The evolution of proprietary trading firms has reshaped how retail traders approach the forex market. Unlike traditional personal accounts, prop firm environments impose strict rules on risk, daily drawdown, maximum loss, trade consistency, and execution discipline. Many traders fail not because their strategy is unprofitable, but because they cannot consistently comply with these rules under live market pressure.

This is where automation has become essential. AI Prop Firms EA V1.0 MT5 is designed specifically for traders operating within prop firm conditions who require precision, control, and rule-based execution rather than emotional decision-making. Built for the MetaTrader 5 platform, this Expert Advisor focuses on capital protection, controlled exposure, and systematic trade execution aligned with modern prop firm evaluation models.

In this in-depth guide, we explore how AI Prop Firms EA V1.0 MT5 works, what makes it suitable for prop firm challenges, how to configure it correctly, and who should consider using it. This article is written for educational and analytical purposes to help traders understand whether this EA aligns with their trading objectives.

Overview of AI Prop Firms EA V1.0 MT5

AI Prop Firms EA V1.0 MT5 is an automated trading system engineered with a rule-centric philosophy. Instead of chasing high-risk gains, the EA prioritizes consistency, drawdown control, and disciplined execution. Its internal logic is structured to adapt trade behavior based on market conditions while maintaining predefined risk boundaries.

The EA is optimized for MetaTrader 5 and is primarily configured to operate on specific market conditions where spread stability and execution speed are reliable. Unlike aggressive grid or recovery-based systems, this EA follows a single-position logic with structured exits and dynamic trade management.

Its core objective is simple: help traders survive and progress through prop firm evaluations by minimizing rule violations while maintaining realistic profitability.

How AI Prop Firms EA V1.0 MT5 Works

Market Condition Assessment

The EA begins by scanning the market for stable volatility zones rather than extreme price spikes. This approach reduces exposure during chaotic market phases that often lead to slippage, stop-loss overruns, or daily loss violations in prop firm accounts.

The system evaluates short-term momentum, price structure, and intraday behavior before allowing trade execution. Trades are filtered to avoid low-quality conditions where spreads widen or liquidity thins.

AI-Driven Trade Logic

While the term “AI” is widely used in trading software, in this EA it refers to adaptive decision logic rather than static indicator triggers. The EA dynamically adjusts trade timing, stop placement, and exit behavior based on real-time price feedback.

This adaptive logic allows the EA to reduce over-trading, avoid repetitive entries, and space trades intelligently throughout the trading session. The goal is not frequency, but efficiency.

Entry Execution

Trades are executed only when multiple internal conditions align. The EA avoids entering trades during news-sensitive periods and does not stack positions. This single-trade exposure model aligns well with prop firm risk policies that penalize excessive margin usage.

Trade Management and Exit Logic

Once a trade is active, the EA manages it dynamically. Stop loss, take profit, and trailing logic adjust based on market behavior rather than remaining static. This allows trades to close earlier when conditions weaken or extend profits when momentum remains favorable.

Key Features of AI Prop Firms EA V1.0 MT5

Prop Firm Rule Compliance Focus

The EA is structured around the reality of prop firm trading. It actively limits exposure to avoid breaching daily drawdown and overall loss thresholds. This makes it suitable for evaluation phases as well as funded accounts.

No Martingale, No Grid, No Recovery

AI Prop Firms EA V1.0 MT5 avoids high-risk position scaling techniques. Each trade is independent, maintaining consistent lot sizing based on risk parameters rather than previous trade outcomes.

Daily Drawdown Protection

The EA includes internal logic to stop trading when daily loss limits approach critical thresholds. This feature is essential for traders attempting to pass evaluations without accidental rule violations.

Adaptive Risk Control

Rather than using fixed risk across all market conditions, the EA adjusts exposure based on volatility and session behavior. This helps maintain stability during unpredictable phases.

News Awareness

The EA avoids trading during high-impact economic events. This reduces the risk of slippage, spread expansion, and sudden equity swings that can invalidate evaluation accounts.

VPS-Friendly Architecture

Designed to run continuously, the EA performs best on a stable VPS environment, ensuring uninterrupted execution and accurate session tracking.

Recommended Trading Settings

Proper configuration is essential to align the EA with prop firm conditions.

Risk Settings

Traders should configure conservative risk parameters, typically keeping per-trade risk low. This ensures that even multiple consecutive losses remain within acceptable limits.

Timeframe and Chart Setup

The EA is designed to operate on lower intraday timeframes, where it can respond efficiently to price changes while maintaining precise trade control.

