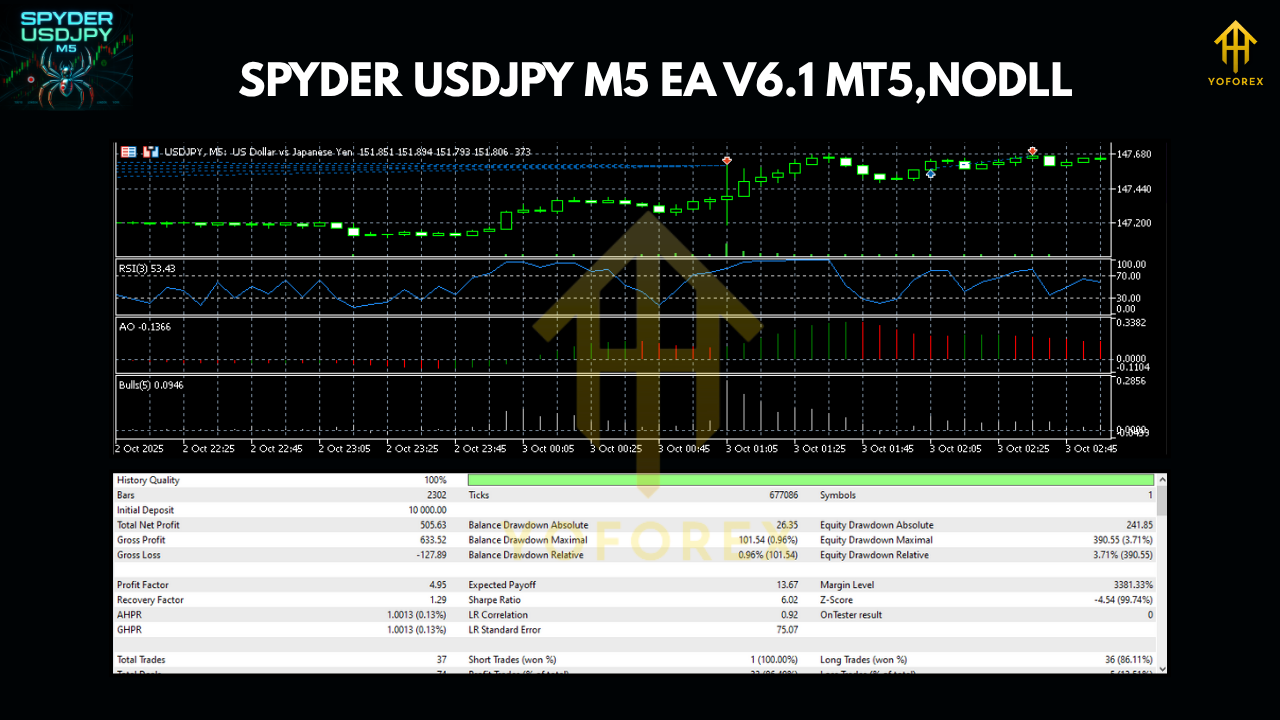

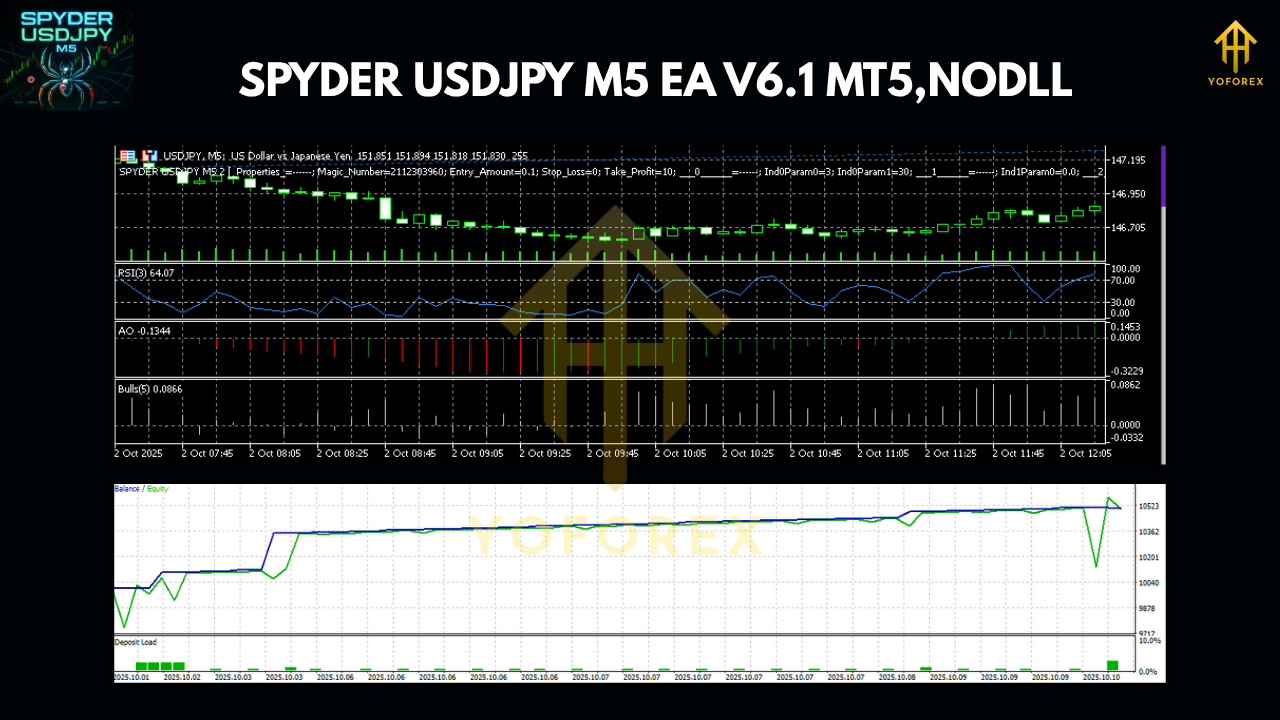

SPYDER USDJPY M5 EA V6.1 MT5 — Precision Scalping for Busy Traders

If you’ve ever stared at the USDJPY chart wishing you could catch those tight M5 entries without babysitting the screen all day… welcome to the shortcut. SPYDER USDJPY M5 EA V6.1 MT5 is a purpose-built Expert Advisor for MetaTrader 5 that focuses on fast, disciplined scalping and trend continuation on the 5-minute timeframe. It hunts high-probability setups, manages trades with strict risk controls, and keeps the workflow simple so you don’t have to overthink every tick. It even extends to GBPJPY for traders who like JPY momentum pairs. Clean logic, quick execution, fewer second guesses—exactly what scalpers need.

Why SPYDER for USDJPY on M5?

The USDJPY pair is famous for its liquidity, tight spreads, and frequent intraday waves, which makes it prime real estate for scalping and short swing trades. SPYDER EA V6.1 takes advantage of that micro-structure by combining a trend filter, volatility gate, and smart pullback detection. In plain English: it trades with the dominant move, waits for price to come to it, and avoids dead, choppy patches where spreads and noise can chew you up. The result is an EA that feels decisive on the good days and conservative when the market’s meh—exactly the balance most traders try to strike manually.

Key Features at a Glance

• Designed for USDJPY (primary) and GBPJPY (optional)

• Timeframe: M5 (5-minute)

• Trading styles: Scalping + Trend continuation

• Built-in trend filter (EMA/structure bias) to avoid counter-trend traps

