Automated trading in the forex market has grown rapidly in recent years, and many traders are turning to Expert Advisors (EAs) for help. If you’re exploring options, the Wolves Prime EA V6.5 MT5 might have crossed your radar. In this article, we’ll dig into what this EA claims to offer, how it works, potential benefits and drawbacks, and some practical tips to evaluate whether it’s right for you.

What is Wolves Prime EA V6.5 MT5?

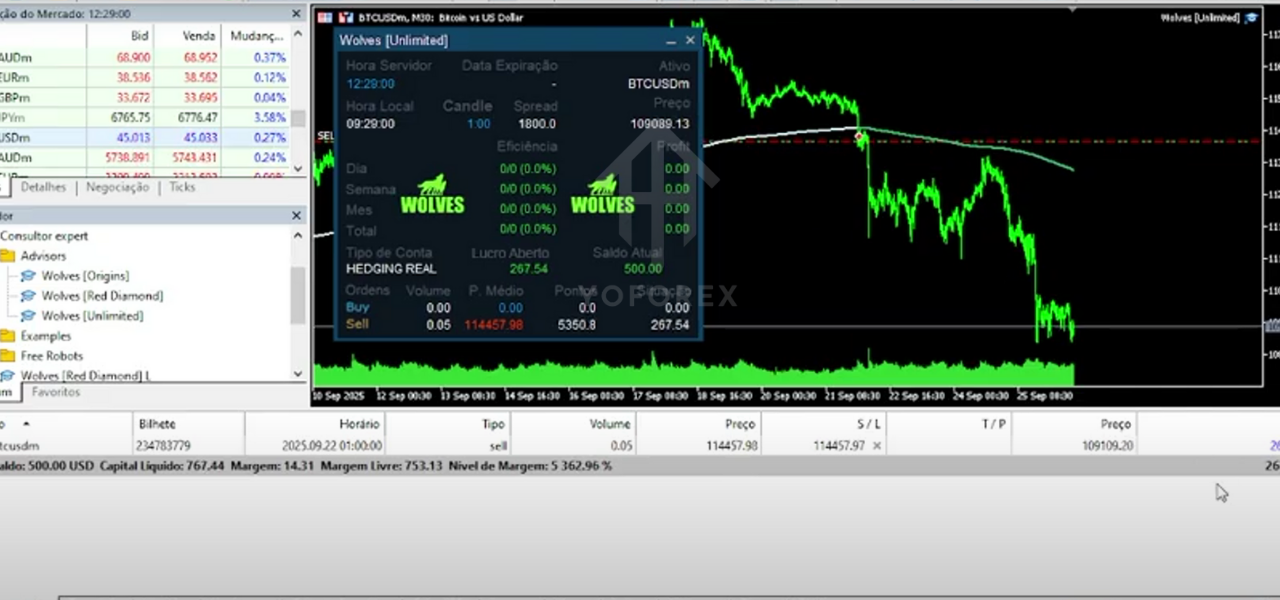

Wolves Prime EA V6.5 MT5 is an Expert Advisor developed for the MetaTrader 5 platform. The designation “V6.5” suggests it has undergone several versions, indicating ongoing development. As an automated trading system, the EA is designed to enter, manage and exit trades on behalf of the trader according to its predefined logic. The idea is to streamline trading, reduce emotion‑driven decisions, and potentially generate consistent results.

Key Features & Claims

While official documentation is limited, typical features attributed to Wolves Prime EA V6.5 include:

- Multi‑pair trading support: The EA purportedly works across several currency pairs, increasing diversification.

- Automated decision making: It uses algorithmic logic to identify trading opportunities, place orders, set stop‑loss/take‑profit levels, and manage trades.

- MetaTrader 5 compatibility: Designed for MT5, which offers more advanced charting, timeframes and order types compared to MT4.

- Customisable settings: Users may adjust risk parameters such as lot size, stop‑loss/take‑profit levels, and other variables to suit their tolerance.

- Around‑the‑clock trading: Because it’s automated, it can monitor markets continuously and act when conditions meet its rules.

