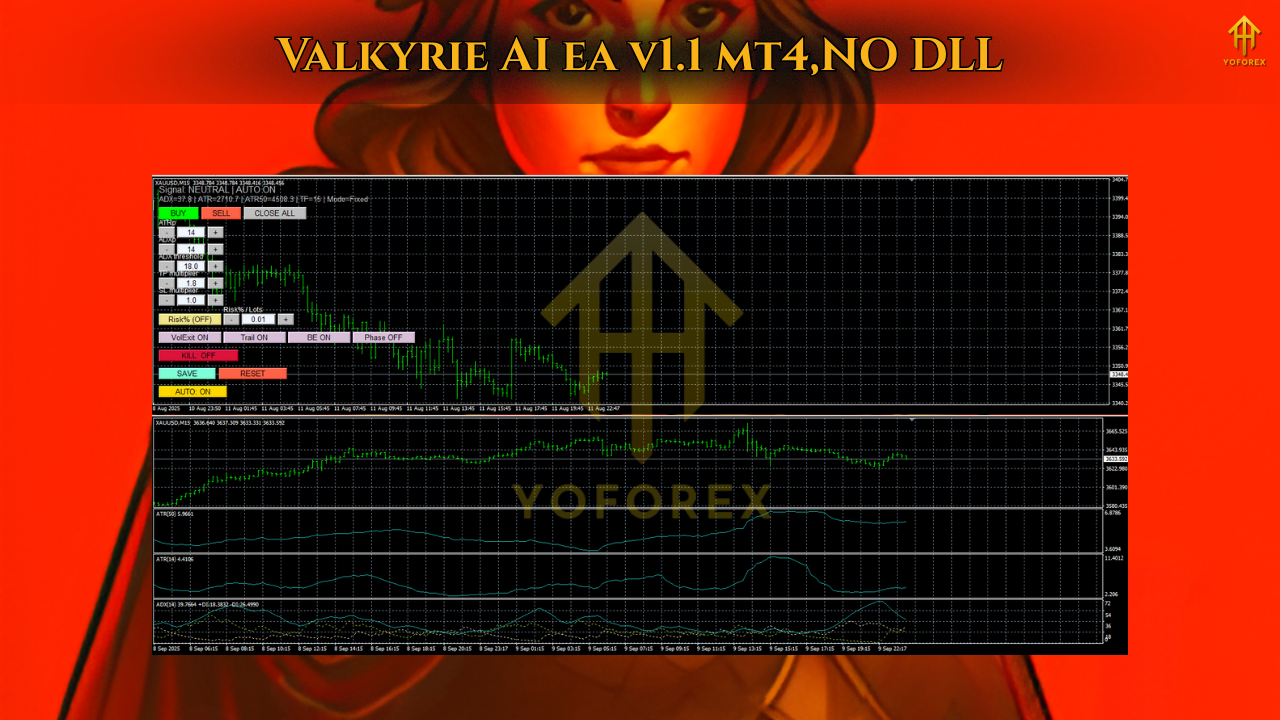

Valkyrie AI EA V1.1 MT4 is an advanced Expert Advisor built for traders who want intelligent automation without sacrificing risk control. Instead of firing random trades or hiding dangerous martingale logic behind a glossy interface, this EA is designed around AI-optimised rules, clean coding and transparent money management. It runs on MetaTrader 4 and focuses on reading trend strength and volatility in real time using ADX (Average Directional Index) and ATR (Average True Range), then placing trades only when those conditions are truly favourable.

For FXCracked readers, this makes Valkyrie AI particularly interesting. It is not a “get rich overnight” script, but a structured trading robot that aims to combine AI-driven optimisation with professional risk habits: single trades, defined risk per position, and clear no-martingale logic. If you are looking for a disciplined EA that respects your capital, this one deserves a deeper look.

WHAT EXACTLY IS VALKYRIE AI EA?

Valkyrie AI EA is a premium MT4 Expert Advisor created by developer Frank Paetsch and released in November 2025. The current version is 1.1 and is presented as a high-performance robot engineered to reach “the optimum of what is technically possible” in MetaTrader 4.

Under the hood, it combines:

- ADX-based trend detection to see whether the market is actually trending or just caught in a range

- ATR-based volatility analysis to size stops and targets in a way that respects current market noise

- AI-optimised logic that has been repeatedly tuned using many optimisation cycles to handle different market regimes, from quiet sideways conditions to explosive breakouts

The result is a rules-based, non-martingale trend and volatility system that tries to join directional moves with precise entries, then manage those trades actively until either profit or a controlled loss is taken.

HOW VALKYRIE AI ANALYSES TREND AND VOLATILITY

The core of Valkyrie AI’s edge is its focus on reading market structure before it risks a single pip. The EA does not simply look for a moving-average crossover; it uses several layers of confirmation.