• Volatility guard to skip low-range sessions and major news spikes

• Spread check—no entry if spread exceeds your set limit

• No martingale, no grid (risk stays linear and predictable)

• Dynamic SL/TP: ATR-based or fixed points (your choice)

• Optional breakeven + trailing stop with sensitivity controls

• Max trades per session to keep risk contained

• Equity protection: daily loss cap / halt-after-loss option

• Fully compatible with hedging accounts on MT5

• Lightweight logic → fast execution on most VPS setups

How the Strategy Works (in short, not salesy)

- Bias Selection

The EA establishes a directional bias using a short-to-medium moving average stack and recent swing structure (higher highs/lows for longs, lower highs/lows for shorts). When bias is mixed or indecisive, it stands down. - Setup Detection

Once bias is set, SPYDER waits for a measured pullback into a value zone (think mean-reversion touch or small discount/premium area) with specific candle behavior—small rejection wicks, lower intrabar volatility, and a return of momentum in the trend direction. - Entry Execution

Entries must pass volatility and spread checks. If conditions align, it executes a market or limit entry (depending on your preset), places an initial stop-loss beyond the recent structural pivot or an ATR multiple, and sets take-profit using either a fixed R:R or dynamic ATR bands. - Trade Management

If price runs favorably, the EA can move SL to breakeven after a threshold (e.g., 0.8R) and optionally trail behind a short EMA or ATR stop. If price stalls, a time-based exit can cut dead weight to free margin for better opportunities.

