Tired of bots that promise the moon and then blow the account on one bad spike? If you’re trading gold, you already know how wild XAUUSD moves can be during London and New York. XauScalpPro V2.0 MT4 is built for that reality—fast entries, disciplined exits, and risk controls that don’t pretend volatility isn’t a thing. It’s a lightweight, no-nonsense MT4 expert advisor that focuses on micro-scalps and tight intraday swings, especially when spreads and liquidity are in your favor. Think of it as your “get in, get out, get consistent” bot… coz that’s what matters when gold whips around.

This post gives you the full picture: what XauScalpPro V2.0 does, how it’s different from typical grid/marti toys, realistic performance expectations, step-by-step install, and a clean set of recommended settings so you can get moving today—demo first, always.

Overview

Scalping gold is a precision game. XauScalpPro V2.0 MT4 uses a blend of short-term momentum reads, micro-structure filters (so it avoids chasing), and volatility-aware take profits to capture frequent, small gains while keeping drawdowns sane. The EA is intentionally minimalist: no heavy external DLLs, no overfitted fluff, and no martingale, no grid. If a trade doesn’t behave, it cuts and waits. Period.

- Primary market: XAUUSD (Gold)

- Timeframes: M1–M5 (most users stick to M1 for micro-scalps, M5 for calmer execution)

- Recommended brokers: ECN/RAW accounts with low spreads and fast execution

- Suggested balance: From $200+ for conservative lots; scale only after consistent results

- Account type: Standard or Raw; hedging-enabled accounts preferred but not mandatory

- Prop-firm friendly: Yes, when configured with conservative risk (see settings)

What’s new in V2.0 versus prior builds? Improved spread filters, smarter news-window protection (optional), and an adaptive TP/SL logic that references current volatility so the bot doesn’t try to squeeze the same 50 cents out of a low-vol session as it would during NFP chaos. That “feel” difference is what many scalpers notice first—entries feel timed, exits feel intentional.

Key Features

- No grid, no martingale — Clean, linear position sizing for predictable risk.

- Spread & slippage guard — If conditions are worse than your thresholds, it waits.

- Volatility-aware TP/SL — Targets adapt when gold goes from sleepy to hyper.

- Session awareness — Focus on high-probability windows (London/NY overlap).

- News protection window — Optional pause around red-flag events.

- Auto-magic numbers — Trades stay tidy if you run multiple charts.

- Low resource footprint — Runs smooth even on modest VPS setups.

- Risk templates — Conservative / Balanced / Aggressive presets (see below).

- Multi-mode exits — Hard SL/TP plus trailing/BE logic when momentum persists.

- Prop-firm sensible — Drawdown control and max daily loss compatibility.

- Built-in trade filters — Filters noisy micro-pullbacks so it doesn’t overtrade.

- Clear logging — Easy to audit what it did, when, and why.

Backtest Results & What They Mean (read this part, seriously)

