FXCracked – Your Gateway

to Smart Forex Insights

Explore the latest forex news, bot reviews, and top indicator breakdowns

— everything a trader needs, all in one place.

Explore the latest forex news, bot reviews, and top indicator breakdowns

— everything a trader needs, all in one place.

Traders Profited Using FX Cracked Bots

Positive Feedback on Our Strategies

Trusted Indicators Reviewed

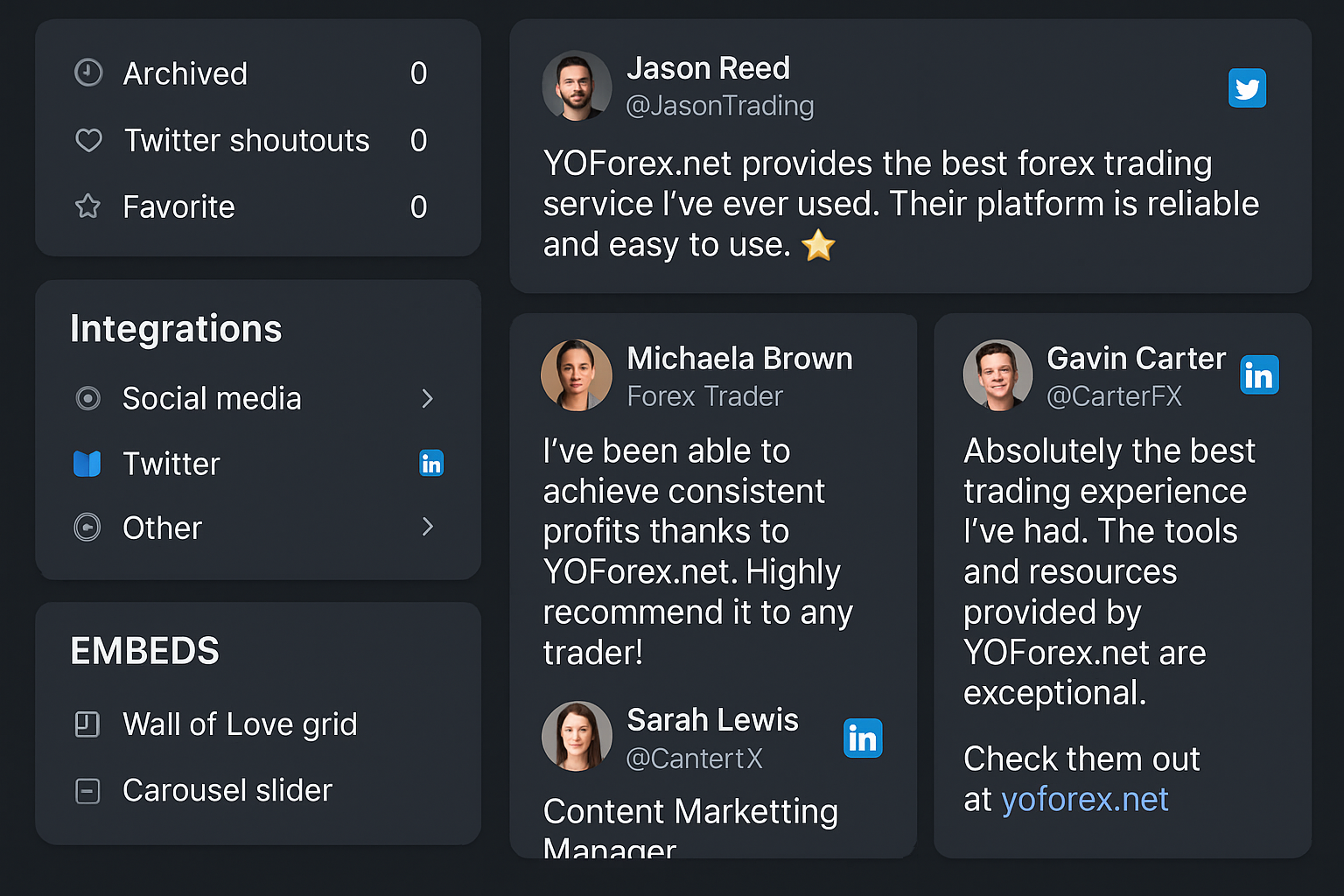

Hear from our satisfied customers who have transformed their Forex trading journey with FXCracked. From social media shoutouts to in-depth reviews, see why traders trust us.

Read Testimonials

Join thousands of traders who trust FXCracked for expert insights,

powerful tools, and proven strategies.

Take the next step in

your trading journey today!

Access premium Forex tools.

Learn from expert strategies.