First, ADX and its associated directional movement components are used to confirm that trend strength is above a certain minimum threshold. When ADX is low and the slope of ADX and ATR suggests a flat phase, Valkyrie AI will stand aside. This is important because many retail robots get chopped to pieces in sideways ranges.

Second, ATR tells Valkyrie AI how much the price is actually moving. If volatility is too low, stop-losses and take-profits can become unrealistically tight. If volatility is extreme, unadjusted stops may become too wide or expose the account to unnecessary drawdown. By defining stops and targets as ATR-based multiples, Valkyrie AI can adapt its exits to the current environment.

Finally, a high-timeframe (HTF) ADX filter checks whether the broader trend supports the trade direction. That way, the EA is not just reacting to local noise on a lower timeframe but aligning entries with higher-timeframe structure.

TECHNOLOGY, DESIGN PHILOSOPHY AND CODE QUALITY

One area where Valkyrie AI EA clearly differentiates itself is in how it has been engineered. The developer states that the system has been refined through hundreds of AI-driven optimisation cycles, focusing on trade timing, lot sizing and volatility response across multiple years of data.

Some key design points:

- Built entirely in pure MQL4 for speed and stability

- Lightweight enough to run on multiple charts without noticeable lag

- Clear parameter names, making configuration accessible even to newer traders

- Very strong emphasis on rule-based behaviour, not “hidden tricks”

For traders used to dealing with heavy, DLL-dependent robots that freeze MT4, this lightweight architecture is a welcome change.

RECOMMENDED PAIRS, TIMEFRAMES AND RISK SETTINGS

Valkyrie AI EA is not restricted to a single symbol, but the developer provides clear guidance on where it performs best:

- Recommended pairs: EURUSD, GBPUSD, NZDUSD, USDJPY (other major pairs are possible after proper testing)

- Timeframes: M5 to H1, with M15 highlighted as the sweet spot between signal frequency and control

- Suggested risk: around 0.5–1.0% per trade in percentage-risk mode, or very small fixed lots such as 0.01–0.05 while you are learning the system

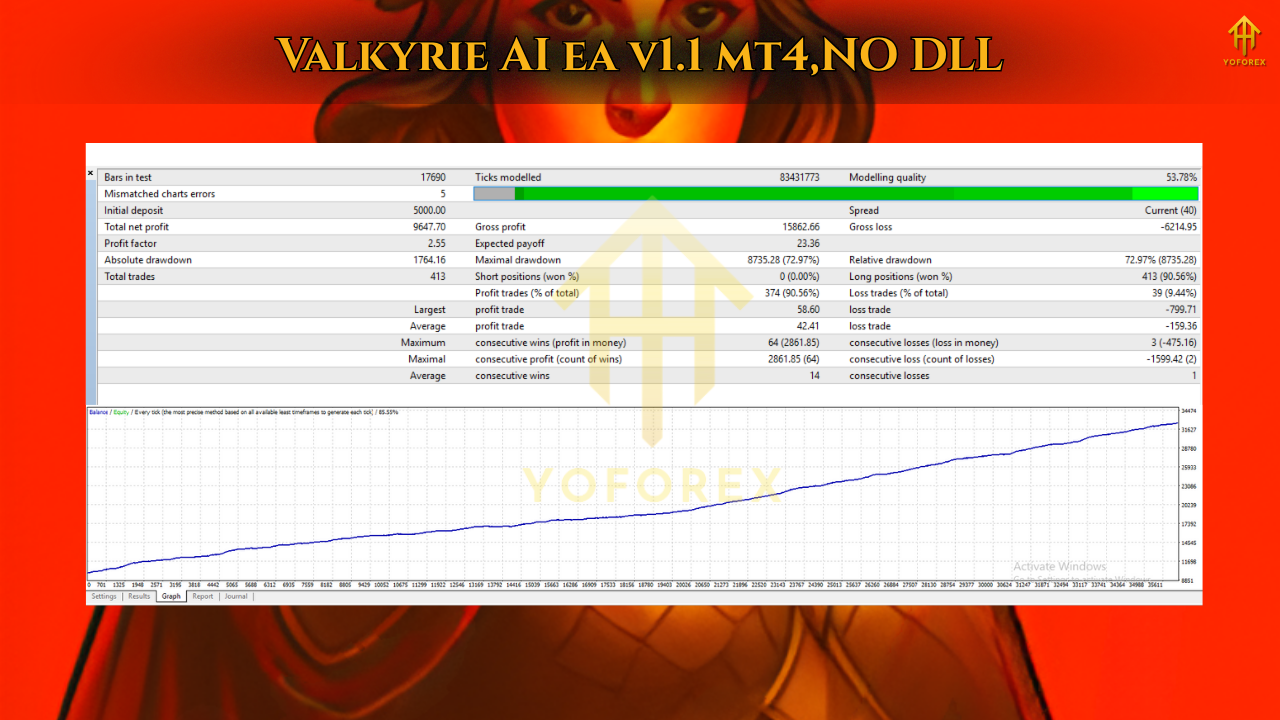

The EA has been backtested over the period 2022–2025, which covers multiple volatility cycles, including calm and highly volatile phases. While any backtest must be treated with caution, this wider testing window is better than optimising only on a few good months.

