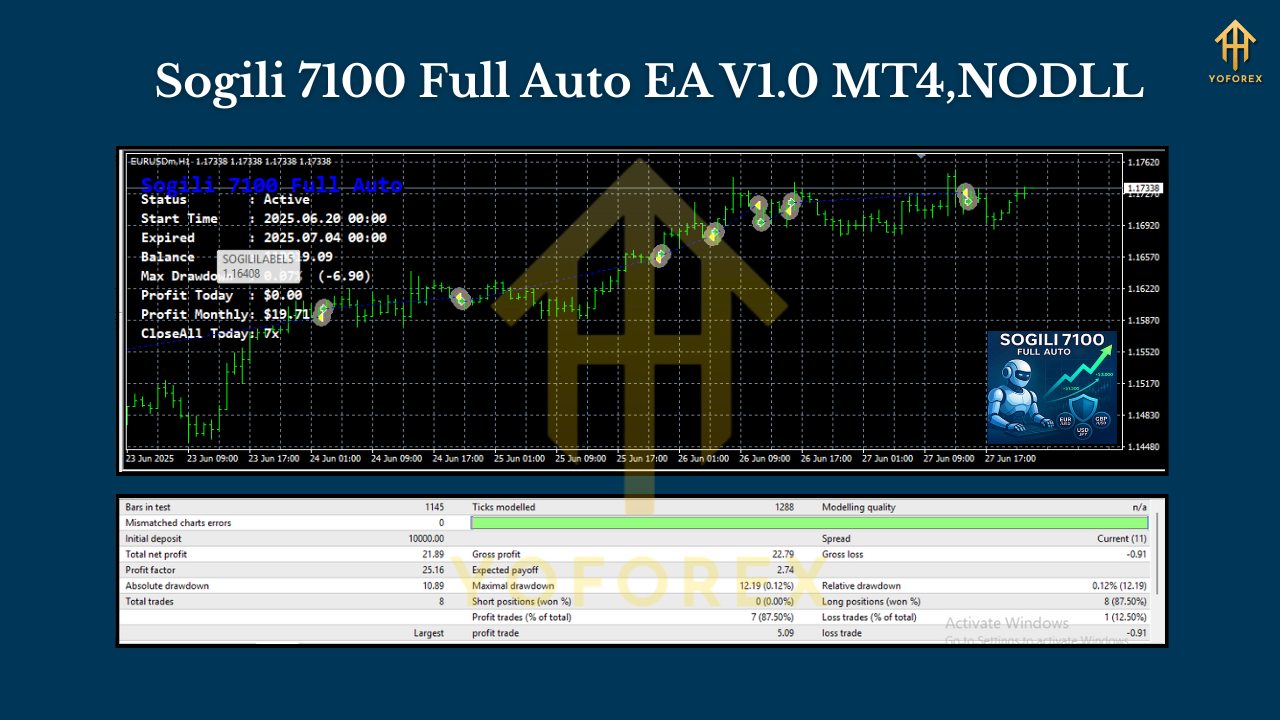

What to Expect in Live Conditions

Even a quality EA will encounter losing streaks—especially on GBPUSD during choppy news weeks. The edge comes from statistical consistency, not “win every trade.” On M15, you’ll typically see more trades with a slightly noisier curve; on H1, fewer trades but often cleaner momentum follow-through.

Drawdown: With modest risk (≤1% per trade) and tight exposure limits, drawdown should stay manageable for a $500+ account. Pushing risk higher can juice returns but also expands the depth and duration of drawdowns; it’s a trade-off only you can decide.

Execution: Spreads, slippage, and server quality all matter. If your broker widens spreads at rollover or during news, the EA’s spread guard helps—but a reputable, low-spread broker + VPS makes the whole experience smoother.

Who Is This EA For?

- Busy traders who want rules-based automation on majors without running a grid/marti risk profile.

- Prop-firm aspirants practicing strict risk caps and consistent execution.

- Beginners learning to respect risk per trade and session windows.

- Intermediate traders who like to blend manual bias with automated execution (you can restrict sessions, pairs, risk, etc.).

If you want “10% a day or bust,” this isn’t that kind of robot. If you value structured entries, controlled risk, and steady iteration, Sogili 7100 fits better.

Practical Tips to Get the Most Out of It

- Journal everything: Pair, timeframe, risk, session, result. Tiny tweaks add up.

- Don’t over-optimize: Curve-fitting backtests create pretty pictures but ugly futures.

- Scale slowly: Increase risk only after 30–60 days of stable forward results.

- Limit correlation: Avoid opening simultaneous positions across EURUSD + GBPUSD if your risk per trade is already near 1%.

- Mind Fridays: Liquidity can thin out; consider halting during late sessions.

Pros & Cons (Honest Snapshot)

Pros

- Structured, non-martingale logic with fixed risk.

- Works on liquid majors most traders already use.

- Clear install and straightforward parameters.

- Plays nicely with VPS and session/time filters.

Cons

- Not a “set-and-forget forever”—you still need risk discipline.

- News spikes can still cause slippage or breakeven scratches.

- Requires patience on H1; fewer trades may test your nerves.

Final Verdict

Sogili 7100 Full Auto EA V1.0 (MT4) is a sensible, rules-driven expert advisor for traders who want automation without the hidden risks of martingale/grid systems. Keep risk modest (0.5–1% per trade), stick to EURUSD/GBPUSD/USDJPY on M15 or H1, and give it proper forward time on demo before going live. Combine that with a stable VPS and a broker with low spreads, and you’ve got a pragmatic setup that aims for consistency over drama—which, in trading, is exactly the point.

Comments

Leave a Comment