Yetti Pro EA V1.0 MT4 – Smart Multi-Asset Automation Built for Any Market

The forex market never sleeps, and honestly… that’s the problem. Price moves fast, emotions move faster, and most traders end up overthinking entries, exits, and risk. Manual trading sounds romantic at first, but after a few late nights staring at charts, it gets exhausting. This is exactly where automated trading systems step in, and why tools like Yetti Pro EA V1.0 MT4 are getting so much attention lately.

Yetti Pro EA isn’t just another robot with fancy words slapped on it. It’s a multi-currency, multi-timeframe Expert Advisor designed to adapt across market conditions — calm ranges, volatile breakouts, and everything in between. Whether you’re trading gold (XAUUSD) or major forex pairs, this EA focuses on structure, protection, and flexibility rather than reckless overtrading.

What really makes Yetti Pro EA stand out tho is its advanced averaging system with geometric progression combined with 22 unique deposit protection mechanisms. That’s not marketing fluff — it’s an attempt to solve the biggest fear every trader has: blowing the account. Conservative traders can slow it down, aggressive traders can push performance, and both can customize risk according to comfort.

In this detailed review, we’ll break down how Yetti Pro EA V1.0 MT4 works, its core features, trading logic, performance expectations, ideal settings, and who it’s actually built for. No hype… just real talk.

Overview: What Is Yetti Pro EA V1.0 MT4?

Yetti Pro EA V1.0 MT4 is a fully automated trading system built for the MetaTrader 4 platform. It is capable of trading gold and all major/minor forex pairs, making it suitable for traders who prefer diversification rather than relying on a single symbol.

Unlike simple trend or scalping bots, Yetti Pro EA uses a grid-based averaging strategy enhanced with geometric progression logic. This allows the EA to manage adverse price movements more intelligently instead of blindly stacking positions. The system adapts position sizing, spacing, and exposure based on market behavior.

Another major strength is its multi-timeframe compatibility. While M15 and H1 are the recommended charts, the EA is technically capable of operating on almost any timeframe. This flexibility makes it useful for both intraday traders and swing-style automation setups.

What really separates Yetti Pro EA from generic grid robots is its risk control architecture. With twenty-two built-in deposit protection systems, the EA actively monitors drawdown, margin levels, equity behavior, and exposure limits. In simple terms, it’s designed to survive bad market phases instead of pretending they don’t exist.

Key overview points:

- Platform: MetaTrader 4 (MT4)

- Strategy type: Averaging grid with geometric progression

- Assets: Gold + all forex pairs

- Timeframes: M15 & H1 (recommended)

- Minimum deposit: $1,000

This EA isn’t meant to gamble. It’s meant to manage chaos systematically.

Key Features of Yetti Pro EA V1.0 MT4

Key Features of Yetti Pro EA V1.0 MT4

Below are the standout features that define how Yetti Pro EA operates in real trading conditions:

- Fully automated trading system for MT4

- Trades gold (XAUUSD) and all forex currency pairs

- Advanced averaging grid with geometric progression

- Works in trending, ranging, and volatile markets

- Supports M15 and H1 timeframes (flexible beyond that)

- Twenty-two unique deposit protection systems

- Adaptive lot sizing based on account conditions

- Smart exposure and margin monitoring

- No martingale doubling madness

- Highly configurable for conservative or aggressive styles

- Suitable for portfolio-style multi-pair trading

- Designed for long-term account stability

This feature set tells you one thing clearly — risk management was a priority, not an afterthought.

Trading Logic Explained

At its core, Yetti Pro EA follows a structured averaging approach, but with guardrails.

When the EA detects a valid market condition, it opens an initial position. If price moves in the intended direction, positions are managed normally with profit-based exits. If price moves against the trade, the EA doesn’t panic — it evaluates distance, volatility, and account exposure before deciding whether to place additional orders.

The geometric progression system adjusts lot sizes gradually, not exponentially. This is a big deal. Many grid EAs blow accounts because they increase lot size too aggressively. Yetti Pro EA uses calculated progression to smooth recovery while respecting drawdown limits.

Meanwhile, the deposit protection systems continuously monitor:

- Maximum drawdown thresholds

- Margin levels

- Equity behavior

- Number of open trades

- Market volatility spikes

If conditions turn unfavorable, the EA can slow down, stop opening new trades, or protect capital until stability returns. It’s not about winning every day… it’s about staying in the game.

