Introduction

Automated trading can be a powerful shortcut for traders who want consistency, speed, and rule-based execution. But not every trader wants “safe and slow.” Some traders intentionally choose aggressive systems that aim for faster growth—while accepting the reality that higher returns usually come with higher risk.

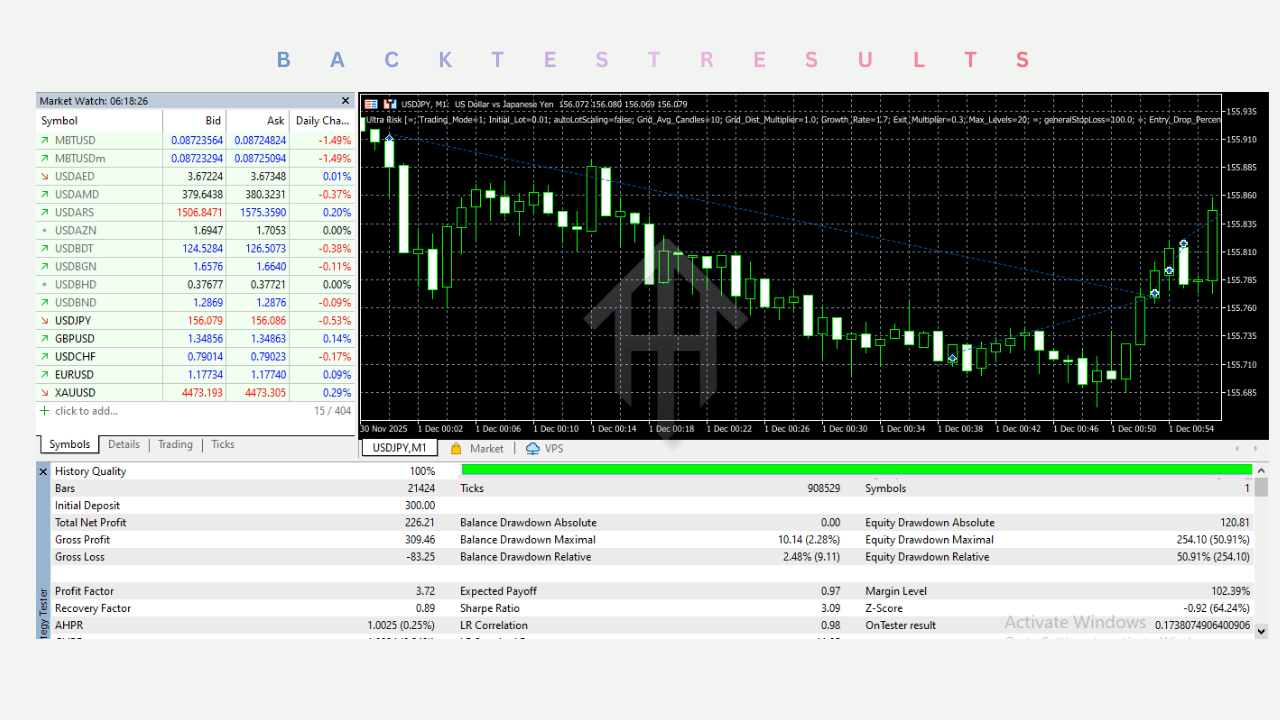

Ultra Risk EA V1.0 MT5 is built for high-risk, high-reward trading behavior. It’s designed for traders who want an Expert Advisor that can take frequent opportunities, scale positions, and push for bigger outcomes—especially during volatile sessions. If you’re the type of trader who understands drawdown, knows how to manage exposure, and prefers automation over manual decision-making, this EA is worth a close look.

What is Ultra Risk EA V1.0 MT5?

Ultra Risk EA V1.0 MT5 is an Expert Advisor (EA) for MetaTrader 5 that automates trading using aggressive logic. Most EAs are built around one main goal:

- Conservative EAs: protect capital first, grow slowly

- Balanced EAs: aim for steady performance with moderate risk

- Aggressive EAs: pursue higher growth and faster recovery, but accept bigger drawdowns

Ultra Risk EA belongs to the third category.

It typically focuses on:

- fast entries

- high activity

- dynamic lot sizing

- recovery behavior (when trades go against direction)

- volatility-based opportunity capture

This kind of EA can perform strongly in the right environment, but it demands disciplined setup.

Who Should Use Ultra Risk EA V1.0 MT5?

Ultra Risk EA V1.0 MT5 is best for:

Aggressive traders who understand drawdown

If you panic during pullbacks, this EA is not for you.

Traders using higher leverage and proper margin buffers

Aggressive EAs can stack exposure quickly. Low leverage + small balance can cause margin pressure.

Traders running cent / small accounts for testing

Before any real capital goes into a high-risk EA, testing is mandatory.

Traders who can control risk via settings

Good aggressive EAs give control (risk %, max trades, max lot, equity protection). Your job is to use those controls.

