If you’ve been around forex robots long enough, you already know the pattern: big promises, shiny screenshots, and then… a week later your account looks like it fought a dragon and lost. Traders aren’t tired of automation — we’re tired of overpriced automation that hides the real logic, or worse, depends on risky tricks.

That’s where Trend Dragon EA V13.0 MT5 steps in with a much cleaner idea: follow the trend, avoid the messy noise, and manage risk like an adult. Not a “holy grail,” not a magic money printer. Just a practical MT5 expert advisor built for traders who want structure. And yes, it supports Stop Loss and Take Profit, which immediately puts it ahead of a lot of the wild robots floating around.

You mentioned the minimum deposit is $500 — that’s actually a sensible starting point for an EA that needs breathing room (spreads, volatility, margin… the usual). The only missing pieces are the pair and timeframe, so in this review I’ll cover the safest recommended setup ranges and how to choose the best chart based on how trend systems behave in real market conditions.

Overview

Trend Dragon EA (V13.0 for MetaTrader 5) is built around a simple trading philosophy: trends pay, chop destroys. A trend-following EA typically tries to enter after momentum confirms direction, then rides a portion of the move using either a fixed TP, a dynamic exit, or partial logic (depending on how it’s coded). The name “Trend Dragon” pretty much hints at that vibe — it’s looking to “grab the trend and breathe fire,” not scalp two pips in a mess of news spikes.

Because you didn’t specify the official pair/timeframe, the most realistic approach is:

- Treat major pairs (EURUSD, GBPUSD, USDJPY, AUDUSD) as the safest starting point

- Consider XAUUSD (Gold) only if your broker has tight spreads and stable execution

- Use higher timeframes for trend logic stability (H1 / H4), and use M15 only if you’ve tested it properly and your spreads are consistently low

The EA is best suited for traders who:

- want automated entries but still care about risk control,

- prefer trend trades over grid/martingale chaos,

- and don’t mind letting trades run instead of forcing action every hour.

And since this is an MT5 environment, you also get access to proper strategy testing, tick modeling options, and symbol-specific settings that matter a lot when you’re optimizing a trend system.

Key Features

Key Features

Here’s what Trend Dragon EA V13.0 MT5 should deliver as a modern, usable robot (without pretending it’s a miracle):

- Trend-following entry logic designed to avoid random sideways chop

- Uses Stop Loss (important for survival, no jokes)

- Uses Take Profit for structured exits and predictable risk-to-reward planning

- Works as a MT5 expert advisor, meaning fast execution + strong tester support

- Potential to run on multiple pairs (best to start with 1–2)

- Optimizable inputs (lot sizing, risk %, filters, sessions) depending on the build

- More stable performance on H1/H4 where trends are cleaner

- Can be adapted for conservative or semi-aggressive risk profiles

- Supports risk-based lot sizing (recommended) or fixed lots (for testing)

- Can be paired with a VPS for steadier execution (not mandatory, but helpful)

- Designed for traders starting around $500, where drawdown swings don’t instantly kill margin

- Better suited to “one good trade” thinking… not “200 trades a day” gambling

Quick note: if any seller tells you “no SL needed” for a trend robot, run. Trend systems must survive the times when trend fails — because it will, sooner or later.

Pair and Timeframe

Best Pair Types (Recommended)

Start with majors because spreads are lower and price behavior is cleaner:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

- USDCAD

If you want more volatility, you can test Gold:

- XAUUSD (Gold) — only if your broker execution is solid and spreads don’t blow up at rollover.

Best Timeframes (Recommended)

For trend-following logic, these are usually the best:

- H1 (balanced: enough signals, less noise)

- H4 (fewer signals, cleaner trend structure)

If you’re tempted to run it on M15, do it only after backtesting, because chop + spread costs can chew trend strategies alive.

