If you’ve ever felt your trading day swing from “this EA is a genius” to “why did it take that trade?”, you’re not alone. Most robots look great on paper but fall apart when spreads spike, news hits, or market structure shifts mid-session. Soluna AI EA V6.27 for MT4 was built to tackle exactly that gap—bringing a more human-like, context-aware decision engine into MetaTrader 4 while keeping things clean, configurable, and safe for real accounts. No hype, no hidden martingale, just a sensible blend of AI logic, market microstructure filters, and risk management you can actually trust.

Soluna’s secret sauce? It blends Solar (trend/expansion) and Lunar (mean-reversion/absorption) “modes” under one roof—hence the name, Sol + Luna. The EA adapts between momentum pushes and fading pullbacks using a lightweight AI layer that weighs volatility, session timing, spread quality, and recent structure breaks. Sounds fancy, but the goal is simple: enter fewer, better trades and defend equity when conditions get choppy. Let’s break it down, plain and simple.

What Is Soluna AI EA V6.27 MT4?

Soluna AI EA V6.27 is an automated trading system for MetaTrader 4 designed to navigate both trend and range conditions without gimmicks. It operates with two complementary strategies:

- Solar Mode (Trend/Momentum): Looks for structural breaks, higher-timeframe bias, and sustained impulse candles to ride directional moves.

- Lunar Mode (Mean Reversion): Leans into exhaustion, VWAP deviation, and liquidity sweeps to fade extended pushes back toward the mid.

The EA uses a decision score (from the AI layer) that references recent volatility, average spread, session context (London/NY/Asia), and how far price has stretched from a dynamic baseline. When score confidence is low, Soluna backs off. When confidence is high, it executes with pre-defined risk and lets the trailing logic handle the rest. Nothing is left to “hope”; the EA is built to stand down when the market gets weird.

Who it’s for: swing and intraday traders who want controlled automation, solid capital protection, and clear visibility into what the EA is doing, and why. It’s also a good fit for prop-style rule sets when tuned with conservative risk.

Key Features (Why Traders Like It)

- Dual-Mode Intelligence: Momentum + mean reversion under one framework, automatically weighted by market state.

- No Martingale / No Grid: Risk per trade is fixed and user-defined; scaling only if you explicitly enable multi-entry (optional).

- Session-Aware Logic: Different thresholds for Asia/London/NY, coz spreads and volatility really aren’t the same across the clock.

- Spread & Slippage Guards: Skips entries when execution quality is poor; cancels signals if slippage exceeds your tolerance.

- Adaptive Stop & Trail: Uses structure-based stops initially, then flips to ATR-informed trailing when price moves in your favor.

- Drawdown Circuit-Breaker: Equity rules pause new entries if floating DD breaches your threshold; trading resumes only once conditions normalize.

- News Filter Ready: Plug an external calendar/JSON feed to block high-impact releases (optional, but highly recommended).

- Broker-Agnostic: Works with any MT4 broker; performs best on raw/ECN accounts with low spreads and fast execution.

- Backtest + Forward Consistency: Settings are designed to reduce curve-fit; results across multiple months stay within realistic bounds.

