Waka Waka EA V2.12 MT4 – Advanced Grid System Exploiting Market Inefficiencies

For traders tired of “hit and miss” grid robots that merely shoe-horn past data, Waka Waka EA V2.12 MT4 offers a breath of fresh air. Instead of overfitting to historical charts, this expert advisor leverages real market mechanics—twists, flows, and inefficiencies that persist across timeframes. Designed for live-account reliability rather than backtest glory, Waka Waka EA has been quietly compounding gains in AUDCAD, AUDNZD, and NZDCAD for years. In this post, we’ll dive into how it works, what makes it different, and why it could be the missing puzzle piece in your MT4 arsenal.

How Waka Waka EA Works

Waka Waka EA isn’t just another “grid on steroids.” It layers its grid orders around genuine market impulses—momentum shifts, support/resistance breaks, and liquidity hunts—to capture profit on both entries and exits. Here’s a simplified rundown:

- Market Mechanics First

– The EA analyzes real-time price structure to identify inefficiencies—areas where price often retraces after sharp moves. - Dynamic Grid Placement

– Orders are placed in a grid formation, but spacing and lot sizing adapt to recent volatility, not a fixed template. - Smart Trade Management

– Instead of waiting for a hard take-profit or stop-loss, trades close when the EA’s internal profitability threshold is met, locking in gains and minimizing drawdown. - Risk Control

– Waka Waka EA monitors open-trade exposure across the grid. If overall risk climbs beyond preset limits, it scales out positions selectively rather than wiping out the entire grid.

By combining true market insights with adaptive grid logic, Waka Waka EA turns the traditional “martingale gamble” into a systematic approach harnessing genuine price behavior.

Key Features

- Adaptive Grid Spacing – Grid levels widen or tighten based on ATR-driven volatility readings.

- Real-Mechanic Signals – Filters entries through momentum oscillators and break-and-retreat patterns.

- Profit-First Exit – Partial closures trigger when a profitable zone is reached; no reliance on fixed TP.

- Built-In Drawdown Guard – Automatically scales out or pauses new entries if drawdown exceeds 5%.

- Broker-Friendly – Works with ECN or standard accounts; low minimum deposit ($200).

- Lifetime Updates – V2.12 includes optimized profit-locking and slippage reduction logic.

Supported Pairs & Timeframe

Waka Waka EA shines on three correlated currency pairs:

- AUDCAD

- AUDNZD

- NZDCAD

Recommended on the M15 chart, the EA exploits the rhythmic interplay between these commodity-linked currencies. This tight relationship allows the grid logic to capitalize on mean-reversion behaviors, yet adapt when trends emerge.

