Automated trading has become an essential tool in the arsenal of modern forex traders. But not every robot is worth your attention. Many either over-complicate strategies or rely on risky systems like martingale and grid methods. SuperTrend EA Pro V1.0 for MT4 is a clean departure from that. It’s built with a single principle: follow the trend with confirmation and discipline.

SuperTrend EA Pro focuses on real market direction using a proven indicator—SuperTrend—while giving traders full control over risk, position management, and execution logic. Whether you’re new to trading or looking for a hands-off system that works with structure, this EA can be a valuable asset in your portfolio.

In this article, we’ll explore the workings of the EA, how to set it up, and why it’s designed for stable long-term performance in trending markets.

What Is SuperTrend EA Pro V1.0?

SuperTrend EA Pro V1.0 is an expert advisor developed for the MetaTrader 4 platform. It’s based on the SuperTrend indicator—a volatility-based trend indicator that dynamically follows price and changes direction when price breaks above or below a certain threshold based on ATR (Average True Range).

The EA takes this indicator and builds a fully automated strategy around it. Using three different SuperTrend signals, it creates a consensus for entry and filters out weak signals. Add to that dynamic stop loss, trailing stop, customizable lot sizes, and equity protection, and you have a comprehensive trend-following robot.

How SuperTrend EA Pro Works?

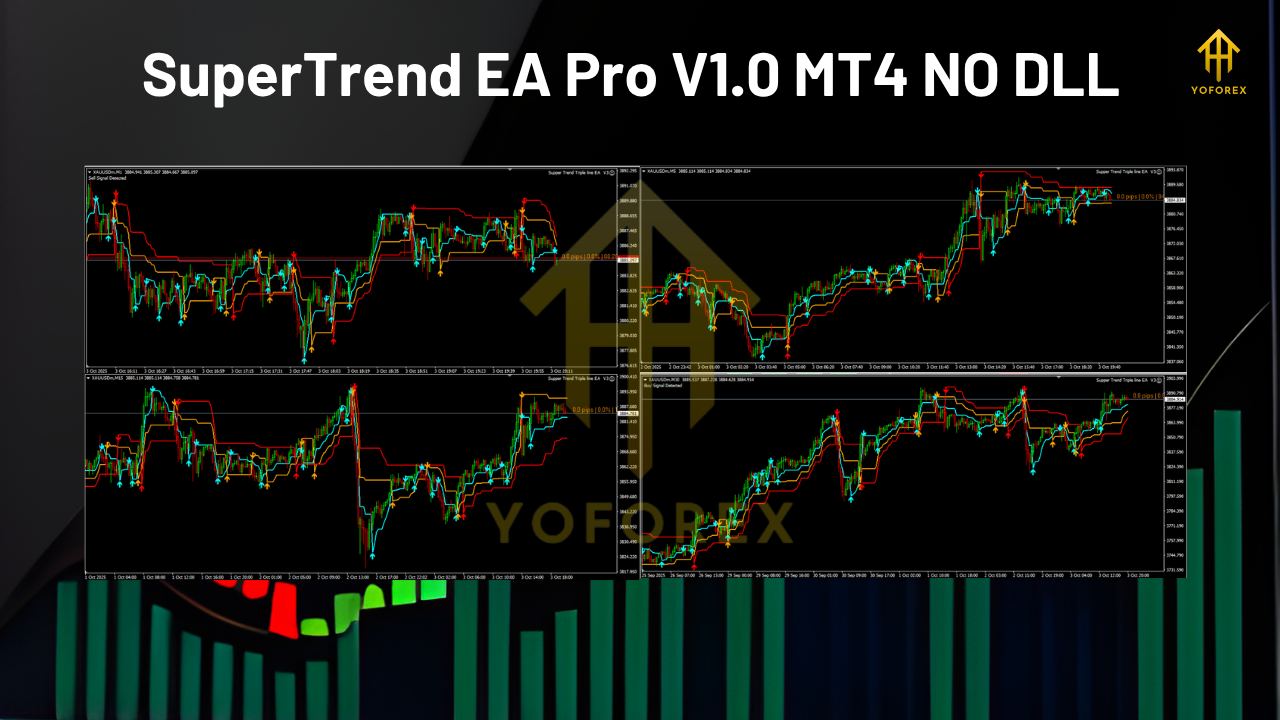

The EA monitors the SuperTrend indicator across three independent configurations. These could be based on different timeframes, ATR settings, or sensitivity levels. When all three signals point in the same direction, the EA places a trade accordingly—either a buy or a sell.