Session Control

Limiting trading to stable market sessions helps reduce unnecessary exposure. The EA allows session-based execution control to avoid low-liquidity periods.

Drawdown Safeguards

Daily and overall loss limits should be configured according to the specific prop firm rules of the account being used.

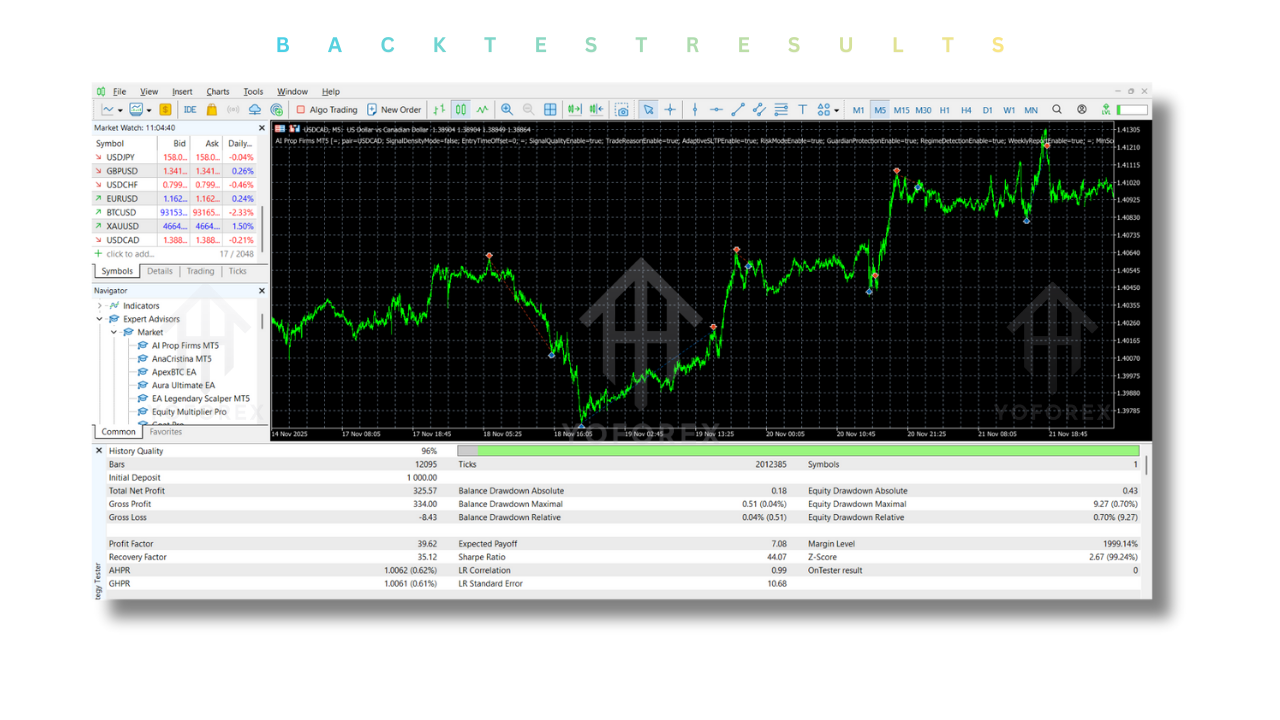

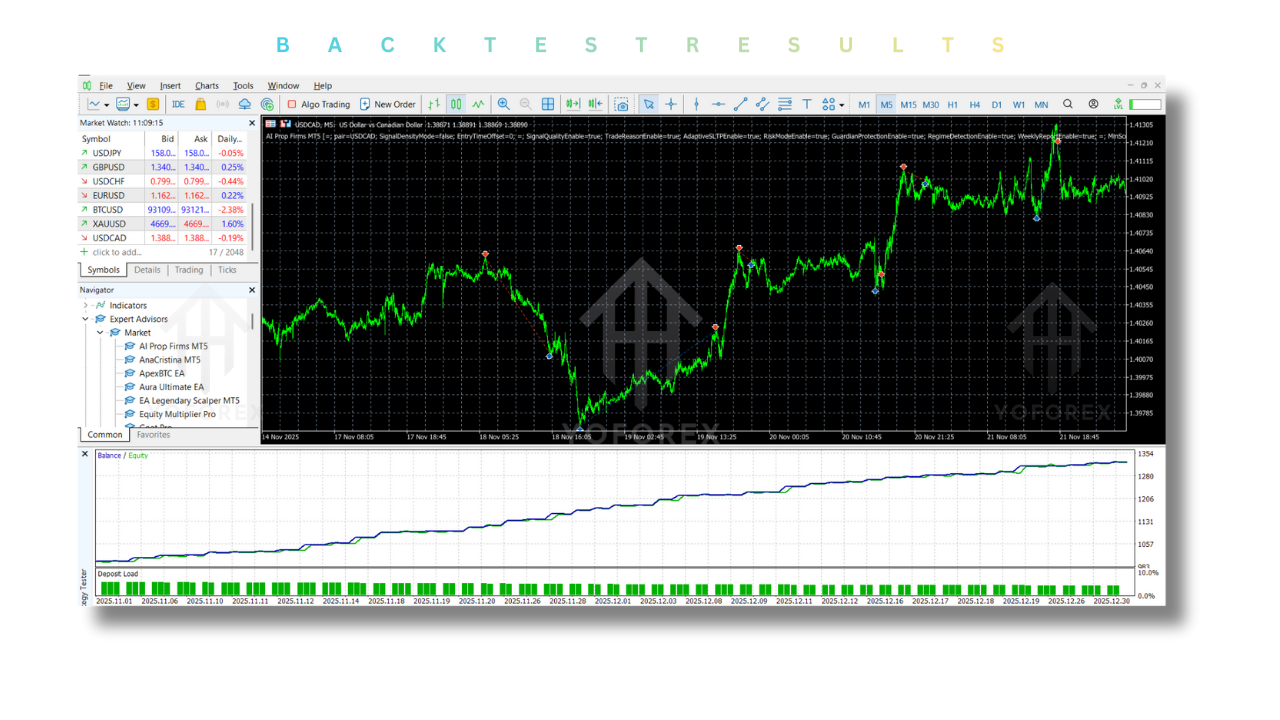

Backtesting and Performance Expectations

Backtesting is a useful analytical tool but should not be treated as a guarantee of future results. When reviewing historical data, traders should focus on drawdown behavior, trade duration, and equity curve stability rather than raw profit numbers.

AI Prop Firms EA V1.0 MT5 is designed to produce smooth equity progression rather than aggressive spikes. Its performance characteristics typically reflect controlled growth, limited drawdowns, and moderate trade frequency.

Forward testing on demo accounts that replicate prop firm conditions is strongly recommended before deployment on live or evaluation accounts.

Installation Guide for AI Prop Firms EA V1.0 MT5

- Download the EA file in compatible MT5 format.

- Open MetaTrader 5 and navigate to the data folder.

- Place the EA file into the Experts directory.

- Restart the trading platform.

- Attach the EA to the appropriate chart and timeframe.

- Enable algorithmic trading and adjust input parameters.

- Confirm that risk, session, and drawdown settings match your prop firm rules.

Advantages of AI Prop Firms EA V1.0 MT5

- Designed specifically for prop firm environments

- Emphasis on drawdown and rule compliance

- No aggressive recovery strategies

- Adaptive trade management

- Suitable for disciplined traders

- Reduces emotional decision-making

- Encourages consistency over speculation

Disadvantages and Limitations

- Not suitable for high-risk or aggressive traders

- Requires careful configuration