That’s the heart of it—clean trend alignment + disciplined entries + strict risk. Nothing exotic, coz the point here is consistency, not fireworks.

Recommended Settings (Starter Template)

- Pairs: USDJPY (core), GBPJPY (optional)

- Timeframe: M5 only (don’t mix timeframes on the same symbol instance)

- Risk: 0.5% – 1% per trade (start small, scale later)

- Max Spread: ≤ 20 points (2.0 pips on 5-digit brokers), lower is better

- SL/TP: ATR(14) × 1.5 for SL; ATR(14) × 2.0 for TP (≈ 1:1.3+ baseline)

- Breakeven: On at +0.8R (optional)

- Trailing: ATR trail ×1.0 or EMA(20) trail (optional—test both)

- Max Trades Per Day: 3 (keeps overtrading in check)

- News Filter: If your broker’s conditions spike on news, pause 5–10 min before/after tier-1 events for JPY/USD

Pro tip: Run USDJPY and GBPJPY on separate MT5 charts with independent magic numbers. Keep risk fractional when both are on, coz JPY momentum can sync.

VPS, Broker, and Practicalities

For scalping, low latency and tight spreads make or break results. Use a reliable VPS close to your broker’s trading servers. Choose a broker with raw/ECN accounts, typical spreads under 1 pip on USDJPY during liquid sessions, and fast execution. Disable other heavy indicators or EAs on the same terminal to keep ticks snappy.

Installation & Setup (Quick Start)

- Open MT5 → File → Open Data Folder.

- Drop the EA file into MQL5/Experts.

- Restart MT5 or right-click Experts → Refresh in the Navigator panel.

- Open USDJPY M5 chart (and GBPJPY M5 if you plan to run both).

- Drag SPYDER USDJPY M5 EA V6.1 MT5 onto the chart.

- Enable Algo Trading and confirm AutoTrading is green.

- Set input parameters: risk %, SL/TP mode (ATR or fixed), spread filter, magic number, and your trailing/breakeven choices.

- Click OK and watch the journal for any initialization messages.

Run it first on demo for a few days to make sure the EA, broker, and VPS combo behaves as expected. Then go live with minimal risk and scale responsibly.

Risk Management Philosophy (the not-so-sexy part that matters)

SPYDER is coded to avoid martingale and runaway grids. Keep risk fixed and boring—that’s how you ride variance without blowing up. Respect your daily loss limit; once hit, stop trading and review. The EA includes a halt-after-loss routine (if you choose to enable it) to enforce discipline even when emotions try to take the wheel.

Who Is It For?

- Intraday scalpers who love USDJPY’s rhythm and want a rules-driven assistant

- Part-time traders who can’t sit at the charts all day but still want exposure to the Asian/London overlap

- Systematic traders who prefer non-martingale, risk-defined strategies

- Beginners who want a clean, no-gimmick EA to learn process and structure (start in demo, always)

Tips to Get the Most Out of SPYDER

- Trade the liquid sessions (Tokyo/London overlap) where spreads and moves are better.

- Avoid releasing minutes of major news (FOMC, BOJ, CPI).

- Don’t over-optimize in Strategy Tester; focus on robustness tests across months with minor parameter tweaks.

- Use consistent risk across both USDJPY and GBPJPY; don’t double risk just coz both flash a signal.

- Journal weekly—wins, losses, spread conditions, VPS latency. Tiny tweaks → big edge.

Frequently Asked (Quick)

Does it use martingale or grid?

No. Linear position sizing only.

Can I change SL/TP style?

Yes—ATR-based or fixed points, plus optional trailing and breakeven.

Will it work on other pairs/timeframes?

It’s built for USDJPY/GBPJPY on M5. Anything else is experimental and not recommended.

Minimum deposit?

Depends on your lot size and broker margin. For micro-lots and 0.5% risk, even small accounts can run it—but a bit more cushion is always safer.

Final Word

SPYDER USDJPY M5 EA V6.1 MT5 is about clarity and control—trade the trend, take the clean pullbacks, manage risk tightly, and skip the noise. If you’ve been hunting for an MT5 scalper that behaves like a disciplined assistant rather than a casino bot, this one’s built for you. Start on demo, dial in your settings, then step into live with confidence—not haste.

Comments

Leave a Comment