Here’s a breakdown of its key functions:

- Multi-Level SuperTrend Confirmation: Trade signals are only triggered when all trend indicators align, which helps avoid false entries during uncertain market phases.

- ATR-Based Stop Loss: Rather than fixed pip stops, this EA adapts stop-loss levels based on market volatility.

- Trailing Stop Feature: Once in profit, the EA trails the stop loss to lock in gains. You decide how aggressive or conservative the trailing should be.

- Fixed or Risk-Based Lot Sizing: Trade size can be defined manually or automatically calculated based on your risk percentage per trade.

- Equity Protection System: If your account balance drops below a certain threshold, the EA can stop trading or close all positions to limit losses.

This approach ensures that every trade is executed based on both logic and risk control, which is often missing in many EAs available on the market.

Why SuperTrend EA Pro Makes Sense for Smart Traders?

What makes this EA stand out is its simplicity and focus on confirmation. It doesn’t use grid trading. It doesn’t chase losses. It waits for real signals. And that’s where its strength lies.

Trend-Focused Logic

Instead of reacting to every candle or minor pullback, the EA looks for true market direction. The use of three SuperTrend layers filters out market noise and focuses on real opportunities.

Flexibility Across Assets

Although it’s commonly used for forex pairs, the EA is fully capable of trading commodities like gold, indices, and even crypto. It works on any asset available in your MT4 terminal.

Timeframe Independence

The EA can operate on all timeframes. If you're into scalping, it can be used on M15 or M30. For swing traders, H1 or H4 offer solid results. Each setup can be optimized separately.

Full Customization

You can configure SuperTrend parameters, ATR multipliers, trailing rules, lot size, and maximum trades. The EA doesn’t lock you into a rigid system—you control how it behaves.

Getting Started with SuperTrend EA Pro

To run this EA effectively, follow these simple steps:

- Attach the EA to your chosen chart on MT4 (e.g., EURUSD H1).

- Configure the SuperTrend indicators—you can change periods, multipliers, and sensitivity to match your strategy.

- Set your stop loss method—use ATR for dynamic control or set a fixed value.

- Choose your risk style—fixed lot or risk-based sizing.

- Enable trailing stop to protect gains once the trade moves in your favour.

- Activate equity protection to automatically manage risk across your portfolio.

Once configured, the EA runs on its own and makes decisions based on the market structure and trend strength.

When and Where It Performs Best

- Trending Pairs: It shines in markets like GBPUSD, USDJPY, XAUUSD (Gold), and BTCUSD, where long-lasting trends are common.

- Higher Timeframes: H1 and H4 provide cleaner trends and less noise, allowing the EA’s logic to work more effectively.

- Low-Spread Brokers: Since the strategy relies on precise entry and exit points, low spreads and fast execution are ideal.

- VPS Hosting: For consistent uptime and execution speed, running the EA on a VPS is recommended.

Pros and Cons of Using SuperTrend EA Pro

Pros:

- Logical trend-following method

- Works on various instruments and timeframes

- Flexible stop loss and risk management tools

- Does not use martingale or dangerous strategies

- Fully automated after initial setup

Cons:

- Not ideal in sideways or choppy markets

- Needs occasional parameter tuning

- Requires discipline to avoid over-optimisation

- May enter fewer trades in low volatility environments

Despite its simplicity, this EA is built with professional risk controls. That makes it suitable for both beginners and experienced traders who prefer structured systems.