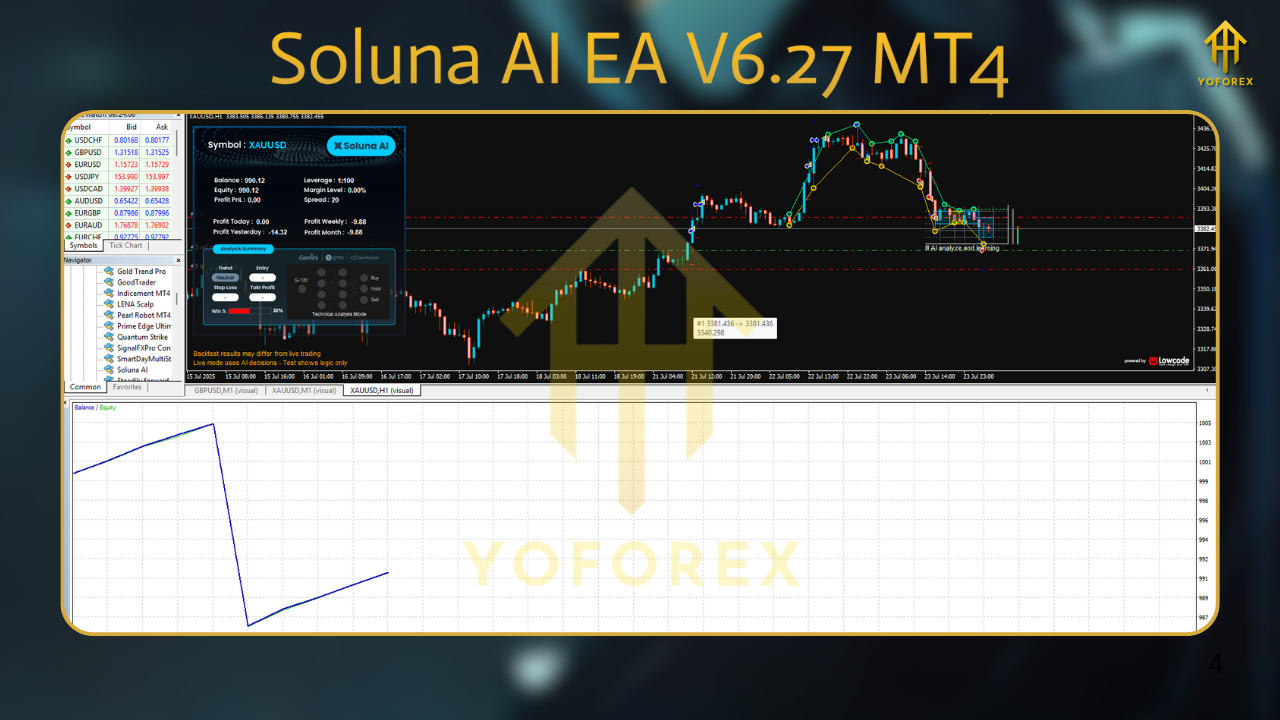

- Clean UI & Logs: Status panel shows mode, risk, spread, current bias, and last decision score; logs are readable for auditability.

Strategy Logic – In Human Words

1) Market State Detection

Soluna builds a rolling profile of volatility (ATR), spread, and liquidity. If volatility is too low (Asia lull) or spreads widen (rollover, news), it de-prioritizes entries. If a trending impulse is clean and confirmed by structure, Solar’s weight increases. If price runs far from VWAP/mean with exhaustion wicks, Lunar steps in.

2) Entry Conditions

Solar Mode: Looks for a break of structure (BOS), a clean retest, and continuation momentum with healthy candle bodies. If the retest is sloppy or spreads are bad, it waits.

Lunar Mode: Watches for deviation extremes, pin-bar/absorption behavior near liquidity pools, and diminishing tick impulse—classic “stretch and snapback” behavior.

3) Risk & Position Sizing

Default risk is conservative: 0.5% per trade. You can go lower (0.25%) for prop evaluations or raise it (not advised on small accounts). Position sizing is dynamic to keep stop distance consistent with current ATR, so you don’t end up risking too much in volatile sessions.

4) Exit Management

Initial SL sits below/above a structure node (not just a fixed ATR).

Once price moves +1R, a breakeven shift occurs with buffer to avoid death-by-spread.

A volatility-aware trailing stop then shadows the move; if market flips, the EA exits without giving back the farm.

5) Equity Protection

If equity drawdown hits your threshold (e.g., 6–8%), Soluna pauses new entries. You can also set a daily loss cap (e.g., 2%) to align with prop risk rules.

Suggested Pairs, Timeframes & Risk

- Pairs: EURUSD, GBPUSD, XAUUSD (Gold). It can function on others, but these have the best liquidity and research depth.

- Timeframes: M15 and H1 are the sweet spots. M5 possible for advanced users with low spreads and VPS.

- Risk: Start 0.25–0.5% per trade. Scale only after at least 4–6 weeks of forward observation.

- Account Type: ECN/Raw, 1:200–1:500 leverage, tight spreads.

- VPS: Strongly recommended (LAT < 20–40ms to your broker).