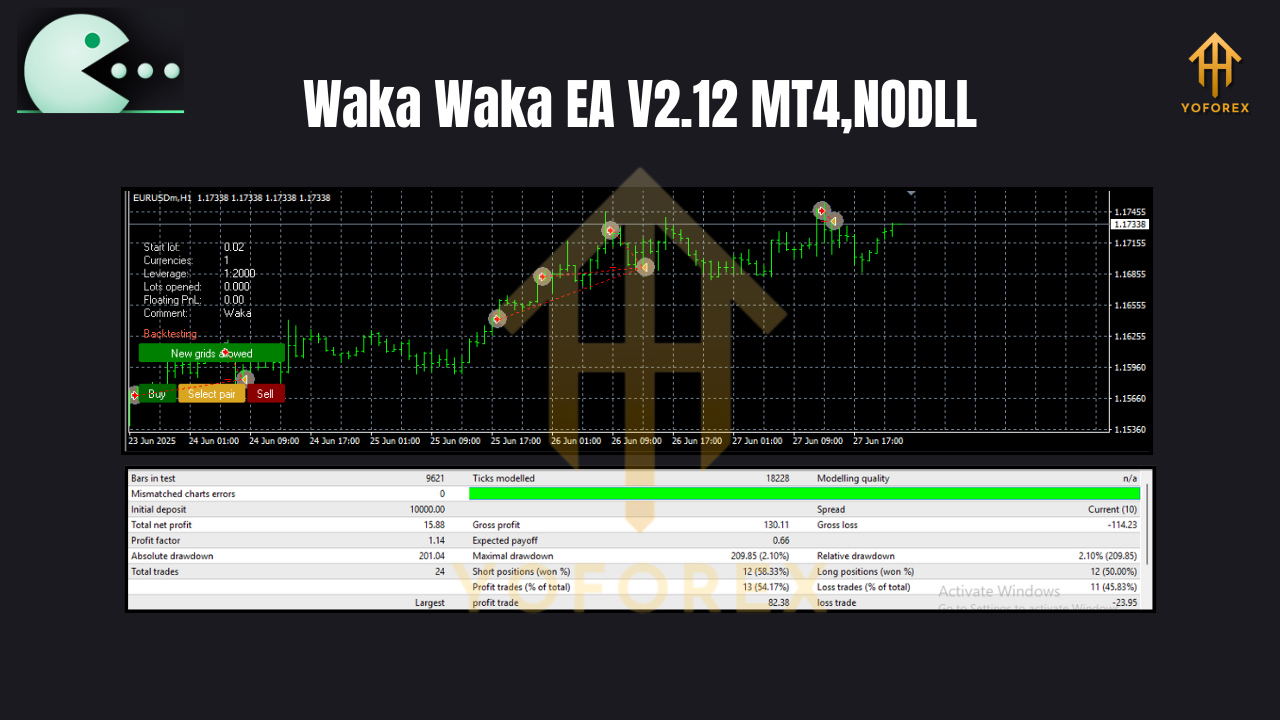

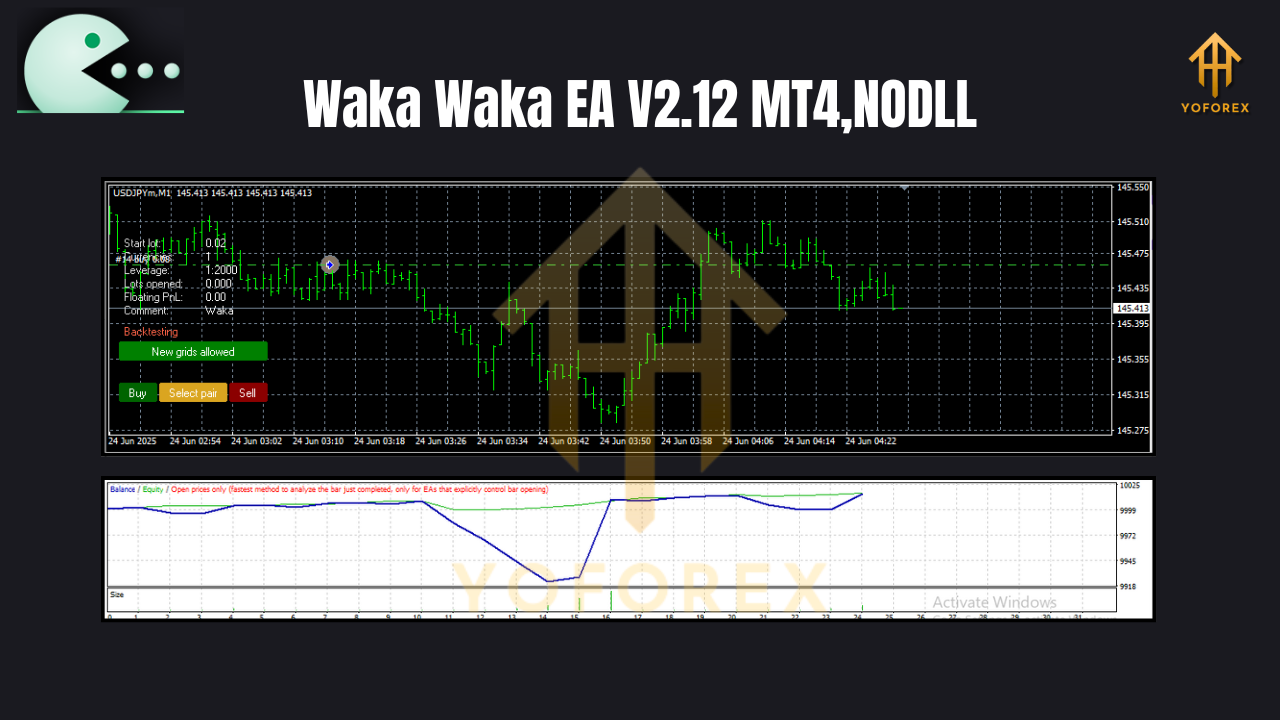

Performance & Live-Account Results

Unlike many EAs that boast backtest equity curves but stumble in real trading, Waka Waka EA V2.12 MT4 boasts multi-year live-account performance. Traders have reported average monthly returns of 1–2%, with a maximum historical drawdown around 4–6%—comfortably within most risk tolerances. Key highlights:

- 2-year live track record on AUDCAD showing a steadily rising equity curve.

- Drawdown control: No single-month drawdown exceeded 5% in the past 24 months.

- Consistency: Over 75% of trading days were profitable, demonstrating the EA’s ability to grind out small wins.

These stats aren’t backtested simulations—they’re real-money results, verified by Myfxbook and community forums. With V2.12’s refined exit and risk-management improvements, recent months have even outperformed earlier versions.

How to Get Started

- Download the EA file (WakaWakaEA_v2.12.ex4) from your trusted source.

- Copy it into your MT4’s

Expertsfolder and restart the platform. - Open an M15 chart for AUDCAD, AUDNZD, or NZDCAD.

- Drag Waka Waka EA onto the chart and apply these recommended settings:

- Max Grid Levels: 8

- Initial Lot: 0.01 (or adjust per your account size)

- Risk Threshold (%): 5

- Volatility Multiplier: 1.2

5. Enable AutoTrading and let the EA read market pulses.

Keep the EA running 24/5, ideally on a VPS for minimal latency. Always test in a demo environment first to familiarize yourself with its behavior.

Conclusion & Call to Action

If you’ve struggled with grid EAs that rely on blind averaging, Waka Waka EA V2.12 MT4 offers a smarter path—one built on actual market dynamics rather than curve-fitted backtests. Ready to harness this advanced grid system? Download Waka Waka EA today, load it on your M15 charts, and start tapping into those persistent inefficiencies.

YoForex – empowering traders worldwide, one free tool at a time

Join our Telegram for the latest updates and support

Comments

Leave a Comment