How to Optimise for Better Results

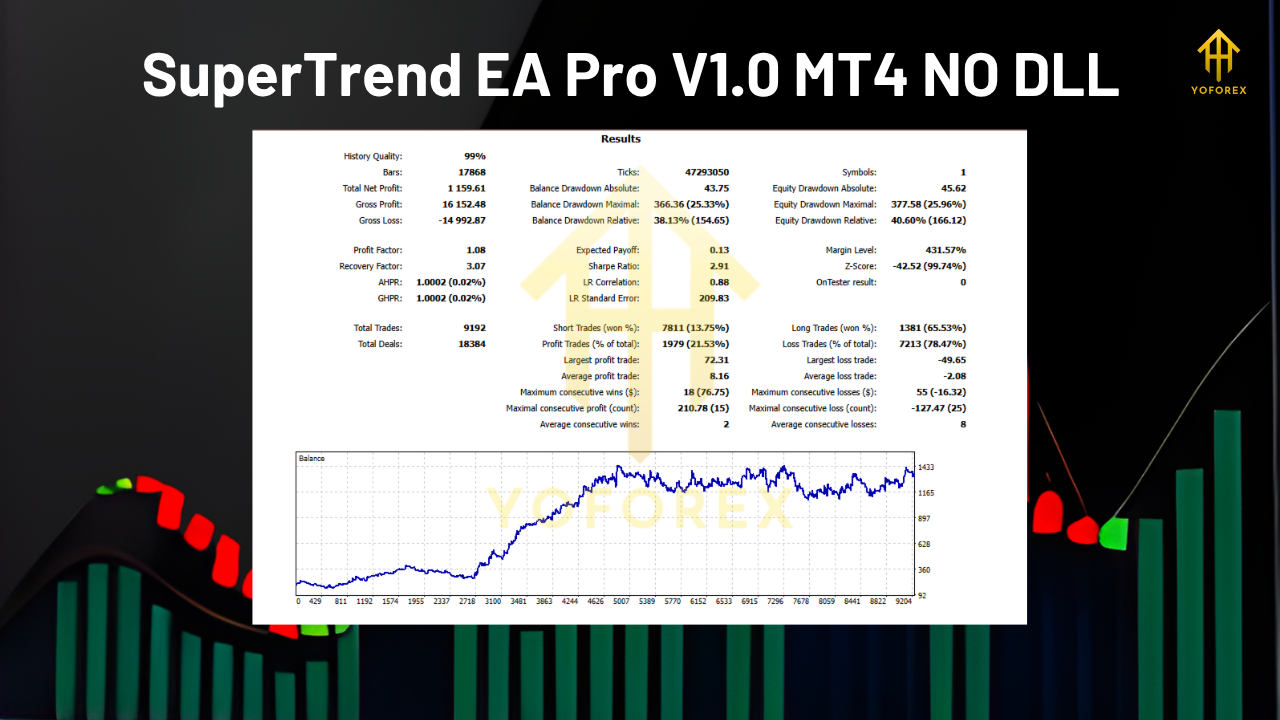

- Backtest Before Going Live: Try different settings on your chosen pair and timeframe. Look for consistent equity curves rather than high profit.

- Use Multi-Pair Deployment: Diversify your strategy by running it on 3–5 different assets at once.

- Start with Low Risk: Begin with small lot sizes or risk percentages until you fully understand how the EA behaves.

- Avoid High Impact News: Consider disabling the EA during major economic events that can create unexpected volatility.

- Review Weekly: Check performance and adjust settings if needed based on market conditions.

Is SuperTrend EA Pro Right for You?

This EA is built for traders who believe in trend-following but don’t have the time or emotional control to manage trades manually. It’s not a quick-rich solution. Instead, it’s a reliable system that aims to generate consistent results over time.

If you’re someone who prefers rules over guesswork and safety over reckless strategies, this EA fits your profile. It removes emotional interference, introduces clear logic, and still gives you the flexibility to adjust its behaviour.

Final Thoughts

In a market flooded with aggressive and overly complicated robots, SuperTrend EA Pro V1.0 MT4 stands out with its clear logic and simplicity. It’s based on a respected trend-following indicator, avoids risky methods, and offers features that can be tuned to fit almost any trading style.

Its ability to operate across assets, timeframes, and conditions—combined with real risk control—makes it a smart addition to any trader’s toolbox. If you’re looking for a dependable EA that respects your capital and reacts only when the market speaks clearly, this might be your answer.

Comments

Leave a Comment