- Performance depends on broker conditions

- Not designed for manual intervention

- Lower trade frequency may feel slow to some users

Who Should Use AI Prop Firms EA V1.0 MT5

This EA is best suited for:

- Traders preparing for prop firm evaluations

- Funded traders seeking consistency

- Traders who struggle with emotional discipline

- Users who prefer rule-based execution

- Traders focused on capital preservation

It may not be ideal for traders seeking fast growth, high leverage exposure, or experimental strategies.

Why Choose AI Prop Firms EA V1.0 MT5

Passing a prop firm challenge requires discipline more than creativity. AI Prop Firms EA V1.0 MT5 is designed for traders who understand that long-term success in proprietary trading depends on respecting limits, managing risk, and maintaining consistency across market cycles.

By automating execution and enforcing internal safeguards, the EA acts as a structured trading assistant rather than a speculative profit engine.

Conclusion

AI Prop Firms EA V1.0 MT5 represents a modern approach to automated trading under strict prop firm conditions. Its emphasis on adaptive logic, controlled exposure, and rule compliance makes it a practical tool for traders focused on long-term progression rather than short-term gambling.

While no Expert Advisor can guarantee success, disciplined usage, proper configuration, and realistic expectations can make AI Prop Firms EA V1.0 MT5 a valuable component in a structured prop trading strategy.

As always, traders should test thoroughly, understand their firm’s rules, and approach automation as a tool, not a shortcut.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: Click here

Telegram Group: Join our community

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Refferal

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges, join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Happy Trading

Comments

Leave a Comment