Core Concept: How Ultra Risk EA Typically Trades

Since different builds of Ultra Risk EA can vary, here’s the practical behavior you can expect from many “Ultra Risk” type EAs:

1) Entry Logic

It may enter trades based on:

- short-term momentum triggers

- volatility breakouts

- mean reversion signals

- indicator confirmation (MA/RSI/ATR style logic)

2) Position Scaling

Aggressive EAs usually scale positions when:

- price moves favorably (to maximize trend profit), or

- price moves against (to average/recover faster)

3) Risk Handling

Most high-risk EAs implement risk control through:

- maximum open trades

- maximum spread filter

- time filters (avoid illiquid times)

- equity protection / stop-out protection

- dynamic lot calculation

If Ultra Risk EA offers these controls, your performance will depend heavily on how you configure them.

Key Features of Ultra Risk EA V1.0 MT5

Here are the most valuable features traders should look for in Ultra Risk EA V1.0 MT5 (and what they mean in real usage):

1) Fully Automated Trading on MT5

No manual entries needed. The EA can open, manage, and close trades automatically based on its rules.

2) Dynamic Lot Sizing

Instead of fixed lots, the EA may calculate lots based on:

- balance/equity

- selected risk percentage

- symbol volatility

Tip: If you want survivability, cap the maximum lot size.

3) Volatility-Aware Behavior (ATR / session-based)

High-risk EAs often perform best when volatility is “tradable” (not dead, not insane). A volatility filter helps avoid random chop.

4) Spread Filter

This protects you from bad entries when spreads widen (news, rollover, illiquid hours).

5) Equity Protection / Emergency Stop

A must-have for aggressive systems. This can:

- close all trades at a max drawdown limit

- pause trading after loss threshold

- stop trading at daily loss cap

6) Trading Session Filter

Lets you pick London, New York, or overlap sessions which typically have better liquidity.

7) Trailing Stop / Break-Even Logic

Even aggressive EAs can reduce risk by locking profits when price moves in favor.

Best Symbols & Pairs for Ultra Risk EA V1.0 MT5

Aggressive EAs usually prefer:

- tight spreads

- strong liquidity

- clean movement

- consistent volatility

Recommended (common best performers)

- XAUUSD (Gold) – volatile, opportunity-rich, but risky

- EURUSD – stable liquidity, low spread

- GBPUSD – strong volatility, clean sessions

- USDJPY – smooth movement, good liquidity

Avoid (unless you really know what you’re doing)

- exotic pairs with wide spreads

- symbols with high swap or unstable volatility

- low liquidity instruments at odd hours

Best Timeframes (Practical Guidance)

Ultra Risk EAs typically work best on:

- M5 (fast response, controlled noise)

- M15 (balanced speed and stability)

- H1 (safer entries, fewer trades)

If the EA is a fast scalper, it may also run on M1, but M1 is extremely sensitive to spread, broker execution, and slippage.

Broker Requirements (Important)

For Ultra Risk EA V1.0 MT5, broker choice can make or break results.

Ideal Broker Conditions

- Raw/ECN spreads (lower is better)

- fast execution (low latency)

- stable MT5 server uptime

- low slippage

- allows EAs, scalping, and hedging (if EA uses hedging)

Avoid

- wide spreads or “markup” accounts

- slow execution brokers

- brokers that restrict scalping or limit orders.

Recommended Deposit & Risk Level (Reality Check)

Because this is a high-risk EA, deposit depends on your settings and leverage. A safer approach is:

For Testing

- start small (cent/micro account)

- run it 7–14 days minimum

- check drawdown and margin usage

For Live Use

- use a balance that can tolerate drawdowns

- don’t push max risk from day 1

- increase slowly only after stable behavior

If you want survivability, you must configure:

- max lot cap

- max open trades

- equity stop / daily stop

Best Settings Strategy (Safer Aggressive Setup)

Here’s a realistic setup approach that many successful aggressive-EA users follow:

Step 1: Use Conservative Risk on an Aggressive EA

Yes, it sounds funny, but it works.

- Risk per trade: 0.5% – 1%

- Max open trades: 3–7

- Max lot cap: strict

- Equity stop: enabled

Step 2: Add Filters

- spread filter: ON

- news filter: ON (if available)

- session filter: ON (trade London/NY)

Step 3: Use VPS

A VPS reduces:

- disconnects

- missed entries

- execution delays

For scalping-style EAs, VPS is almost mandatory.

Pros and Cons

Pros

- aggressive profit potential when conditions suit

- fast automated execution

- good for traders who like high activity

- can exploit volatility in major sessions

Cons

- higher drawdown risk

- not suitable for small margin buffers

- poor brokers will ruin results

- not ideal for “set and forget” beginners

Risk Warning (Read This Like a Pro)

Ultra Risk EA V1.0 MT5 is not a “guaranteed profit machine.” Any EA with aggressive behavior can produce:

winning streaks

sudden deep drawdowns

recovery phases that feel uncomfortable

If you want to run this EA properly:

test it first

control exposure

keep equity protection enabled

avoid emotional interference

Aggressive automation only works when the trader is more disciplined than the EA.

Conclusion

Ultra Risk EA V1.0 MT5 is an aggressive MetaTrader 5 Expert Advisor built for traders who want faster growth potential and automated execution, but it should be used with strict risk controls and the right broker conditions. If you understand drawdown, can manage exposure with max-lot and max-trade limits, and you’re willing to test properly on demo/cent before going live, this EA can be a strong option for volatility-focused trading on major pairs (and gold). However, it’s not ideal for beginners or anyone expecting “set-and-forget” safety—your results will depend heavily on disciplined settings, equity protection, and execution quality.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment