Volume Scalper EA V3.0 MT4 — Precision M5 Scalping for Gold, USDJPY & US30

If you’re hunting for an MT4 robot that thrives on momentum without the typical “account killer” tricks, Volume Scalper EA V3.0 MT4 is built for you. It focuses on high-quality volume shifts on the M5 timeframe across three popular instruments—XAUUSD (Gold), USDJPY, and US30—so you can capture fast, repeatable moves while avoiding grid, martingale, or hedging. In short, it’s a clean, disciplined scalper designed to keep risk tight and entries smart.

What Makes Volume Scalper Different?

Most scalpers look only at price. Volume Scalper EA blends price action with volume signatures to filter out weak impulses and target only those bursts that tend to follow through. That means fewer trades, but better conviction. The algorithm closely monitors surge and decline thresholds, session liquidity, and micro-pullbacks, then enters with protective stops and predefined targets. No averaging down, no “hope and pray” recovery tactics… just disciplined, one-shot logic.

Built for the M5 Timeframe

Why M5? Because it balances noise and opportunity. On one hand, you get enough setups per session to matter; on the other, you’re not drowning in M1 noise. Volume Scalper EA V3.0 reads very short-term imbalances and uses them to aim for quick 1:1.5–1:3 risk-to-reward structures, depending on market conditions and the profile you choose.

Supported Symbols

- XAUUSD (Gold) – Highly liquid with strong intraday bursts.

- USDJPY – A classic for clean moves during Tokyo and London overlaps.

- US30 (Dow Jones) – Offers strong impulsive legs during the New York session.

Tip: If you saw “USDIPY” elsewhere, treat that as a typo—USDJPY is the intended pair.

Who Is It For?

- Traders who want fast, focused scalps with a rules-based system.

- Those who reject grid/martingale/hedging and prefer one-entry, one-exit logic.

- Traders who can respect stops and want tighter drawdowns.

- Beginners who want structure; intermediates who want consistency; pros who want an extra, low-maintenance edge.

Key Features at a Glance

- Volume-based entries: Confirms momentum with real participation, not just price wiggles.

- No grid, no martingale, no hedging: Every position stands on its own.

- Adaptive filters: Session, spread, slippage, and news avoidance filters (user-configurable).

- Tight risk controls: Fixed SL/TP or dynamic ATR-based stops; breakeven/partial close options.

- Smart trade timing: Focus on liquid windows to avoid dead spreads and fake ticks.

- Low footprint: Lightweight code engineered for VPS stability and quick execution.

- Multi-symbol ready: Attach to XAUUSD, USDJPY, and US30 charts simultaneously.

- Clear logs: Transparent trade reasoning in the Experts/Journal tabs for easy debugging and learning.

- Magic Number per chart: Clean separation for tracking results and management.

- News buffer (optional): Pause trading around major releases if you prefer calmer conditions.

Strategy Logic (Plain English)

Volume Scalper waits for a surge condition (e.g., above a rolling volume percentile), then checks that price has space to run (near-term structure, micro-SR distance, and spread quality). If all filters align, it places a market or stop order (depending on your mode) with a predefined stop loss. Targets use either a fixed multiple of risk or a hybrid model: partial profits at 1R–1.5R with runners to 2R–3R when momentum is strong. The aim is to win small and often, while cutting losers quickly—a classic scalper’s edge.

Recommended Setup (Quick Start)

- Account & Conditions

- Use a low-spread, low-slippage account with fast execution.

- Leverage: High leverage is common for scalping, but risk controls matter more than leverage itself.

- VPS: Strongly recommended for 24/5 uptime and lower latency.

2. Chart Preparation

- Timeframe: M5.

- Symbols: XAUUSD, USDJPY, US30 (one chart per symbol).

- Market sessions: Prioritize London and New York for Gold/US30; Tokyo/London overlap for USDJPY.

3. EA Inputs (Typical Baselines)

- Risk per trade: 0.5%–1.0% (newer accounts can start at 0.25%).

- SL/TP Mode: Start with a fixed 1:2 RR; later test ATR-based stops.

- Trade Hours: Enable the session filter for your chosen windows.

- Spread Guard: Set a maximum spread threshold per symbol (Gold often wider than FX).

- News Filter: Optional—exclude NFP, CPI, FOMC minutes, etc., if you want quieter execution.

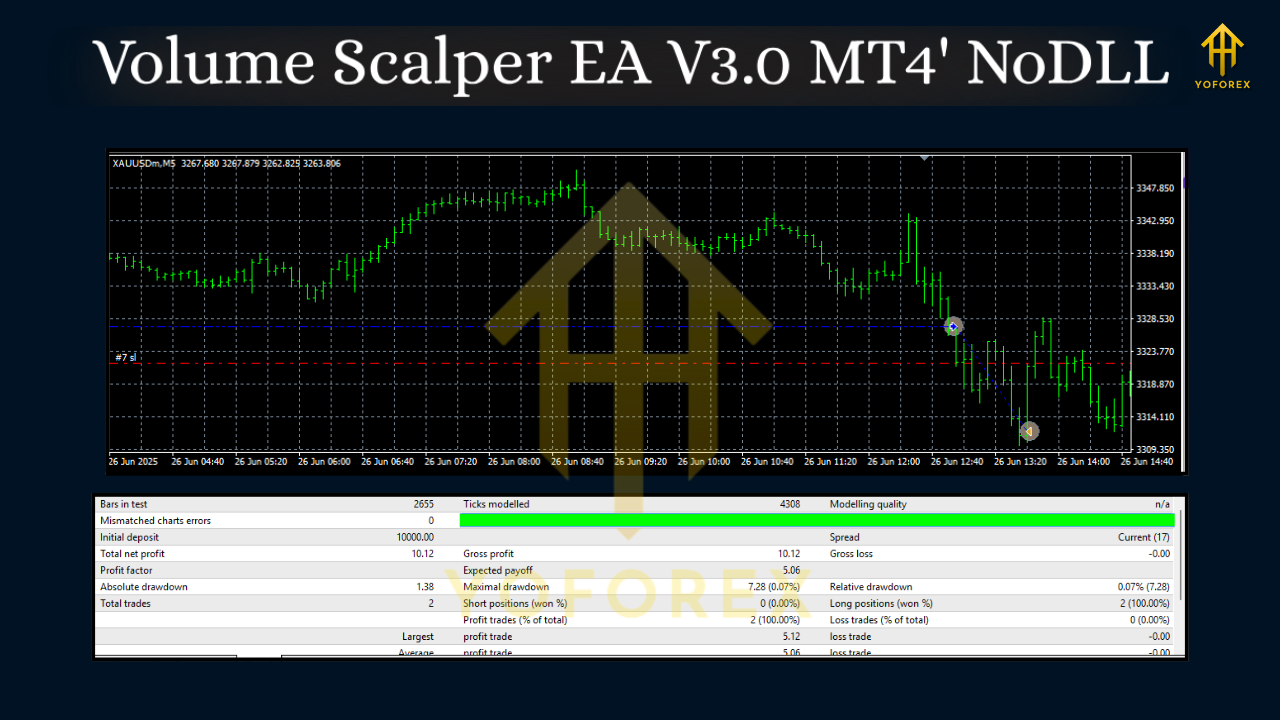

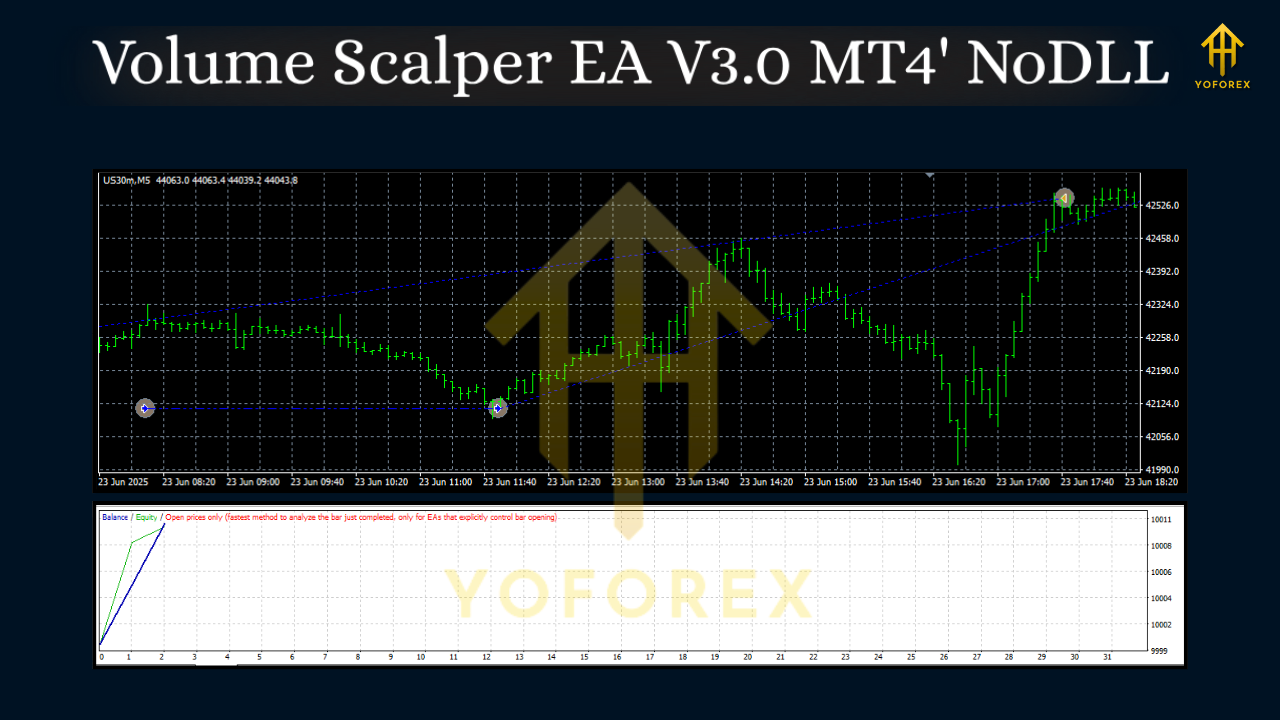

4. Testing & Go-Live

- Backtest with high-quality data to understand distribution.

- Forward test on demo for at least 1–2 weeks; confirm broker performance.

- Go live with conservative risk; scale only after you’ve seen stable execution.

Risk Management Philosophy

This EA is deliberately anti-martingale. Losses are capped by a hard stop. If a trade fails, the EA won’t “average down” or open a recovery basket. That’s a conscious design choice to protect equity curves from tail events. On the upside, wins are designed to be clean—usually one or two partials, then flat. It’s the textbook scalper profile: tight risk, frequent entries, controlled targets.

Position Sizing Tips

- Don’t exceed 1% risk per trade when you start.

- Run symbol caps (e.g., max one open trade per symbol) until you’re comfortable.

- If you enable multi-symbol trading, cap simultaneous trades across charts to manage exposure.

Performance Expectations

Scalping is streaky. You’ll see clusters of wins when conditions are aligned and thinner activity when markets stagnate. That’s normal. The edge comes from staying selective and keeping losers small. Focus on weekly outcomes rather than minute-by-minute P/L. Solid execution + disciplined risk usually beats hyper-active tinkering.

Pro tip: If you switch brokers or server locations, re-run a short forward test. Latency and slippage can affect fill quality on scalps.

Backtesting & Forward-Testing (How to Do It Right)

- Data Quality: Use quality tick data where possible for Gold and US30; synthetic fills can distort outcomes.

- Spreads & Slippage: Model realistic spreads. For US30 and Gold, spikes happen—bake that in.

- Sessions: Test both “all sessions” and “session-filtered” to see where the edge lives.

- Walk-Forward: Try a simple walk-forward approach—optimize lightly on one month, validate on the next.

Backtests are not guarantees, but they help you understand behavior: average hold times, distribution of wins/losses, and drawdown characteristics. A good forward test will confirm whether your broker + VPS combo can replicate the logic cleanly.

Best Practices for Daily Use

- Check spreads before London open; disable trading if conditions are abnormal.

- Avoid turning filters on/off mid-trade.

- Keep a journal. Note session, symbol, spread, and any slippage outliers.

- Update responsibly. If you change inputs, test on demo first.

Final Word

Volume Scalper EA V3.0 MT4 isn’t trying to be everything. It’s a focused tool that leverages volume-confirmed impulses on M5 to deliver clean, rule-based scalps on XAUUSD, USDJPY, and US30. If you’re tired of bots that look great on paper but blow up with grid or martingale, this approach—tight risk, transparent entries, realistic targets—will feel like a breath of fresh air. Start light, respect the process, and let the edge play out over a meaningful sample.

Comments

Leave a Comment