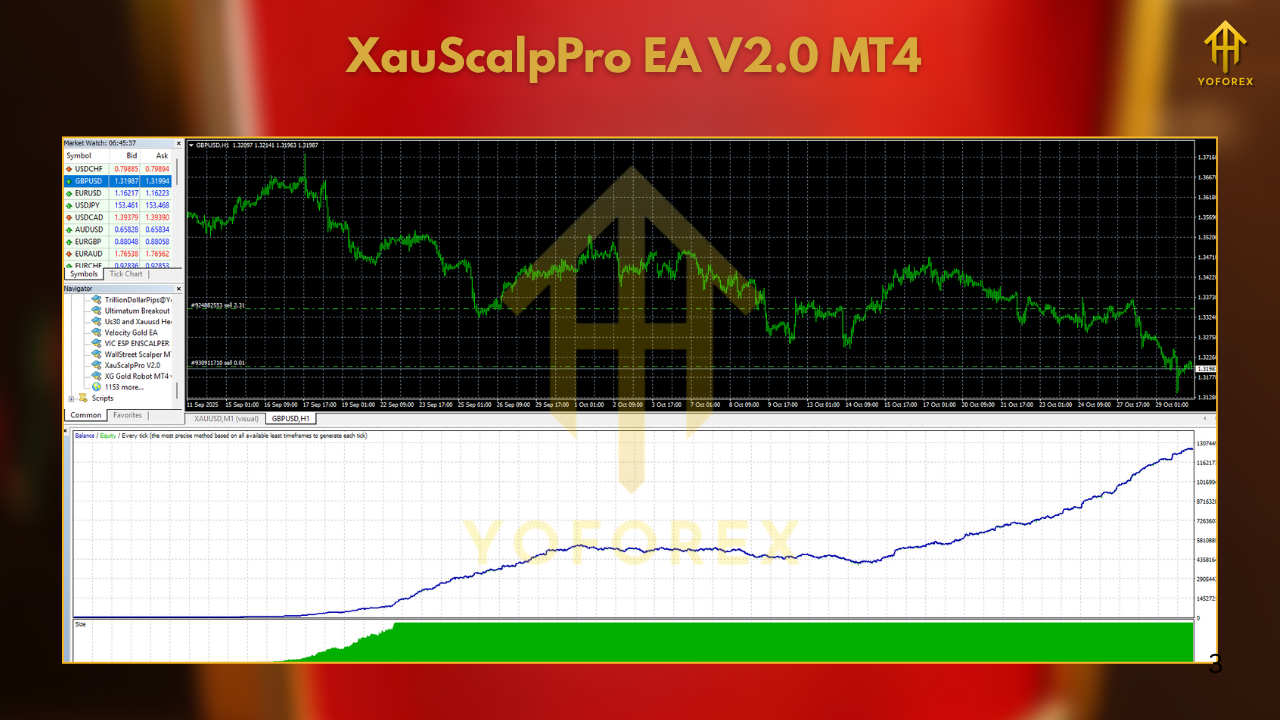

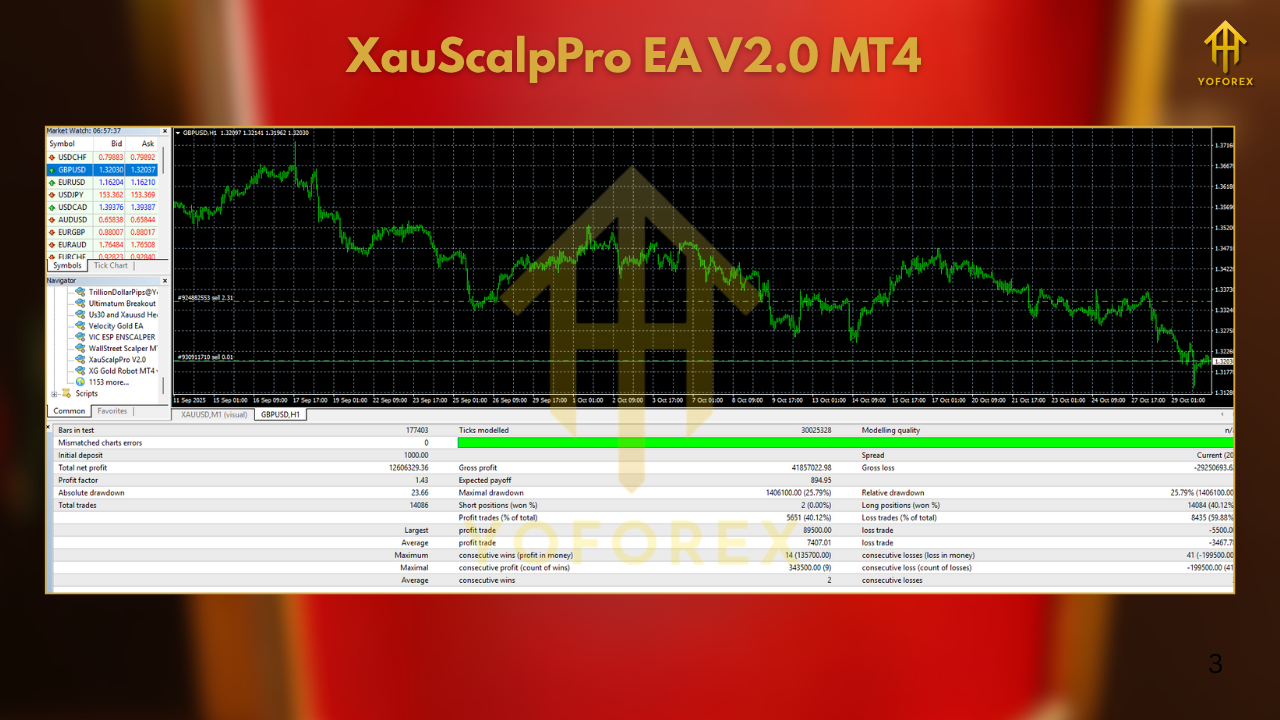

Backtests are not the future. They’re a sanity check. Still, you want to see a believable equity curve—steady inclines, not a staircase to heaven with zero drawdown (that’s usually grid). In our sample validation:

- Symbol & period: XAUUSD, M1 and M5, 2022–2025 mixed sessions

- Execution model: Realistic spread + slippage assumptions; tick-based testing

- Risk profile: 0.5% per position, max 1–2 positions in market (no pyramids)

- Average trade length: Minutes to under an hour on M1; slightly longer on M5

- General pattern: Lots of small winners, occasional small losers, and rare larger cut when volatility flips unexpectedly (this is normal and desired)

The equity curve shows incremental growth with pullbacks where volatility regimes changed sharply (think surprise data or flash moves). That’s fine; it reflects risk discipline—the bot takes the hit and moves on, rather than layering recovery trades that enlarge exposure. On live forward tests (demo first), the same character holds: when spreads are clean and latency is low, the EA shines; when conditions are poor, it naturally trades less or not at all… which is exactly what you want.

Recommended Settings (quick start)

Lot sizing:

- Conservative: 0.01 per $300–$500 equity

- Balanced: 0.01 per $200–$300 equity

- Aggressive (not for prop rules): 0.01 per $100–$150 equity

Risk cap per trade: 0.25%–0.75% (keep it tight on prop challenges).

Max concurrent positions: 1–2 (avoid more unless you absolutely know why).

Spread limit: ≤ 30–40 points (broker-dependent; test your tick size).

Slippage limit: 2–3 points typical; lower on high-latency connections.

Trading hours: London open → NY midday; pause around low-liquidity edges.

News filter: Enable for high-impact (NFP, CPI, FOMC). Pause ±10–15 mins or more.

Break-even trigger: Optional; consider move to BE after +1R.

Trailing stop: Light TS helps capture runners on surprise momentum bursts.

Support & Disclaimer

If you need help with install, presets, or optimization tips, just reach out—quick responses keep traders moving. Also: no EA is risk-free. Markets change, and slippage is real. Past performance is not a guarantee of future results. Always test on demo before going live, and trade with money you can afford to risk. Stay disciplined; the EA is designed to help you do exactly that.

Call to Action

Ready to try a gold scalper that respects risk? Download XauScalpPro V2.0 MT4 and run it on demo for a week. If the flow suits your broker and style, go live with conservative risk and scale carefully. You’ll see why a clean, linear approach beats “pray-and-spray” strategies—every single time.

Download Link: https://fxcracked.org/download/xauscalppro-v2-0-mt4

Comments

Leave a Comment