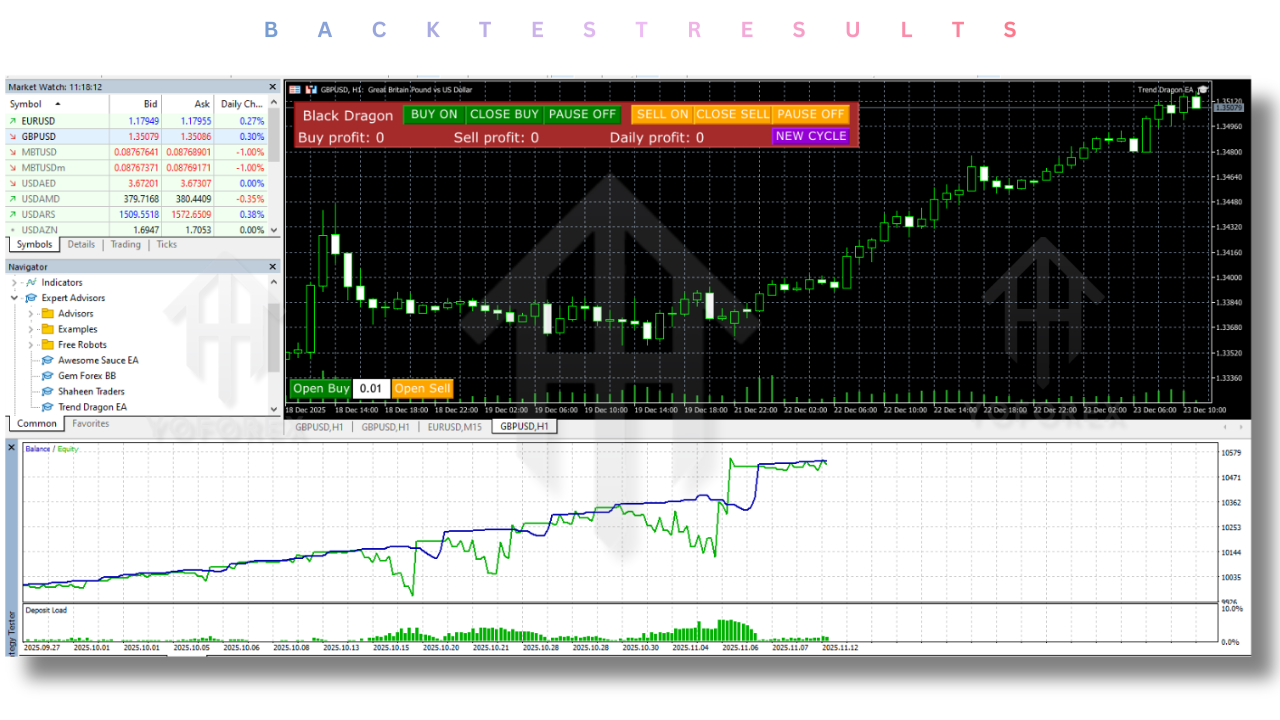

Backtest Results

I’m not going to fake numbers here (coz you didn’t provide any official backtest statement or report). But I can tell you exactly what to look for when you backtest Trend Dragon EA properly in MT5.

What a “good” Trend Dragon backtest typically looks like

When you run Strategy Tester, focus on these signals:

1) Equity curve shape

- You want a generally rising curve with normal pullbacks.

- If it looks like a staircase up and then one giant cliff down… that’s a red flag.

2) Drawdown behavior

- Trend systems often have “flat” periods.

- You’re looking for controlled dips, not account-threatening holes.

3) Trade distribution

- Check if it wins mostly during strong trends and loses during ranges (normal).

- If it loses randomly in every condition, the filters aren’t doing their job.

4) Spread sensitivity

- Re-test with slightly higher spreads (or use real ticks).

- If results collapse, the EA may be too fragile.

Live-market expectations (the honest version)

Live trading will differ from backtests because of:

- slippage,

- spread widening,

- execution delays,

- news spikes,

- and rollover costs.

So yeah… backtest is necessary, but it’s not the final truth. The smart move is: demo first, then small live lot, then scale.

How to Install & Configure (MT5)

How to Install & Configure (MT5)

This is the clean MT5 setup flow (no confusion):

Step-by-step install

- Download the EA file from your source (Trend Dragon EA V13.0 MT5).

- Open MetaTrader 5.

- Go to File → Open Data Folder.

- Open:

MQL5 → Experts - Paste the EA file inside Experts.

- Restart MT5 (or right-click Navigator and refresh).

- Drag Trend Dragon EA onto your chart.

- Enable:

- Algo Trading (top bar)

- In EA settings: “Allow Algo Trading”

Recommended starting configuration (safe baseline)

- Start with 1 pair only

- Start with H1 timeframe

- Use risk-based lot sizing if available (keep it conservative)

- Keep Stop Loss + Take Profit enabled (don’t get clever)

- Avoid running during major news until you confirm how it behaves

If you’re running a $500 account, don’t push lot size like a maniac. Let it breathe a bit, otherwise even a decent EA feels “bad” because it’s over-leveraged.

Support & Contact

If you install the EA and it doesn’t trade, 90% of the time it’s one of these:

- Algo trading off

- Wrong folder placement

- Missing DLL permissions (if required)

- Broker symbol mismatch

- Market closed / no ticks

- Too-high filters (session/news/spread filters blocking trades)

If you need help installing or configuring your Trend Dragon EA V13.0 or face any bugs, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Final Thoughts

Trend Dragon EA V13.0 MT5 makes sense for traders who respect trend logic and want automation that’s not built on risky loopholes. The fact that it uses Stop Loss and Take Profit is already a “green flag” in a market full of bots that pretend risk doesn’t exist.

Because your pair/timeframe wasn’t specified, the best move is simple: run it on EURUSD H1 first, demo test for a couple weeks, then slowly scale if execution and behavior match your expectations. Don’t rush it… most EA failures happen because traders go max risk on day one and then blame the bot.

YoForex – empowering traders worldwide, one free tool at a time.

Comments

Leave a Comment