RISK MANAGEMENT AND WHY IT IS PROP-FIRM FRIENDLY

One of the strongest reasons to consider Valkyrie AI EA is its approach to risk management. Many EAs promise “no martingale”, but still use some form of hidden lot escalation or ultra-tight stops that cause psychological stress. Valkyrie AI takes a different route.

- It opens single trades per signal instead of stacking large grids

- It offers both percentage-based position sizing and fixed-lot options

- It uses ATR-based stop-loss and target placement instead of fixed, arbitrary pip distances

- It includes a daily drawdown guard that can automatically disable new trading once a specified daily loss threshold is hit

These features make it much more suited for traders who must operate under strict risk rules, such as those trading in prop-firm challenges where daily drawdown violations can instantly terminate an account.

TRADE MANAGEMENT: FROM ENTRY TO EXIT

Once a valid setup is detected, Valkyrie AI EA follows a clear workflow:

- Confirm trend and volatility with its ADX/ATR-based filters, including high-timeframe confirmation.

- Size the position using either percentage risk or a fixed lot size, based on your chosen configuration.

- Place the order with ATR-based stop-loss and take-profit levels.

- Manage the trade dynamically with:

- Break-even logic, moving the stop to a safe level once the price has travelled a sufficient distance

- Trailing-stop control, which can be tuned to be tighter or looser depending on your preference

- Partial take-profit and “runner” management, locking in gains while leaving a smaller portion open to catch extended trends

This layered management approach allows Valkyrie AI to avoid the “all or nothing” mentality. It can protect capital, secure partial profits, and still stay in the market during strong moves.

WHO CAN BENEFIT MOST FROM VALKYRIE AI EA?

Valkyrie AI EA V1.1 MT4 is not aimed only at algorithmic experts. It can be valuable for several different trader profiles:

- Beginners who understand MT4 basics and want a serious, rule-driven system instead of random entry robots

- Intermediate traders who are comfortable with ADX/ATR concepts and want those tools automated in a clean framework

- Prop-firm and funded-account traders who must respect daily loss limits and prefer non-martingale strategies

- Busy part-time traders who cannot stare at charts all day but still want to participate in trends with a controlled, automated solution

If you are searching for an EA that promises impossible monthly percentages or relies on hyper-aggressive grid averaging, this is not it. Valkyrie AI is built for traders who are okay with slower, steadier growth in exchange for more consistent risk control.

PRACTICAL SETUP STEPS FOR FXCRACKED USERS

If you plan to test Valkyrie AI EA V1.1 on your own account, it makes sense to follow a structured checklist:

- Begin with a demo account and attach the EA to one or two recommended pairs on M15.

- Use conservative risk settings and default parameters at first, so you can see the “intended” behaviour.

- Let the EA trade through multiple sessions and at least several weeks of data before judging it.

- Track trades and equity curve in a simple spreadsheet or journal so you can see how it behaves through winning streaks, losing days and sideways markets.

- Once you are comfortable, move to a small live account, still using low risk. Only consider increasing lot size after you have months of live results that match your expectations.

This slow, methodical approach aligns with how Valkyrie AI was designed: as a professional-grade tool, not a lottery ticket.

TIPS TO GET THE BEST OUT OF VALKYRIE AI EA

To maximise the value of this EA, keep a few principles in mind:

- Do not overload your account with too many pairs at once. Start small and expand gradually.

- Respect the daily drawdown guard. If it stops trading for the day, treat that as useful protection, not an obstacle.

- Avoid changing parameters too frequently. Every tweak resets the learning process for you as an operator.

- Combine Valkyrie AI with clear rules for withdrawals and profit-taking so that realised gains are regularly moved out of the trading account.

By treating the EA as part of a complete trading business rather than a standalone “magic box”, you give it the best environment to perform.

FINAL VERDICT – IS VALKYRIE AI EA V1.1 MT4 WORTH USING?

Valkyrie AI EA V1.1 MT4 is a serious, AI-optimised trading robot for MetaTrader 4 that focuses on three things: intelligent entries, volatility-aware exits and strict risk discipline. With its ADX/ATR-based filters, high-timeframe confirmation, dynamic trade management and daily drawdown guard, it offers a much more professional approach than many typical retail robots.

For FXCracked.org readers who value capital preservation and structured trend trading, Valkyrie AI EA is certainly worth testing on demo and then, carefully, on live funds. Use it with realistic expectations, conservative risk and a clear trading plan, and it can become a powerful ally in building long-term, sustainable results in the forex market.

Comments

Leave a Comment