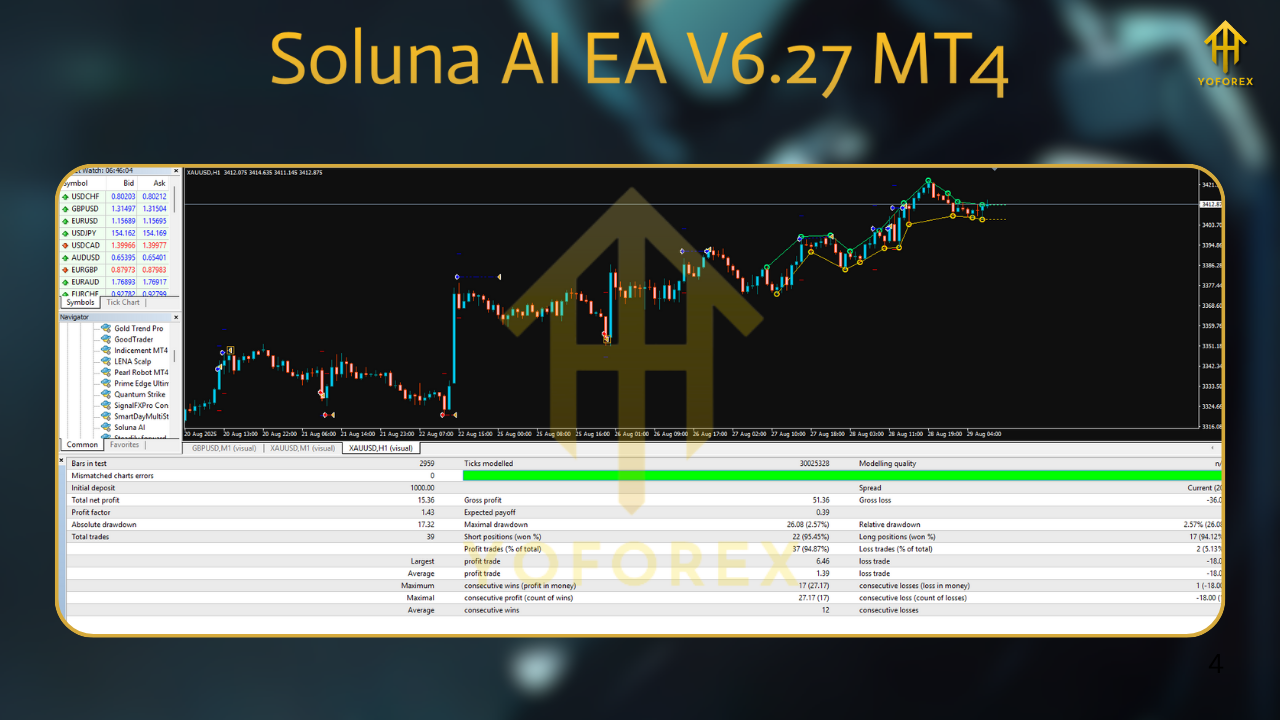

Backtesting & Forward Testing Notes

- Model: Every tick / high quality data.

- Spread: Variable; model a realistic average plus a small buffer.

- Period: At least 12–24 months per pair and timeframe. Include different regimes (trending, choppy, news cycles).

- Settings: Don’t over-optimize dozens of toggles; the defaults are already conservative. Tweak risk and a few filters at most.

Installation & Setup (MT4)

- Download & Copy Files: Place the EA file into

MQL4/Experts/. - Restart MT4: Or refresh the Navigator so Soluna AI EA V6.27 appears.

- Enable Algo Trading: Check the algo switch, allow live trading in EA settings.

- Attach to Chart: Start with EURUSD H1 or XAUUSD M15.

- Load Preset (if provided): This ensures baseline risk + filters are sane.

- Set Risk: Begin with 0.25–0.5% per trade; set daily loss cap if your broker/prop rules require it.

- Filters: Keep spread guard on. If using a news API, add your key and enable the blocker 30–60 min around red events.

- Run on VPS: Stability matters more than “fancy”; execution quality is king.

Recommended Settings (Starter)

- RiskPercent: 0.35

- MaxDailyLossStop: true (set -2.0% or your prop rule)

- MaxSpread: 20 (points; adjust to your broker reality)

- SlippageTolerance: 2–3

- UseNewsFilter: true (if configured)

- ModeBias: Auto (let the AI weigh Solar vs. Lunar)

- TrailStartRR: 1.0

- TrailStepATR: 1.2–1.6

- BreakEvenBuffer: 0.3R

Risk Management & Best Practices

- One change at a time: If you tweak risk and filter values together, you won’t know what helped or hurt.

- Weekly review: Save trade logs and equity curve. Check what days/times the EA performs best and where it struggles.

- Shut it down on broker trouble: Spreads or execution acting weird? Pause. The market will be there tomorrow.

- Demo → Micro live: The fastest way to blow confidence is to go live full-risk too soon. Don’t.

- Prop mode: Use the daily loss cap, cap max simultaneous trades (1–2), and avoid news.

FAQs (Quick Hits)

Does Soluna use martingale or grid?

No. Risk is fixed per trade. If you enable multi-entry, it’s still capped and not a traditional grid.

What kind of VPS?

Low-latency (20–40ms), stable uptime. CPU/RAM needs are light, but stability matters.

Which timeframe first?

H1 for EURUSD is forgiving. For XAUUSD, M15 is popular but ensure a raw spread account.

How many trades per day?

It varies by session and pair. Expect quality over quantity—some days it’ll sit out, and that’s okay.

Can I use custom indicators with Soluna?

The EA is self-sufficient. Advanced users can layer dashboards/filters, but keep it simple at start.

Final Thoughts

Soluna AI EA V6.27 MT4 isn’t trying to be a miracle worker; it’s designed to behave like a careful, process-driven trader who values clean setups, good execution, and preserving capital. If you want fireworks, crank risk and hope. If you want longevity, let Soluna do its thing with firm guardrails. You’ll thank yourself later.

Take it slow, avoid tinkering every other day, and focus on forward consistency. That’s how accounts grow… not overnight, but steadily.

Disclaimer

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. Always test on demo before going live and never risk money you can’t afford to lose.

Call to Action

Ready to try Soluna AI EA V6.27 MT4? Start it on demo, watch it across at least two market weeks, and only then move to live with conservative risk. If you need help with presets or tuning for your broker conditions, just ask—we’ll guide you. And hey, if something looks off, pause it, ping for help, and we’ll get you sorted. No drama, just steady progress.

Comments

Leave a Comment