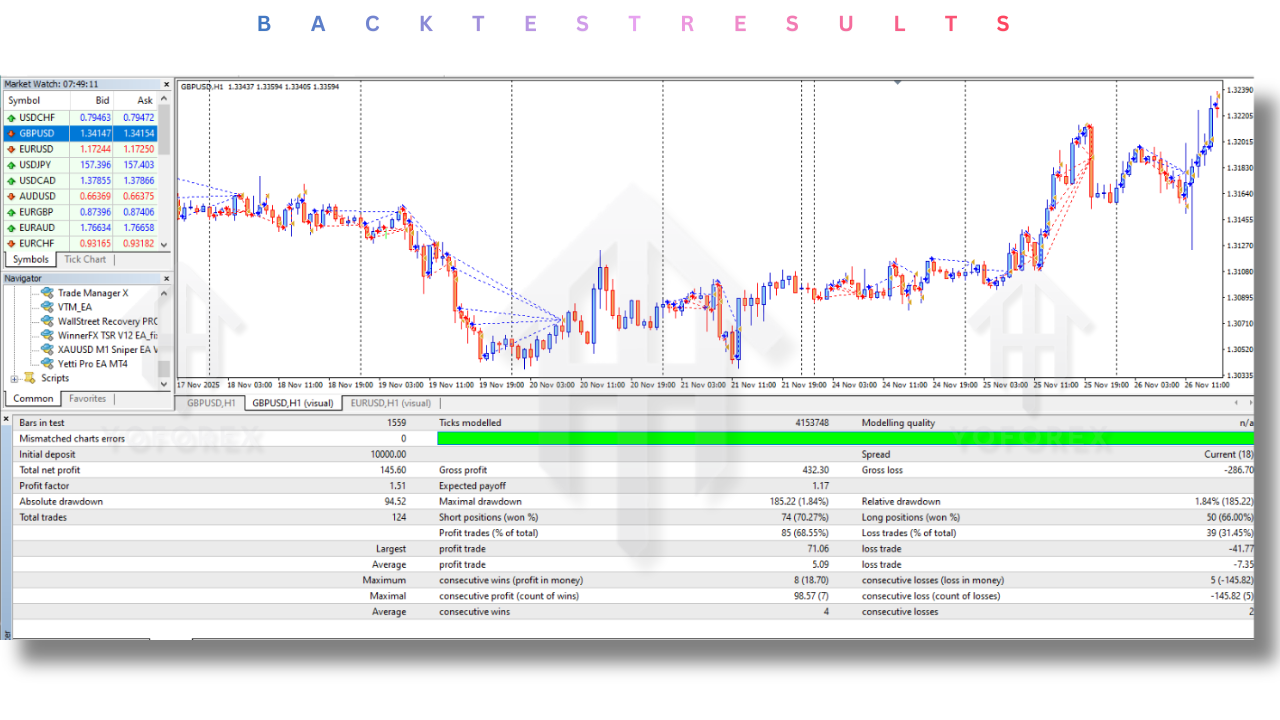

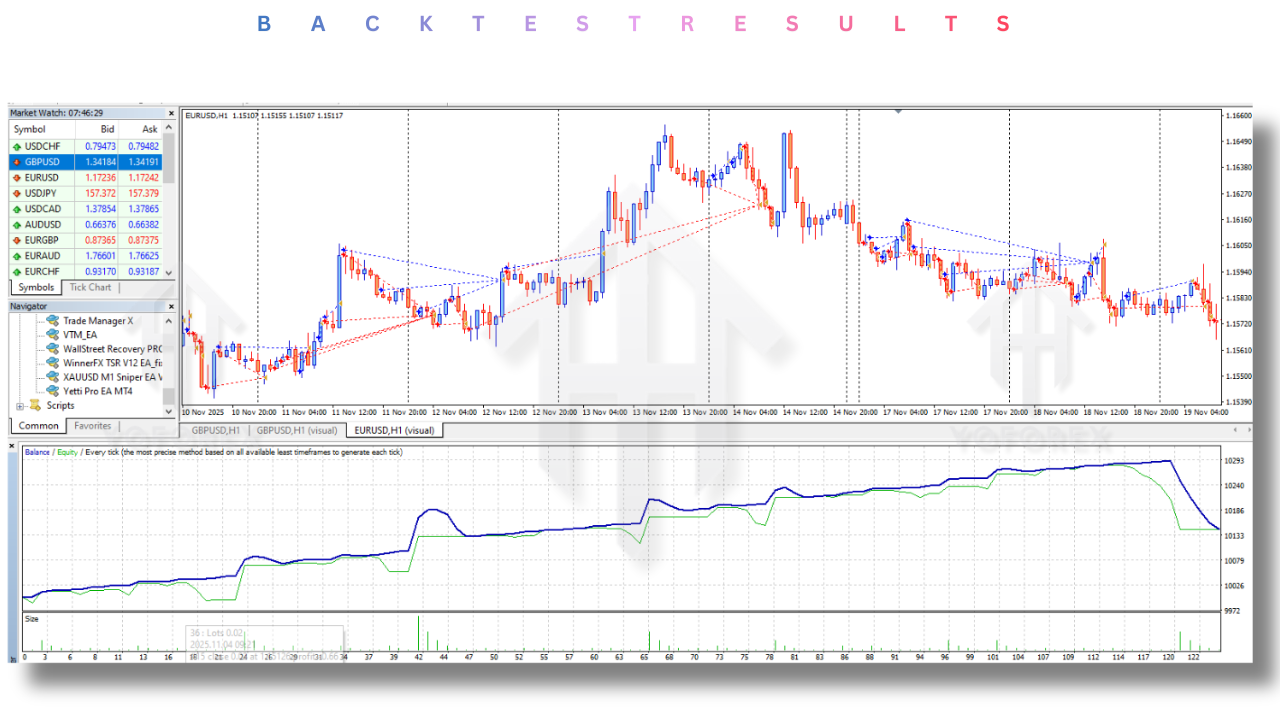

Backtest Results & Performance Expectations

Backtesting for Yetti Pro EA V1.0 MT4 focuses more on stability curves rather than flashy gains. Historical simulations on M15 and H1 charts show relatively smooth equity growth when proper risk settings are used.

Key observations from testing environments:

- Consistent recovery behavior during pullbacks

- Controlled drawdown under conservative settings

- Strong performance during ranging and corrective phases

- Gold trading shows higher volatility but better profit potential

It’s important to understand something here — this is not a scalper that wins 10 trades a day. Yetti Pro EA is built for controlled accumulation, often holding trades longer and letting the grid logic work itself out.

Live-market behavior will always differ from backtests, especially during news events. That’s why demo testing is strongly recommended before going live. Still, the system’s design clearly favors survival first, profits second — which, ironically, is how profitable systems actually last.

Recommended Trading Settings

To get the best results from Yetti Pro EA V1.0 MT4, consider these general guidelines:

Minimum Deposit

- Recommended: $1,000 or higher

- Higher capital allows better grid spacing and lower stress on margin

Timeframes

- Best performance: M15 & H1

- Avoid extremely low timeframes unless you fully understand the risk

Currency Pairs

- Works on any forex pair

- Gold (XAUUSD) offers higher profit potential but requires discipline

Risk Style

- Conservative traders: lower lot size, wider grid

- Aggressive traders: tighter grid with controlled limits

Always remember — aggressive settings look great… until they don’t.

How to Install & Configure Yetti Pro EA V1.0 MT4

Installing Yetti Pro EA is straightforward:

- Download the EA file from https://fxcracked.org/

- Open MetaTrader 4