How It Works

At a high level, here’s how the EA would typically function:

- Market analysis: Wolves Prime uses historical price data, current market structure, and technical filters to identify favourable trade setups.

- Signal generation: When specific conditions are met (e.g., trend breakout, momentum shift, filter confirmation), the EA generates a buy or sell signal.

- Trade placement and management: The EA automatically enters a trade on MT5, attaches appropriate stop‑loss and take‑profit, and monitors the trade. It might adjust trailing stops or close the trade early if conditions change.

- Risk and money‐management: It applies lot sizing and risk rules to protect capital and attempt to maximise potential gains while controlling drawdown.

Benefits of Using Wolves Prime EA V6.5

There are several advantages to using a well‑constructed EA such as this:

– Less manual effort: The EA automates trade execution, freeing you from constant monitoring and manual decision making.

– Emotion‑free trading: It removes human emotion (greed / fear) from the equation so trades are executed based on logic.

– Potential for faster reaction: Automated systems can respond more quickly than manual methods when conditions are met.

– Customisable for risk: You can usually adjust settings to align with your risk tolerance and account size.

– MetaTrader 5 features: Since it runs on MT5, there are more tools and order flexibility available to support advanced strategies.

Drawbacks & Considerations

However, it’s critical to approach with caution. Here are key considerations:

– No guarantee of profit: Even the best EA cannot eliminate market risk. Past results (if available) don’t guarantee future performance.

– Broker/Execution dependency: EA performance is influenced by broker spreads, slippage, execution speed, and account type (hedging vs netting).

– Strategy transparency: If the strategy logic isn’t clearly documented, you may not fully understand when and why the EA takes trades.

– Market regime changes: An EA optimised for a past market condition may struggle when conditions shift (e.g., high volatility, news events).

– Maintenance & updates: Ongoing updates are necessary to adapt to market changes; outdated EAs may become less effective over time.

– Initial setup & demo testing required: You should test the EA on demo account or small live account before full deployment.

How to Evaluate Wolves Prime EA V6.5 MT5

Before committing real capital, here are practical steps:

- Request verified performance data: Look for live or demo account results with verified history (spread, slippage included).

- Back‑test under realistic conditions: Use historical tick data and realistic broker spreads for the pairs and timeframe the EA targets.

- Check for broker compatibility: Confirm your broker supports MT5, wildcard symbols, hedging if needed, and offers low latency execution.

- Understand the input parameters: Review the EA inputs and risk settings—knowing exactly what they do is key to control.

- Start small: Use the EA on a demo or small live account to observe behaviour in real‑world conditions.

- Monitor drawdown and trade behaviour: See how the EA handles losing streaks, news spikes, and unusual market conditions.

- Have a plan for management: No EA should be set and forgotten—monitor it, adjust as needed, and be ready to intervene if performance degrades.

Best Practices for Using an EA Like Wolves Prime

To maximise your chances of success, consider the following best practices:

- Use a VPS close to your broker’s server to reduce latency.

- Select a broker with low spreads and reliable execution—these factors significantly affect EA performance.

- Run the EA on a demo account first to validate settings and performance before migrating to live.

- Optimise risk settings conservatively—avoid large lot sizes or aggressive settings until you are comfortable with its behaviour.

- Keep a journal or log of EA trades and performance, noting any anomalies.

- Stop trading the EA temporarily during major economic news events or when your broker spreads widen significantly.

- Always maintain capital protection—use appropriate leverage and keep drawdown well within your risk tolerance.

Conclusion

In summary, Wolves Prime EA V6.5 MT5 presents an interesting automated trading solution for the MetaTrader 5 platform. With features such as automated trade execution, customisable risk settings, and multi‑pair support, it holds promise for traders seeking to automate their forex strategy. But like all EAs, success depends on many external factors: the broker, market conditions, proper setup, and ongoing monitoring.

If you’re a trader who wants to leverage automation while still maintaining oversight, then this EA may warrant further investigation. Be sure to validate performance data, test it thoroughly, and use it with realistic risk management before committing substantial capital.

Comments

Leave a Comment