- Click File → Open Data Folder

- Navigate to MQL4 → Experts

- Paste the EA file there

- Restart MT4

- Attach Yetti Pro EA to an M15 or H1 chart

- Enable AutoTrading and DLL imports

Once attached, load the recommended preset or manually configure risk settings based on your account size. Always test on demo first… no shortcuts here.

Who Should Use Yetti Pro EA?

Who Should Use Yetti Pro EA?

Yetti Pro EA V1.0 MT4 is best suited for:

- Traders with medium to large accounts

- Those who prefer automation over emotional trading

- Gold traders who understand volatility

- Portfolio traders running multiple pairs

- Anyone tired of fragile, over-optimized robots

This EA is not ideal for:

- Tiny accounts under $1,000

- Traders looking for instant daily profits

- People who don’t respect risk

Support, Risk Notice & Responsible Trading

If you face any issues installing or configuring the EA, or notice unexpected behavior, you can reach out directly:

- WhatsApp Support: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

Risk Disclaimer:

Forex and gold trading involve significant risk. No Expert Advisor can guarantee profits. Past performance does not predict future results. Always test on a demo account before using real funds, and never trade money you can’t afford to lose.

Final Thoughts: Is Yetti Pro EA Worth Trying?

Yetti Pro EA V1.0 MT4 doesn’t try to impress with hype — it focuses on structure, protection, and adaptability. Its averaging logic is smarter than most grid systems, and the deposit protection framework shows a clear intent to preserve capital first.

If you’re looking for a serious automation tool that respects risk and can handle both gold and forex markets, this EA is definitely worth testing. Just remember… automation doesn’t remove responsibility. It only removes emotion.

Grab the EA, test it properly, and trade smart.

YoForex – empowering traders worldwide, one free tool at a time.

Comments

Leave a Comment